Fed Loan Servicing plays a crucial role in the student loan landscape, offering a range of services to help borrowers manage their federal student loans effectively. This comprehensive guide delves into the intricacies of Fed Loan Servicing, exploring its services, repayment options, and resources available to borrowers.

When planning a home purchase, staying up-to-date on home loan interest rates today is crucial. These rates fluctuate regularly, so it’s essential to compare offers from different lenders to secure the best possible financing.

From understanding the different types of federal student loans serviced by Fed Loan Servicing to navigating repayment plans and loan forgiveness programs, this guide provides valuable insights for borrowers seeking to gain control over their student loan debt. Whether you’re a recent graduate or a seasoned borrower, understanding the nuances of Fed Loan Servicing can empower you to make informed decisions and optimize your repayment journey.

Looking for a specific type of loan? Green Arrow Loans might be a good starting point for your research. They offer a variety of loan products, so you can explore your options and find the right fit for your financial goals.

Contents List

Overview of Fed Loan Servicing

Fed Loan Servicing plays a crucial role in the student loan ecosystem, acting as a central point of contact for borrowers seeking information, managing their loans, and navigating the repayment process. It’s a government-contracted entity responsible for servicing a significant portion of federal student loans.

Need a loan but don’t know where to start? Finding loan companies near me can be a good first step. Check online directories or ask for recommendations from friends or family to find lenders in your area.

Types of Federal Student Loans Serviced by Fed Loan Servicing

Fed Loan Servicing handles a variety of federal student loans, including:

- Direct Subsidized Loans: These loans are offered to undergraduate students with financial need, and the government pays the interest while the borrower is in school, during grace periods, and during deferment periods.

- Direct Unsubsidized Loans: These loans are available to both undergraduate and graduate students, and the borrower is responsible for paying interest accrued during all periods.

- Direct PLUS Loans: These loans are available to graduate students and parents of dependent undergraduate students, and they have higher interest rates than other federal student loans.

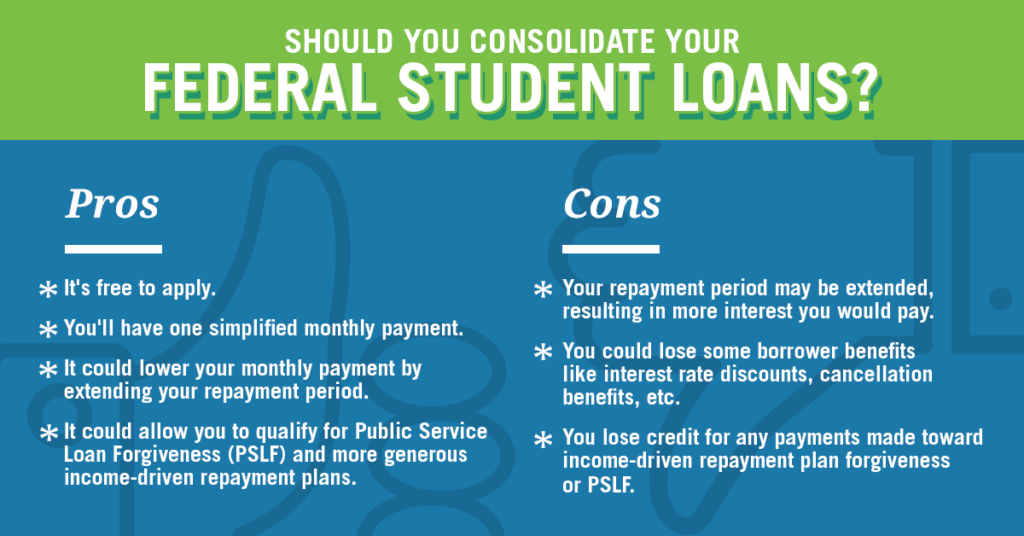

- Direct Consolidation Loans: These loans allow borrowers to combine multiple federal student loans into one loan with a single interest rate and repayment schedule.

Key Responsibilities of Fed Loan Servicing

Fed Loan Servicing performs various essential tasks to support borrowers throughout their loan lifecycle:

- Payment Processing: They handle all loan payments, ensuring timely and accurate processing. This includes online payments, automatic deductions, and manual payments.

- Loan Management: They maintain borrower accounts, track loan balances, and manage interest accrual. This includes updating loan status, applying payments, and calculating interest charges.

