An Annuity Is A Series Of Equal Periodic Payments 2024: A Comprehensive Guide – Annuities are financial products that offer a steady stream of income for a specified period. These payments, often referred to as “annuities,” are typically equal and made at regular intervals, providing a sense of financial security and predictability.

Annuities are often considered a form of fixed income. You can find more information about the relationship between annuities and fixed income here: Is Annuity Fixed Income 2024.

This guide explores the various aspects of annuities, from their fundamental concepts to their practical applications in retirement planning and risk management.

Understanding annuities is crucial for anyone seeking to secure their financial future. Whether you are nearing retirement or simply looking for ways to supplement your income, annuities can be a valuable tool. This guide will delve into the different types of annuities, their key features, and the factors to consider when making an informed decision.

The tax implications of annuities can be complex. This article explains how annuities are taxed: How Annuity Is Taxed 2024.

Contents List

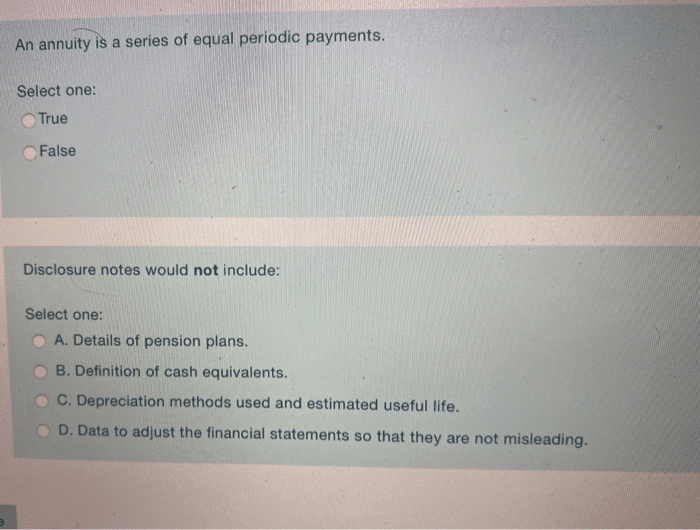

Defining Annuities

An annuity is a financial product that provides a series of equal periodic payments, either for a fixed period or for the lifetime of the recipient. These payments are typically used to provide a steady stream of income, particularly during retirement.

Calculating the number of periods for an annuity is important for financial planning. This calculator can help you determine the duration of your annuity payments: Annuity Number Of Periods Calculator 2024.

The key defining characteristic of an annuity is the consistent and predictable nature of these payments.

It’s important to understand the tax implications of any financial product, including annuities. This article addresses whether the life insurance portion of an annuity is taxable: Is Annuity For Life Insurance Taxable 2024.

Types of Annuities

Annuities come in various forms, each with unique features and benefits. Some common types include:

- Fixed Annuities:These annuities guarantee a fixed rate of return on the principal investment, providing predictable income payments. The interest rate is set at the time of purchase and remains unchanged throughout the annuity’s term.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater risk. The interest rate and income payments fluctuate based on the performance of underlying investments, such as stocks or mutual funds.

- Immediate Annuities:Payments begin immediately after the annuity is purchased. This type is suitable for those seeking immediate income, such as retirees or those needing supplementary income.

- Deferred Annuities:Payments start at a later date, allowing the principal to grow tax-deferred until the payout period begins. This type is often used for long-term savings and retirement planning.

Examples of Annuity Use

Annuities are widely used in various financial scenarios:

- Retirement Planning:Annuities can provide a reliable source of income during retirement, supplementing other retirement savings such as IRAs and 401(k)s.

- Income Generation:Annuities can provide a steady stream of income for individuals seeking financial security, particularly during periods of market volatility.

- Estate Planning:Annuities can be used to create a legacy for heirs, providing a guaranteed income stream after the owner’s death.

Annuity Features and Characteristics

Annuities offer several key features that influence their performance and suitability for different individuals.

In simple terms, an annuity is a financial product that provides a stream of payments. You can find a detailed explanation of annuities here: Annuity Meaning In English 2024.

Payment Schedules, An Annuity Is A Series Of Equal Periodic Payments 2024

Annuity contracts specify the frequency and duration of payments. Common payment schedules include monthly, quarterly, or annually. The duration can be fixed, for a specific number of years, or for the lifetime of the annuitant.

Determining if an annuity is a good investment depends on your individual financial goals and risk tolerance. This article explores whether annuities are a suitable investment: Annuity Is It A Good Investment 2024.

Interest Rates

The interest rate, or the rate of return on the principal investment, is a crucial factor determining the size of annuity payments. Fixed annuities offer a guaranteed interest rate, while variable annuities have a fluctuating interest rate based on market performance.

An annuity drawdown allows you to access your funds gradually. Learn more about annuity drawdown options here: Is Annuity Drawdown 2024.

