M&A Law guides the complex world of mergers and acquisitions, where businesses join forces or one entity takes over another. This legal framework encompasses everything from initial negotiations to the final integration of companies, ensuring a smooth and legally sound process.

It involves a meticulous dance of legal considerations, due diligence, and regulatory approvals to ensure a successful outcome for all parties involved.

Understanding the intricacies of M&A Law is crucial for businesses considering growth through acquisitions or mergers. It provides a roadmap for navigating the legal landscape, mitigating risks, and achieving strategic goals.

If you suspect you’ve been a victim of fraud, it’s crucial to seek legal advice from a qualified Fraud Lawyer Near Me. They can help you protect your rights and pursue legal action.

Contents List

Introduction to M&A Law

Mergers and acquisitions (M&A) law is a complex and multifaceted area of law that governs the legal processes involved in combining or acquiring businesses. It encompasses a wide range of legal principles, regulations, and procedures that aim to ensure fairness, transparency, and legal compliance in M&A transactions.

This article provides a comprehensive overview of M&A law, covering its core principles, legal framework, key legislation, and various aspects of M&A transactions.

Navigating legal issues related to mental health can be complex. A dedicated Mental Health Lawyer can advocate for your rights and ensure your legal needs are met.

Core Principles of M&A Law

M&A law is built upon several fundamental principles that guide the legal processes involved in mergers and acquisitions. These principles ensure fairness, transparency, and protection of the interests of all stakeholders involved in the transaction. Some key principles include:

- Fairness and Transparency:M&A transactions should be conducted fairly and transparently, with all parties having access to relevant information and the opportunity to negotiate terms on an equal footing. This principle helps prevent unfair advantages or hidden agendas that could harm the interests of shareholders, employees, or other stakeholders.

- Protection of Shareholders’ Rights:M&A law prioritizes the protection of shareholders’ rights in the context of mergers and acquisitions. Shareholders must be informed of the proposed transaction, their voting rights must be respected, and they must receive fair compensation for their shares.

- Compliance with Regulatory Requirements:M&A transactions are subject to a wide range of regulations, including antitrust laws, securities regulations, and tax laws. Compliance with these regulations is essential to ensure the legality and validity of the transaction.

- Fiduciary Duties of Directors:Directors of companies involved in M&A transactions have fiduciary duties to act in the best interests of their shareholders. This includes carefully evaluating the proposed transaction, ensuring fair terms, and making informed decisions.

Legal Framework Governing M&A Transactions

The legal framework governing M&A transactions is complex and involves various laws, regulations, and judicial precedents. This framework aims to provide a comprehensive set of rules and guidelines for conducting M&A transactions in a legal and ethical manner. Key aspects of the legal framework include:

- Antitrust Laws:Antitrust laws, such as the Sherman Act and Clayton Act in the United States, aim to prevent monopolies and promote competition in the marketplace. M&A transactions that could create or enhance market power may be subject to antitrust review and approval by government agencies.

If you’re looking to establish a living trust, finding a qualified Living Trust Lawyer Near Me is essential. They can guide you through the process and ensure your wishes are legally protected.

- Securities Regulations:Securities regulations, such as the Securities Act of 1933 and the Securities Exchange Act of 1934 in the United States, govern the issuance and trading of securities. M&A transactions involving publicly traded companies are subject to these regulations, requiring disclosure of relevant information and compliance with filing requirements.

Family law matters can be emotionally challenging. A skilled Family Law Attorney can provide legal guidance and representation to help you navigate these complex issues.

- Corporate Law:Corporate law governs the formation, structure, and operation of corporations. M&A transactions often involve changes to the corporate structure, such as mergers or acquisitions, which must comply with applicable corporate law provisions.

- Contract Law:Contract law governs the creation, interpretation, and enforcement of contracts. M&A transactions involve various contracts, including merger agreements, acquisition agreements, and employment contracts, which must be legally valid and enforceable.

Key Legislation and Regulations

Various legislation and regulations govern M&A transactions, depending on the jurisdiction and type of transaction. Some key examples of relevant legislation and regulations include:

- United States:

- Sherman Act (1890)

- Clayton Act (1914)

- Securities Act of 1933

- Securities Exchange Act of 1934

- Hart-Scott-Rodino Antitrust Improvements Act (1976)

- Sarbanes-Oxley Act (2002)

- European Union:

- Merger Regulation (EC) No. 139/2004

- Competition Act (1998)

- Takeover Code (2011)

- United Kingdom:

- Companies Act (2006)

- Takeover Code (2011)

- Competition Act (1998)

