Best Travel Insurance For Covid 2024: Navigating a Changing World. The global landscape of travel has been dramatically altered by the COVID-19 pandemic, making it more crucial than ever to have comprehensive travel insurance. As travel restrictions continue to evolve and new variants emerge, travelers need to be prepared for potential disruptions and unexpected medical expenses.

Finding the best auto insurance can be a challenge, but comparing quotes and researching different providers can help you find the most comprehensive and affordable coverage for your needs.

This guide will explore the essential elements of travel insurance in the context of COVID-19, providing insights into choosing the right coverage for your 2024 adventures.

For affordable and reliable car insurance, Drive Insurance is worth considering. They offer a variety of coverage options and discounts, making it easy to find the right policy for your budget.

The pandemic has highlighted the importance of travel insurance, particularly for those traveling internationally. This guide will delve into the critical factors to consider when choosing travel insurance in 2024, including coverage for COVID-19-related medical expenses, trip cancellation, and interruption.

When traveling abroad, it’s essential to have peace of mind. American Express Travel Insurance provides comprehensive coverage for unexpected events, ensuring you can enjoy your trip without worry.

We will also explore the key features of top travel insurance providers, helping you make an informed decision for your next journey.

Your furry friend deserves the best protection. ASPCA insurance offers comprehensive coverage for your pet, including accidents, illnesses, and preventative care, ensuring they receive the best possible care.

Contents List

- 1 Understanding Travel Insurance in the Context of COVID-19

- 2 Essential Coverage for COVID-19 Related Travel Disruptions: Best Travel Insurance For Covid 2024

- 3 Key Factors to Consider When Choosing Travel Insurance

- 4 Comparing Top Travel Insurance Providers for 2024

- 5 Additional Tips for Protecting Your Travel Plans

- 6 Ending Remarks

- 7 Question & Answer Hub

Understanding Travel Insurance in the Context of COVID-19

The COVID-19 pandemic has dramatically altered the travel landscape, making travel insurance more crucial than ever. As we move into 2024, it’s essential to understand how travel insurance has evolved to address the unique challenges posed by the ongoing pandemic.

Planning for long-term care can be daunting, but understanding long-term care insurance costs is crucial. This type of insurance helps cover expenses for assisted living, nursing homes, or in-home care, providing financial security for your future.

Key Considerations for Travelers in 2024

When selecting travel insurance in 2024, travelers should prioritize coverage that addresses potential COVID-19 related disruptions. This includes:

- Coverage for COVID-19 related medical expenses: This is crucial, as COVID-19 treatment costs can be significant, especially if you require hospitalization or prolonged care.

- Trip cancellation and interruption coverage: This is particularly important given the possibility of travel restrictions, flight cancellations, or quarantine requirements due to COVID-19.

- Emergency medical evacuation: In the event of a COVID-19 related health emergency while traveling, having coverage for medical evacuation ensures you can access the necessary care.

- Quarantine coverage: This covers expenses related to unexpected quarantines, including accommodation, meals, and transportation.

Specific Coverage Options for COVID-Related Travel Risks

Travel insurance policies now offer specific coverage options tailored to COVID-19 related travel risks. These include:

- COVID-19 medical expense coverage: This covers the costs of medical treatment, hospitalization, and other expenses related to COVID-19 illness while traveling.

- COVID-19 related trip cancellation and interruption coverage: This covers expenses incurred due to travel disruptions caused by COVID-19, such as flight cancellations, travel restrictions, or positive COVID-19 test results.

- COVID-19 quarantine coverage: This covers expenses related to mandatory quarantines, including accommodation, meals, and transportation.

Essential Coverage for COVID-19 Related Travel Disruptions: Best Travel Insurance For Covid 2024

Travel insurance policies should include essential coverage elements to address potential COVID-19 related travel disruptions.

Finding the right car insurance can be a hassle, but Compare The Market can help you compare quotes from different providers to find the best deal for your needs.

Medical Expenses

Medical expense coverage is crucial, as COVID-19 treatment costs can be substantial. Look for policies that cover:

- Hospitalization: This includes the costs of room and board, nursing care, and medical procedures.

- Medical treatment: This covers the costs of doctor visits, medications, and other medical services.

- Emergency medical evacuation: This ensures you can be transported back to your home country for medical care if necessary.

Trip Cancellation and Interruption Coverage, Best Travel Insurance For Covid 2024

Trip cancellation and interruption coverage is essential, as COVID-19 related travel restrictions or disruptions can significantly impact your travel plans. This coverage should include:

- Cancellation due to COVID-19: This covers the cost of your trip if you need to cancel due to a positive COVID-19 test, travel restrictions, or quarantine requirements.

- Interruption due to COVID-19: This covers expenses incurred if your trip is interrupted due to COVID-19 related issues, such as flight cancellations, travel restrictions, or a positive COVID-19 test result.