Guarantees

Some annuities offer guarantees, such as a minimum guaranteed interest rate or a guaranteed death benefit. These guarantees provide a level of protection against market fluctuations and ensure a minimum payout even in unfavorable economic conditions.

Comparing Annuity Contracts

Different annuity contracts offer varying features and benefits, making it essential to compare and contrast options before making a decision. Key factors to consider include:

- Interest Rates and Returns:Compare the guaranteed interest rates of fixed annuities or the potential returns of variable annuities.

- Fees and Expenses:Consider the fees associated with the annuity, such as administrative fees, surrender charges, and mortality and expense charges.

- Guarantees and Protection:Evaluate the level of guarantees offered, such as minimum interest rate guarantees or death benefit guarantees.

- Flexibility and Access to Funds:Assess the flexibility of withdrawing funds from the annuity, considering any surrender charges or penalties.

Factors Influencing Annuity Payouts

Several factors influence the size of annuity payouts:

- Initial Investment Amount:The larger the initial investment, the larger the annuity payments.

- Interest Rates:Higher interest rates result in larger payments, especially for fixed annuities.

- Longevity:Individuals who live longer will receive more payments from a lifetime annuity.

Annuities and Retirement Planning: An Annuity Is A Series Of Equal Periodic Payments 2024

Annuities play a significant role in retirement planning, providing a reliable source of income during retirement years.

Steady Stream of Income

Annuities offer a consistent and predictable stream of income, ensuring financial security and peace of mind during retirement. This steady income stream can help cover essential expenses such as housing, healthcare, and everyday living costs.

Understanding annuities can be easier with examples. You can find examples that illustrate how annuities work here: Annuity Meaning With Example 2024.

Benefits and Drawbacks

Using annuities for retirement planning offers both benefits and drawbacks:

- Benefits:

- Guaranteed Income: Fixed annuities provide a guaranteed stream of income, regardless of market fluctuations.

- Longevity Protection: Lifetime annuities ensure payments for the rest of the annuitant’s life, mitigating longevity risk.

- Tax Advantages: Annuity payments may be tax-deferred or tax-free, depending on the type of annuity.

- Drawbacks:

- Limited Liquidity: Accessing funds from an annuity may be restricted, especially in the early years.

- Fees and Expenses: Annuities often involve fees and expenses, which can reduce the overall return.

- Potential for Lower Returns: Fixed annuities may offer lower returns compared to other investment options.

Comparison with Other Retirement Savings Options

Annuities should be considered alongside other retirement savings options, such as IRAs, 401(k)s, and pensions:

- IRAs and 401(k)s:These accounts offer tax-deferred growth and flexibility in investment choices but do not provide guaranteed income.

- Pensions:Pensions provide a guaranteed income stream during retirement but are becoming less common.

Annuities and Risk Management

Annuities can help manage various financial risks, providing a safety net against unexpected expenses and market volatility.

The term “annuity” translates to “वार्षिकी” in Hindi. This article provides a comprehensive explanation of annuities in Hindi: Annuity Kya Hai 2024.

Risks Associated with Annuities

Annuities are not without risks. Some common risks include:

- Interest Rate Risk:Fixed annuities are susceptible to interest rate risk. If interest rates rise, the value of the annuity may decline.

- Inflation Risk:Inflation can erode the purchasing power of annuity payments, particularly for fixed annuities.

- Longevity Risk:Individuals who live longer than expected may outlive their annuity payments, leaving them with limited income.

Risk Mitigation Strategies

Several strategies can mitigate these risks:

- Choose the Right Type of Annuity:Consider the level of risk tolerance and select an annuity that aligns with individual needs and financial goals.

- Diversify Investments:Invest in a diversified portfolio of assets, including stocks, bonds, and real estate, to reduce overall risk.

- Consider Indexed Annuities:Indexed annuities offer a minimum guaranteed interest rate and potential for growth based on the performance of a specific index, such as the S&P 500.

Annuities as a Safety Net

Annuities can provide a financial safety net against unexpected expenses or financial emergencies. They can offer a reliable source of income to cover unexpected medical bills, home repairs, or other unforeseen costs.

Annuities and Taxes

The tax implications of annuities vary depending on the type of annuity and the withdrawal method.

Taxation of Annuity Payments

Annuity payments are generally taxed as ordinary income. The portion of each payment that represents the return of principal is tax-free, while the portion representing interest or earnings is taxable.

Tax Effects of Withdrawals

Withdrawals from an annuity before the annuitant reaches age 59 1/2 are generally subject to a 10% penalty, in addition to ordinary income tax. However, there are exceptions to this rule, such as for certain medical expenses or disability.

Tax Advantages of Annuities

Annuities offer several tax advantages:

- Tax-Deferred Growth:Earnings within an annuity grow tax-deferred, meaning taxes are not paid until the funds are withdrawn.

