Annuity Meaning With Example 2024: A Guide to Income Security, annuities have been a cornerstone of financial planning for centuries, offering individuals a way to secure a steady stream of income during retirement or other life stages. This guide delves into the world of annuities, explaining their meaning, different types, how they work, and their potential benefits and risks.

If you’re considering a large financial investment, you might be interested in a single premium annuity. This type of annuity allows you to make a lump sum payment, which then grows over time. It can be a great option for those looking for a guaranteed income stream in retirement.

We’ll explore the intricacies of annuities, examining how they function, the various types available, and the factors that influence their payouts. By understanding the different aspects of annuities, you can make informed decisions about whether they are a suitable financial tool for your specific needs and goals.

If you’re interested in developing your own mobile apps, there are many great courses available online. You can find some of the best Android app development courses from reputable institutions like Udemy or Coursera.

Contents List

Introduction to Annuities

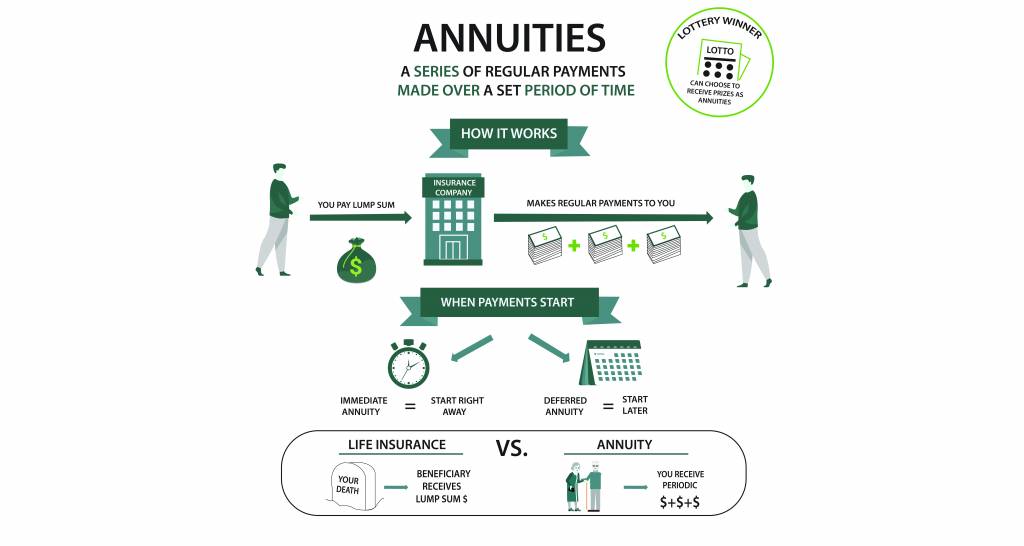

An annuity is a financial product that provides a stream of regular payments for a specified period of time. Think of it like a financial plan that helps you secure a steady income, especially during retirement. Annuities are designed to ensure you have a regular flow of money, no matter what happens in the market.

If you’re a beginner and interested in learning how to develop Android apps, there are many resources available to help you get started. You can find helpful tutorials and guides for Android app development for beginners on platforms like YouTube or Codecademy.

The concept of regular payments is crucial. These payments can be made monthly, quarterly, annually, or even in a lump sum. The duration of the payments can be for a fixed period, like 20 years, or for your entire lifetime.

Annuity payments can provide a regular income stream for many years, but you might be wondering how they actually work. You can find a detailed explanation of how annuities work on many financial websites.

This predictability makes annuities a reliable source of income.

Annuity payments can be a source of income in retirement, but you might be wondering if they are taxable. Generally, annuities for life insurance are taxed as ordinary income.

Annuities have a rich history dating back to ancient Rome. They were initially used to provide financial security for soldiers and their families. Over time, annuities evolved into the complex financial products we know today, offering a variety of options for different needs.

Annuity payments can be a bit complex to calculate, but luckily there are tools like Excel that can help you understand how they work. These tools can help you determine the best annuity options for your individual financial goals.

Types of Annuities, Annuity Meaning With Example 2024

Annuities come in different flavors, each designed for specific financial goals and risk tolerances. Let’s break down some common types:

- Fixed Annuities:These offer a guaranteed rate of return, providing predictable income. Think of it like a steady stream of payments, regardless of market fluctuations. They are perfect for those seeking stability and peace of mind.

- Variable Annuities:These are linked to the performance of underlying investments, such as stocks or bonds. The payouts can fluctuate based on the market’s ups and downs. If you’re comfortable with some risk and want the potential for higher returns, variable annuities might be a good fit.

Artificial intelligence is rapidly changing the world, and it’s also having a significant impact on the way Android apps are developed. AI can be used to automate tasks, improve app performance, and even create entirely new app features. You can learn more about the impact of AI on Android app development online.

