Annuity Number Of Periods Calculator 2024 is a powerful tool for anyone looking to plan for their financial future. Whether you’re saving for retirement, a down payment on a house, or your child’s education, understanding how long it takes to reach your goals is crucial.

Want to understand the concept of annuities in Hindi? This article provides a clear and concise explanation: Annuity Meaning In Hindi 2024.

This calculator can help you determine the number of periods needed to achieve your desired financial outcome, considering factors like interest rates, annuity payments, and future value goals.

Annuity examples are everywhere! Think about retirement plans, pensions, or even structured settlements. Want to see some real-life examples? Check out this article: Annuity Examples In Real Life 2024.

Annuities are financial instruments that provide a stream of regular payments over a set period of time. They can be a valuable tool for individuals looking to secure their financial future. The number of periods in an annuity is a critical factor in determining the overall value of the annuity.

This calculator simplifies the process of calculating the number of periods required to achieve a specific financial goal.

Annuity is a financial product that provides a stream of regular payments. Confused about the details? This article provides a clear definition: Annuity Is Definition 2024.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It is a common way to generate income during retirement or to save for long-term financial goals. Annuities are typically purchased with a lump sum of money, and the payments can be made for a fixed period or for the rest of your life.

Annuity – good or bad? It’s not a simple yes or no answer. It depends on your individual needs and financial goals. Learn more about the pros and cons of annuities here: Annuity Is Good Or Bad 2024.

Key Features of Annuities

- Guaranteed Payments:Annuities offer guaranteed payments, providing financial security and peace of mind.

- Tax-Deferred Growth:In many cases, the earnings on annuities grow tax-deferred, meaning that you won’t have to pay taxes on them until you start receiving payments.

- Flexibility:Annuities offer various options for customizing payment schedules, investment choices, and death benefits.

Types of Annuities

Annuities can be categorized into different types based on their features and investment strategies.

Excel can be a handy tool for annuity calculations. Learn how to use it to analyze annuity options and make informed decisions: Annuity Is Excel 2024.

- Fixed Annuities:These annuities provide a fixed interest rate, guaranteeing a set amount of income for a specific period.

- Variable Annuities:These annuities allow you to invest in a variety of sub-accounts, such as stocks, bonds, or mutual funds. The payments you receive will fluctuate based on the performance of your investments.

- Indexed Annuities:These annuities offer returns linked to a specific market index, such as the S&P 500. You have the potential for growth, but your returns are capped at a certain level.

Real-World Examples of Annuities

- Retirement Income:Many individuals use annuities to supplement their retirement income. They can provide a steady stream of payments to help cover living expenses.

- Long-Term Care:Annuities can be used to cover the costs of long-term care, such as assisted living or nursing home expenses.

- Estate Planning:Annuities can be included in estate plans to provide income for beneficiaries after your death.

The Role of the Number of Periods: Annuity Number Of Periods Calculator 2024

The number of periods in an annuity refers to the total number of payments you will receive. It is a crucial factor that influences the overall value of your annuity.

Annuities can be a good choice for certain individuals, but not everyone benefits from them. Discover if annuities are a good fit for you: Annuity Is Good 2024.

