Interest Rates Today 2024: A Look at the Current Landscape. In a world of economic uncertainty, understanding the ebb and flow of interest rates is paramount. From influencing borrowing costs for individuals and businesses to shaping investment strategies, interest rates play a crucial role in shaping the economic landscape.

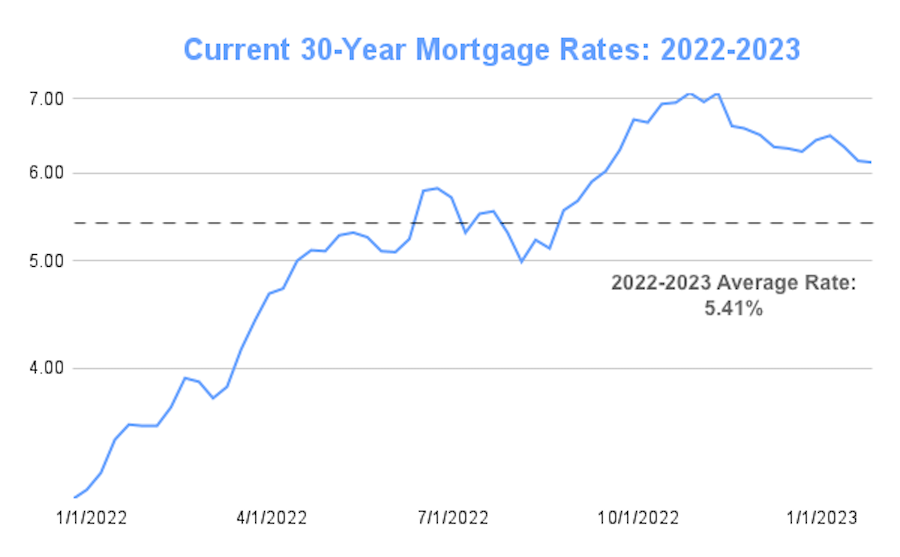

Before you start shopping for a mortgage, understanding current mortgage rates can help you set realistic expectations and make informed decisions.

This year, 2024, has presented a dynamic environment, with central banks navigating a complex interplay of inflation, economic growth, and geopolitical factors. This exploration delves into the current state of interest rates, examining the factors that influence their movements and their implications for borrowers, lenders, and investors alike.

This exploration delves into the current state of interest rates, examining the factors that influence their movements and their implications for borrowers, lenders, and investors alike. From the impact on mortgage rates and consumer loans to the strategies for navigating a volatile market, this article provides insights into the evolving world of interest rates and their broader economic consequences.

Whether you’re a first-time buyer or looking to upgrade, exploring home loan options is a key step. Shop around for the best rates and terms to find the right fit for your financial situation.

Contents List

Current Interest Rate Landscape

The interest rate landscape in 2024 is characterized by a dynamic interplay of factors, including inflation, economic growth, and central bank policies. As of [Tanggal], interest rates have been on an upward trajectory, reflecting a combination of persistent inflation and efforts by central banks to cool down economic activity.

Mortgage rates can vary significantly depending on the lender and loan type. To get a clear picture of mortgage rates in 2024, compare offers from multiple lenders.

Factors Influencing Interest Rates

Several key factors influence interest rate movements, including:

- Inflation:When inflation is high, central banks tend to raise interest rates to curb excessive spending and bring inflation back to their target level. The higher inflation is, the more likely central banks are to increase interest rates.

- Economic Growth:When the economy is growing strongly, central banks may raise interest rates to prevent overheating and potential inflation. Conversely, during periods of slow economic growth, central banks may lower interest rates to stimulate borrowing and spending.

- Central Bank Policies:Central banks play a crucial role in setting interest rates. The Federal Reserve (Fed) in the United States, the European Central Bank (ECB), and other central banks around the world use interest rate adjustments as a primary tool to manage inflation and economic growth.

Current Interest Rates

| Benchmark | Current Rate |

|---|---|

| Federal Funds Rate | [Insert current rate] |

| Prime Rate | [Insert current rate] |

| LIBOR | [Insert current rate] |

Impact on Borrowers and Lenders

Rising interest rates have a significant impact on both borrowers and lenders, affecting their borrowing costs and lending returns.

