Insurance Claim Process is the intricate journey you undertake when you need to file a claim after an unexpected event. Whether it’s a car accident, a house fire, or a medical emergency, understanding the process can make a significant difference in your experience.

After a car accident , filing an insurance claim can feel overwhelming. However, your insurance company will guide you through the process, and you can often file your claim online for convenience.

From the initial notification to receiving payment, navigating the claims process requires a blend of knowledge, documentation, and communication. This guide aims to demystify the process, offering insights into the key stages, essential documents, and common challenges you might encounter.

Contents List

- 1 Understanding Insurance Claims

- 2 The Claims Filing Process

- 3 Claim Investigation and Assessment

- 4 Claim Processing and Payment

- 5 Claim Denial and Appeals

- 6 Claim Fraud and Prevention

- 7 Technology and the Claims Process

- 8 Best Practices for Claim Handling

- 9 End of Discussion: Insurance Claim Process

- 10 FAQ Insights

Understanding Insurance Claims

Insurance claims are a crucial aspect of the insurance industry, providing financial protection to policyholders in the event of unexpected losses or damages. They serve as a mechanism to transfer risk from individuals to insurance companies, ensuring financial stability and peace of mind.

If you’re dealing with a work-related injury, you may need to file a claim with Broadspire Workers Comp. They offer a variety of resources and support to help you navigate the claims process and receive the benefits you need.

Types of Insurance Claims

Insurance claims encompass a wide range of scenarios, categorized based on the type of insurance policy involved. Some common types include:

- Health Insurance Claims:These claims are filed when policyholders incur medical expenses due to illness, injury, or hospitalization. They cover costs related to doctor visits, surgeries, medications, and other healthcare services.

- Auto Insurance Claims:Auto insurance claims are triggered by accidents, theft, or damage to vehicles. They cover repairs, replacement costs, and liability for injuries or property damage caused by the insured vehicle.

- Property Insurance Claims:Property insurance claims are filed when insured properties, such as homes or businesses, suffer damage or loss due to events like fire, floods, or natural disasters. They cover repairs, rebuilding costs, and replacement of lost belongings.

Key Stakeholders in the Claims Process

The insurance claims process involves various stakeholders who play distinct roles:

- Policyholder:The individual or entity who holds the insurance policy and files the claim.

- Insurer:The insurance company that provides the policy and handles the claims process.

- Adjuster:A representative of the insurer who investigates the claim, evaluates the damage, and determines the amount of coverage.

