Annuity Is Loan 2024: A Comprehensive Guide delves into the complex world of annuities, exploring their characteristics, potential risks, and how they compare to traditional loans. We will examine the argument that annuities are essentially loans, analyzing their features and exploring the implications of this perspective.

This guide will equip you with the knowledge you need to make informed decisions about annuities in 2024.

Annuity contracts are financial products that provide a stream of payments over a set period. They are often used for retirement planning, but they can also be used for other purposes, such as income replacement or long-term care. While annuities can be a valuable tool for financial planning, it’s crucial to understand their intricacies and potential risks.

This guide will provide a comprehensive overview of annuities, their various types, and the factors to consider before investing in them.

Contents List

Annuity Basics: Annuity Is Loan 2024

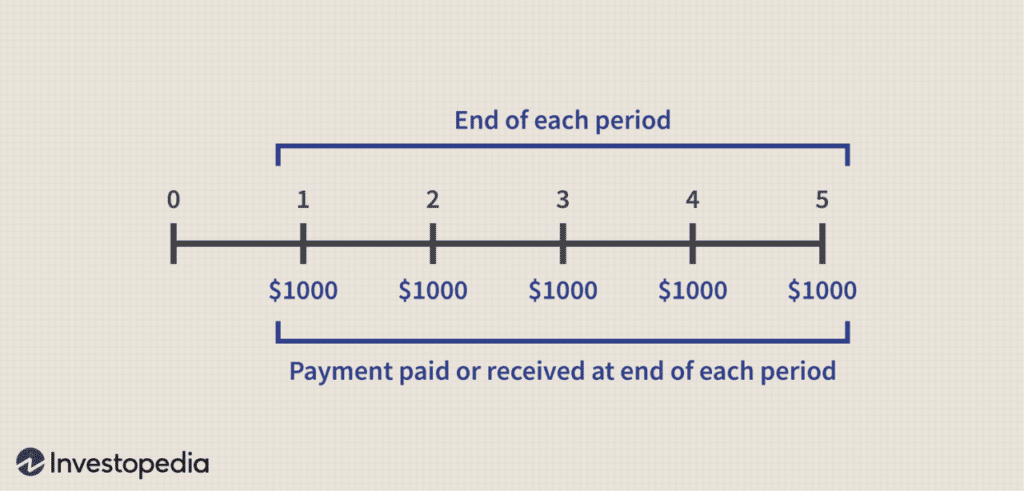

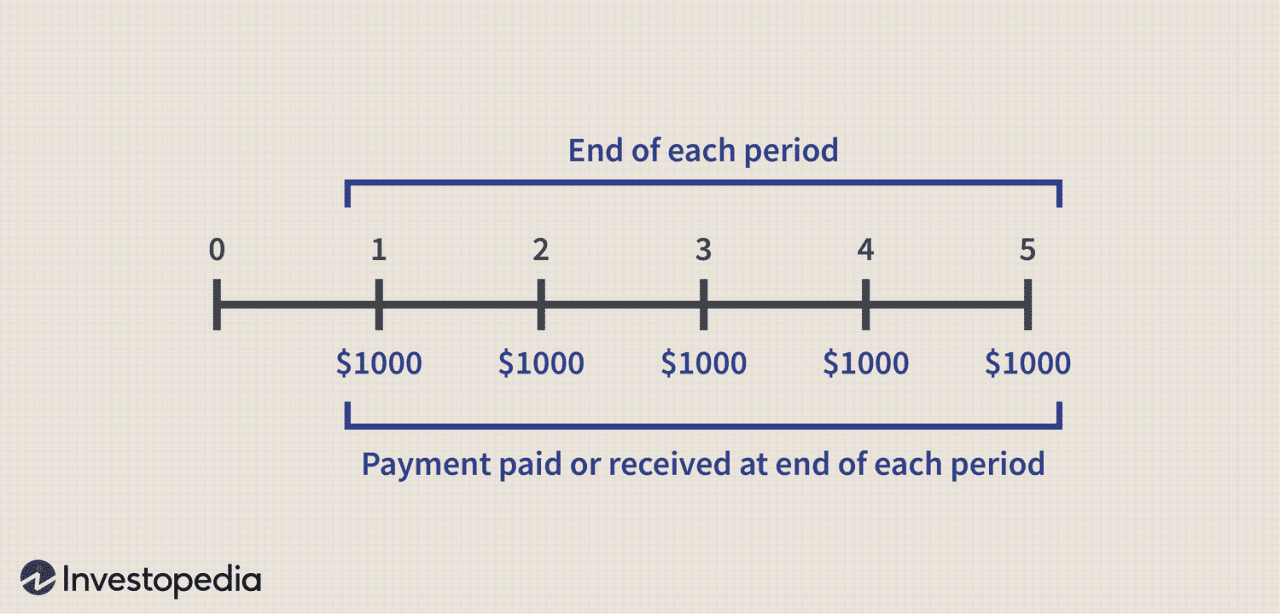

An annuity is a financial product that provides a stream of regular payments for a specified period of time. Annuities are often used for retirement planning, but they can also be used for other purposes, such as income replacement or long-term care.

