I Inherited An Annuity Is It Taxable 2024 – I Inherited An Annuity: Is It Taxable in 2024? This question often arises when individuals inherit an annuity from a loved one. Annuities can be a complex financial instrument, and understanding the tax implications of inheriting one is crucial for proper financial planning.

This guide will delve into the intricacies of inherited annuities, providing insights into their tax treatment, key considerations for 2024, and strategies for minimizing your tax burden.

Annuities are financial contracts that provide a stream of income payments over a specified period. They can be purchased by individuals to secure their financial future or can be inherited as part of an estate. The tax implications of inheriting an annuity differ significantly from those associated with purchasing an annuity.

This guide will break down these differences and explore the taxability of annuity payments received from an inheritance.

Contents List

Understanding Annuities

Annuity is a financial product that provides a stream of regular payments for a specific period. It is often used for retirement planning, but can also be used for other purposes such as income replacement or long-term care. Annuities can be purchased from insurance companies or other financial institutions.

When you purchase an annuity, you make a lump sum payment or series of payments to the insurer. In return, the insurer agrees to make regular payments to you for a set period of time, or for your lifetime.

To calculate the value of an annuity, you’ll need a formula, and Annuity Formula Is 2024 gives you the details. But what about using annuities in a different context? Android WebView 202 for hybrid apps explores the potential for using WebView in mobile development, and Android WebView 202 for enterprise use looks at its applications in a business setting.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Some of the most common types of annuities include:

- Fixed annuities: These annuities provide a guaranteed rate of return on your investment. This means that you know exactly how much you will receive in payments each year. Fixed annuities are generally considered to be less risky than variable annuities, but they also tend to have lower returns.

- Variable annuities: These annuities invest your money in a variety of mutual funds or sub-accounts. The value of your investment will fluctuate based on the performance of the underlying investments. Variable annuities offer the potential for higher returns than fixed annuities, but they also carry more risk.

- Immediate annuities: These annuities begin making payments immediately after you purchase them. Immediate annuities are often used by people who need income right away, such as retirees.

- Deferred annuities: These annuities do not begin making payments until a later date. Deferred annuities are often used by people who are saving for retirement. They allow you to grow your investment tax-deferred, and then receive income payments later on.

Tax Implications of Purchasing an Annuity

The tax implications of purchasing an annuity can vary depending on the type of annuity you purchase and how you use it. In general, the premiums you pay for an annuity are not tax-deductible. However, the income you receive from an annuity is generally taxable as ordinary income.

For example, if you purchase a fixed annuity for $100,000 and receive $10,000 in annual payments, the $10,000 will be taxed as ordinary income. The portion of each payment that represents your original investment (the $100,000) is considered to be a return of principal and is not taxed.

However, the remaining portion of the payment (the interest earned) is taxed as ordinary income.

Inheritance and Annuities

When you inherit an annuity, you become the beneficiary of the contract. This means that you are entitled to receive the annuity payments for the remainder of the term. The tax treatment of inherited annuities can differ from the tax treatment of purchased annuities.

Tax Treatment of Inherited Annuities

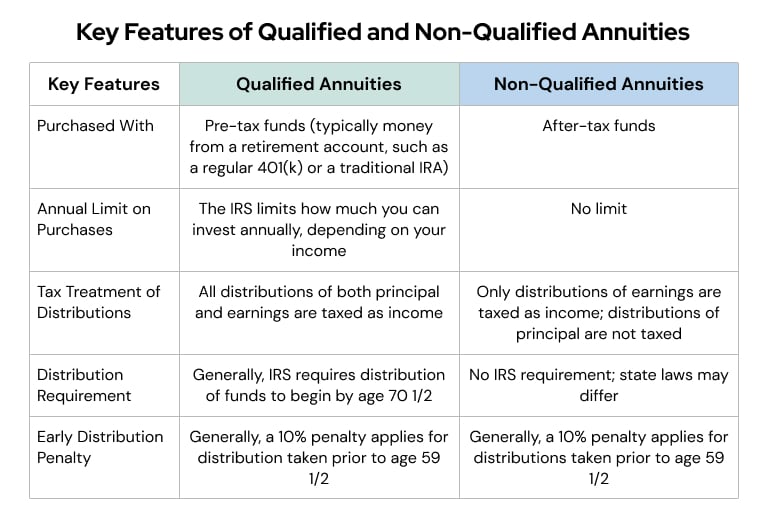

The tax treatment of inherited annuities depends on whether the annuity was purchased with after-tax or pre-tax dollars. If the annuity was purchased with after-tax dollars, the beneficiary will not have to pay taxes on the principal amount of the annuity.

