Private Mortgage 2024 presents a compelling landscape for borrowers seeking alternative financing options. As traditional mortgage rates fluctuate, the private mortgage market offers a unique avenue for securing financing, particularly for those with specific needs or who may not meet conventional lending criteria.

Refinancing your mortgage can be a smart financial move, especially if interest rates have dropped since you took out your original loan. Refinance 2024 can help you understand the refinancing process and determine if it’s the right decision for you.

This guide explores the intricacies of private mortgages, delving into their eligibility, advantages, disadvantages, types, rates, and the process of finding and working with private lenders.

Looking to tap into your home equity? Home Equity Interest Rates 2024 can help you understand the current rates and options available for home equity loans and lines of credit. Whether you’re planning a home improvement project or need extra cash, explore your home equity options.

Navigating the world of private mortgages requires careful consideration, as it differs significantly from traditional lending. Understanding the nuances of this market, including its advantages and disadvantages, is crucial for making informed decisions. Whether you’re a seasoned real estate investor or a first-time homebuyer, this guide provides the information you need to navigate the complexities of private mortgages in 2024.

Securing the lowest mortgage rate can save you thousands of dollars over the life of your loan. Lowest Mortgage Rates 2024 can help you find the best rates available in the current market. Compare rates from multiple lenders to maximize your savings.

Ending Remarks: Private Mortgage 2024

In conclusion, private mortgages offer a valuable alternative for borrowers seeking flexibility and tailored financing solutions. While they may not be suitable for everyone, understanding their unique characteristics and potential benefits is essential for those considering this option. By carefully evaluating your financial situation, exploring the available options, and working with reputable private lenders, you can leverage the potential of private mortgages to achieve your real estate goals in 2024 and beyond.

If you’re a senior citizen considering a reverse mortgage, Hecm 2024 is a great resource. Learn about the benefits, eligibility requirements, and how a reverse mortgage can provide financial flexibility in your later years.

User Queries

What are the main differences between private and traditional mortgages?