- Immediate Annuities:These start paying out right away, providing immediate income. They are ideal for retirees who need a steady income stream right after they stop working.

- Deferred Annuities:These start paying out at a later date, allowing your money to grow tax-deferred. They are a good option for those planning for retirement years down the line.

How Annuities Work

Buying an annuity is like making a deal with an insurance company. You give them a lump sum of money, and in return, they promise to make regular payments to you for a specific period. This process is called “annuitization.”

If you’re looking to sell annuities, you’ll need to generate leads. There are many strategies for generating annuity leads , including online marketing, networking, and referrals.

Insurance companies play a vital role in annuity contracts. They are responsible for managing the funds and guaranteeing the payments. They use their expertise to invest your money and ensure that you receive the promised income.

Annuity payments can be a source of income, but you might be wondering if they are taxable. The answer depends on the specific annuity you have, but in general, annuity payments from LIC are taxable.

The amount of your annuity payouts depends on several factors, including:

- Interest Rates:Higher interest rates generally lead to larger payouts.

- Investment Performance:For variable annuities, the performance of the underlying investments directly affects your payouts.

- Your Age and Life Expectancy:The younger you are, the longer you are expected to live, so your payouts might be smaller.

Benefits of Annuities

Annuities offer several advantages, particularly for retirement planning and income security:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, shielding you from market volatility.

- Financial Stability:Annuities can help you maintain a stable financial foundation, even during market downturns.

- Tax Advantages:In some cases, annuity payouts may be tax-deferred or tax-free.

- Longevity Protection:Some annuities provide lifetime income, ensuring you have a financial safety net for as long as you live.

Risks Associated with Annuities

While annuities offer benefits, they also come with certain risks:

- Market Volatility:Variable annuities are subject to market risk, meaning your payouts could fluctuate.

- Fees and Surrender Charges:Annuities often have fees and surrender charges, which can reduce your returns.

- Limited Liquidity:Once you annuitize your money, it can be difficult to access it before the payout period.

- Insurance Company Risk:The financial stability of the insurance company issuing the annuity can impact your payouts.

Annuity Example: 2024 Scenario

Let’s imagine Sarah, a 65-year-old retiree, is looking for a reliable source of income. She has $500,000 saved and wants to use it to purchase an annuity. She’s considering three options:

| Annuity Type | Estimated Monthly Payout | Potential Benefits | Potential Risks |

|---|---|---|---|

| Fixed Annuity | $2,500 | Guaranteed income, stability | Lower potential returns |

| Variable Annuity | $3,000 (estimated) | Potential for higher returns | Market volatility, risk of losing principal |

| Immediate Annuity | $2,000 | Immediate income stream | Lower potential returns compared to deferred annuities |

Sarah needs to weigh the potential benefits and risks of each option. If she prioritizes stability, a fixed annuity might be the best choice. If she’s willing to take on more risk for the potential of higher returns, a variable annuity could be an option.

Immediate annuities provide a guaranteed income stream right away, but you might be wondering if the payments are taxable. Generally, immediate annuity income is taxable as ordinary income.

An immediate annuity would provide her with immediate income but may offer lower potential returns.

Ultimate Conclusion

Annuities offer a compelling solution for those seeking income security and financial stability, particularly during retirement. By carefully considering the various types of annuities available, their benefits, and associated risks, individuals can make informed decisions that align with their financial objectives.

If you’ve inherited an annuity, you might be wondering if the payments are taxable. The answer depends on a few factors, but generally, inherited annuities are taxed as ordinary income.

Whether you’re seeking a guaranteed stream of income, protecting your assets from market volatility, or simply looking for a way to supplement your retirement savings, annuities provide a valuable tool for achieving your financial goals.

Essential Questionnaire: Annuity Meaning With Example 2024

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments.

Are annuities a good investment for everyone?

Annuities may not be suitable for everyone. It’s crucial to consider your individual financial situation, risk tolerance, and long-term goals before making a decision.

An annuity is essentially a series of payments that are made over time, and there are different types of annuities available. For example, you might consider a fixed annuity which offers guaranteed payments, or a variable annuity which offers the potential for higher returns but also comes with more risk.

How do I choose the right annuity for me?

Consulting with a qualified financial advisor is recommended to determine the most appropriate annuity type based on your specific circumstances.

Annuity payments can provide a guaranteed income stream, which is why they are often considered a form of fixed income. However, there are also variable annuities, which offer the potential for higher returns but also come with more risk.

Learn more about annuity fixed income on financial websites.

If you’re considering an annuity, you might want to use an annuity estimator to help you understand how much income you can expect to receive.

Annuity payments can also be used to finance a home loan. This can be a good option for those who are looking for a fixed monthly payment. Learn more about annuity home loans from a financial advisor.