Epli Coverage, often referred to as Employment Practices Liability Insurance, is a vital shield for businesses navigating the complexities of today’s workforce. It provides a safety net against a wide range of employment-related claims, offering peace of mind for employers and their organizations.

Filing an Allstate auto claim can be a straightforward process if you have your policy information and details of the accident ready. Allstate offers multiple ways to file a claim, including online, through their app, or by phone. It’s important to follow their instructions and provide all necessary documentation.

EPLI coverage protects businesses from financial losses arising from allegations of discrimination, harassment, wrongful termination, wage and hour violations, and other employment-related issues. This type of insurance is particularly crucial for businesses with a significant number of employees, those operating in industries with high litigation risks, and those facing evolving employment laws.

Understanding your insurance policy and knowing how to file a claim is essential to ensure you receive the claim benefits you’re entitled to. Familiarize yourself with your policy’s terms and conditions, and keep your contact information up-to-date for a smooth claim process.

Contents List

What is EPLI Coverage?

EPLI coverage, or Employment Practices Liability Insurance, is a specialized type of liability insurance designed to protect businesses from financial losses arising from employment-related claims. It acts as a safety net for employers, safeguarding them against legal expenses, settlements, and judgments stemming from various employment-related issues.

AT&T offers a convenient way to file a claim for your damaged phone through their Phoneclaim app. This app allows you to file a claim, track its progress, and even order a replacement phone, all from your mobile device.

It’s a hassle-free way to handle phone claims.

Types of Risks Covered

EPLI insurance provides coverage for a wide range of employment-related risks, including:

- Wrongful termination:This includes claims alleging unfair dismissal, discrimination, or breach of contract.

- Harassment and discrimination:This covers claims related to sexual harassment, racial discrimination, or other forms of unlawful discrimination.

- Retaliation:EPLI protects employers against claims arising from retaliation against employees who have filed complaints or engaged in protected activities.

- Wage and hour violations:Claims related to unpaid wages, overtime pay, or misclassification of employees can be covered by EPLI.

- Defamation and privacy violations:This includes claims arising from false statements about employees or unauthorized disclosure of confidential information.

- Negligent hiring and supervision:EPLI can cover claims alleging that an employer failed to properly screen or supervise employees, leading to harm to others.

Examples of Situations Where EPLI Coverage Would Be Beneficial

- A company terminates an employee without proper documentation, leading to a wrongful termination lawsuit.

- An employee alleges sexual harassment by a supervisor, resulting in a discrimination claim.

- A company faces a wage and hour lawsuit for failing to pay overtime to its employees.

Key Features of EPLI Coverage

EPLI policies typically include various key features that define the scope and limits of coverage. Understanding these features is crucial for making informed decisions about EPLI coverage.

Coverage Limits

EPLI policies have coverage limits, which represent the maximum amount the insurer will pay for covered claims during a policy period. These limits can vary depending on factors such as the size and industry of the business.

American Family Insurance offers a convenient online platform for filing American Family insurance claims. You can file a claim, track its progress, and communicate with your insurer all from the comfort of your home. This makes the claim process easier and more efficient.

Deductibles

EPLI policies often include deductibles, which are the amount the insured party must pay out-of-pocket before the insurer begins covering claims. Deductibles can be negotiated and vary depending on the policy terms.

Exclusions

EPLI policies also have exclusions, which are specific circumstances or types of claims that are not covered. Common exclusions include claims arising from intentional acts, criminal activity, or certain types of discrimination.

First party insurance covers your own losses, such as damage to your car in an accident. It’s crucial to understand your coverage and limits, as it can protect you financially in unexpected situations. Make sure you know what your policy covers and how to file a claim if needed.

Types of Claims Covered

EPLI policies typically cover a wide range of claims, including:

- Defense costs:EPLI covers the legal fees and expenses associated with defending against employment-related lawsuits.