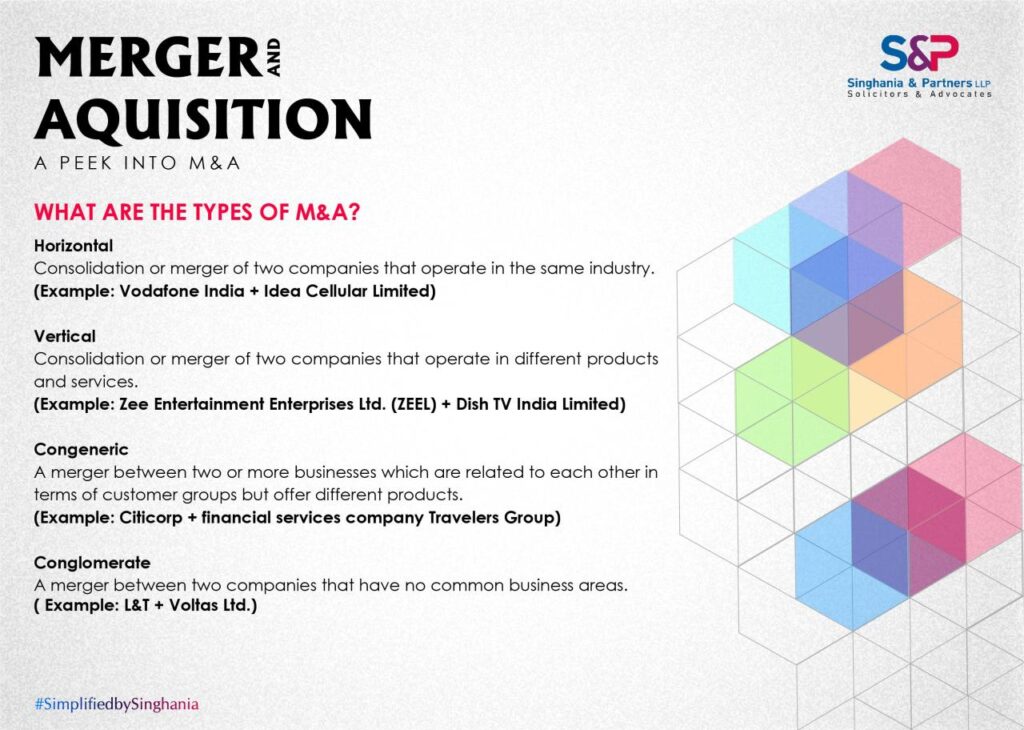

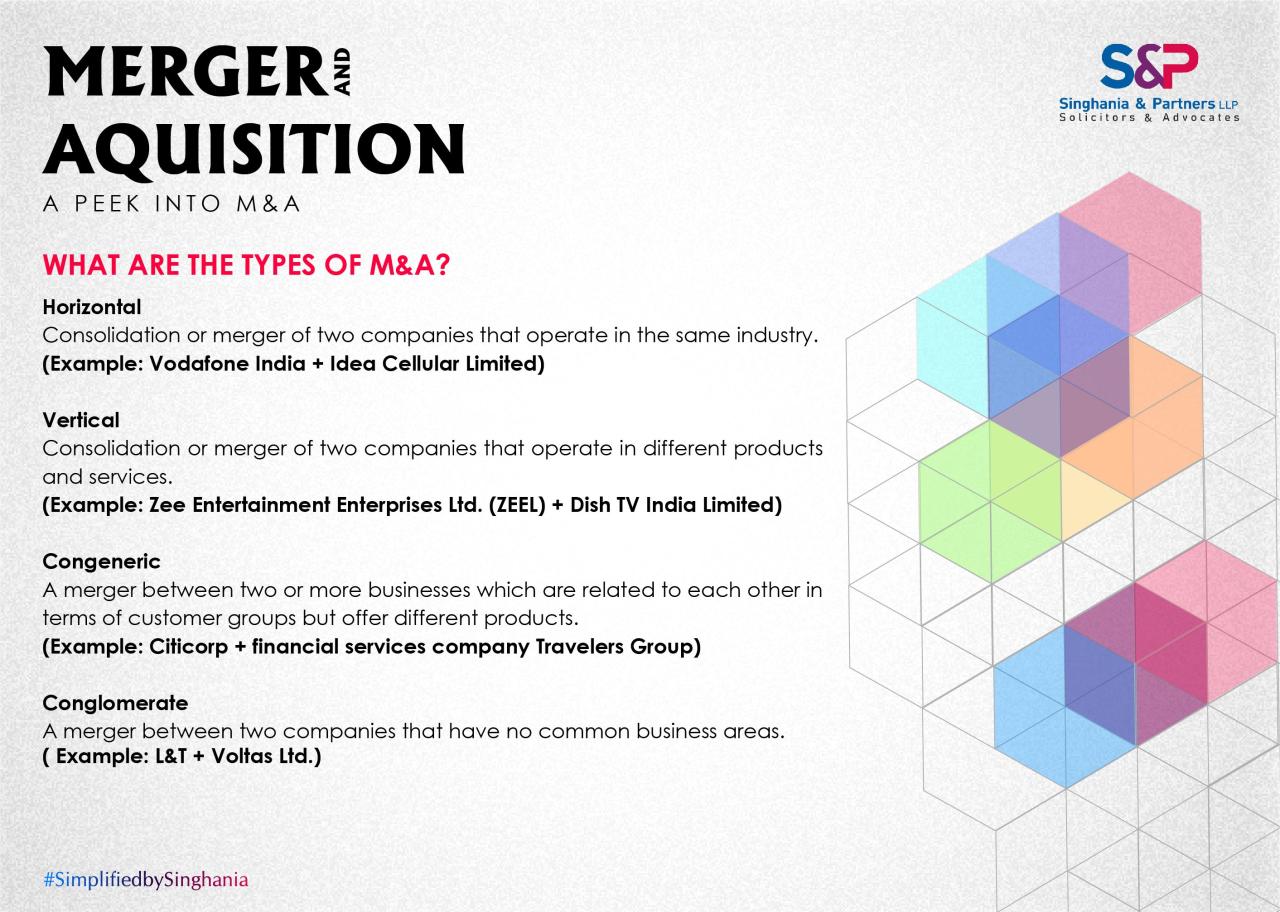

Types of M&A Transactions

M&A transactions can take various forms, each with unique characteristics and legal implications. Understanding the different types of M&A transactions is crucial for businesses considering mergers or acquisitions, as the chosen structure can significantly impact the legal processes, regulatory requirements, and overall outcome of the transaction.

Mergers

A merger is a combination of two or more companies into a single entity. In a merger, one company typically absorbs the other, with the surviving company inheriting all the assets and liabilities of the absorbed company. The shareholders of the absorbed company receive shares in the surviving company, representing their ownership in the merged entity.

Mergers are often driven by strategic considerations, such as expanding market share, gaining access to new technologies, or achieving economies of scale.

Acquisitions

An acquisition is a transaction where one company (the acquirer) purchases a controlling interest in another company (the target). In an acquisition, the target company remains a separate legal entity, but its operations are controlled by the acquirer. Acquisitions can be friendly, where the target company’s management and board of directors support the transaction, or hostile, where the target company’s management opposes the acquisition.

Starting a small business can be exciting, but it’s important to have a skilled Small Business Lawyer Near Me to guide you through the legal aspects of your venture.

Consolidations

A consolidation is similar to a merger, but it involves the creation of an entirely new company. In a consolidation, both merging companies cease to exist, and a new company is formed, inheriting the assets and liabilities of both original companies.

The shareholders of the original companies receive shares in the newly consolidated company, representing their ownership in the combined entity.

