Best Fixed Rate Mortgage 2024: In a world of fluctuating interest rates, securing a fixed-rate mortgage can provide much-needed stability and predictability for your homeownership journey. Whether you’re a first-time buyer or looking to refinance, understanding the intricacies of fixed-rate mortgages is crucial to navigating the current market landscape.

St. George is another popular choice for home loans. You can find details on their current offerings at St George Home Loan 2024.

This guide delves into the key aspects of fixed-rate mortgages in 2024, exploring the factors that influence rates, offering tips for securing favorable terms, and demystifying the costs and fees associated with this popular loan type.

Discover offers a range of home loan options. You can find more information on their offerings at Discover Home Loans 2024.

Contents List

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage is a type of home loan where the interest rate remains the same for the entire term of the loan, typically 15 or 30 years. This means your monthly payments will be predictable and consistent throughout the life of the loan, providing financial stability and allowing you to budget effectively.

Mr. Cooper is a well-known mortgage lender. If you’re interested in their offerings, check out Mr Cooper Mortgage 2024 for more information on their current programs and rates.

Key Features of a Fixed-Rate Mortgage

- Consistent Interest Rate:The interest rate is fixed for the duration of the loan, ensuring predictable monthly payments.

- Predictable Monthly Payments:With a fixed interest rate, you know exactly how much your monthly mortgage payments will be, making budgeting easier.

- Long-Term Financial Stability:Fixed-rate mortgages provide long-term financial stability by protecting you from rising interest rates.

Advantages and Disadvantages of Fixed-Rate Mortgages

Advantages

- Predictability and Stability:Fixed interest rates offer predictable monthly payments and financial stability over the long term.

- Protection Against Rising Interest Rates:You’re shielded from fluctuating interest rates, which can be beneficial in a volatile market.

- Easier Budgeting:Consistent payments make budgeting easier and allow you to plan for future expenses.

Disadvantages

- Potentially Higher Initial Interest Rates:Fixed-rate mortgages may have higher initial interest rates compared to adjustable-rate mortgages (ARMs).

- Limited Flexibility:Once the interest rate is set, it cannot be changed, which may not be ideal if interest rates decline significantly in the future.

Comparing Fixed-Rate Mortgages to Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) have interest rates that can fluctuate over time, usually tied to a benchmark index like the LIBOR (London Interbank Offered Rate). While ARMs may offer lower initial interest rates, they carry the risk of higher payments if rates rise.

A 40-year mortgage can be an option for some borrowers. To learn more about this type of loan, check out 40 Year Mortgage 2024.

Fixed-rate mortgages offer stability and predictability, while ARMs provide potential for lower initial payments but with the risk of rate increases.

Understanding current Home Loan Interest Rates 2024 is essential for making informed decisions about your mortgage. Rates can vary based on factors like your credit score and the type of loan you’re seeking.