- Customer Service: They provide support to borrowers through various channels, including phone, email, and live chat. They answer questions about loan terms, repayment options, and other related issues.

Accessing Fed Loan Servicing Services

Fed Loan Servicing provides a comprehensive online portal and multiple communication channels to ensure easy access to its services.

Looking for financing for your next vehicle? Santander Auto Finance is a reputable lender specializing in auto loans. Explore their options and compare their rates and terms to find the best fit for your needs.

Accessing the Fed Loan Servicing Online Portal

Here’s how to access the Fed Loan Servicing online portal:

- Visit the Fed Loan Servicing website.

- Click on the “Login” button located in the top right corner of the page.

- Enter your FSA ID and password to access your account.

- Once logged in, you can view your loan details, make payments, update your contact information, and access various resources.

Contacting Fed Loan Servicing

Fed Loan Servicing offers various communication channels to reach out for assistance:

- Phone: Call their customer service number for immediate assistance.

- Email: Send an email for non-urgent inquiries or to request specific information.

- Live Chat: Engage in real-time conversations with a customer service representative through the online portal.

Resources and Tools Offered by Fed Loan Servicing

Fed Loan Servicing provides valuable resources and tools to help borrowers manage their loans effectively:

- Repayment Calculators: These tools allow borrowers to estimate their monthly payments based on different repayment plans and interest rates.

- Loan Forgiveness Information: They provide comprehensive information about various loan forgiveness programs, including eligibility requirements and application processes.

- Financial Planning Resources: They offer guidance and support for borrowers looking to create a budget, plan for repayment, and explore financial literacy resources.

Loan Repayment Options

Fed Loan Servicing offers a variety of repayment plans to suit different borrowers’ financial situations and needs. Understanding the different options can help borrowers choose the best plan to manage their debt effectively.

Securing auto financing can be a significant step in purchasing a new or used vehicle. Research different lenders and compare their rates and terms to find the most favorable option for your financial situation.

Standard Repayment Plan

This is the most common repayment plan, where borrowers make fixed monthly payments for a set period, typically 10 years. The monthly payment amount is calculated based on the total loan amount, interest rate, and loan term.

If you’re managing student loans, MyGreatLakes can be a valuable resource. This platform allows you to manage your loans, track payments, and explore repayment options. Stay organized and informed about your student loan journey.

Benefits

- Predictable monthly payments.

- Shorter repayment term compared to other plans.

Drawbacks

- Higher monthly payments compared to other plans.

- May not be affordable for borrowers with limited income.

Graduated Repayment Plan

This plan offers lower monthly payments in the early years, gradually increasing over time. This can be beneficial for borrowers who expect their income to rise in the future.

Wells Fargo is a major financial institution offering a range of loan products. If you’re considering Wells Fargo personal loans , compare their rates and terms with other lenders to find the best option for your needs.

Benefits

Drawbacks

Income-Driven Repayment Plans

These plans base monthly payments on a borrower’s income and family size. There are several income-driven repayment plans, including:

- Income-Based Repayment (IBR): Payments are capped at 10% of discretionary income.

- Pay As You Earn (PAYE): Payments are capped at 10% of discretionary income.

- Revised Pay As You Earn (REPAYE): Payments are capped at 10% of discretionary income, but interest is accrued on the unpaid portion of the loan.

Benefits

Drawbacks

Loan Forgiveness and Cancellation Programs

Fed Loan Servicing administers various loan forgiveness and cancellation programs that can help borrowers reduce or eliminate their student loan debt under specific circumstances.

Public Service Loan Forgiveness (PSLF)

This program forgives the remaining balance on Direct Loans after 120 qualifying payments made while working full-time for a qualifying employer, such as a government agency or non-profit organization.

River Valley Loans offers a variety of loan products to meet different needs. If you’re considering River Valley Loans , compare their rates and terms with other lenders to find the best deal for your situation.

Eligibility Requirements

- Work full-time for a qualifying employer.

- Make 120 qualifying payments on Direct Loans under a qualifying repayment plan.

- Have Direct Loans or consolidated loans into Direct Loans.

Benefits

Limitations

Teacher Loan Forgiveness

This program forgives up to $17,500 in Direct Loans for teachers who work full-time in a low-income school for at least five consecutive academic years.