If you find yourself facing criminal charges, it’s essential to seek legal advice from a qualified Criminal Solicitor. They can guide you through the legal process and advocate for your rights.

Joint Ventures

A joint venture is a partnership between two or more companies to create a new business entity for a specific purpose. Joint ventures allow companies to share resources, expertise, and risks, while maintaining their separate legal identities. Joint ventures are often used for projects that require significant capital investment or specialized knowledge.

If you’ve been injured in an accident, it’s crucial to have an experienced I Accident Lawyer fighting for your rights. They can help you seek compensation for your injuries and losses.

Legal Implications of Different Transaction Structures

The legal implications of different M&A transaction structures can vary significantly. For example, mergers typically require shareholder approval and may be subject to regulatory scrutiny, while acquisitions may involve a more complex process of due diligence and negotiation.

Facing criminal charges can be daunting, but a skilled Criminal Defense Lawyer can provide strong legal representation and fight for your best interests.

- Mergers:Mergers often require shareholder approval from both merging companies, as well as regulatory approval, depending on the industry and jurisdiction. The legal processes involved in mergers typically include drafting a merger agreement, obtaining shareholder approval, and filing necessary documents with relevant authorities.

- Acquisitions:Acquisitions can be structured as asset purchases or stock purchases. Asset purchases involve the acquisition of specific assets of the target company, while stock purchases involve the acquisition of shares in the target company. The legal processes involved in acquisitions typically include due diligence, negotiation of an acquisition agreement, and closing the transaction.