- Settlements and judgments:EPLI provides coverage for settlements and judgments awarded against the insured party in employment-related cases.

- Punitive damages:In some cases, EPLI policies may cover punitive damages, which are intended to punish the wrongdoer.

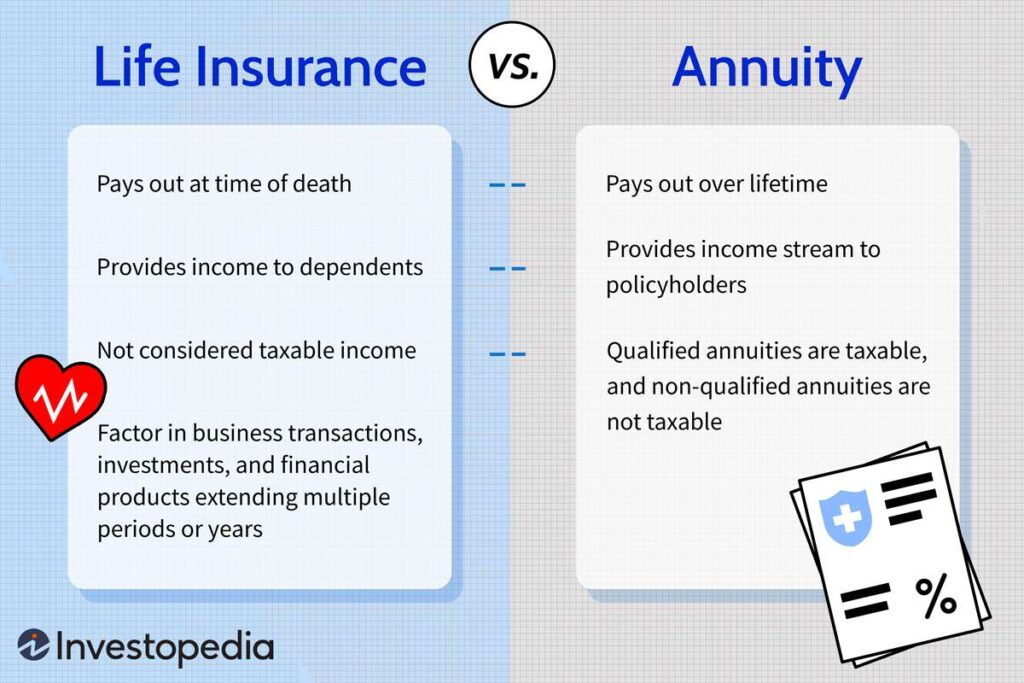

Comparison with Other Liability Insurance

EPLI coverage is distinct from other types of liability insurance, such as general liability insurance. While general liability insurance covers risks associated with property damage or bodily injury, EPLI specifically focuses on employment-related risks. It is essential to have both types of insurance to provide comprehensive protection for your business.

Maintaining a good driving record can earn you a no claims discount on your car insurance. This discount rewards responsible drivers with lower premiums. By driving safely and avoiding accidents, you can save money on your insurance costs.

Who Needs EPLI Coverage?

EPLI coverage is essential for a wide range of organizations, particularly those with employees. While it is not mandatory, it is highly recommended for businesses that face potential employment-related risks.

Understanding the legal concept of defamation can be helpful in protecting your reputation. Defamation involves making false statements that damage someone’s character or reputation. If you believe you’ve been a victim of defamation, it’s essential to consult with an attorney to understand your legal options.

Types of Organizations That Should Consider EPLI Coverage

- Businesses with a large workforce:Larger companies have a higher probability of facing employment-related claims due to the sheer number of employees.

- Companies in high-risk industries:Industries such as healthcare, education, and hospitality are prone to employment-related claims.

- Organizations with complex employment practices:Businesses with intricate employment policies, procedures, or employee agreements may benefit from EPLI.

- Startups and small businesses:While often overlooked, startups and small businesses can also face employment-related risks and benefit from EPLI coverage.

