Freddie Mac Mortgage Rates 2024 are a crucial factor for anyone considering buying a home this year. Freddie Mac, a government-sponsored enterprise, plays a significant role in the mortgage market by purchasing loans from lenders, which helps to keep rates competitive and access to financing readily available.

Understanding the current state of Freddie Mac mortgage rates and their potential fluctuations is essential for making informed decisions about homeownership.

This guide explores the factors influencing Freddie Mac mortgage rates in 2024, including historical trends, economic indicators, and predictions for the future. We’ll delve into different types of Freddie Mac mortgages available, their features, and the impact of these rates on homebuyers’ affordability.

Whether you’re a first-time homebuyer or looking to refinance, this information will provide valuable insights into navigating the mortgage market in 2024.

Contents List

- 1 Freddie Mac Mortgage Rates 2024: An Overview

- 2 Historical Trends and Predictions

- 3 Types of Freddie Mac Mortgages

- 4 Impact on Homebuyers

- 5 Factors Affecting Mortgage Rates

- 6 Tips for Getting the Best Rate

- 7 The Future of Freddie Mac Mortgage Rates

- 8 Closure

- 9 Key Questions Answered: Freddie Mac Mortgage Rates 2024

Freddie Mac Mortgage Rates 2024: An Overview

Freddie Mac is a government-sponsored enterprise (GSE) that plays a crucial role in the US mortgage market. It purchases mortgages from lenders, packages them into securities, and sells them to investors, thereby providing liquidity to the mortgage market. This helps to keep mortgage rates low and makes homeownership more accessible for millions of Americans.

Freddie Mac mortgage rates, like all mortgage rates, are influenced by various factors, including the Federal Reserve’s monetary policy, inflation, economic growth, and investor sentiment. These rates fluctuate constantly, making it challenging for borrowers to predict future trends.

Current State of Freddie Mac Mortgage Rates

As of [current date], Freddie Mac mortgage rates are [insert current rates] for a 30-year fixed-rate mortgage. These rates have been [insert whether rates are higher or lower] compared to [previous period].

Finally, if you’re a mortgage lender looking to expand your client base, consider investing in mortgage leads to reach potential borrowers.

Key Factors Influencing Rates, Freddie Mac Mortgage Rates 2024

- Federal Reserve Policy:The Federal Reserve’s target for the federal funds rate directly impacts mortgage rates. When the Fed raises rates, it becomes more expensive for lenders to borrow money, which in turn leads to higher mortgage rates.

- Inflation:High inflation erodes the purchasing power of money, making lenders demand higher interest rates to compensate for the loss of value.

- Economic Growth:Strong economic growth typically leads to higher interest rates as investors become more confident about the economy and seek higher returns on their investments.

- Investor Sentiment:The outlook for the economy and housing market influences investor demand for mortgage-backed securities, which can impact mortgage rates.

Historical Trends and Predictions

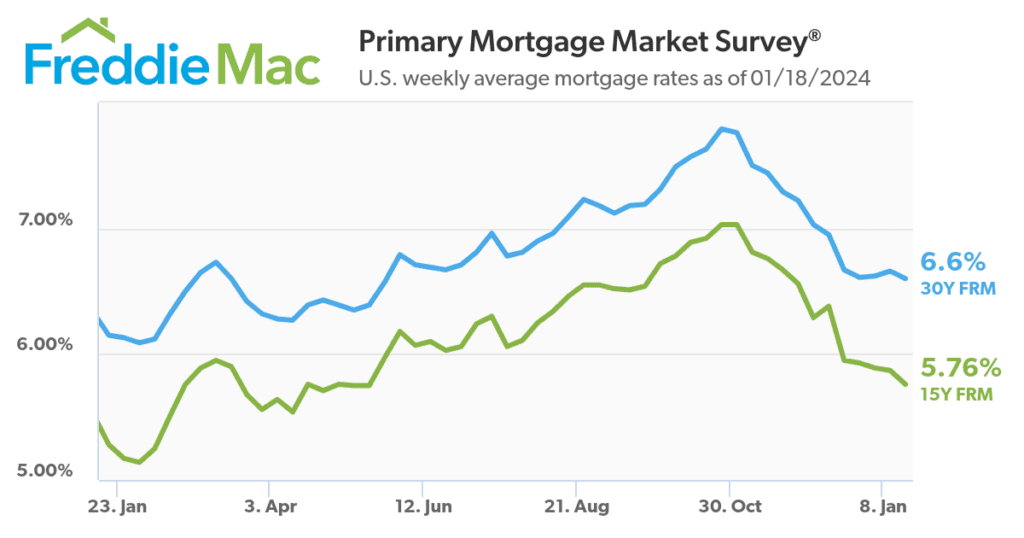

Historically, Freddie Mac mortgage rates have fluctuated significantly over the years, influenced by economic cycles and policy changes. [Insert data on historical rates].