- Consolidations:Consolidations involve the creation of a new company, which requires the formation of a new corporate entity and the transfer of assets and liabilities from the original companies. The legal processes involved in consolidations are similar to mergers, but with the added step of creating a new corporate entity.

When you need legal assistance with a settlement agreement, it’s crucial to have an experienced Settlement Agreement Solicitor on your side. They can help you understand the terms of the agreement and negotiate a fair outcome.

- Joint Ventures:Joint ventures involve the creation of a new business entity, typically governed by a joint venture agreement. The legal processes involved in joint ventures include drafting the joint venture agreement, establishing the joint venture entity, and allocating ownership and control.

Due Diligence in M&A

Due diligence is a critical step in M&A transactions, involving a thorough investigation of the target company to assess its financial, legal, and operational health. The due diligence process aims to identify potential risks and opportunities associated with the transaction, allowing the acquirer to make an informed decision about whether to proceed with the acquisition.

Purpose and Scope of Due Diligence

The purpose of due diligence is to gather sufficient information to evaluate the target company’s strengths and weaknesses, identify potential risks and liabilities, and assess the feasibility of the proposed transaction. The scope of due diligence can vary depending on the type of transaction, the industry, and the acquirer’s specific needs.

However, common areas of focus during due diligence include:

Key Areas of Focus

- Financial Due Diligence:This involves reviewing the target company’s financial statements, cash flow, profitability, and debt levels. It also includes examining the target company’s accounting policies, internal controls, and tax compliance.

- Legal Due Diligence:This involves reviewing the target company’s legal documents, such as contracts, leases, permits, and licenses. It also includes assessing the target company’s compliance with relevant laws and regulations, as well as potential legal risks and liabilities.

- Operational Due Diligence:This involves reviewing the target company’s operations, including its management team, employees, technology, and supply chain. It also includes assessing the target company’s efficiency, productivity, and customer relationships.

- Environmental Due Diligence:This involves reviewing the target company’s environmental compliance and potential environmental risks and liabilities. It includes examining the target company’s environmental permits, waste management practices, and compliance with environmental regulations.

Due Diligence Reports

The results of the due diligence process are typically summarized in a due diligence report, which provides a comprehensive overview of the target company’s strengths, weaknesses, risks, and opportunities. The due diligence report is a critical document for the acquirer, as it provides the basis for evaluating the transaction and negotiating the terms of the acquisition agreement.

- Structure of a Due Diligence Report:A due diligence report typically includes an executive summary, a detailed review of the key areas of focus, and a conclusion that summarizes the findings and recommendations. The report should be clear, concise, and well-organized, providing sufficient detail to support the conclusions and recommendations.

- Examples of Due Diligence Reports:Due diligence reports can vary in format and content depending on the specific transaction. However, they typically include sections on financial analysis, legal review, operational assessment, and environmental compliance. The report may also include a risk assessment section that identifies potential risks and liabilities associated with the acquisition.

Negotiation and Drafting of M&A Agreements: M&A Law

The negotiation and drafting of M&A agreements are critical steps in the transaction process, as they determine the legal rights and obligations of the parties involved. The M&A agreement is a legally binding contract that Artikels the terms and conditions of the transaction, including the purchase price, representations and warranties, covenants, and closing conditions.

The cost of a Divorce Lawyer can vary depending on factors such as the complexity of the case and the lawyer’s experience. It’s important to discuss fees upfront to ensure you understand the financial implications.

Key Elements of M&A Agreements

- Purchase Price:The purchase price is the amount of money or other consideration that the acquirer will pay for the target company. The purchase price can be structured in various ways, including cash, stock, or a combination of both.

- Representations and Warranties:Representations and warranties are statements made by the target company about its business, financial condition, and legal compliance. These statements are typically made in good faith, but they can create liability for the target company if they are found to be inaccurate or misleading.

Finding the Best Accident Lawyers is crucial for maximizing your chances of a successful outcome. Look for lawyers with experience in handling similar cases and a proven track record of success.

- Covenants:Covenants are promises made by the parties to the agreement, outlining their obligations and restrictions during the transaction process. Covenants can include provisions related to the target company’s operations, financing, and regulatory compliance.

- Closing Conditions:Closing conditions are specific requirements that must be met before the transaction can be completed. These conditions can include regulatory approvals, financing arrangements, and shareholder approval.

Legal Implications of Negotiation Strategies and Drafting Techniques

The negotiation strategies and drafting techniques used in M&A agreements can have significant legal implications. For example, the choice of purchase price structure, the scope of representations and warranties, and the negotiation of closing conditions can all impact the legal risks and obligations of the parties involved.