Factors Determining the Need for EPLI

Several factors influence the need for EPLI insurance, including:

- Industry:Certain industries, such as healthcare and hospitality, are more prone to employment-related claims.

- Size of the workforce:Larger companies with more employees have a higher risk of facing employment-related lawsuits.

- Employment practices:Complex employment policies or practices can increase the likelihood of claims.

- Financial resources:Businesses with limited financial resources may find EPLI coverage crucial to mitigate potential financial losses.

Consequences of Not Having EPLI Coverage

Businesses that choose not to obtain EPLI coverage face significant risks, including:

- Financial ruin:Employment-related lawsuits can be costly, and without EPLI, businesses could face significant financial losses.

- Reputational damage:Employment-related claims can damage a company’s reputation, making it difficult to attract and retain employees.

- Operational disruptions:Legal proceedings can be time-consuming and distracting, disrupting business operations.

The Claims Process

Filing an EPLI claim involves a series of steps designed to ensure fair and efficient processing. Understanding the process is crucial for navigating the claims process effectively.

If you need to file a claim with Statefarm, you can do so through their website, Statefarm.com. They offer a variety of resources and tools to guide you through the process. It’s important to gather your policy information and any relevant documentation before you begin.

Steps Involved in Filing an EPLI Claim

- Notify the insurer:Upon receiving a claim, the insured party should immediately notify their insurer.

- Provide documentation:The insurer will request documentation related to the claim, such as employment records, contracts, and relevant correspondence.

- Investigation:The insurer will investigate the claim to determine its validity and coverage.

- Negotiation and settlement:If the claim is covered, the insurer will negotiate a settlement or defend the insured party in court.

Factors Influencing Claim Settlement

Several factors can influence the claim settlement process, including:

- Policy terms:The terms of the EPLI policy, including coverage limits and exclusions, play a significant role in claim settlement.

- Strength of the claim:The validity and strength of the claim will impact the insurer’s decision.

- Negotiation skills:The ability of the insured party and their insurer to negotiate a favorable settlement is crucial.

Best Practices for Managing EPLI Claims, Epli Coverage

To manage EPLI claims effectively, it is essential to:

- Communicate promptly:Notify the insurer immediately upon receiving a claim.

- Gather relevant documentation:Provide the insurer with all necessary documentation to support the claim.

- Cooperate with the insurer:Respond to the insurer’s requests and cooperate with the investigation.

- Seek legal counsel:Consult with an attorney experienced in employment law to protect your rights.

Cost and Benefits of EPLI Coverage

The cost of EPLI insurance can vary depending on several factors, while the benefits of obtaining EPLI coverage can outweigh the costs for many businesses.

If you’re receiving unemployment benefits, you can manage your account and file claims online through the UI Online platform. This platform allows you to check your balance, file weekly claims, and manage your account settings, making it easy to access unemployment benefits.

Factors Determining the Cost of EPLI

- Industry:Industries with a higher risk of employment-related claims typically pay higher premiums.

- Size of the workforce:Companies with larger workforces generally pay more for EPLI.

- Claims history:Businesses with a history of employment-related claims may face higher premiums.

- Coverage limits:Higher coverage limits result in higher premiums.

- Deductibles:Lower deductibles typically lead to higher premiums.

Potential Benefits of EPLI Coverage

- Financial protection:EPLI coverage protects businesses from the financial consequences of employment-related lawsuits.

- Peace of mind:Knowing that EPLI coverage is in place can provide peace of mind for employers.

- Improved employee relations:EPLI coverage can help to foster a positive work environment and improve employee morale.

- Reduced legal expenses:EPLI coverage covers legal fees and expenses associated with defending against employment-related lawsuits.