However, the interest earned on the annuity will be taxable as ordinary income.

Annuity is a topic with many different opinions. Annuity Is Bad 2024 presents a negative perspective, while Annuity Is Immediate 2024 discusses a specific type of annuity. Annuity Fund Is 2024 explores the concept of an annuity fund, and Annuity Is Good Or Bad 2024 offers a balanced view.

Annuity Examples 2024 provides real-world scenarios, and Annuity Calculator Uk 2024 focuses on a specific calculator tool. Annuity Is A Mcq 2024 presents a multiple-choice question format to test your understanding.

If the annuity was purchased with pre-tax dollars, such as from a traditional IRA or 401(k), the beneficiary will have to pay taxes on the entire amount of the annuity payments. The beneficiary will also be required to report the annuity income on their tax return.

Difference Between Inherited and Purchased Annuities

The main difference between inherited annuities and purchased annuities is the tax treatment of the principal amount. With a purchased annuity, the principal amount is generally considered to be a return of capital and is not taxed. However, with an inherited annuity, the principal amount may be taxable, depending on whether the annuity was purchased with after-tax or pre-tax dollars.

Tax Implications of Receiving an Annuity as Part of an Estate

If you receive an annuity as part of an estate, the annuity will be included in the value of the estate for estate tax purposes. The estate tax rate is progressive, meaning that the tax rate increases as the value of the estate increases.

The estate tax is only applicable to estates that exceed a certain threshold, which is adjusted annually.

Taxability of Annuity Payments

The taxability of annuity payments depends on the type of annuity and the beneficiary’s tax status. In general, the portion of an annuity payment that represents a return of principal is not taxed. However, the portion of the payment that represents interest earned is taxable as ordinary income.

Exclusion Ratio

The exclusion ratio is a fraction that is used to determine the taxable portion of an annuity payment. The exclusion ratio is calculated by dividing the original investment in the annuity by the expected total payments from the annuity. For example, if you invested $100,000 in an annuity that is expected to pay out $200,000 over the course of its term, the exclusion ratio would be 1/2 (or 50%).

Taxable Portion

The taxable portion of an annuity payment is calculated by multiplying the payment amount by the exclusion ratio. For example, if you receive a $10,000 annuity payment and your exclusion ratio is 50%, the taxable portion of the payment would be $5,000 ($10,000 x 0.50).

Examples of Calculating the Taxable Portion of Annuity Payments

Here are some examples of how to calculate the taxable portion of annuity payments:

- Example 1:You inherit a fixed annuity with an original investment of $100,000 and an expected payout of $200,000. The exclusion ratio is 1/2 (or 50%). If you receive a $10,000 payment, the taxable portion would be $5,000 ($10,000 x 0.50).

- Example 2:You inherit a variable annuity with an original investment of $100,000 and an expected payout of $250,000. The exclusion ratio is 2/5 (or 40%). If you receive a $12,000 payment, the taxable portion would be $4,800 ($12,000 x 0.40).

Tax Reporting and Filing

Annuity income must be reported on your tax return. The specific form you will need to use will depend on the type of annuity you have and the beneficiary’s tax status.

Many people wonder if they can still work while receiving an annuity. Can You Receive Annuity And Still Work 2024 answers that question. For those seeking organization tools, Google Tasks 2024: Google Tasks for Businesses explores how Google Tasks can be used in a business context.

And if you’re interested in the future of mobile development, Android app development for the metaverse in 2024 provides insight.

Forms and Procedures for Reporting Annuity Income

- Form 1099-R: This form is used to report distributions from pensions, annuities, retirement, profit-sharing, and stock bonus plans. You will receive this form from the payer of the annuity.

- Schedule B (Form 1040): This form is used to report interest and ordinary dividends. If you are receiving annuity payments that are taxable, you will need to report the income on this form.

- Form 1040: This is the main form used to file your federal income tax return. You will need to report all of your income, including annuity income, on this form.