Number of Periods and Annuity Calculations

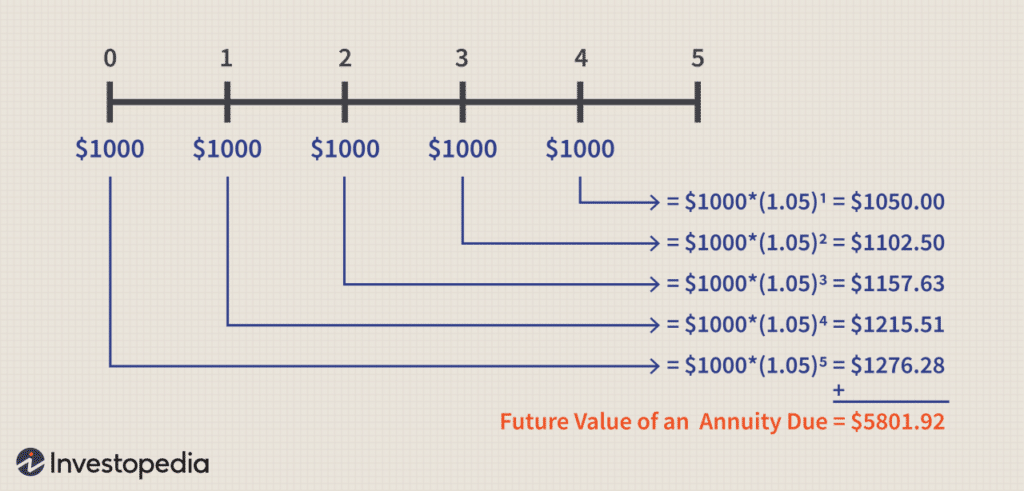

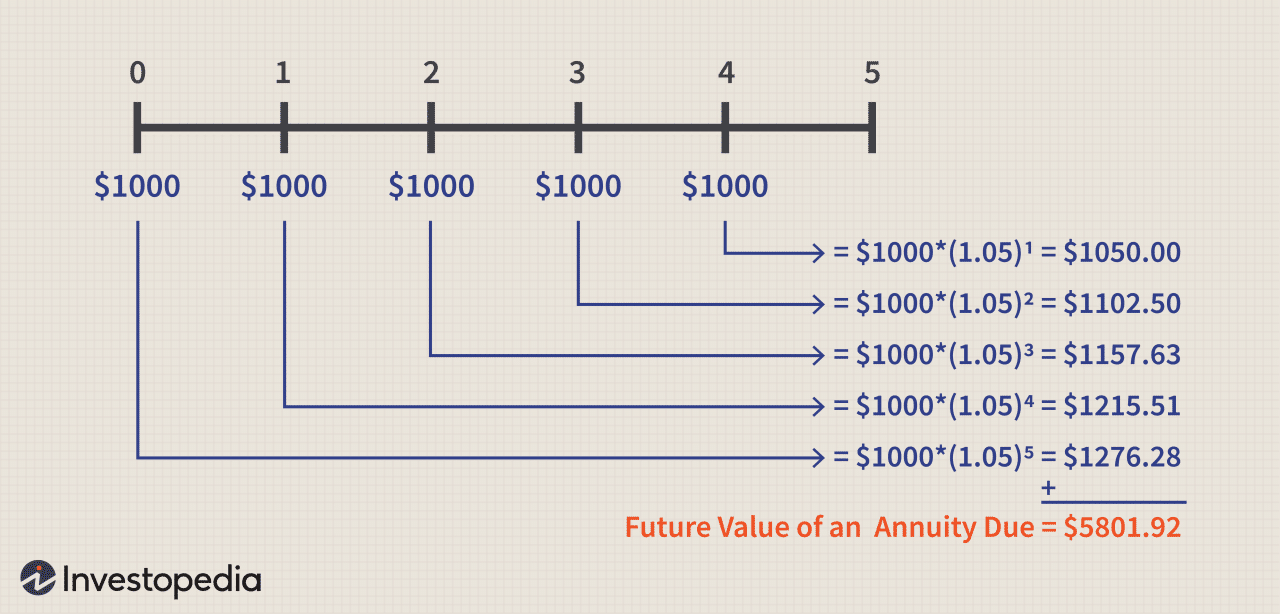

The number of periods directly impacts the present value and future value of an annuity. The more periods you have, the higher the future value of your annuity will be, assuming a constant interest rate.

Relationship Between Number of Periods, Interest Rates, and Annuity Payments

The relationship between the number of periods, interest rates, and annuity payments is complex. Higher interest rates generally lead to a higher future value of an annuity, even with the same number of periods. However, if the interest rate is fixed, a longer period will result in a higher future value.

Joint and survivor annuities are a popular option for couples. They guarantee income for both spouses, even after one passes away. Want to know more about this type of annuity? Read this article: Annuity Joint And Survivor 2024.

The amount of each payment also plays a role. Larger payments will result in a higher future value, regardless of the number of periods or interest rate.

Annuity can be a complex concept. To understand it better, it helps to have an example. This article provides a clear and concise explanation with an example: Annuity Meaning With Example 2024.

Examples of Number of Periods Influence

- Scenario 1:If you invest $10,000 in an annuity with a 5% interest rate for 10 years, you will have a higher future value than if you invest the same amount for 5 years.

- Scenario 2:If you invest $10,000 in an annuity with a 5% interest rate for 10 years and receive $1,000 payments annually, you will have a higher future value than if you receive $500 payments annually.

Using an Annuity Number of Periods Calculator

An annuity number of periods calculator is a valuable tool that helps you determine the number of periods required to reach a specific annuity goal.

Functionality of an Annuity Number of Periods Calculator

The calculator typically requires you to input the following information:

- Present value:The initial amount you invest in the annuity.

- Annuity payment:The amount of each regular payment.

- Interest rate:The annual interest rate earned on your annuity.

- Future value:The desired amount you want to accumulate from the annuity.

Step-by-Step Guide to Using the Calculator

- Enter the present value:Input the amount you plan to invest in the annuity.

- Enter the annuity payment:Input the amount of each regular payment you will receive.

- Enter the interest rate:Input the annual interest rate earned on your annuity.

- Enter the future value:Input the desired amount you want to accumulate from the annuity.

- Calculate:Click on the “Calculate” button to determine the number of periods required.

Tips and Tricks for Effective Use

- Experiment with different values:Try changing the present value, annuity payment, interest rate, or future value to see how it affects the number of periods.

- Consider inflation:Adjust your future value goal to account for inflation.

- Use multiple calculators:Compare results from different annuity calculators to ensure accuracy.

Factors Influencing the Number of Periods

Several factors can influence the number of periods required for an annuity. Understanding these factors is crucial for making informed decisions about your annuity goals.