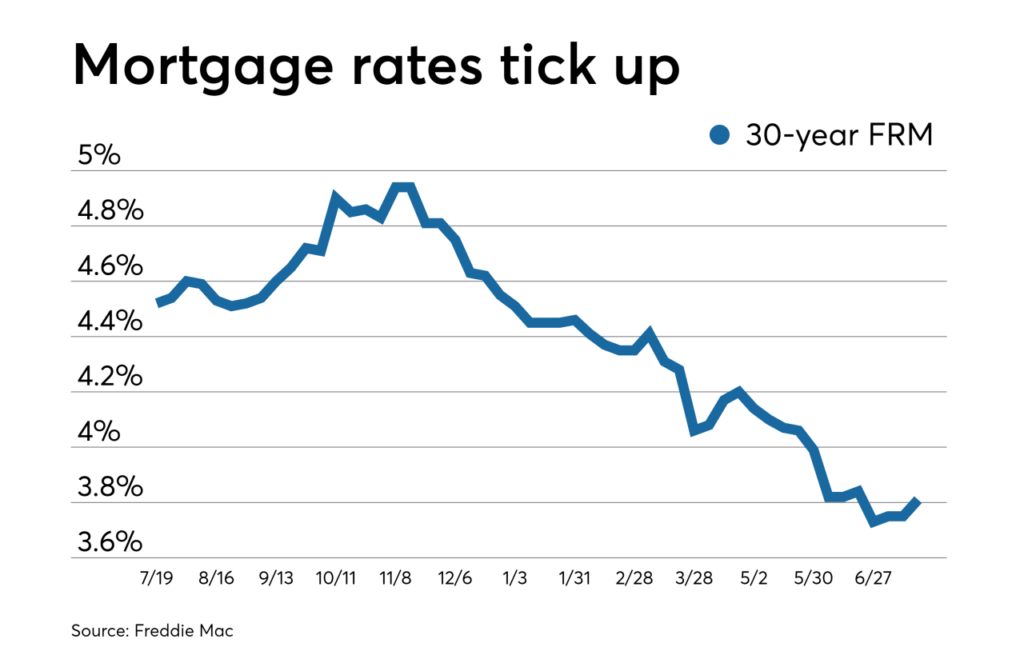

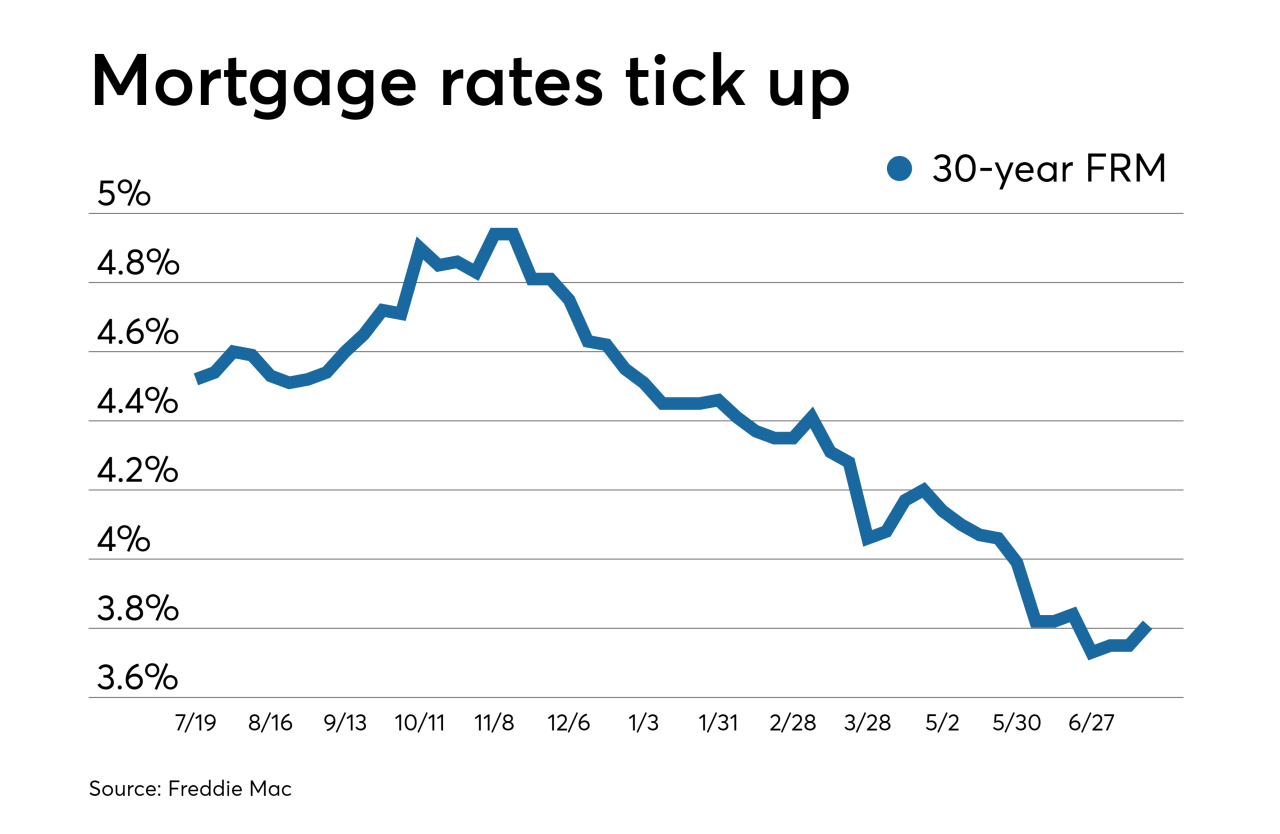

A 30-year fixed mortgage is a popular choice for many homeowners, offering predictable monthly payments and a long-term commitment. 30 Year Fixed Mortgage Rates 2024 provides you with current rates and information on the best 30-year fixed mortgage options available today.

Private mortgages are typically offered by individual investors or non-bank lenders, often with more flexible terms and requirements compared to traditional mortgages. Traditional mortgages are provided by banks and credit unions and often adhere to stricter guidelines.

Choosing the right mortgage lender is crucial for a smooth and successful homebuying experience. Top Mortgage Lenders 2024 provides insights into the top-rated mortgage lenders based on factors like customer satisfaction, rates, and loan options.

How can I find a reputable private mortgage lender?

Finding the best mortgage interest rates in 2024 can be a daunting task, but it doesn’t have to be. Best Mortgage Interest Rates 2024 can help you compare rates from various lenders and find the best deal for your situation.

Whether you’re looking for a 30-year fixed mortgage or a home equity loan, we’ve got you covered.

Look for lenders with a proven track record, positive reviews, and strong financial standing. It’s also advisable to consult with real estate professionals and financial advisors for recommendations.

Are private mortgages riskier than traditional mortgages?

Private mortgages can carry higher risks due to the potential for less stringent underwriting standards. However, the potential for higher returns can offset this risk for some borrowers.

What are some common fees associated with private mortgages?

Don’t just settle for any lender. Local Mortgage Lenders 2024 can connect you with trusted mortgage professionals in your area who understand your specific needs and can offer personalized advice. Working with a local lender can provide a more personalized experience and potentially even better rates.

Fees can vary depending on the lender, but common ones include origination fees, appraisal fees, and closing costs.

A guarantor mortgage can be a helpful option for first-time homebuyers who may not have enough savings for a large down payment. Guarantor Mortgage 2024 explains how a guarantor mortgage works and what you need to know about finding a lender who offers this option.

Finding a reputable mortgage lender near you can be easier than you think. Lenders Near Me 2024 can connect you with local mortgage lenders who can provide personalized service and support throughout your homebuying journey.

If you’re a veteran or active-duty service member, you may be eligible for special mortgage benefits and rates. Veterans United Interest Rates 2024 provides information on the mortgage options available through Veterans United Home Loans, including their competitive interest rates.

Commercial mortgages are used to finance the purchase or refinance of commercial properties. Commercial Mortgage Rates 2024 can help you find current rates and learn about the different types of commercial mortgages available.

Mr. Cooper is a well-known mortgage lender offering a range of mortgage products and services. Mr Cooper Mortgage 2024 provides information on Mr. Cooper’s current mortgage rates, loan options, and customer reviews.

Finding the right mortgage lender can be a crucial step in your homebuying journey. Mortgage Lender 2024 provides guidance on choosing a lender, comparing rates, and navigating the mortgage application process.

Buying a home for the first time can be both exciting and overwhelming. First Time Home Buyers 2024 offers resources and advice specifically for first-time homebuyers, covering topics like financing options, down payment requirements, and the closing process.