- Negotiation Strategies:The negotiation process in M&A transactions typically involves a balance of cooperation and competition. The parties aim to reach an agreement that is mutually beneficial, but they may also engage in competitive tactics to secure favorable terms.

- Drafting Techniques:The drafting of M&A agreements requires careful attention to detail and legal expertise. The language used in the agreement should be clear, concise, and unambiguous, avoiding potential loopholes or ambiguities that could lead to disputes.

Common Clauses and Their Impact on the Transaction, M&A Law

M&A agreements often include a variety of standard clauses, each with specific legal implications. Some common clauses include:

- Indemnification Clause:This clause protects the acquirer from certain liabilities of the target company, such as environmental liabilities or product liability claims.

- Material Adverse Change Clause:This clause allows the acquirer to terminate the agreement if a material adverse change occurs in the target company’s business before the closing date.

- Termination Clause:This clause Artikels the conditions under which either party can terminate the agreement.

Regulatory Approvals and Filings

M&A transactions often require regulatory approvals and filings before they can be completed. These approvals ensure that the transaction complies with antitrust laws, securities regulations, and other relevant laws and regulations. The specific regulatory approvals required will depend on the type of transaction, the industry, and the jurisdiction.

For those who cannot afford legal representation, Pro Bono Family Lawyers can provide valuable legal assistance at no cost. These lawyers are dedicated to helping those in need.

Regulatory Approvals

- Antitrust Clearance:Antitrust laws aim to prevent monopolies and promote competition in the marketplace. M&A transactions that could create or enhance market power may be subject to antitrust review and approval by government agencies. For example, in the United States, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) review M&A transactions to ensure they do not violate antitrust laws.

- Securities Filings:M&A transactions involving publicly traded companies are subject to securities regulations, requiring disclosure of relevant information and compliance with filing requirements. For example, in the United States, the Securities and Exchange Commission (SEC) requires companies to file certain documents, such as prospectuses and proxy statements, related to M&A transactions.

- Other Regulatory Approvals:Depending on the industry and jurisdiction, M&A transactions may also require other regulatory approvals, such as approval from banking regulators, telecommunications regulators, or environmental protection agencies.

Process for Obtaining Approvals

The process for obtaining regulatory approvals can vary depending on the specific requirements of the relevant agencies. However, it typically involves the following steps:

- Pre-filing Consultation:The parties may engage in pre-filing consultations with the relevant agencies to discuss the proposed transaction and obtain guidance on the regulatory requirements.

- Filing of Applications and Documents:The parties will file applications and supporting documents with the relevant agencies, providing detailed information about the proposed transaction.

- Agency Review:The relevant agencies will review the filed documents and may request additional information or hold hearings to assess the potential impact of the transaction.

- Decision:The agencies will make a decision on whether to approve or reject the proposed transaction, based on their assessment of the potential impact on competition, consumer welfare, or other relevant factors.

Impact of Regulatory Scrutiny

Regulatory scrutiny can significantly impact the timeline and outcome of M&A transactions. If a transaction is subject to extensive regulatory review, it may take longer to complete, and the terms of the transaction may be subject to negotiation with the regulatory agencies.

In some cases, regulatory agencies may impose conditions on the transaction, such as divestitures or behavioral remedies, to address concerns about potential antitrust issues or other regulatory concerns.

A knowledgeable Trust Lawyer can provide expert guidance on setting up and managing trusts, ensuring your assets are distributed according to your wishes.

Summary

Navigating the world of M&A Law requires a deep understanding of legal principles, regulatory requirements, and the intricacies of business transactions. From due diligence to regulatory approvals, every step demands careful planning and execution. Ultimately, M&A Law empowers businesses to make informed decisions, navigate complex legal landscapes, and achieve their strategic objectives through mergers and acquisitions.

The Bradley Law Firm is a reputable legal firm known for its expertise in various legal areas. Their team of experienced attorneys can provide guidance and representation for a wide range of legal needs.

Query Resolution

What is the difference between a merger and an acquisition?

A merger involves two companies combining to form a new entity, while an acquisition is where one company takes over another, absorbing it entirely.

Facing foreclosure can be a stressful experience, but a skilled Foreclosure Defense Lawyer can help you explore your options and fight for your property.

Why is due diligence important in M&A transactions?

Due diligence helps identify potential risks and liabilities before a deal is finalized. It involves examining the target company’s financial records, legal documents, and operations.

What are some common legal issues that arise in M&A transactions?

Common issues include antitrust concerns, securities regulations, intellectual property rights, and contract disputes.

What are the key considerations for post-merger integration?

Post-merger integration involves aligning operations, cultures, and systems. Key considerations include employee retention, technology integration, and brand management.