Equity Loan Rates are a crucial aspect of home financing, offering homeowners a way to tap into their home’s value for various purposes. Understanding the factors that influence these rates is essential for making informed financial decisions.

If you’re carrying a lot of debt, Debt Consolidation might be a good option to consider. This process involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage your finances and potentially save money on interest payments.

This guide will delve into the complexities of equity loan rates, exploring how they are determined, how they compare to other loan options, and how to find the best rates available. We’ll also discuss the financial implications of taking out an equity loan and provide guidance on managing payments effectively.

A Home Loan is a significant financial commitment, so it’s essential to shop around and compare different lenders and their offerings. Consider factors like interest rates, loan terms, and fees to find the best fit for your individual needs and financial situation.

Contents List

Understanding Equity Loan Rates

An equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of your home and the amount you still owe on your mortgage.

Discover Home Equity Loans offer competitive rates and flexible terms. They may be a good option if you need a loan for home improvements, debt consolidation, or other major expenses. Discover offers a variety of loan options to suit your needs.

Equity loans can be a valuable financing option for a variety of purposes, including home improvements, debt consolidation, or even funding a business venture. Understanding the rates associated with equity loans is crucial to making informed financial decisions.

A 2nd Mortgage can be a helpful tool for homeowners who need additional funds. It essentially acts as a second loan secured by your home, allowing you to borrow against the equity you’ve built. This can be useful for various purposes, such as home renovations, debt consolidation, or other significant expenses.

