Is Immediate Annuity Income Taxable 2024 – Is Immediate Annuity Income Taxable in 2024? Understanding the tax implications of immediate annuities is crucial for anyone considering this retirement income strategy. Immediate annuities offer a guaranteed stream of income for life, but the tax treatment of these payments can vary depending on several factors.

Dollify has exciting new features! Dollify 2024: How to Use the New Features guides you through the latest updates, from creating custom avatars to adding unique details.

This article explores the taxability of immediate annuity income in 2024, highlighting key considerations and potential tax implications for individuals seeking retirement security.

Immediate annuities provide a guaranteed stream of income for life, often preferred by retirees seeking financial stability. However, understanding the tax implications of these payments is essential for maximizing retirement income and avoiding unexpected tax burdens. This article will delve into the tax treatment of immediate annuity income in 2024, outlining the relevant tax laws, deductions, and exemptions applicable to these financial instruments.

Annuity drawdown is a popular strategy for retirement income. Is Annuity Drawdown 2024 explains how it works and its potential advantages for managing your retirement funds.

We’ll also discuss how different annuity contract terms and individual circumstances can influence taxability, providing valuable insights for informed decision-making.

Google Tasks is a handy tool for students, especially in 2024. Google Tasks 2024: Google Tasks for Students showcases its features and how it can help you stay organized and on top of your academic workload.

Contents List

Understanding Immediate Annuities

An immediate annuity is a type of financial product that provides a stream of guaranteed income payments for life. This type of annuity is purchased with a lump sum payment, and the payments begin immediately after the purchase is complete.

Immediate annuities are often used by retirees to supplement their income and provide financial security.

While Dollify is popular, there are other excellent alternatives. Dollify 2024: The Best Dollify 2024 Alternatives explores some of the best options for creating custom avatars and digital art.

Characteristics of Immediate Annuities

Immediate annuities have several key characteristics that make them distinct from other financial products. Here’s a breakdown:

- Guaranteed Payments:Immediate annuities provide a guaranteed stream of income payments for life, regardless of how long the annuitant lives. This feature makes them attractive to individuals seeking predictable income.

- Lump Sum Payment:The purchase of an immediate annuity requires a lump sum payment. This payment is used to fund the annuity and generate the income stream.

- Fixed or Variable Payments:Immediate annuities can offer fixed or variable payments. Fixed annuities provide a guaranteed amount of income each month, while variable annuities offer payments that fluctuate based on the performance of underlying investments.

- No Death Benefit:Unlike some other annuities, immediate annuities typically do not offer a death benefit. This means that the remaining payments are not paid to a beneficiary upon the annuitant’s death.

Differences Between Immediate and Deferred Annuities

Immediate annuities are different from deferred annuities, which are purchased with a lump sum payment but do not begin making payments until a future date. Deferred annuities allow for the accumulation of funds over time, potentially growing through investment returns.

Here’s a table summarizing the key differences:

| Feature | Immediate Annuity | Deferred Annuity |

|---|---|---|

| Payment Start Date | Immediately after purchase | At a future date |

| Lump Sum Payment | Required at purchase | Required at purchase |

| Growth Potential | Limited to interest earned on the initial payment | Potential for investment growth over time |

| Death Benefit | Typically none | May include a death benefit |

Tax Implications of Immediate Annuities: Is Immediate Annuity Income Taxable 2024

Understanding the tax implications of immediate annuities is crucial for retirement planning. Here’s a breakdown of how annuity payments are taxed.

Android WebView 202 is gaining traction in the enterprise world. Android WebView 202 for enterprise use examines its benefits for businesses, including improved security and enhanced web app integration.

Tax Treatment of Annuity Payments

The payments from an immediate annuity are generally taxed as ordinary income. This means that the income is taxed at the same rate as your other income, such as wages or interest. The IRS uses the “exclusion ratio” to determine the taxable portion of each payment.

Breakdown of Principal and Interest

The payments from an immediate annuity consist of two parts: principal and interest. The principal portion represents the original lump sum payment you made to purchase the annuity, while the interest portion represents the earnings on that payment. The exclusion ratio is used to determine what portion of each payment represents a return of your original principal (which is not taxable) and what portion represents taxable interest income.