Pros and Cons of EPLI Coverage

| Pros | Cons |

|---|---|

| Financial protection against employment-related lawsuits | Increased insurance premiums |

| Peace of mind for employers | Potential for exclusions and limitations |

| Improved employee relations | Need for thorough policy review |

| Reduced legal expenses | Potential for claims denial |

Considerations for Choosing EPLI Coverage

Choosing the right EPLI coverage requires careful consideration of various factors. Working with a qualified insurance broker can help navigate this process effectively.

If you’re dealing with a work-related injury, you may need to file a claim with Broadspire Workers Comp. They can help guide you through the process of filing a claim and navigating the workers’ compensation system.

Checklist for Choosing EPLI Coverage

- Coverage limits:Ensure the coverage limits are sufficient to cover potential financial losses.

- Deductibles:Determine a deductible that balances cost savings with financial protection.

- Exclusions:Carefully review the policy exclusions to understand what is not covered.

- Claims process:Understand the insurer’s claims process and the timeframes involved.

- Reputation of the insurer:Choose an insurer with a strong reputation for claims handling and financial stability.

Importance of Working with a Qualified Insurance Broker

A qualified insurance broker can provide valuable guidance and expertise in choosing the right EPLI coverage. Brokers can help you:

- Assess your risk:Brokers can help you identify your specific employment-related risks.

- Compare policies:Brokers can compare policies from different insurers to find the best fit for your needs.

- Negotiate terms:Brokers can help you negotiate favorable coverage terms and premiums.

Tips for Negotiating Favorable EPLI Coverage Terms

- Shop around:Get quotes from multiple insurers to compare coverage and premiums.

- Negotiate deductibles:Consider higher deductibles to lower premiums.

- Review exclusions:Carefully review the exclusions to ensure they are acceptable.

- Consider endorsements:Explore endorsements to add specific coverage for your business needs.

Closing Notes: Epli Coverage

In today’s dynamic business landscape, EPLI coverage stands as an essential safeguard against potential employment-related risks. By understanding the nuances of this insurance, businesses can make informed decisions, mitigate their exposure, and protect their bottom line. As the employment landscape continues to evolve, EPLI coverage will remain a cornerstone of risk management for organizations seeking to operate with confidence and stability.

FAQs

How much does EPLI coverage cost?

The cost of EPLI coverage varies depending on factors such as industry, number of employees, company size, claims history, and location. It’s essential to consult with an insurance broker to obtain a customized quote.

Dealing with an Allstate insurance claim can be a bit daunting, but it doesn’t have to be. Allstate offers various ways to file a claim, from online to phone. By following their instructions and providing the necessary information, you can ensure a smooth and efficient claim process.

What is the difference between EPLI coverage and general liability insurance?

Filing an Aflac claim can be a simple process. Aflac provides various ways to file a claim, such as online or through their mobile app. Make sure you have your policy information and supporting documentation ready for a quick and easy claim submission.

While general liability insurance covers accidents and injuries on business property, EPLI coverage specifically addresses employment-related claims. It’s crucial to have both types of insurance for comprehensive protection.

Can I get EPLI coverage if my company has a history of employment-related claims?

Yes, you can still obtain EPLI coverage even if your company has a history of claims. However, the premium may be higher, and you might need to work with a specialized insurance broker.

If you’ve been injured at work, you might need to file an L&I claim. This type of claim helps cover medical expenses and lost wages. Understanding the process and knowing your rights can ensure you receive the benefits you’re entitled to.

Is EPLI coverage mandatory?

Dealing with a car accident insurance claim can be stressful, but knowing the process can ease the burden. First, ensure everyone is safe. Then, document the accident, contact your insurer, and follow their instructions. They’ll help you navigate the claim process and get back on the road.

EPLI coverage is not mandatory in most jurisdictions. However, it’s highly recommended for businesses, especially those with significant employment risks, to protect their financial well-being.

Filing an Allianz insurance claim can be a straightforward process, but it’s always helpful to understand the steps involved. Gather your policy information, contact Allianz, and provide the necessary documentation. They’ll guide you through the process, ensuring a smooth and efficient claim resolution.