The Claims Filing Process

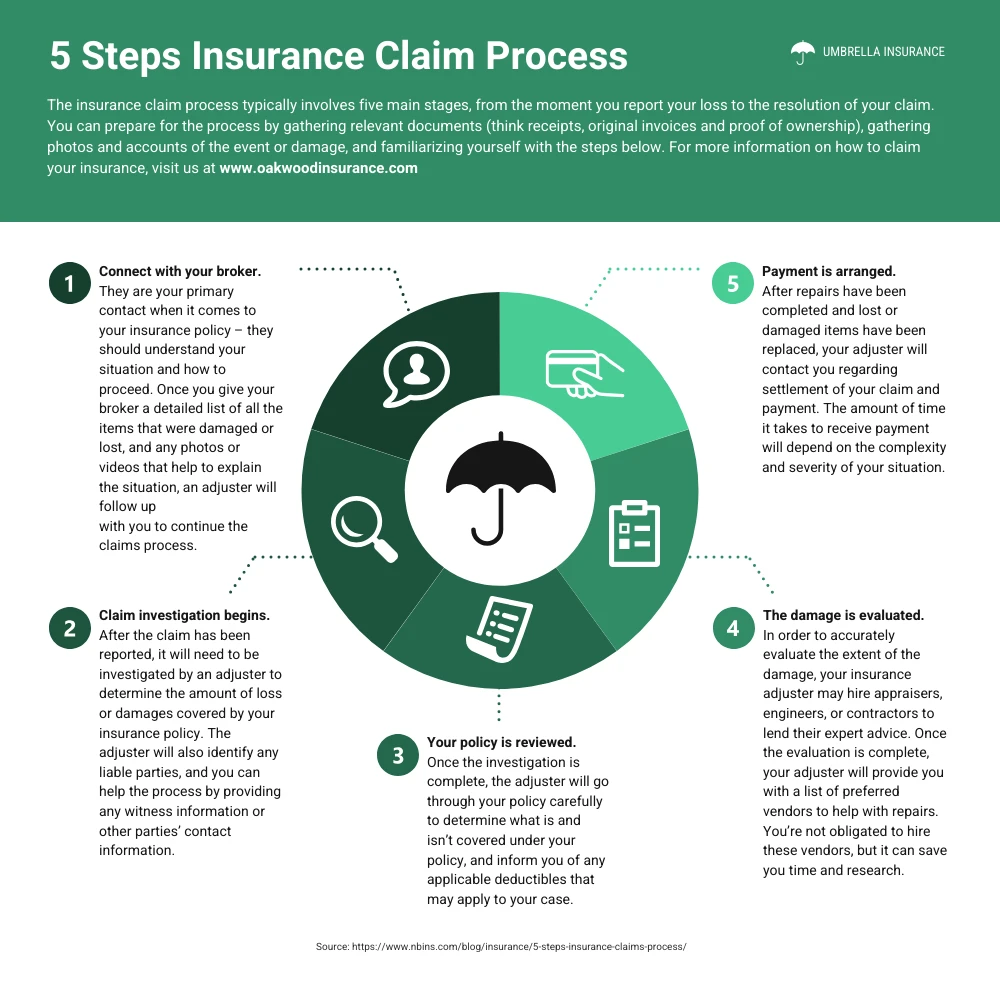

Filing an insurance claim involves a series of steps designed to ensure a fair and efficient process:

Initial Notification

The first step is to notify the insurer about the claim. This can be done through phone calls, emails, or online portals, depending on the insurer’s procedures.

Filing an Aflac claim is usually straightforward. You can submit your claim online, over the phone, or by mail. Aflac offers a range of resources and support to help you navigate the claims process.

Gathering Necessary Documentation

After notifying the insurer, the policyholder must gather the required documentation to support their claim. This may include:

- Policy details:The insurance policy number, coverage details, and contact information.

- Proof of loss:Documentation that substantiates the loss, such as police reports, medical bills, or repair estimates.

- Photographs or videos:Visual evidence of the damage or loss.

- Witness statements:Accounts from individuals who witnessed the incident.

Claim Forms

Insurance companies use specific forms to collect information about the claim. These forms vary depending on the type of insurance and the nature of the claim.

Filing a claim with State Farm is convenient and efficient. You can submit your claim online, over the phone, or through their mobile app. They offer a range of resources and support to help you navigate the claims process.

| Insurance Type | Common Claim Forms |

|---|---|

| Health Insurance | Claim Form, Explanation of Benefits (EOB) |

| Auto Insurance | Accident Report, Damage Estimate |

| Property Insurance | Proof of Loss, Damage Assessment Report |

Claim Investigation and Assessment

Once a claim is filed, the insurer initiates an investigation to gather evidence and assess the validity and extent of the loss.

Filing an Allianz Insurance Claim can be a stressful experience, but it’s important to remember that you’re not alone. Allianz offers a range of resources and support to help you navigate the process, from online claim filing to 24/7 customer service.

Investigation Methods

Insurance companies employ various methods to investigate claims, including:

- Reviewing documentation:Examining the claim form, supporting documents, and policy details.

- Conducting site inspections:Visiting the location of the loss to assess the damage firsthand.

- Interviewing witnesses:Gathering statements from individuals who witnessed the incident.

- Obtaining expert opinions:Seeking assessments from specialists, such as medical professionals or engineers, to determine the cause and extent of the loss.

Role of Adjusters

Insurance adjusters play a crucial role in claim investigation and assessment. They are responsible for:

- Evaluating the claim:Determining whether the loss is covered by the policy and the extent of coverage.

- Negotiating settlements:Discussing the amount of compensation with the policyholder.

- Processing the claim:Ensuring that the claim is processed according to the insurer’s procedures.

Challenges in Claim Investigation

Claim investigations can present challenges, such as:

- Determining the cause of loss:Establishing the origin of the damage or loss can be complex, especially in cases of accidents or natural disasters.

- Assessing the extent of damage:Accurately evaluating the damage, especially in cases of complex repairs or replacement, can be challenging.

- Fraudulent claims:Identifying and investigating fraudulent claims can be time-consuming and resource-intensive.

Claim Processing and Payment

Once the claim is investigated and assessed, the insurer proceeds with processing and approving the claim for payment.