Impact on Borrowers

- Mortgage Holders:As interest rates rise, mortgage rates also increase, making it more expensive to borrow money for home purchases or refinancing existing mortgages. This can put a strain on household budgets and potentially limit home affordability.

- Business Owners:Businesses that rely on borrowing to finance operations or expansion may face higher interest costs, impacting their profitability and growth prospects. Increased borrowing costs can make it more challenging for businesses to invest in new projects or expand their operations.

Need cash for home improvements or other expenses? A cash-out refinance might be a viable option. This allows you to borrow against your home’s equity, but be sure to consider the potential risks involved.

- Consumers:Consumers who take out loans for cars, credit cards, or personal expenses will experience higher interest rates, increasing their monthly payments and overall borrowing costs. This can lead to reduced discretionary spending and potentially impact consumer confidence.

Impact on Lenders

- Banks and Financial Institutions:Rising interest rates can benefit lenders, as they can charge higher interest rates on loans, leading to increased profits. However, they also need to manage the risk of borrowers defaulting on their loans, as higher interest rates can make it more challenging for borrowers to make their payments.

Comparison of Loan Types

The impact of rising interest rates varies depending on the type of loan. For example, variable-rate mortgages are more sensitive to interest rate changes than fixed-rate mortgages. Similarly, short-term loans tend to be more affected by interest rate increases than long-term loans.

Interest Rate Forecasts

Forecasting future interest rate movements is a complex task, as it involves numerous factors and uncertainties. However, experts and analysts provide insights and predictions based on their analysis of economic conditions, central bank policies, and market sentiment.

Expert Opinions and Forecasts

According to [Source 1], interest rates are expected to [Forecast 1]. [Source 2] suggests that interest rates may [Forecast 2]. These forecasts are based on [Reason 1] and [Reason 2].

Potential Risks and Opportunities

Rising interest rates present both risks and opportunities for investors. On the one hand, higher interest rates can erode the value of fixed-income investments, such as bonds. On the other hand, they can create opportunities for higher returns on investments in sectors that benefit from a strong economy, such as certain stocks and real estate.

Factors Influencing Future Decisions

Future interest rate decisions by central banks will likely be influenced by factors such as inflation, economic growth, labor market conditions, and geopolitical events. Central banks will continue to monitor these factors closely and adjust interest rates accordingly to maintain price stability and support sustainable economic growth.

If you’re a senior homeowner looking to tap into your home equity, a reverse mortgage could be an option. These loans allow you to receive cash based on your home’s value, without having to make monthly payments.

Investment Strategies

In a rising interest rate environment, investors need to adjust their portfolios to mitigate potential risks and capitalize on potential opportunities. This involves understanding the impact of interest rates on different asset classes and developing investment strategies that align with their risk tolerance and financial goals.

Stay up-to-date on the latest mortgage rates by checking online resources or consulting with a mortgage lender. Rates can fluctuate daily, so staying informed is crucial.

Adjusting Portfolios

Investors may consider reducing their exposure to fixed-income securities, such as bonds, as rising interest rates can erode their value. Conversely, they may consider increasing their exposure to assets that tend to perform well in a rising interest rate environment, such as stocks, real estate, and commodities.

Investment Strategies for Different Risk Tolerances

- Conservative Investors:Conservative investors may prefer to focus on low-risk investments, such as short-term bonds or money market accounts, which offer relatively stable returns. They may also consider diversifying their portfolios with investments in real estate or other assets that are less sensitive to interest rate changes.

- Moderate Investors:Moderate investors may consider a balanced portfolio that includes a mix of stocks, bonds, and other assets. They may adjust their asset allocation based on their assessment of interest rate trends and economic conditions.

- Aggressive Investors:Aggressive investors may consider investing in growth stocks, emerging markets, or other investments that have the potential for higher returns but also carry higher risks. They may also consider using leverage, such as margin accounts or options, to amplify their returns but should be aware of the increased risks involved.

Investing in Bonds, Stocks, and Other Assets

- Bonds:Bonds are fixed-income securities that pay a fixed interest rate. In a rising interest rate environment, the value of existing bonds tends to decline, as investors demand higher yields on newly issued bonds. However, bonds can still provide a steady stream of income and diversification benefits in a portfolio.