The key characteristics of an annuity include:

Types of Annuities

Annuities can be broadly classified into three main types:

- Fixed Annuities:These annuities offer a guaranteed rate of return, meaning that the payments you receive will not fluctuate. This makes them a good choice for investors seeking stability and predictability. However, fixed annuities typically offer lower returns than other types of annuities.

- Variable Annuities:These annuities invest your money in a portfolio of assets, such as stocks or bonds. The value of your payments will fluctuate based on the performance of the underlying investments. Variable annuities can offer the potential for higher returns, but they also come with higher risk.

- Indexed Annuities:These annuities offer a guaranteed minimum rate of return, but also have the potential to participate in the growth of a specific index, such as the S&P 500. Indexed annuities provide some protection from market volatility while still offering the potential for growth.

Advantages and Disadvantages of Annuities

Annuities offer several advantages, including:

- Guaranteed Income:Many annuities provide a guaranteed stream of income for life, which can be a valuable source of financial security in retirement.

- Tax Advantages:Annuities can offer tax-deferred growth, meaning that you don’t pay taxes on the earnings until you withdraw them. This can help you accumulate wealth more quickly.

- Protection from Market Risk:Some annuities, such as fixed annuities, offer protection from market risk. This can be appealing to investors who are risk-averse.

However, annuities also have some disadvantages, including:

- High Fees:Annuities can have high fees, which can eat into your returns.

- Lack of Liquidity:Annuities can be illiquid, meaning that it can be difficult to access your money before the annuity begins to make payments.

- Complexity:Annuities can be complex financial products, and it’s important to understand the terms and conditions before investing.

Annuities as Loans

The argument that an annuity is essentially a loan is based on the fact that you are essentially “borrowing” money from the insurance company that issues the annuity. You are paying premiums to the insurance company, and in return, they are promising to pay you back a stream of income for a certain period of time.

This can be seen as a loan where the principal is the sum of your premiums, and the interest is the difference between the total amount you receive in payments and the total amount you paid in premiums.

Comparing Annuities and Loans

Here’s a comparison of annuities and traditional loans:

| Feature | Annuity | Loan |

|---|---|---|

| Purpose | Retirement income, income replacement, long-term care | Purchasing a home, financing a car, paying for education |

| Payment Structure | Regular payments for a specified period | Regular payments with principal and interest |

| Interest Rate | Implied interest rate based on the difference between premiums and payments | Explicit interest rate |

| Risk | Risk of outliving your annuity payments | Risk of defaulting on the loan |

Risks and Benefits of Viewing an Annuity as a Loan

Viewing an annuity as a loan can help you understand the potential risks and benefits of this investment:

- Risk of Outliving Your Payments:If you live longer than expected, you may run out of annuity payments before you die. This is a significant risk to consider, especially if you are relying on the annuity for your primary source of income.

- Potential for Lower Returns:The implied interest rate on an annuity may be lower than the interest rate you could earn on other investments, such as bonds or stocks.

- Benefit of Guaranteed Income:The guaranteed income stream provided by an annuity can provide peace of mind and financial security, especially in retirement.

- Tax Advantages:Annuities can offer tax-deferred growth, which can be a significant benefit, especially if you are in a high tax bracket.

Annuity Investment Considerations

Choosing the right annuity can be a complex decision. Here’s a comprehensive guide to help you make an informed choice:

Investment Goals, Risk Tolerance, and Time Horizon

Your investment goals, risk tolerance, and time horizon are key factors to consider when choosing an annuity.

- Investment Goals:Are you looking for guaranteed income, growth potential, or both? Your goals will help you determine the type of annuity that best suits your needs.

- Risk Tolerance:How comfortable are you with the potential for fluctuations in the value of your investments? If you are risk-averse, a fixed annuity may be a better choice. If you are willing to take on more risk, a variable or indexed annuity may be more appropriate.

- Time Horizon:How long do you plan to hold the annuity? The longer your time horizon, the more time you have for your investments to grow. This can be an important factor when choosing between annuities with different investment options.

Fees and Charges

Annuities can have various fees and charges, including:

- Mortality and Expense Charges:These charges cover the cost of providing the guaranteed income stream and administrative expenses.

- Surrender Charges:These charges are imposed if you withdraw money from the annuity before a certain period.

- Investment Management Fees:These fees are charged for managing the underlying investments in a variable annuity.

It’s crucial to carefully review the fees and charges associated with any annuity before investing. High fees can significantly impact your returns.

Tax Implications

The tax implications of annuities can vary depending on the type of annuity and how you withdraw the money. Here are some key points to consider:

- Tax-Deferred Growth:Annuities offer tax-deferred growth, meaning that you don’t pay taxes on the earnings until you withdraw them.

- Taxable Withdrawals:When you withdraw money from an annuity, the withdrawals are typically taxed as ordinary income.

- Tax-Free Withdrawals:In some cases, you may be able to withdraw money from an annuity tax-free. For example, you may be able to withdraw contributions to a qualified annuity tax-free.

It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.