Factors Influencing Best Fixed-Rate Mortgage Rates in 2024

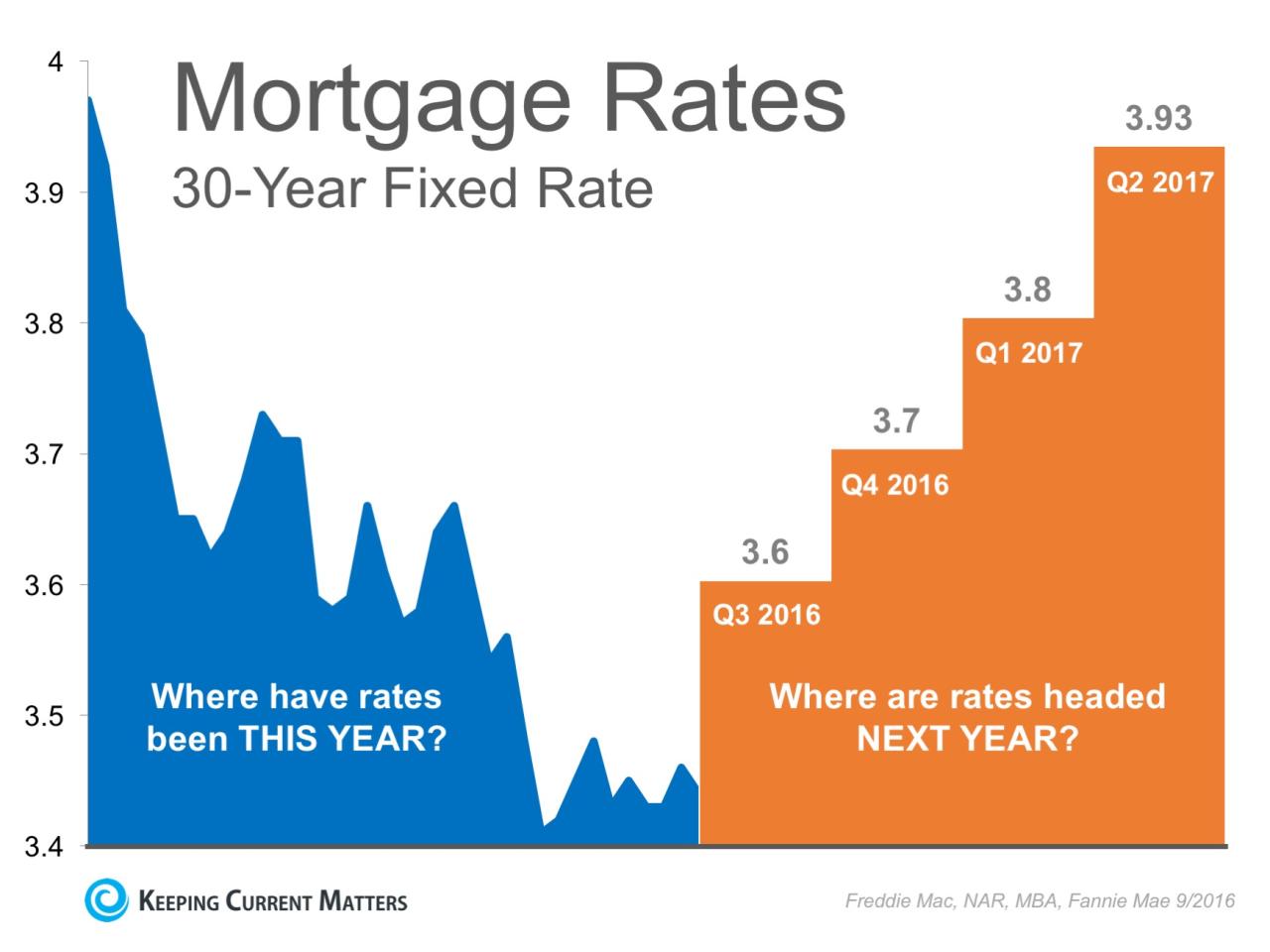

Mortgage rates are influenced by a complex interplay of economic factors. Understanding these factors can provide insights into the potential trajectory of rates in 2024.

Need to find a mortgage lender in your area? Lenders Near Me 2024 can help you locate lenders in your local area.

Major Economic Factors Impacting Mortgage Rates, Best Fixed Rate Mortgage 2024

- Federal Reserve Monetary Policy:The Federal Reserve’s actions, such as adjusting interest rates and controlling the money supply, significantly impact mortgage rates. When the Fed raises interest rates, mortgage rates tend to follow suit.

- Inflation:High inflation can lead to increased interest rates as lenders seek to protect their returns against rising prices.

- Economic Growth:A strong economy generally supports lower interest rates, as investors are more willing to lend money at lower rates.

- Government Policies:Government policies, such as tax incentives for homeownership, can influence mortgage rates by affecting demand for housing.

Current State of the Housing Market and Its Influence on Rates

The current state of the housing market, including supply and demand dynamics, inventory levels, and home price appreciation, plays a crucial role in shaping mortgage rates. A strong housing market with high demand can drive up rates as lenders compete for borrowers.

For those who qualify, VA loans offer unique benefits. You can find information on current VA loan rates at Va Loan Interest Rate 2024.

Insights from Financial Experts on the Expected Trajectory of Mortgage Rates in 2024

Financial experts are cautiously optimistic about the trajectory of mortgage rates in 2024. They anticipate that rates may remain relatively stable, with potential for modest increases, depending on economic conditions and the Federal Reserve’s actions.

If you’re looking for current rates on Rocket Mortgage in 2024, you can check out Rocket Mortgage Rates Today 2024. This will give you a good idea of what to expect, but remember that rates can fluctuate daily.