Equity Loan Rates Explained

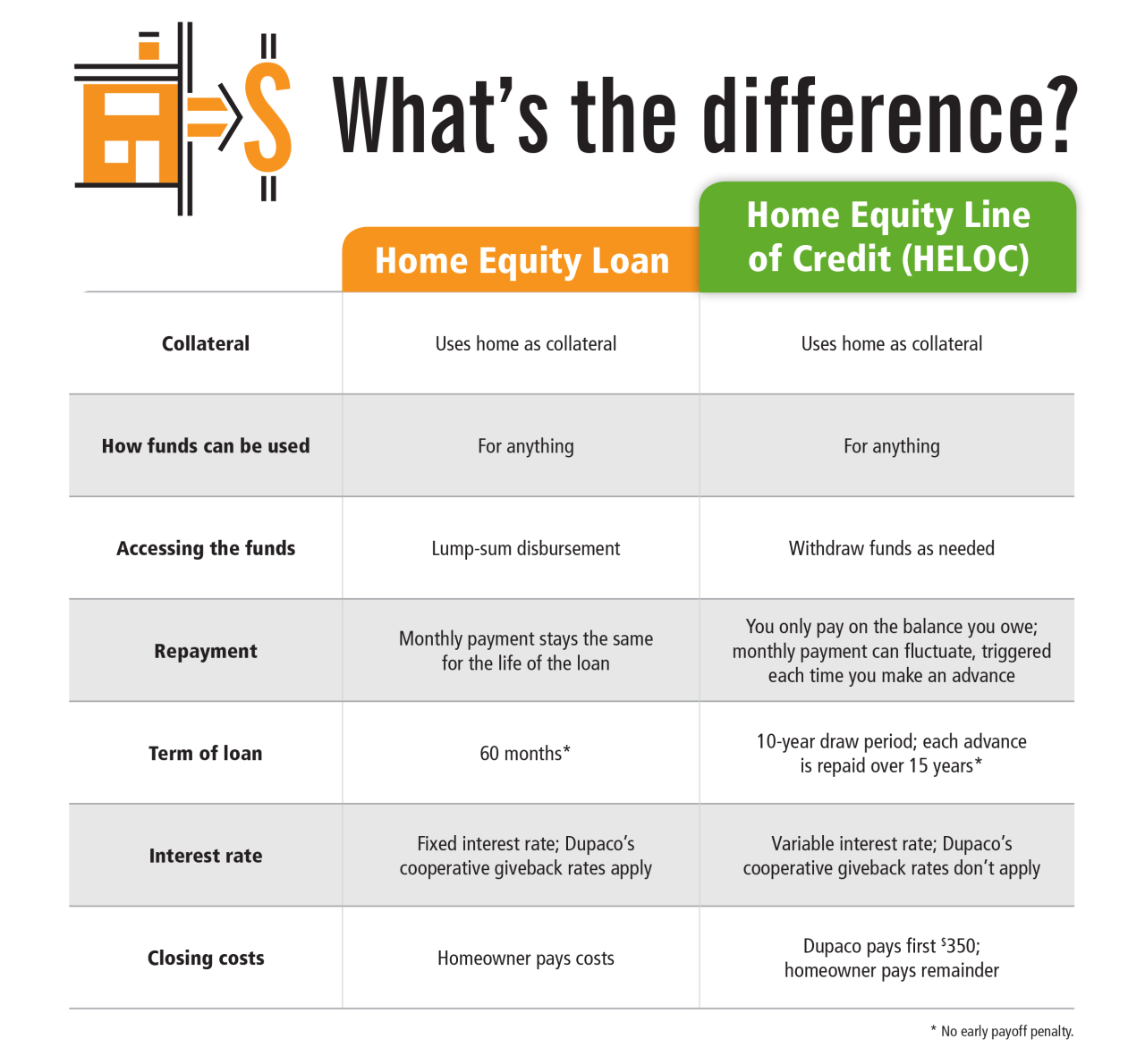

Equity loan rates are the interest rates you pay on the money you borrow. They are typically expressed as an annual percentage rate (APR), which includes the interest rate plus any fees associated with the loan. The rates for equity loans can vary depending on several factors, including your credit score, the loan-to-value (LTV) ratio, and prevailing market interest rates.

If you’re considering a home equity loan, Discover Home Equity Loans might be a good option to explore. They offer competitive rates and terms, along with a straightforward application process. It’s important to compare different lenders and their offerings to find the best fit for your individual needs.

Fixed vs. Variable Equity Loan Rates

Equity loans can come with either fixed or variable interest rates. Fixed rates remain the same for the entire duration of the loan, providing predictable monthly payments. Variable rates, on the other hand, fluctuate based on market conditions. While variable rates may initially be lower than fixed rates, they can increase over time, leading to unpredictable payments.

A 1000 Loan can be a helpful solution for unexpected expenses. It can be used for a variety of purposes, such as medical bills, car repairs, or travel. You can find a variety of lenders offering these loans online, and you can apply for one in just a few minutes.

The choice between fixed and variable rates depends on your individual financial situation and risk tolerance.

A Home Loan is a mortgage that helps you finance the purchase of a home. You can choose from a variety of loan options, including fixed-rate and adjustable-rate mortgages. It’s important to shop around for the best rates and terms.

Factors Affecting Equity Loan Rates

Several factors influence the interest rate you will receive on an equity loan. Understanding these factors can help you make informed decisions and potentially secure a more favorable rate.

Before you start shopping for a home loan, it’s a good idea to get Home Loan Pre Approval. This process allows you to understand your potential borrowing power and helps you navigate the home buying process with more confidence.

Lenders will review your financial information and provide you with an estimate of how much you can borrow.

Credit Score

Your credit score is a significant factor in determining your equity loan rate. Lenders use your credit score to assess your creditworthiness and determine the risk associated with lending you money. A higher credit score generally indicates a lower risk, which can translate into a lower interest rate.

If you’re looking for a small personal loan, a 1000 Loan can be a convenient option. Many lenders offer these short-term loans for various purposes, such as covering unexpected expenses or consolidating smaller debts.

Conversely, a lower credit score may result in a higher interest rate.

An Equity Line Of Credit is a revolving line of credit secured by your home’s equity. It allows you to borrow money as needed, up to a certain limit, and repay it over time. This can be a great option for home renovations, debt consolidation, or other large expenses.

Loan-to-Value (LTV) Ratio

The LTV ratio is the percentage of your home’s value that you are borrowing against. A lower LTV ratio generally indicates a lower risk for the lender, as you have more equity in your home. Lower LTV ratios often lead to lower interest rates.