An annuity certain is a type of annuity that guarantees payments for a specific period. Curious about examples of annuity certain? This article provides some insight: Annuity Certain Is An Example Of 2024.

Key Factors

- Interest Rates:Higher interest rates generally lead to a shorter number of periods required to reach your future value goal. Conversely, lower interest rates will require a longer period.

- Annuity Payments:Larger annuity payments will result in a shorter number of periods. Smaller payments will require a longer period to reach the desired future value.

- Future Value Goals:Higher future value goals will require a longer number of periods, assuming all other factors remain constant. Lower goals will require a shorter period.

Examples of Factor Impact

- Scenario 1:If you want to accumulate $100,000 in an annuity with a 5% interest rate, you will need a shorter period if you receive $5,000 annual payments compared to $1,000 annual payments.

- Scenario 2:If you want to accumulate $100,000 in an annuity with $5,000 annual payments, you will need a shorter period if the interest rate is 7% compared to 3%.

Practical Applications of the Calculator

An annuity number of periods calculator can be a valuable tool for various financial planning scenarios.

Annuity is a versatile financial tool with various applications. Curious to learn more about its uses? This article covers the basics: Annuity Is 2024.

Retirement Planning

You can use the calculator to determine how long your retirement savings will last based on your expected income, expenses, and interest rates.

The term “annuity” can be confusing. What exactly does it mean? This article provides a simple and clear explanation: Annuity Is Meaning 2024.

- Example:If you want to retire with $1 million in savings and receive $50,000 annually, with an average interest rate of 4%, the calculator can tell you how many years your savings will last.

Saving for a Down Payment on a House

You can use the calculator to estimate how long it will take to save enough for a down payment on a house based on your current savings, monthly contributions, and expected interest rates.

The term “annuity jackpot” might sound exciting, but it’s not about winning big. It’s about maximizing your annuity income. Curious about how to achieve this? Find out more in this article: Annuity Jackpot 2024.

- Example:If you want to save $50,000 for a down payment, contribute $500 monthly, and earn a 2% interest rate, the calculator can show you how many months it will take to reach your goal.

Funding a Child’s Education

You can use the calculator to determine how much you need to save monthly to fund your child’s education based on the estimated college costs, expected interest rates, and the number of years until they start college.

Can you still work even if you’re receiving an annuity? Absolutely! It’s a common question, and the answer is yes. Learn more about this in this article: Can You Receive Annuity And Still Work 2024.

- Example:If your child is 5 years old and college costs are estimated at $200,000, with a 5% interest rate, the calculator can help you determine the monthly savings required to meet your goal.

Additional Considerations

While an annuity number of periods calculator can be helpful, it is essential to consult with a financial advisor before making any annuity decisions.

The annuity exclusion ratio is a crucial factor when calculating taxes on annuity payments. Understanding this ratio is important for tax planning. Find out more here: Annuity Exclusion Ratio 2024.

Importance of Consulting a Financial Advisor

A financial advisor can help you understand the complexities of annuities, assess your risk tolerance, and develop a personalized financial plan that meets your specific needs.

Potential Risks and Benefits of Annuities, Annuity Number Of Periods Calculator 2024

- Benefits:Annuities offer guaranteed payments, tax-deferred growth, and flexibility.

- Risks:Annuities can have high fees, limited access to your funds, and potential for lower returns compared to other investments.

Resources for Further Information

- Financial Industry Regulatory Authority (FINRA):FINRA provides information on annuities and other financial products.

- Securities and Exchange Commission (SEC):The SEC offers investor education resources on annuities.

- National Association of Insurance Commissioners (NAIC):The NAIC provides information on state insurance regulations and consumer protection.

Conclusion

Understanding how the number of periods impacts annuity calculations is essential for making informed financial decisions. By using the Annuity Number Of Periods Calculator 2024, you can gain valuable insights into your financial goals and make more informed decisions about your financial future.

One of the key features of annuities is the guarantee of income. But what exactly does that mean? This article explains the details: Is Annuity Income Guaranteed 2024.

Remember, consulting with a financial advisor can provide personalized guidance and help you navigate the complexities of annuities.

FAQ Overview

What is an annuity?

An annuity is a financial product that provides a stream of regular payments over a set period of time. They can be used for a variety of purposes, such as retirement planning, saving for a down payment on a house, or funding a child’s education.

How does the number of periods affect the value of an annuity?

The number of periods directly influences the total value of an annuity. A longer period generally results in a higher overall value, as there are more payments received. However, the specific impact of the number of periods depends on the interest rate and the amount of each payment.

What are some real-world examples of how the Annuity Number Of Periods Calculator 2024 can be used?

The calculator can be used to determine the number of periods required to save for a down payment on a house, to accumulate a specific retirement nest egg, or to fund a child’s education. It can also be used to assess the impact of different interest rates and payment amounts on the overall value of an annuity.