Are you thinking about including a fixed annuity in your IRA? Fixed Annuity In Ira 2024 explores the advantages and drawbacks of this strategy for retirement savings.

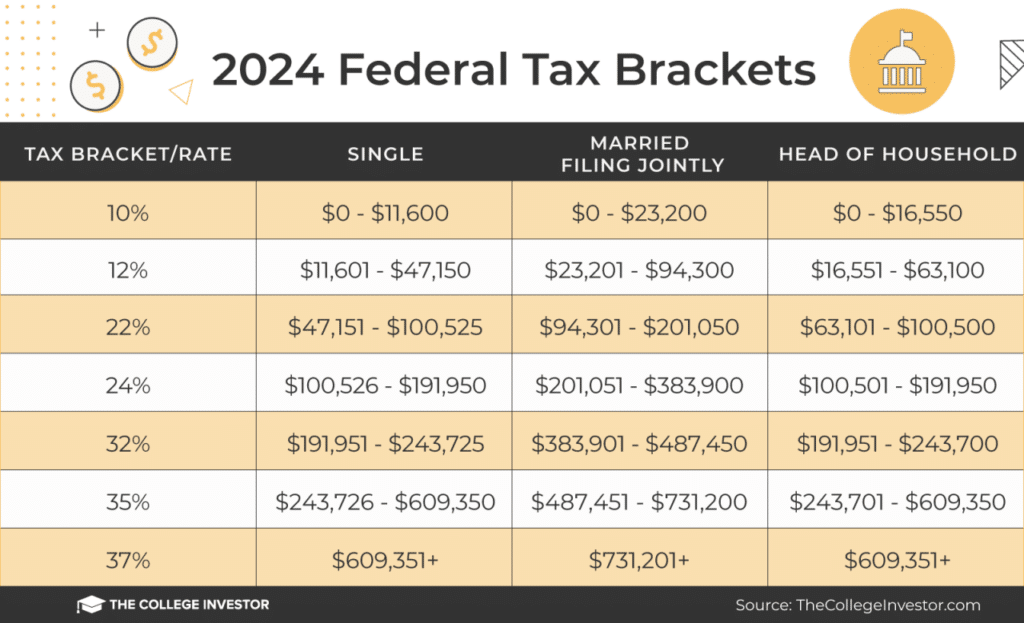

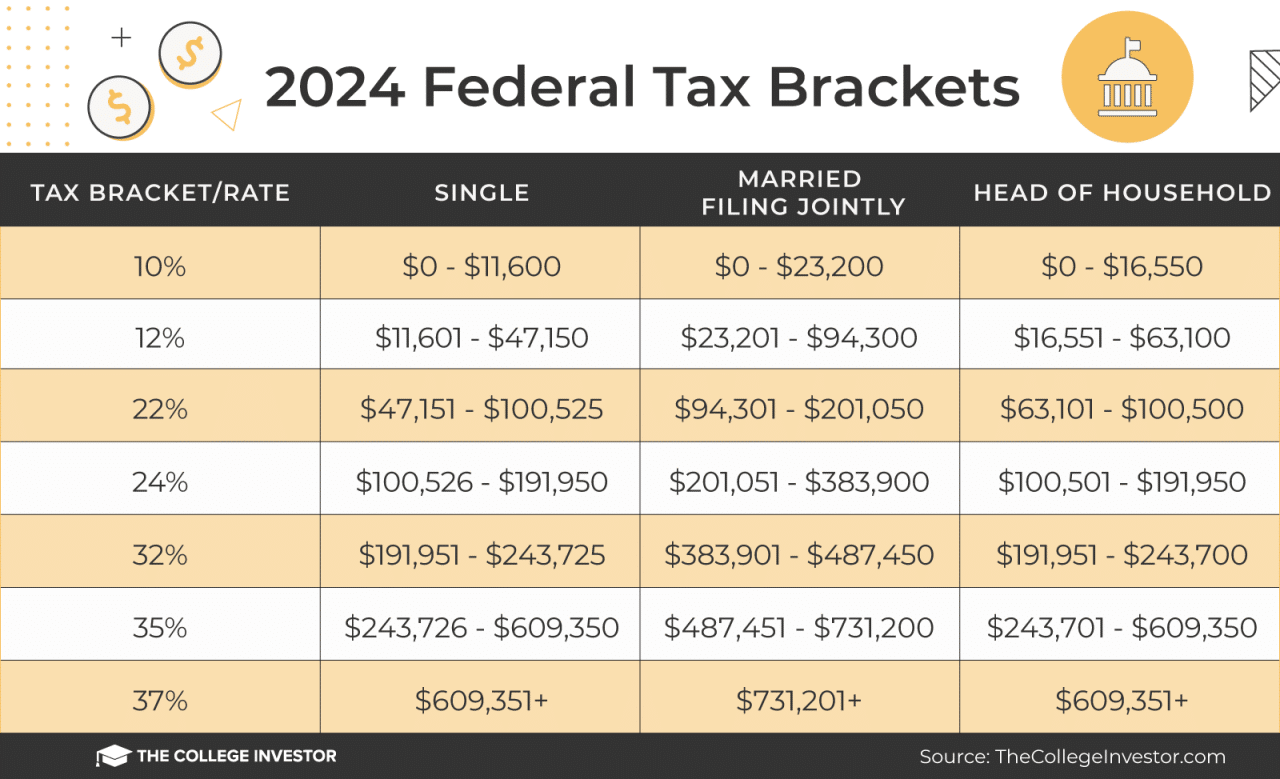

Tax Brackets and Annuity Income

The tax bracket you fall into will determine the tax rate you pay on the taxable portion of your annuity payments. For example, if you are in the 22% tax bracket, you will pay 22% in taxes on the taxable portion of your annuity income.

Android app development is booming across industries. Android app development for specific industries in 2024 examines the trends and opportunities in sectors like healthcare, finance, and e-commerce.

It’s important to consider your current and projected tax bracket when planning for retirement income using an immediate annuity.

Taxability of Immediate Annuity Income in 2024

While the general principles of taxation for immediate annuities remain consistent, it’s crucial to stay informed about any potential changes in tax laws that may impact your retirement income planning. Here are some key points to consider for 2024:

Tax Law Changes in 2024

As of this writing, there are no specific changes to tax laws in 2024 that directly impact immediate annuity income. However, it’s always a good idea to consult with a tax professional for the most up-to-date information.

Is an annuity a good investment for you in 2024? Is Annuity Good Investment 2024 explores the factors to consider when evaluating annuities as part of your investment portfolio.

Deductions and Exemptions

There are no specific deductions or exemptions available for immediate annuity income in 2024. However, you may be able to deduct certain expenses related to your annuity, such as investment advisory fees or insurance premiums, if they meet specific IRS criteria.

