Annuity Loan Formula 2024 offers a structured approach to calculating loan payments, providing clarity and insight into the financial obligations associated with borrowing. This formula considers various factors, including interest rates, loan term, and principal amount, to determine the regular payment amount needed to repay the loan over time.

By understanding the mechanics of the annuity loan formula, borrowers can gain valuable knowledge about the financial implications of their loan choices. This formula serves as a crucial tool for making informed decisions, allowing individuals to plan effectively for their financial obligations and manage their debt responsibly.

Contents List

Understanding Annuity Loans

Annuity loans, also known as installment loans, are a common type of loan where the borrower repays the principal and interest in equal installments over a fixed period. These loans are characterized by regular, predictable payments, making them a popular choice for various financial needs.

Key Features of Annuity Loans

Annuity loans are distinguished by several key features:

- Fixed Payments:Borrowers make consistent, equal payments throughout the loan term.

- Fixed Interest Rate:The interest rate remains constant for the duration of the loan, providing predictable financing costs.

- Loan Term:The loan term specifies the period over which the loan is repaid, typically expressed in months or years.

- Amortization:Each payment comprises a portion of the principal and interest, gradually reducing the outstanding loan amount.

Comparison with Other Loan Types

Annuity loans differ from other loan types in several ways:

- Mortgages:While mortgages are also annuity loans, they are specifically designed for real estate purchases and typically have longer terms.

- Credit Cards:Unlike annuity loans, credit cards have revolving balances and variable interest rates, making payments less predictable.

- Payday Loans:Payday loans are short-term loans with high interest rates and typically involve a lump sum repayment.

Advantages and Disadvantages

Annuity loans offer both advantages and disadvantages for borrowers:

Advantages:

- Predictable Payments:Fixed payments make budgeting easier and reduce the risk of missed payments.

- Lower Interest Rates:Compared to short-term loans like payday loans, annuity loans generally have lower interest rates.

- Long-Term Financing:Annuity loans allow for long-term financing, spreading the cost over a longer period.

Disadvantages:

- High Total Interest Cost:Over a long loan term, the total interest paid can be substantial.

- Prepayment Penalties:Some annuity loans may impose penalties for early repayment, limiting flexibility.

- Credit Score Impact:A missed payment can negatively impact a borrower’s credit score.