- Potential for Tax-Free Withdrawals:Some annuity types, such as qualified longevity annuity contracts (QLACs), allow for tax-free withdrawals during retirement.

Tax Treatment of Different Annuity Types

| Annuity Type | Tax Treatment |

|---|---|

| Fixed Annuity | Payments taxed as ordinary income, portion representing principal is tax-free. |

| Variable Annuity | Payments taxed as ordinary income, portion representing principal is tax-free. |

| Immediate Annuity | Payments taxed as ordinary income, portion representing principal is tax-free. |

| Deferred Annuity | Earnings grow tax-deferred, payments taxed as ordinary income upon withdrawal. |

| QLAC | Withdrawals during retirement may be tax-free, subject to certain requirements. |

Choosing the Right Annuity

Selecting the appropriate annuity requires careful consideration of individual circumstances, financial goals, and risk tolerance.

Annuity examples can help you visualize how they work in real-world scenarios. You can find helpful examples here: Annuity Examples 2024. Understanding these examples can clarify the benefits and potential drawbacks of annuities.

Decision Tree for Annuity Selection

A decision tree can guide individuals through the process of choosing an annuity:

- Determine Retirement Income Needs:Estimate the amount of income needed during retirement to cover essential expenses.

- Assess Risk Tolerance:Consider the level of risk the individual is willing to take. Those with a low risk tolerance may prefer fixed annuities, while those with a higher risk tolerance may consider variable annuities.

- Evaluate Investment Goals:Determine whether the primary goal is income generation, capital preservation, or a combination of both.

- Consider Tax Implications:Evaluate the tax implications of different annuity types and how they affect overall retirement income.

- Compare Annuity Providers:Research and compare different annuity providers, considering fees, guarantees, and customer service.

Checklist for Annuity Providers

Ask potential annuity providers these questions to ensure a thorough understanding of the contract terms:

- What are the interest rates or potential returns?

- What are the fees and expenses associated with the annuity?

- What guarantees are offered, such as minimum interest rate guarantees or death benefit guarantees?

- What are the withdrawal options and any associated penalties?

- What is the surrender charge schedule?

- What are the customer service policies and complaint resolution procedures?

Factors to Consider

When choosing an annuity, consider these factors:

- Investment Goals:Align the annuity with specific investment goals, such as income generation, capital preservation, or growth.

- Risk Tolerance:Select an annuity that aligns with the individual’s risk tolerance and comfort level.

- Financial Situation:Consider the individual’s current financial situation, including income, assets, and debts.

- Time Horizon:Determine the time horizon for the annuity, considering the expected duration of the payments.

- Tax Implications:Understand the tax implications of different annuity types and how they affect overall retirement income.

Last Point

Annuities offer a compelling blend of financial security and income generation. By understanding the different types, features, and considerations associated with annuities, individuals can make informed decisions that align with their financial goals. Whether you are planning for retirement, seeking to protect your assets, or simply looking for a reliable source of income, annuities provide a valuable financial tool.

This guide has aimed to equip you with the knowledge and insights to navigate the world of annuities confidently and effectively.

An annuity is essentially a stream of payments that you receive over a set period. Learn more about the nature of annuities in this article: An Annuity Is A Stream Of 2024.

FAQ Guide

What are the main benefits of an annuity?

Annuities offer several benefits, including guaranteed income, tax-deferred growth, and potential tax-free withdrawals. They can also provide protection against longevity risk and inflation, ensuring a consistent stream of income throughout retirement.

Life Insurance Corporation (LIC) offers various annuity plans, but it’s essential to research them thoroughly before making a decision. Check out this resource for more information on LIC’s annuity offerings: Is Annuity Lic 2024.

How do I choose the right annuity for my needs?

Tax implications are a significant factor to consider when choosing an annuity. You can find information on whether the death benefit of an annuity is taxable in this article: Is Annuity Death Benefit Taxable 2024.

Selecting the right annuity depends on your individual circumstances, financial goals, and risk tolerance. Consider factors such as your age, retirement timeline, investment objectives, and tax situation. Consulting with a financial advisor can help you make an informed decision.

The “Gator” annuity is a popular choice for many, and you can learn more about it here: Annuity Gator 2024. It’s crucial to compare different annuity options to find the best fit for your needs.

Are annuities a good investment for everyone?

Annuities are not a one-size-fits-all solution. They can be beneficial for individuals seeking guaranteed income, tax advantages, and protection against longevity risk. However, they may not be suitable for everyone, particularly those with a high risk tolerance or short-term investment goals.

If you’re looking for information on how the National Pension System (NPS) works with annuities, you can find it here: Annuity Nps 2024. It’s important to understand the different types of annuities available and how they might fit into your financial plan.