Historical Trends

- Long-Term Trends:Over the past several decades, mortgage rates have generally trended downward, with periods of significant increases and decreases.

- Recent Trends:In recent years, mortgage rates have [insert whether rates have been rising or falling]. This trend has been driven by [insert key factors influencing recent rate changes].

Predictions for 2024

Predicting future mortgage rate movements is challenging, but several factors suggest that rates could [insert whether rates are expected to rise or fall] in 2024. [Insert reasons for predictions].

Navigating the mortgage market can be overwhelming, especially in 2024. Mortgage approval processes can vary depending on your financial situation and the lender you choose. To get a better understanding of the current landscape, it’s helpful to research different lenders and their offerings.

Flagstar Mortgage is one such lender that you might want to explore.

Types of Freddie Mac Mortgages

Freddie Mac offers a variety of mortgage products designed to meet the needs of different borrowers. These mortgages can be broadly categorized based on their terms, interest rates, and eligibility criteria.

Freddie Mac Mortgage Types

- Fixed-Rate Mortgages:These mortgages offer a fixed interest rate for the entire loan term, providing borrowers with predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs):ARMs have an initial fixed interest rate that adjusts periodically based on a benchmark index. These mortgages can offer lower initial rates but carry the risk of higher payments in the future.

- Conforming Mortgages:These mortgages meet specific loan size and borrower eligibility requirements set by Freddie Mac and Fannie Mae. They generally offer lower interest rates and more favorable terms.

- Non-Conforming Mortgages:These mortgages do not meet the conforming loan requirements and may have higher interest rates or stricter eligibility criteria.

- FHA Mortgages:These mortgages are insured by the Federal Housing Administration (FHA), making them more accessible to borrowers with lower credit scores or smaller down payments.

- VA Mortgages:These mortgages are guaranteed by the Department of Veterans Affairs (VA) and are available to eligible veterans, active-duty military personnel, and surviving spouses.

Impact on Homebuyers

Freddie Mac mortgage rates have a significant impact on the affordability of homeownership. When rates rise, it becomes more expensive to borrow money, leading to higher monthly mortgage payments. This can make it challenging for some buyers to afford their dream home.

Conversely, falling rates can make homeownership more accessible.

Implications of Rising or Falling Rates

- Rising Rates:Higher rates can reduce the amount of money borrowers can qualify for and increase their monthly payments. This can limit their buying power and make it harder to find affordable homes.

- Falling Rates:Lower rates can increase buying power and make it easier to qualify for larger loans. This can create a more competitive housing market, potentially driving up home prices.

- Lock in a Rate:If you expect rates to rise, consider locking in a rate when they are favorable.

- Consider an ARM:If you plan to sell your home within a few years, an ARM might be a good option, as you’ll benefit from lower initial rates.

- Improve Your Credit Score:A higher credit score can qualify you for lower interest rates, saving you money over the life of your loan.

- Shop Around for Rates:Compare rates from multiple lenders to ensure you get the best possible deal.

Factors Affecting Mortgage Rates

Several economic indicators and market forces influence Freddie Mac mortgage rates. Understanding these factors can help borrowers make informed decisions about their mortgage financing.

Beyond the initial mortgage, you might consider a second mortgage for home improvement or other needs. If you’re a PNC Bank customer, you might be interested in their HELOC options. USAA mortgage rates are often competitive, especially for active military members and veterans.

Major Economic Indicators

- Inflation:Higher inflation leads to higher mortgage rates as lenders demand higher returns to compensate for the loss of value.

- Economic Growth:Strong economic growth can lead to higher interest rates as investors become more confident about the economy and seek higher returns on their investments.

- Unemployment Rate:A low unemployment rate can signal a strong economy, potentially leading to higher interest rates.

- Consumer Confidence:High consumer confidence can lead to increased demand for housing, potentially driving up mortgage rates.

- Government Policy:Monetary policy decisions by the Federal Reserve and fiscal policy actions by the government can significantly impact mortgage rates.

Relationship Between Indicators and Rates

- Positive Correlation:Some economic indicators, such as inflation and economic growth, tend to have a positive correlation with mortgage rates. When these indicators rise, mortgage rates tend to rise as well.