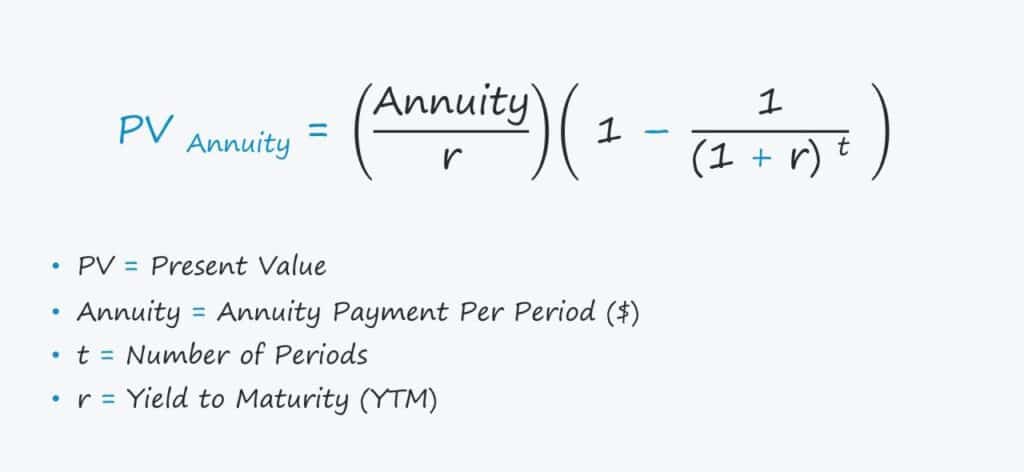

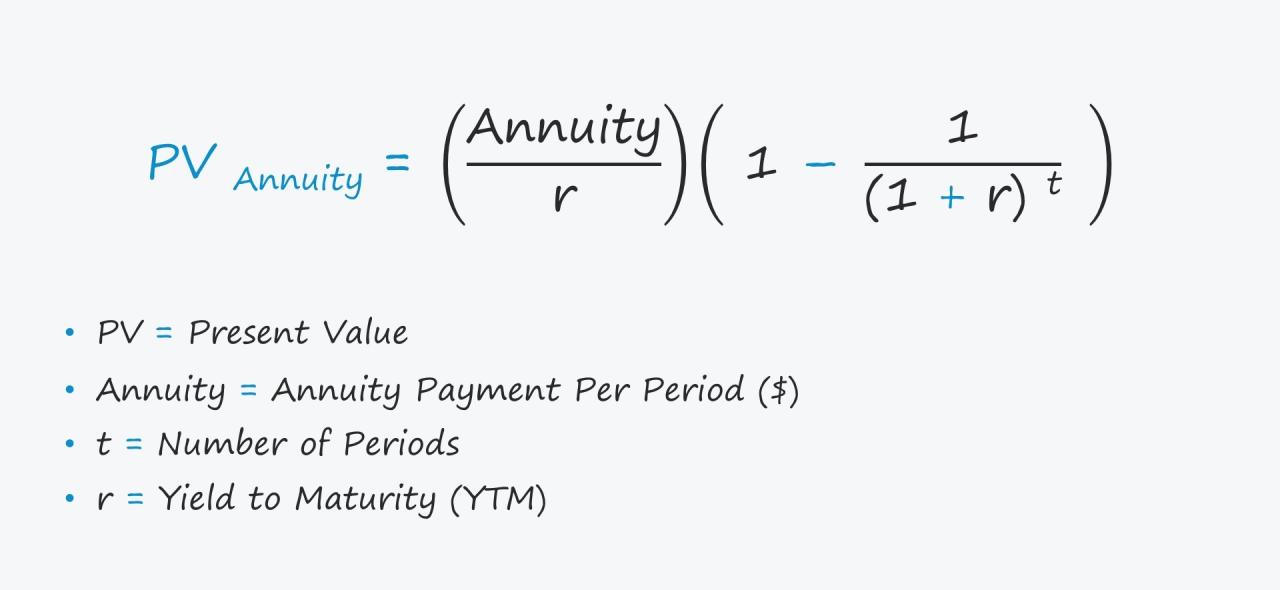

The Annuity Loan Formula

The annuity loan formula is used to calculate the regular payment amount for an annuity loan. It considers the principal amount, interest rate, and loan term.

Annuity products are offered by various financial institutions, including insurance companies like LIC. Is Annuity From Lic Taxable 2024 addresses the tax implications of annuities purchased from LIC, providing insights into potential tax liabilities. Annuity Is A Mcq 2024 offers a concise overview of annuities through a multiple-choice question format, testing your understanding of this financial instrument.

Is Annuity Income Taxable In India 2024 dives deeper into the tax treatment of annuity income within the Indian tax system, clarifying its taxability and potential deductions.

Formula:

Payment = (P

Annuity is a term with several synonyms and alternative names, as explored in Annuity Is Also Known As 2024. The concept of an “annuity jackpot” might sound intriguing, but it’s crucial to understand its implications and potential risks.

Annuity Jackpot 2024 sheds light on this topic, helping you navigate the intricacies of annuity investments. Annuity Is Indefinite Duration 2024 explores the possibility of annuities with indefinite durations, offering insights into their long-term financial implications.

- r

- (1 + r)^n) / ((1 + r)^n

- 1)

Variables:

- P:Principal amount borrowed

- r:Interest rate per period (usually monthly)

- n:Total number of payment periods

Example:

Let’s say you borrow $10,000 at an annual interest rate of 5% for a term of 5 years (60 months). Using the formula, the monthly payment would be:

Payment = (10000

- 0.05/12

- (1 + 0.05/12)^60) / ((1 + 0.05/12)^60

- 1) = $188.71

Factors Influencing Annuity Loan Payments

Several factors can influence the monthly payment amount for an annuity loan.

Interest Rate:

A higher interest rate results in higher monthly payments. This is because more interest is accrued on the loan balance, increasing the total amount to be repaid.

Loan Term:

A longer loan term generally leads to lower monthly payments but higher total interest cost. Conversely, a shorter term results in higher payments but less overall interest paid.

Principal Amount:, Annuity Loan Formula 2024

The principal amount borrowed directly impacts the payment amount. A larger principal requires higher payments to cover the loan balance.

Loan Fees:

Some annuity loans may include additional fees, such as origination fees or closing costs, which can increase the total cost and monthly payments.