In need of some extra cash? You’re not alone. If you’re wondering, “Where can I find a loan?”, exploring Need A Loan can be a helpful starting point. They offer a platform for comparing loans from different lenders, making the process easier for you.

Eligibility Requirements

- Work full-time as a teacher in a qualifying school.

- Teach for at least five consecutive academic years.

- Have Direct Loans or consolidated loans into Direct Loans.

Benefits

Limitations

Managing Your Student Loans: Fed Loan Servicing

Effective student loan management involves a proactive approach to budgeting, setting repayment goals, and staying organized. By following these tips, borrowers can minimize stress and ensure they’re on track to achieve their financial goals.

Ready to take the next step? Apply for a personal loan and access the funds you need for your personal goals. Compare loan offers from different lenders to ensure you’re getting the best rates and terms.

Budgeting and Setting Repayment Goals

- Create a realistic budget that accounts for all income and expenses.

- Allocate a portion of your income towards student loan payments.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) repayment goals.

Staying Organized and Tracking Loan Information

- Keep track of all loan details, including interest rates, repayment terms, and due dates.

- Set reminders for upcoming payments and deadlines.

- Consider using online loan management platforms to simplify tracking and organization.

Avoiding Late Payments

- Set up automatic payments to ensure timely payments.

- Make payments well in advance of the due date to avoid late fees.

- Contact your loan servicer if you anticipate a payment issue.

Challenges and Concerns with Fed Loan Servicing

While Fed Loan Servicing strives to provide excellent customer service, borrowers may encounter challenges and concerns during their interactions.

Capital One offers a variety of financial products, including personal loans. If you’re considering Capital One personal loans , compare their rates and terms with other lenders to ensure you’re getting the best deal for your needs.

Common Challenges and Concerns

- Customer Service Issues: Long wait times, difficulty reaching a representative, and inconsistent communication can be frustrating.

- Loan Processing Delays: Delays in loan processing, payment application, and account updates can cause stress and financial uncertainty.

- Communication Gaps: Miscommunication regarding loan terms, repayment options, and program eligibility can lead to confusion and errors.

Addressing Challenges and Advocating for Rights, Fed Loan Servicing

- Document all interactions and concerns, including dates, times, and communication methods.

- Escalate issues to a supervisor or higher-level representative if initial attempts to resolve problems are unsuccessful.

- Familiarize yourself with your rights as a borrower and seek assistance from consumer protection agencies or legal aid organizations if necessary.

Conclusion

Managing student loans can be a daunting task, but Fed Loan Servicing provides essential tools and resources to navigate this process effectively. By understanding the various services offered, exploring repayment options, and utilizing available resources, borrowers can gain control over their student loan debt and work towards a brighter financial future.

Chase is a well-known financial institution offering a range of loan products. If you’re considering a loan, you might want to check out Chase loans. Compare their rates and terms with other lenders to ensure you’re getting the best deal.

This guide serves as a comprehensive resource for borrowers seeking to understand and manage their student loans with Fed Loan Servicing.

FAQ Explained

What is the difference between FedLoan Servicing and the Department of Education?

Home equity lines of credit, or HELOCs, can be a valuable tool for homeowners. Checking HELOC interest rates can help you determine if this financing option is right for your needs. Keep in mind that these rates can vary significantly depending on the lender and your creditworthiness.

FedLoan Servicing is a private company contracted by the Department of Education to manage and service federal student loans. The Department of Education sets the rules and regulations for federal student loans, while FedLoan Servicing handles the day-to-day operations, such as processing payments and providing customer service.

How can I contact FedLoan Servicing?

If you’re looking to borrow money, understanding line of credit interest rates is essential. These rates fluctuate based on factors like your credit score and the lender’s current offerings. It’s important to compare rates from different lenders to secure the best deal.

You can contact FedLoan Servicing through their website, phone, or email. Their contact information can be found on their website. You can also use their online portal to manage your loans and communicate with them directly.

Can I switch from FedLoan Servicing to another loan servicer?

Need a quick cash infusion? A $500 cash advance no credit check might seem appealing, but be cautious. These options often come with high interest rates and fees. Explore alternatives like personal loans or credit cards if possible.

You may be able to switch to a different loan servicer, but this is not always possible. You can contact the Department of Education or FedLoan Servicing directly to inquire about switching servicers.