Finding the Best Fixed-Rate Mortgage for Your Needs

Securing the best fixed-rate mortgage involves careful research, comparison, and consideration of your individual circumstances.

If you’re a first-time homebuyer, there are resources available to help you navigate the process. First Time Home Buyers 2024 provides information on programs and resources designed specifically for new homeowners.

Importance of Comparing Rates from Multiple Lenders

It’s essential to compare rates from multiple lenders to ensure you’re getting the most competitive offer. Different lenders have varying rates and terms, so shopping around is crucial to finding the best deal.

It’s essential to keep up with Home Loan Interest Rates Today 2024 to find the best deals. Rates can fluctuate throughout the day, so it’s worth checking frequently.

Factors to Consider When Choosing a Mortgage

- Loan Term:Consider the length of the loan, typically 15 or 30 years, and its impact on your monthly payments and total interest paid.

- Down Payment:The amount of your down payment will influence the loan amount and potentially the interest rate.

- Credit Score:Your credit score plays a significant role in determining the interest rate you qualify for. A higher credit score generally leads to lower rates.

- Debt-to-Income Ratio:Your debt-to-income ratio, calculated by dividing your monthly debt payments by your gross monthly income, can affect your loan approval and interest rate.

- Closing Costs:Understand the various closing costs associated with obtaining a mortgage, such as origination fees, appraisal fees, and title insurance.

Role of Mortgage Brokers in Finding the Best Rates

Mortgage brokers can be valuable resources in finding the best mortgage rates. They work with multiple lenders and can help you compare options and secure the most favorable terms.

A cash-out refinance can be a good way to tap into your home’s equity. If you’re considering this option, check out Cash Out Refi 2024 to learn more about the process.

Tips for Securing a Favorable Fixed-Rate Mortgage

Taking proactive steps can improve your chances of securing a favorable fixed-rate mortgage.

To get a good sense of the current market, it’s helpful to look at Current Home Loan Interest Rates 2024. This will give you a general idea of what to expect.

Improving Your Credit Score

- Pay Bills on Time:Consistent on-time payments are crucial for building a strong credit history.

- Keep Credit Utilization Low:Aim to keep your credit utilization ratio, calculated by dividing your total credit card balances by your total credit limits, below 30%.

- Avoid Opening New Accounts:Opening too many new credit accounts can negatively impact your credit score.

Negotiating a Lower Interest Rate

- Shop Around:Compare rates from multiple lenders to leverage competition and potentially negotiate a lower rate.

- Strong Credit Score:A higher credit score gives you more bargaining power when negotiating interest rates.

- Large Down Payment:A substantial down payment can demonstrate your financial stability and potentially lead to a lower rate.

Securing a Pre-Approval Letter from a Lender

A pre-approval letter from a lender demonstrates your financial readiness to potential sellers and can make your offer more competitive.

Staying informed about Current Housing Interest Rates 2024 is crucial whether you’re buying or refinancing. Rates can change quickly, so it’s good to keep an eye on the market.

Conclusive Thoughts

Securing a fixed-rate mortgage in 2024 requires careful planning and informed decision-making. By understanding the nuances of this loan type, comparing rates from multiple lenders, and taking proactive steps to improve your financial standing, you can position yourself to secure a favorable mortgage that aligns with your financial goals.

Thinking about purchasing an investment property in 2024? You’ll want to explore Investment Property Loans 2024 to see what financing options are available to you.

Remember, seeking professional guidance from a mortgage broker can provide valuable insights and support throughout the process.

Popular Questions: Best Fixed Rate Mortgage 2024

What is the current average fixed-rate mortgage rate?

The current average fixed-rate mortgage rate fluctuates daily. It’s best to check with multiple lenders for the most up-to-date information.

How long does it take to get approved for a fixed-rate mortgage?

The approval process can vary depending on the lender and your individual circumstances. It typically takes a few weeks, but it’s advisable to start the process early.

What are the common closing costs associated with a fixed-rate mortgage?

Closing costs include various fees such as appraisal fees, title insurance, and loan origination fees. These costs can vary depending on the lender and the property location.

Keep an eye on Current Va Home Loan Rates 2024 to get the best possible deal. Rates can change frequently, so it’s worth checking often.