For Home Buyers looking for financing options, there are many resources available. You can compare rates and terms from different lenders to find the best deal. It’s also important to get pre-approved for a mortgage before you start looking at homes.

For example, if your home is worth $300,000 and you owe $100,000, your LTV ratio would be 33.33%. This lower LTV ratio would likely result in a more favorable interest rate compared to someone with a higher LTV ratio, say, 80%.

Debt Consolidation is a process of combining multiple debts into one loan. This can help you simplify your finances and lower your monthly payments. A home equity loan can be a good option for debt consolidation, but it’s important to make sure you can afford the payments.

Market Interest Rates

Prevailing interest rates in the broader market significantly influence equity loan rates. When interest rates rise, lenders typically increase their rates on equity loans to reflect the higher cost of borrowing money. Conversely, when interest rates fall, lenders may lower their rates to remain competitive.

Navigating the home buying process can be overwhelming, but there are resources available to help Home Buyers along the way. From finding the right mortgage lender to understanding the closing process, there are experts who can guide you through each step.

Property Location and Condition, Equity Loan Rates

The location and condition of your property can also affect your equity loan rate. Homes located in desirable areas with high market values tend to have lower interest rates. Additionally, homes in good condition with well-maintained features may also attract lower rates, as they are perceived as less risky investments for lenders.

Discover Home Loans offer a variety of mortgage options to suit your needs. They provide competitive rates and flexible terms, and you can apply for a loan online. Discover also offers a dedicated team of loan specialists to answer your questions and guide you through the process.

Equity Loan Rates Compared to Other Loan Options

Equity loans are not the only financing option available to homeowners. Comparing equity loan rates to other loan options can help you determine the most suitable choice for your specific needs.

An Equity Line Of Credit can be a helpful tool for homeowners who need access to funds. It allows you to borrow against the equity you’ve built in your home, giving you a revolving line of credit that you can draw from as needed.

This flexibility can be valuable for various purposes, such as home renovations, debt consolidation, or unexpected expenses.

Home Equity Lines of Credit (HELOCs)

HELOCs are similar to equity loans, but they provide a revolving line of credit that you can borrow against as needed. HELOCs typically have variable interest rates, which can fluctuate over time. The interest rates on HELOCs are often lower than those on equity loans, but they may also carry higher fees.

Best Egg Loan is a popular option for personal loans, offering competitive rates and flexible repayment terms. They are known for their quick and easy application process, making it a convenient choice for borrowers who need funds quickly.

Advantages and Disadvantages of Equity Loans

- Advantages: Equity loans offer fixed interest rates, predictable monthly payments, and can be used for a variety of purposes.

- Disadvantages: Equity loans can be risky if you are unable to make your payments, as you could lose your home. They may also have higher interest rates than other financing options.

Potential Risks Associated with Equity Loans

Equity loans come with inherent risks, particularly if you are unable to make your payments. If you default on your loan, the lender could foreclose on your home, resulting in significant financial losses. It is crucial to carefully consider your financial situation and ability to repay the loan before taking out an equity loan.

A 2nd Mortgage is a loan secured by your home, but it’s taken out in addition to your primary mortgage. This can be a good option if you need extra cash for home improvements, debt consolidation, or other major expenses.

It’s important to understand the terms and conditions before taking out a second mortgage.

Finding the Best Equity Loan Rates

Securing the most competitive equity loan rates requires careful research and comparison shopping. Here’s a step-by-step guide to help you find the best deal:

Shop Around for Loans

Don’t settle for the first offer you receive. Contact multiple lenders and compare their rates, terms, and fees. This will help you identify the most competitive options and potentially save you money in the long run.

Wells Fargo is a well-known financial institution that offers various home financing options, including Wells Fargo Home Equity Loan. They have a wide range of products and services to cater to different needs, so it’s worth checking out their offerings if you’re considering a home equity loan.