Impact of Inherited Annuities on Estate Taxes

Inherited annuities may be subject to estate taxes, depending on the value of the estate. The estate tax rate is progressive, meaning that the tax rate increases as the value of the estate increases. If the value of the estate exceeds a certain threshold, the beneficiary may be required to pay estate taxes on the inherited annuity.

Tax Implications of Annuity Payments Based on Type of Annuity and Beneficiary’s Tax Status

| Type of Annuity | Beneficiary’s Tax Status | Tax Implications |

|---|---|---|

| Fixed Annuity | Purchased with after-tax dollars | Interest earned is taxable as ordinary income. |

| Fixed Annuity | Purchased with pre-tax dollars | Entire amount of annuity payments is taxable as ordinary income. |

| Variable Annuity | Purchased with after-tax dollars | Gains from the underlying investments are taxable as capital gains. |

| Variable Annuity | Purchased with pre-tax dollars | Gains from the underlying investments are taxable as ordinary income. |

| Inherited Annuity | Purchased with after-tax dollars | Interest earned is taxable as ordinary income. |

| Inherited Annuity | Purchased with pre-tax dollars | Entire amount of annuity payments is taxable as ordinary income. |

Tax Planning Strategies

There are a number of tax planning strategies that you can use to minimize the tax burden on inherited annuities. Some of these strategies include:

Strategies for Minimizing the Tax Burden on Inherited Annuities

- Consider converting a traditional IRA to a Roth IRA: If you inherit a traditional IRA, you may be able to convert it to a Roth IRA. This will allow you to withdraw the funds tax-free in retirement. However, you will have to pay taxes on the conversion amount.

- Withdraw funds strategically: If you inherit an annuity that is subject to required minimum distributions (RMDs), you will need to withdraw a certain amount each year. You can try to time your withdrawals to minimize your tax liability. For example, you may want to withdraw funds in years when your tax bracket is lower.

- Consider taking a lump sum payment: If you inherit an annuity that is subject to RMDs, you may be able to take a lump sum payment instead of receiving annual payments. This will allow you to control when you receive the funds and how you are taxed on them.

Tax Implications of Different Annuity Withdrawal Options

The tax implications of different annuity withdrawal options can vary. For example, if you withdraw funds from a traditional IRA, the withdrawals will be taxed as ordinary income. However, if you withdraw funds from a Roth IRA, the withdrawals will be tax-free.

Potential Benefits of Converting a Traditional IRA to a Roth IRA, I Inherited An Annuity Is It Taxable 2024

Converting a traditional IRA to a Roth IRA can be a beneficial tax planning strategy. If you convert a traditional IRA to a Roth IRA, you will have to pay taxes on the conversion amount. However, you will be able to withdraw the funds tax-free in retirement.

This can be a good strategy if you expect to be in a higher tax bracket in retirement than you are today.

Last Point

Understanding the tax implications of inherited annuities is essential for individuals who have received such assets. By understanding the tax rules and available strategies, you can effectively manage your tax liability and maximize the benefits of your inheritance. Remember, consulting with a qualified tax advisor can provide personalized guidance and ensure you make informed decisions regarding your inherited annuity.

General Inquiries: I Inherited An Annuity Is It Taxable 2024

What are the different types of annuities?

Annuities can be categorized into various types, including fixed annuities, variable annuities, and immediate annuities. Each type offers different features and tax implications. Fixed annuities provide a guaranteed rate of return, while variable annuities offer potential for growth but also carry investment risk.

Immediate annuities start paying out immediately upon purchase, while deferred annuities have a delay before payments begin.

How do I report inherited annuity income on my tax return?

Inherited annuity income is typically reported on Form 1040, Schedule B, Interest and Ordinary Dividends. The specific reporting requirements may vary depending on the type of annuity and the beneficiary’s tax status. It’s important to consult with a tax professional to ensure accurate reporting.

What are the potential estate tax implications of inherited annuities?

Inherited annuities can be subject to estate taxes depending on the value of the estate and applicable federal and state laws. The estate tax is levied on the value of assets transferred at death, and the value of the annuity may be included in this calculation.

Annuity is a financial product that provides regular payments for a set period of time, and in 2024, you might be wondering how it works. Annuity Is Given By 2024 explains the basic concept, but if you need a deeper understanding, Annuity Is Definition 2024 provides a more detailed explanation.

Consult with a tax advisor to determine if your inherited annuity will be subject to estate taxes.