Annuity Market Trends in 2024

The annuity market is constantly evolving, and several factors are influencing demand and supply in 2024.

Factors Influencing Demand and Supply

- Rising Interest Rates:Rising interest rates can make annuities more attractive to investors, as they offer the potential for higher returns. This can lead to increased demand for annuities.

- Aging Population:As the population ages, there is an increasing need for retirement income, which can drive demand for annuities.

- Economic Uncertainty:Economic uncertainty can make investors more risk-averse, leading to increased demand for annuities that offer guaranteed income streams.

- Competition from Other Investment Products:Annuities face competition from other investment products, such as mutual funds, stocks, and bonds. This can impact the supply of annuities in the market.

Emerging Trends and Innovations, Annuity Is Loan 2024

The annuity industry is constantly innovating, with new products and features emerging to meet the evolving needs of investors. Some key trends include:

- Increased Focus on Longevity Risk:Annuities are increasingly being designed to address longevity risk, the risk of outliving your savings. This is reflected in products that offer lifetime income guarantees.

- Growth of Variable Annuities:Variable annuities are becoming increasingly popular, as investors seek the potential for higher returns. However, it’s important to note that variable annuities also come with higher risk.

- Integration of Technology:The annuity industry is embracing technology to improve the customer experience and make it easier for investors to manage their annuities online.

Impact of Regulatory Changes

Regulatory changes can significantly impact the annuity market. For example, changes to tax laws or regulations governing the sale of annuities can influence demand and supply. It’s important to stay informed about any regulatory changes that may affect your annuity investments.

Annuity vs. Other Investment Options

Annuities are just one of many investment options available to investors. It’s important to compare and contrast annuities with other investment options to determine which is the best choice for your specific needs.

Comparing Annuities to Mutual Funds, Stocks, and Bonds

| Feature | Annuity | Mutual Fund | Stocks | Bonds |

|---|---|---|---|---|

| Risk | Low to high, depending on the type of annuity | Moderate to high, depending on the fund’s investment strategy | High | Moderate |

| Return Potential | Low to high, depending on the type of annuity | Moderate to high, depending on the fund’s investment strategy | High | Moderate |

| Liquidity | Low to moderate, depending on the type of annuity | High | High | Moderate |

| Tax Implications | Tax-deferred growth, taxable withdrawals | Tax-deferred growth, taxable dividends and capital gains | Taxable dividends and capital gains | Taxable interest income |

Scenarios Where Annuities May Be Suitable

- Retirement Income:Annuities can provide a guaranteed stream of income for life, which can be a valuable source of financial security in retirement.

- Income Replacement:Annuities can be used to replace lost income due to disability or other unforeseen circumstances.

- Long-Term Care:Annuities can be used to help cover the costs of long-term care.

- Risk Aversion:Annuities can be a good choice for investors who are risk-averse and want to protect their principal.

Advantages and Disadvantages of Annuities Compared to Alternative Investments

Annuities offer several advantages over other investment options, including:

- Guaranteed Income:Annuities can provide a guaranteed stream of income for life, which can be a valuable source of financial security in retirement.

- Tax Advantages:Annuities can offer tax-deferred growth, meaning that you don’t pay taxes on the earnings until you withdraw them.

- Protection from Market Risk:Some annuities, such as fixed annuities, offer protection from market risk. This can be appealing to investors who are risk-averse.

However, annuities also have some disadvantages compared to other investment options, including:

- High Fees:Annuities can have high fees, which can eat into your returns.

- Lack of Liquidity:Annuities can be illiquid, meaning that it can be difficult to access your money before the annuity begins to make payments.

- Complexity:Annuities can be complex financial products, and it’s important to understand the terms and conditions before investing.

Last Point

Understanding the complexities of annuities is crucial for informed financial planning. This guide has explored the argument that annuities are essentially loans, analyzing their features, potential risks, and how they compare to traditional loans. We’ve examined the various types of annuities, discussed key considerations for choosing an annuity, and explored the annuity market trends in 2024.

By carefully evaluating your financial goals, risk tolerance, and time horizon, you can determine if an annuity is a suitable investment for your individual needs. Remember, seeking advice from a qualified financial advisor can be invaluable in making informed decisions about annuities and other financial products.

Essential FAQs

What are the different types of annuities?

Annuities can be classified into various types, including fixed, variable, and indexed annuities. Fixed annuities provide guaranteed payments, while variable annuities offer growth potential but also carry investment risk. Indexed annuities offer a blend of features, linking returns to a specific index while providing some protection against market losses.

What are the main advantages and disadvantages of annuities?

Advantages of annuities include guaranteed income streams, potential tax benefits, and protection against market fluctuations. However, disadvantages include potential limitations on withdrawals, high fees, and the possibility of outliving the annuity’s payments.

How do annuities compare to other investment options?

Annuities offer a different risk-reward profile compared to other investments like mutual funds, stocks, and bonds. They can be suitable for those seeking guaranteed income streams or protection against market volatility. However, it’s crucial to compare the potential returns, fees, and tax implications of annuities with other options to make an informed decision.