Property damage insurance can help protect you financially in the event of an accident or disaster. Understanding your coverage and the claims process is crucial to ensure you receive the benefits you’re entitled to.

Claim Processing Procedures

The claim processing procedures vary depending on the insurer and the type of claim. However, common steps include:

- Reviewing the claim:Assessing the claim details, supporting documentation, and adjuster’s report.

- Verifying coverage:Ensuring that the loss is covered by the policy and that the policyholder meets the eligibility requirements.

- Calculating the payment:Determining the amount of compensation based on the policy coverage, the extent of the loss, and any applicable deductibles.

- Issuing payment:Disbursing the payment to the policyholder through various methods, such as checks, direct deposit, or electronic payments.

Factors Influencing Claim Settlement Timelines

The time it takes to settle a claim can vary depending on several factors, including:

- Complexity of the claim:Claims involving complex damages, multiple parties, or legal issues may take longer to process.

- Availability of documentation:The speed of claim processing depends on the timely submission of complete and accurate documentation by the policyholder.

- Insurer’s workload:The volume of claims being processed can affect the settlement timelines.

Payment Methods

Insurers offer various payment methods for claim settlements, including:

- Checks:Traditional paper checks mailed to the policyholder.

- Direct deposit:Electronic transfer of funds directly to the policyholder’s bank account.

- Electronic payments:Online payment options, such as PayPal or Venmo.

Claim Denial and Appeals

In some cases, insurance claims may be denied. This can occur due to various reasons, and policyholders have the right to appeal a denied claim.

If you have a Choice Home Warranty claim , you can file it online, over the phone, or through their mobile app. They have a dedicated claims team available to answer your questions and guide you through the process.

Reasons for Claim Denial

Insurance claims may be denied for several reasons, including:

- Lack of coverage:The loss may not be covered by the policy.

- Policy violations:The policyholder may have violated the terms of the policy, such as failing to pay premiums or providing false information.

- Fraudulent claims:The claim may be deemed fraudulent or unsupported by evidence.

Appealing a Denied Claim

Policyholders who disagree with a claim denial have the right to appeal the decision. The appeal process typically involves:

- Submitting an appeal request:Filing a formal appeal with the insurer, outlining the reasons for challenging the denial.

- Providing additional documentation:Supplying further evidence to support the claim.

- Review by the insurer:The insurer reviews the appeal request and any additional documentation provided.

- Decision on appeal:The insurer makes a final decision on the appeal, either upholding the denial or approving the claim.

Independent Dispute Resolution, Insurance Claim Process

In some cases, policyholders may have access to independent dispute resolution mechanisms, such as arbitration or mediation, if they are unable to resolve a claim denial through the insurer’s appeal process.

First-party insurance covers your own losses, like damage to your car or home. It’s important to understand your coverage and the claims process to ensure you receive the benefits you’re entitled to.

Claim Fraud and Prevention

Insurance claim fraud is a serious issue that can impact the insurance industry and policyholders. It involves intentionally misrepresenting or fabricating information to obtain insurance benefits.

Accessing your unemployment benefits online is easy with UI Online. This platform allows you to file claims, track your benefit status, and manage your account, all from the comfort of your home.

Types of Insurance Claim Fraud

There are various types of insurance claim fraud, including:

- Staged accidents:Fabricating accidents to claim insurance benefits.

- Inflated claims:Exaggerating the extent of damage or loss to receive a higher payout.

- Ghost claims:Filing claims for nonexistent losses or damages.

Detection and Prevention Methods

Insurance companies use various methods to detect and prevent claim fraud, such as:

- Data analysis:Using algorithms to identify patterns and anomalies in claims data.

- Fraud investigation units:Dedicated teams of investigators who investigate suspicious claims.

- Verification and validation:Checking the authenticity of supporting documentation and witness statements.

- Collaboration with law enforcement:Working with law enforcement agencies to investigate and prosecute fraudulent claims.

Consequences of Insurance Fraud

Committing insurance fraud is a serious offense that can have severe consequences, including:

- Criminal charges:Fraudulent claims can lead to criminal charges, including fines and imprisonment.

- Denial of future claims:Individuals convicted of insurance fraud may have their future claims denied.

- Damage to reputation:Committing fraud can damage an individual’s reputation and make it difficult to obtain insurance in the future.

Technology and the Claims Process

Technology is transforming the insurance claims process, making it faster, more efficient, and more customer-centric.