Finding the best mortgage rates in 2024 will require some research. Consider factors like your credit score, loan type, and the current market conditions.

- Stocks:Stocks are equity securities that represent ownership in a company. While rising interest rates can negatively impact the stock market in the short term, stocks tend to perform well over the long term, especially in a growing economy. Companies with strong fundamentals and growth potential may be less affected by interest rate increases.

- Other Assets:Other assets, such as real estate, commodities, and alternative investments, can also offer diversification benefits and potential returns in a rising interest rate environment. Real estate can be a hedge against inflation, while commodities can benefit from increased demand in a strong economy.

Active military members and veterans have access to special financing through VA home loans. These loans offer unique benefits, such as no down payment requirement and competitive rates.

However, these investments also carry their own risks and should be carefully considered.

Economic Implications

Rising interest rates have a significant impact on the overall economy, affecting consumer spending, business investment, and economic growth.

Impact on Consumer Spending

Higher interest rates can reduce consumer spending, as borrowers face higher costs for loans and credit cards. This can lead to a slowdown in economic growth, as consumers have less disposable income to spend on goods and services.

Impact on Business Investment, Interest Rates Today 2024

Businesses may also reduce their investment spending in a rising interest rate environment, as borrowing costs increase. This can impact economic growth, as businesses have less incentive to invest in new projects or expand their operations.

Impact on Economic Growth

The overall impact of rising interest rates on economic growth is complex and depends on various factors, including the magnitude of the interest rate increases, the health of the economy, and consumer and business confidence. In general, rising interest rates can slow economic growth, but they can also help to stabilize the economy by controlling inflation and preventing overheating.

Impact on Different Sectors

The impact of rising interest rates can vary across different sectors of the economy. For example, sectors that are sensitive to interest rates, such as housing and consumer durables, may experience a slowdown in growth. However, sectors that benefit from a strong economy, such as technology and healthcare, may continue to perform well.

Risks and Opportunities

Rising interest rates present both risks and opportunities for the overall economy. On the one hand, they can help to control inflation and prevent economic instability. On the other hand, they can slow economic growth and potentially lead to a recession.

It is crucial for policymakers to carefully manage interest rates to balance the need for price stability with the need to support economic growth.

Final Review

As we navigate the complexities of the current interest rate environment, it is clear that staying informed and adaptable is key. Understanding the factors driving interest rate movements, their impact on various stakeholders, and the potential economic implications will empower individuals and businesses to make informed decisions and capitalize on opportunities in this dynamic landscape.

By staying informed and embracing a strategic approach, we can effectively navigate the evolving world of interest rates and its impact on our financial well-being.

If you have an existing mortgage, consider refinancing to lower your monthly payments or shorten your loan term. However, make sure the savings outweigh the closing costs.

FAQ Explained: Interest Rates Today 2024

What are the main factors influencing interest rates in 2024?

Interest rates are influenced by a complex interplay of factors, including inflation, economic growth, central bank policies, and geopolitical events. Inflation, particularly persistent inflation, tends to drive interest rates higher as central banks aim to control price increases. Economic growth, when robust, can also push interest rates up as demand for borrowing increases.

Planning to buy a home in 2024? Understanding mortgage trends is crucial. You’ll want to keep an eye on current mortgage rates to make informed decisions.

Central bank policies, such as setting target interest rates and adjusting monetary supply, directly influence interest rates. Finally, geopolitical events, such as wars or trade disputes, can create uncertainty and impact interest rate movements.

How do rising interest rates affect borrowers?

Rising interest rates increase borrowing costs for individuals and businesses. For mortgage holders, this means higher monthly payments. For business owners, it can make loans more expensive, potentially impacting investment and expansion plans. Consumers may face higher interest rates on credit cards and personal loans, reducing disposable income.

What are some investment strategies for a rising interest rate environment?

In a rising interest rate environment, investors may consider shifting their portfolios toward assets that benefit from higher rates. Bonds, particularly short-term bonds, tend to perform well as yields increase. High-quality, dividend-paying stocks can also provide stability and income. However, it’s crucial to assess individual risk tolerance and investment goals before making any significant changes.