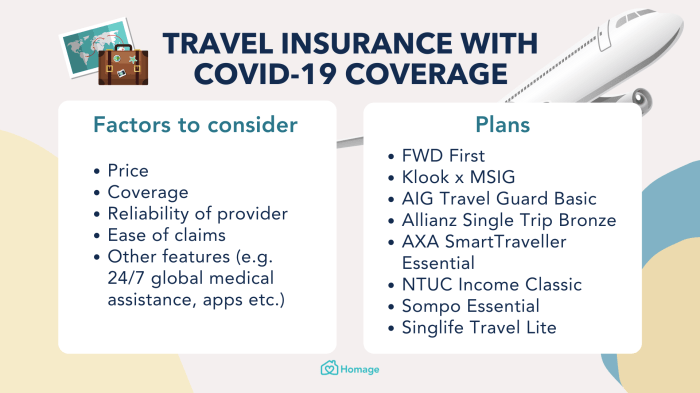

Key Factors to Consider When Choosing Travel Insurance

When comparing and selecting travel insurance policies, travelers should consider several key factors.

Your camera is a valuable investment, so protecting it with camera insurance is a wise choice. It provides coverage for accidents, theft, and damage, ensuring your precious memories are safe.

Policy Premiums and Deductibles

The premium you pay for travel insurance is determined by several factors, including the length of your trip, your destination, and the level of coverage you choose. Deductibles are the amount you pay out of pocket before your insurance coverage kicks in.

Managing your insurance policies can be overwhelming, but My Policy simplifies the process by providing a centralized platform to view and manage all your policies in one place.

It’s essential to find a policy that offers a balance between premium costs and deductible amounts.

For those who enjoy hitting the slopes, ski insurance is essential. It provides coverage for accidents, injuries, and equipment damage, ensuring you can focus on having fun on the mountain.

Reputation and Financial Stability of Insurance Providers

It’s essential to choose a reputable and financially stable insurance provider. Research the provider’s history, customer reviews, and financial ratings to ensure they can meet your claims needs.

Finding the right health insurance can be overwhelming. Health insurance near you can help you find plans that meet your needs and budget, making it easier to access quality healthcare.

Coverage Options

Compare the coverage options offered by different insurance providers to ensure they meet your specific travel needs. Pay close attention to the details of each coverage option, including any limitations or exclusions.

Getting car insurance online is quick and convenient. Buying car insurance online allows you to compare quotes from multiple providers and choose the best option for your needs, all from the comfort of your own home.

Comparing Top Travel Insurance Providers for 2024

| Provider | Coverage Options | Premiums | Deductibles | Customer Service Rating |

|---|---|---|---|---|

| Provider 1 | [List of coverage options] | [Premium range] | [Deductible range] | [Customer service rating] |

| Provider 2 | [List of coverage options] | [Premium range] | [Deductible range] | [Customer service rating] |

| Provider 3 | [List of coverage options] | [Premium range] | [Deductible range] | [Customer service rating] |

Additional Tips for Protecting Your Travel Plans

Beyond insurance coverage, there are several steps you can take to protect your travel plans.

Traveling during a pandemic can be stressful, but travel insurance with COVID-19 cover can provide peace of mind. These policies offer protection against unexpected events related to the pandemic, ensuring you’re covered in case of illness or disruption.

Stay Informed About Travel Advisories and Restrictions

Monitor travel advisories and restrictions issued by your home country and your destination country. This will help you stay informed about any potential COVID-19 related travel disruptions.

Utilize Travel Resources

Take advantage of travel resources like travel insurance comparison websites and travel agents. These resources can help you find the best travel insurance policies and provide valuable travel advice.

Ending Remarks

Navigating the complexities of travel insurance in the post-COVID-19 era can feel overwhelming. Remember, the right travel insurance can provide peace of mind and financial protection, allowing you to focus on enjoying your trip. By carefully considering the factors Artikeld in this guide, you can make an informed decision and choose the best travel insurance policy to safeguard your travel plans and protect yourself from unexpected events.

Protecting your loved ones financially is important. Term life insurance quotes can help you find affordable coverage that meets your specific needs and budget.

Question & Answer Hub

What are the most common COVID-19 related travel insurance claims?

If you’re looking for reliable and comprehensive insurance coverage, Security National Insurance Company could be a good option. They offer a range of insurance products, including auto, home, and life insurance.

The most common COVID-19 related travel insurance claims include trip cancellation due to positive test results, medical expenses for COVID-19 treatment, and quarantine expenses.

How do I know if my existing travel insurance policy covers COVID-19?

It’s best to review your policy documents carefully or contact your insurance provider directly to determine if your existing policy includes COVID-19 coverage.

What are the benefits of using a travel insurance comparison website?

Travel insurance comparison websites allow you to compare quotes from multiple providers side-by-side, making it easier to find the best coverage at the most competitive price.

If you’re looking for affordable and comprehensive vision insurance, Blue View Vision might be a good option. They offer a variety of plans and services, including eye exams, contact lenses, and eyeglasses.