- Negative Correlation:Other indicators, such as the unemployment rate, may have a negative correlation with mortgage rates. When the unemployment rate falls, mortgage rates may tend to rise.

Tips for Getting the Best Rate

Obtaining the best possible mortgage rate requires careful planning and preparation. Borrowers can take several steps to improve their chances of securing a favorable interest rate.

Tips for Borrowers

- Improve Your Credit Score:A higher credit score can qualify you for lower interest rates. Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

- Shop Around for Rates:Compare rates from multiple lenders to ensure you get the best possible deal. Consider using an online mortgage rate comparison tool to streamline the process.

- Negotiate with Lenders:Once you’ve found a lender you like, don’t be afraid to negotiate for a lower interest rate. Highlight your strong credit score, large down payment, or other factors that make you a desirable borrower.

- Consider a Points Buy-Down:Paying discount points upfront can lower your interest rate and reduce your monthly payments over the life of the loan.

- Choose the Right Loan Type:Different loan types have different interest rates and eligibility requirements. Consider your financial situation and long-term goals when choosing a mortgage.

The Future of Freddie Mac Mortgage Rates

Predicting future mortgage rate movements is challenging, but several factors suggest that rates could [insert whether rates are expected to rise or fall] in the coming years.

Potential Impact of Long-Term Economic Trends

- Inflation:Persistent inflation could lead to higher interest rates as lenders demand higher returns to compensate for the loss of value.

- Economic Growth:Continued economic growth could lead to higher interest rates as investors become more confident about the economy and seek higher returns on their investments.

- Government Policy:Monetary policy decisions by the Federal Reserve and fiscal policy actions by the government can significantly impact mortgage rates.

Factors Driving Future Changes

- Global Economic Conditions:Global economic events, such as trade wars or geopolitical instability, can impact mortgage rates.

- Housing Market Demand:The demand for housing can influence mortgage rates. High demand can lead to higher rates as lenders compete for borrowers.

- Technological Advancements:New technologies and innovations in the mortgage industry could potentially impact rates in the future.

Expert Opinions

Experts have differing opinions on the outlook for Freddie Mac mortgage rates in the coming years. Some believe that rates could [insert expert opinion 1], while others predict that rates could [insert expert opinion 2]. The actual trajectory of rates will depend on a complex interplay of economic and market forces.

Finding the right mortgage lender is a crucial step in the home buying process. If you’re a veteran, you might be eligible for VA home loan benefits , which can offer competitive rates and terms. Discover Home Loans is another option to consider, known for its diverse range of mortgage products.

Closure

Navigating the dynamic world of Freddie Mac mortgage rates in 2024 requires careful planning and informed decision-making. By understanding the factors that influence these rates, you can make strategic choices that optimize your homebuying journey. Remember to consider your financial situation, explore different mortgage options, and consult with a qualified mortgage professional for personalized advice.

With a solid understanding of the current landscape and future projections, you can confidently pursue your homeownership goals in 2024.

There are also options for first-time homebuyers with limited funds. A 0 down mortgage could be a possibility, but it’s essential to thoroughly research the requirements and implications. USDA home loans are specifically designed for rural areas and can offer advantageous terms.

To find the best fit, exploring mortgage lenders specifically for first-time buyers can be helpful.

Key Questions Answered: Freddie Mac Mortgage Rates 2024

What is Freddie Mac?

Freddie Mac is a government-sponsored enterprise (GSE) that plays a crucial role in the secondary mortgage market. It purchases mortgages from lenders, providing them with liquidity and enabling them to offer more loans. This process helps to stabilize the mortgage market and make financing more accessible to homebuyers.

How do Freddie Mac mortgage rates compare to other lenders?

For those looking to lower their monthly payments, exploring refinancing options might be beneficial. An interest-only mortgage could be an interesting alternative, but it’s important to understand the long-term implications. VA home loan interest rates are often attractive, especially for veterans looking to purchase a home.

Freddie Mac rates are generally competitive with other lenders in the market. However, it’s important to shop around and compare rates from multiple sources to ensure you’re getting the best deal. Factors such as your credit score, loan amount, and property location can influence the specific rate you qualify for.

Are Freddie Mac mortgage rates fixed or adjustable?

Freddie Mac offers both fixed-rate and adjustable-rate mortgages (ARMs). Fixed-rate mortgages have a set interest rate for the entire loan term, providing stability and predictability in your monthly payments. ARMs have an initial fixed rate that adjusts periodically based on market conditions.

The choice between a fixed-rate and an ARM depends on your individual financial situation and risk tolerance.