Annuity Gator is a valuable resource for annuity shoppers. Annuity Gator 2024 provides a comprehensive guide to navigating the complexities of the annuity market.

Retirement Income Planning Implications

Immediate annuities can be a valuable tool for retirement income planning, but it’s essential to consider their tax implications. By understanding the tax treatment of annuity payments, you can make informed decisions about how to structure your retirement income and minimize your tax liability.

Before committing to an annuity, it’s essential to understand potential issues. Annuity Issues 2024 highlights key factors to consider, like surrender charges and market fluctuations.

Factors Affecting Taxability

Several factors influence the taxability of immediate annuity income. Here’s a breakdown of key considerations:

Annuity Contract Terms

The specific terms of your annuity contract will play a significant role in determining the tax treatment of your payments. Factors to consider include the type of annuity (fixed or variable), the payment schedule, and any optional features included in the contract.

Beyond personal use, Dollify can be a powerful tool for businesses. Dollify 2024: How to Use Dollify 2024 for Business explains how to leverage its capabilities for marketing, branding, and customer engagement.

Types of Immediate Annuities

Different types of immediate annuities may have different tax implications. For example, a single-premium immediate annuity (SPIA) may have a different tax treatment than a flexible premium immediate annuity (FPIA). It’s essential to understand the tax implications of the specific type of annuity you are considering.

Annuity home loans offer a unique approach to financing your dream home. Annuity Home Loan 2024 explains the benefits and considerations of this alternative mortgage option.