Annuity Loan Payment Calculation Tools: Annuity Loan Formula 2024

Various online calculators and software can help calculate annuity loan payments. These tools streamline the process and provide accurate results.

Online Calculators:

| Calculator | Features | Link |

|---|---|---|

| Calculator A | Provides detailed breakdowns of principal and interest payments, amortization schedules, and loan comparison tools. | [Link to Calculator A] |

| Calculator B | Offers a user-friendly interface, adjustable loan parameters, and the ability to compare different loan scenarios. | [Link to Calculator B] |

| Calculator C | Includes advanced features like loan prepayment calculations and the option to customize payment frequency. | [Link to Calculator C] |

Software:

Specialized financial software programs, such as personal finance software or loan management applications, often incorporate annuity loan payment calculators.

Real-World Applications of Annuity Loans

Annuity loans are widely used in various financial situations, providing individuals and businesses with access to affordable financing.

Common Uses:

- Mortgages:Used to finance the purchase of residential or commercial properties.

- Auto Loans:Used to purchase vehicles, including cars, trucks, and motorcycles.

- Personal Loans:Used for various personal expenses, such as home improvements, medical bills, or debt consolidation.

- Business Loans:Used to finance business operations, expansion, or equipment purchases.

Benefits:

- Predictable Cash Flow:Consistent payments make budgeting easier and reduce financial stress.

- Access to Capital:Annuity loans provide access to funds for various needs, enabling individuals and businesses to achieve their financial goals.

- Long-Term Financing:Spreading the cost over a longer term can make large purchases more manageable.

Important Considerations:

Before taking out an annuity loan, it’s crucial to carefully consider the following:

- Interest Rate:Compare interest rates from different lenders to secure the most favorable terms.

- Loan Term:Choose a loan term that aligns with your repayment capacity and financial goals.

- Fees:Understand all associated fees and their impact on the total cost of the loan.

- Credit Score:Your credit score can influence the interest rate and loan approval process.

Closing Summary

The Annuity Loan Formula 2024 empowers borrowers with the knowledge to understand and calculate their loan payments accurately. By considering the impact of various factors, individuals can make informed decisions regarding their borrowing needs, ensuring financial stability and responsible debt management.

Whether it’s a mortgage, auto loan, or personal loan, grasping the principles of the annuity loan formula is a vital step towards financial literacy and well-being.

Understanding the definition of an annuity is crucial when considering it as a financial tool. Annuity Is Definition 2024 provides a comprehensive explanation of annuities, highlighting their key features and characteristics. An annuity can be purchased with a single lump sum payment or through periodic contributions, as detailed in Annuity Is A Single Sum 2024.

Annuity How It Works 2024 breaks down the mechanics of how annuities function, explaining how payments are calculated and distributed. For those seeking a deeper understanding, Annuity Is Bengali Meaning 2024 provides insights into the concept of annuities in Bengali.

FAQs

How does the annuity loan formula differ from other loan payment calculations?

The world of mobile app development is constantly evolving, with new opportunities and challenges emerging every day. How to get started with Android app development in 2024 provides a roadmap for aspiring developers, guiding them through the essential steps and tools.

Once your app is developed, monetization strategies become crucial. How to monetize an Android app in 2024 explores various monetization models, helping you find the right approach to generate revenue from your app.

The annuity loan formula focuses on calculating equal, regular payments over a fixed period, unlike simple interest loans where interest is calculated on the principal only.

What are some real-world examples of annuity loans?

Common examples include mortgages, auto loans, student loans, and some personal loans. These loans typically involve fixed monthly payments over a specified term.

Can I use the annuity loan formula to calculate my own loan payments?

Yes, you can use the formula or online calculators to determine your monthly payments. Remember to factor in the loan’s interest rate, term, and principal amount.

Is it possible to adjust the annuity loan payment amount?

While most annuity loans have fixed payments, some options allow for early repayment or adjustments to the payment schedule with the lender’s approval.

Annuity is a financial product that provides a stream of payments over a period of time, and is often used to provide a steady income during retirement. Annuity Is Primarily Used To Provide 2024 explains how annuities can be a valuable tool for financial planning, offering a guaranteed income stream.

However, it’s important to understand the different types of annuities available, such as fixed and variable annuities, and the potential risks and benefits associated with each. Annuity Contingent Is 2024 provides insights into the contingent nature of some annuities, while Is Annuity Good Investment 2024 helps you determine if an annuity is a suitable investment for your financial goals.