Filing a claim with Safeco Insurance is simple and straightforward. You can submit your claim online, over the phone, or through their mobile app. They offer a dedicated claims team available to answer your questions and guide you through the process.

Digital Platforms and Mobile Apps

Insurers are increasingly using digital platforms and mobile apps to streamline the claims process. These platforms allow policyholders to:

- File claims online:Submit claim information and supporting documents electronically.

- Track claim status:Monitor the progress of their claims in real-time.

- Communicate with adjusters:Exchange messages and documents with adjusters electronically.

- Access claim information:View claim details, payment history, and other relevant information online.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are playing an increasingly significant role in claim assessment and fraud detection. These technologies can:

- Automate claim processing:Streamline routine tasks, such as data entry and document verification.

- Improve claim accuracy:Use algorithms to assess damage and determine coverage amounts.

- Detect fraudulent claims:Analyze claims data to identify patterns and anomalies that may indicate fraud.

Best Practices for Claim Handling

Effective claim handling is essential for ensuring customer satisfaction and maintaining a positive reputation. Here are some best practices for policyholders and insurers:

Best Practices for Policyholders

To ensure smooth claim processing, policyholders should:

- Understand their policy:Familiarize themselves with the coverage details, deductibles, and other terms of their policy.

- Report claims promptly:Notify the insurer as soon as possible after an incident occurs.

- Gather necessary documentation:Collect all relevant documents, such as police reports, medical bills, or repair estimates.

- Be honest and transparent:Provide accurate and complete information to the insurer.

- Cooperate with the adjuster:Respond to inquiries promptly and provide access to the damaged property or relevant information.

Best Practices for Insurers

To enhance claim handling efficiency and customer satisfaction, insurers should:

- Provide clear and concise communication:Keep policyholders informed about the progress of their claims.

- Process claims promptly:Aim to settle claims within reasonable timeframes.

- Treat policyholders fairly:Handle claims with empathy and respect, ensuring that policyholders are treated fairly.

- Invest in technology:Utilize digital platforms and AI to streamline claim processing and improve efficiency.

- Train adjusters effectively:Provide adjusters with the necessary skills and knowledge to handle claims effectively.

Claim Handling Approaches

| Insurance Company | Claim Handling Approach |

|---|---|

| Company A | Focus on speed and efficiency, using automated processes and digital platforms. |

| Company B | Emphasizes customer service, providing personalized attention and proactive communication. |

| Company C | Combines technology and personal touch, offering online tools for claim filing and tracking while maintaining a dedicated team of adjusters. |

End of Discussion: Insurance Claim Process

Understanding the insurance claim process is crucial for anyone with insurance policies. By familiarizing yourself with the steps, requirements, and potential pitfalls, you can ensure a smoother and more efficient experience. Remember, communication and documentation are key to navigating this process effectively.

For those who need to file an Allstate Auto Claim , the company offers a streamlined online process. You can submit your claim, upload supporting documents, and track its status online. Allstate also provides 24/7 claims support for urgent situations.

FAQ Insights

What happens if my claim is denied?

When you need to file a claim with Farmers Insurance , you can do so online, over the phone, or by visiting a local Farmers agent. They provide a comprehensive claims process with 24/7 support, making it easier to navigate a difficult situation.

If your claim is denied, you have the right to appeal the decision. The appeal process involves providing additional information or evidence to support your claim. It’s essential to understand the specific procedures and deadlines for appealing within your insurance policy.

Managing your Travelers insurance policy is made easier with MyTravelers. This online platform allows you to access your policy details, file claims, and even make payments, all from the convenience of your computer or mobile device.

How long does it take to process an insurance claim?

Filing a claim with Mercury Insurance is straightforward. They offer a user-friendly online portal where you can submit your claim, track its progress, and access helpful resources. You can also reach out to their claims team for assistance.

The time it takes to process an insurance claim varies depending on the type of claim, the complexity of the case, and the efficiency of the insurance company. While some claims may be processed quickly, others can take several weeks or even months.

If you need to file a claim with Erie Insurance , they have a user-friendly online portal where you can submit your claim and track its progress. They also have a dedicated claims team available to answer your questions and guide you through the process.

What are the common types of insurance fraud?

Insurance fraud encompasses various deceitful practices, including staging accidents, inflating claims, and filing false claims. Examples include faking injuries, exaggerating the extent of damage, and claiming losses that never occurred.