Planning Considerations

Planning for immediate annuity income requires careful consideration of the tax implications. Here’s a table summarizing the tax implications of various annuity scenarios:

Tax Implications of Annuity Scenarios

| Scenario | Tax Treatment |

|---|---|

| Fixed annuity with guaranteed payments | Taxed as ordinary income, with a portion excluded based on the exclusion ratio |

| Variable annuity with payments based on investment performance | Taxed as ordinary income, with a portion excluded based on the exclusion ratio |

| Annuity with a death benefit | The death benefit may be subject to estate taxes |

| Annuity purchased with a Roth IRA rollover | Payments are generally tax-free |

Checklist for Planning

Here’s a checklist of steps to consider when planning for immediate annuity income:

- Consult with a tax professional to understand the tax implications of your specific situation.

- Review the terms of your annuity contract to determine the tax treatment of your payments.

- Consider your current and projected tax bracket when making decisions about your annuity.

- Explore potential deductions and exemptions that may apply to your annuity income.

Calculating Tax Liability

To calculate the potential tax liability on an immediate annuity, you can use the following steps:

- Determine the exclusion ratio:This is calculated by dividing the original investment in the annuity by the total expected payments. For example, if you invested $100,000 and expect to receive $200,000 in payments, the exclusion ratio would be 0.5 (100,000 / 200,000).

- Multiply the exclusion ratio by each payment:This will give you the non-taxable portion of each payment. For example, if your exclusion ratio is 0.5 and you receive a payment of $1,000, the non-taxable portion would be $500 (0.5 x 1,000).

- Subtract the non-taxable portion from the total payment:This will give you the taxable portion of each payment. In the example above, the taxable portion would be $500 (1,000

500).

- Calculate the total taxable income from your annuity:Add up the taxable portions of all your annuity payments for the year.

- Apply your tax bracket to the taxable income:This will give you your total tax liability on your annuity income.

Seeking Professional Advice

When dealing with complex financial products like immediate annuities, seeking professional advice is essential. Here’s why:

Importance of Professional Guidance

A tax professional can help you understand the tax implications of immediate annuities and ensure you are making informed decisions. They can also provide guidance on strategies to minimize your tax liability and optimize your retirement income planning.

Understanding how annuities are taxed is crucial for financial planning. How Annuity Is Taxed 2024 provides insights into the tax implications of different annuity types.

Benefits of Financial Advisor Expertise

A financial advisor specializing in retirement planning can provide valuable insights into the different types of annuities available and help you choose the best option for your specific needs and financial goals. They can also assist with the investment and management of your annuity funds.

Android WebView 202 has received significant performance improvements. Android WebView 202 performance improvements dives into the updates and how they enhance web browsing experiences on Android devices.

Risks of Making Tax Decisions Without Advice, Is Immediate Annuity Income Taxable 2024

Making tax-related decisions without expert advice can lead to significant financial consequences. You may end up paying more taxes than necessary or make decisions that are not in your best interest. Consulting with a qualified professional can help you avoid these pitfalls and make informed choices for your retirement planning.

Wondering if an annuity is the right financial move for you in 2024? Is Getting An Annuity Worth It 2024 explores the pros and cons, helping you make an informed decision.

Final Wrap-Up

Planning for retirement income requires careful consideration of various factors, including the tax implications of different financial strategies. Immediate annuities can provide a reliable stream of income, but understanding their tax treatment is essential for maximizing retirement income and minimizing potential tax liabilities.

Consulting with a tax professional and financial advisor can help individuals navigate the complexities of annuity income taxation, ensuring informed decision-making and maximizing their retirement savings.

Essential Questionnaire

What is the difference between an immediate annuity and a deferred annuity?

An immediate annuity begins paying out income immediately after purchase, while a deferred annuity has a delay period before income payments start.

Can I deduct the cost of an immediate annuity on my taxes?

Generally, you can’t deduct the cost of an immediate annuity. However, you may be able to deduct certain expenses related to the annuity, such as investment management fees, if they meet specific requirements.

How are annuity payments taxed if I receive them before age 59 1/2?

If you receive annuity payments before age 59 1/2, they may be subject to a 10% early withdrawal penalty, in addition to regular income tax. However, there are exceptions to this rule, such as if you have a qualified disability or meet other specific criteria.

What happens to my annuity payments if I die before I receive all of the payments?

Depending on the terms of your annuity contract, your beneficiary may receive the remaining payments or a lump sum payout. It’s crucial to review your contract and understand the death benefit provisions.