Compare Loan Offers

Once you have received several loan offers, carefully compare the terms of each offer. Consider the interest rate, loan term, origination fees, and any other applicable charges. Look for the offer with the lowest overall cost, including all fees and interest charges.

Best Egg Loan is a personal loan that can be used for a variety of purposes, including debt consolidation, home improvements, or medical expenses. They offer competitive rates and flexible terms, and you can apply online for a quick and easy process.

Negotiate Lower Rates

Don’t be afraid to negotiate with lenders to try and secure a lower interest rate. If you have a good credit score and a low LTV ratio, you may be able to negotiate a more favorable rate. Be prepared to shop around and compare offers from multiple lenders to leverage your negotiating power.

Equity Loans and Financial Planning: Equity Loan Rates

Equity loans can be a valuable financial tool, but it is essential to consider the potential financial implications before taking one out. Carefully evaluate your financial situation and ability to repay the loan before making a decision.

Potential Financial Implications

Taking out an equity loan can impact your financial situation in several ways. You will have additional monthly payments to make, which can affect your cash flow and budgeting. Additionally, if you default on your loan, you could lose your home.

It is crucial to consider these factors before taking out an equity loan.

Getting Home Loan Pre Approval can be a smart move when you’re ready to buy a home. It gives you an idea of how much you can borrow, which helps you focus your search for the right property. Pre-approval can also strengthen your offer when you make an offer on a house.

Uses for Equity Loans

Equity loans can be used for a variety of purposes, including:

- Home Renovations: Equity loans can help finance major home improvements, such as kitchen or bathroom renovations, additions, or energy efficiency upgrades.

- Debt Consolidation: Equity loans can be used to consolidate high-interest debt, such as credit card debt, into a single loan with a lower interest rate.

- Business Funding: Equity loans can provide funding for starting or expanding a business.

- Education Expenses: Equity loans can help finance college tuition or other educational expenses.

Managing Equity Loan Payments

To effectively manage equity loan payments, it is crucial to create a realistic budget that accounts for the additional monthly payments. Consider setting up automatic payments to ensure you don’t miss any payments and avoid late fees. Additionally, make extra payments whenever possible to reduce the principal balance and pay off the loan faster.

Closing Notes

By understanding the nuances of equity loan rates, homeowners can make informed choices that align with their financial goals. Whether you’re considering home renovations, debt consolidation, or other financial needs, a thorough understanding of equity loan rates empowers you to navigate this aspect of home financing with confidence.

Clarifying Questions

What is the minimum credit score required for an equity loan?

A Wells Fargo Home Equity Loan can be a good option if you need a loan for home improvements or debt consolidation. They offer competitive rates and flexible terms, and you can choose from a variety of loan options to suit your needs.

Credit score requirements for equity loans vary by lender, but generally, a score of at least 620 is needed for favorable rates.

Can I use an equity loan to pay off credit card debt?

Yes, equity loans can be used for debt consolidation, including paying off high-interest credit card debt. However, consider the long-term implications of adding more debt to your mortgage.

How long does it take to get approved for an equity loan?

The approval process for equity loans typically takes a few weeks, depending on the lender and the complexity of your application.

Discover Home Loans offers a range of mortgage products to meet different needs, from conventional loans to FHA loans. They have a user-friendly online platform and knowledgeable customer service representatives to guide you through the process.

Applying for a loan online has become increasingly popular, offering convenience and speed. Many lenders have streamlined their application processes, allowing you to Apply For Loan Online from the comfort of your own home. You can typically submit your application, upload documents, and track its progress online.

Bank of America is a major financial institution that offers a variety of personal loan products, including Bank Of America Personal Loan. They have competitive rates and flexible repayment options, making them a good option to consider for your personal loan needs.

Upgrade Personal Loans are known for their competitive rates and flexible repayment options. They offer a convenient online application process and quick funding, making them a good option for borrowers who need funds quickly.

Understanding Home Equity Loan Rates is crucial when considering this type of loan. Rates can vary depending on factors like your credit score, loan amount, and the value of your home. Comparing rates from different lenders is essential to find the best deal.