How the Payout Amount Is Calculated is a fundamental aspect of many financial transactions, impacting individuals, businesses, and even entire industries. Understanding the intricate workings of payout calculations is crucial for making informed decisions, maximizing earnings, and ensuring fair compensation.

This guide delves into the core principles, components, and methods involved in determining payout amounts, providing a clear and comprehensive overview for anyone seeking to navigate this essential topic.

From the basic principles that govern payout calculations to the various methods employed in different scenarios, this guide explores the key factors influencing payout amounts. It examines the role of earnings, fees, deductions, revenue, costs, and profit margins, shedding light on how these elements contribute to the final payout figure.

Additionally, it provides examples of different payout methods, including percentage-based, flat-rate, and tiered approaches, and explores the application of common payout formulas in real-world situations.

Contents List

Understanding the Basis of Payout Calculations

Payout calculations are the core of many financial systems, determining how much money individuals or organizations receive for their contributions or efforts. Understanding the basis of these calculations is crucial for making informed decisions and ensuring fairness in financial transactions.

Factors Influencing Payout Calculations

Payout calculations are influenced by a variety of factors, which vary depending on the specific context. However, some common factors include:

- Earnings:This is the primary factor driving payout calculations. Earnings can be generated through various means, such as sales, commissions, investments, or royalties. The higher the earnings, the larger the payout is likely to be.

- Fees:Fees are charges associated with the process of earning or distributing payouts. These fees can be deducted from the earnings before the final payout is calculated. Fees can include platform fees, transaction fees, or withdrawal fees.

- Deductions:Deductions are amounts subtracted from earnings before the final payout is calculated. These deductions can include taxes, insurance premiums, or contributions to retirement plans. The amount of deductions can vary depending on the individual’s or organization’s circumstances.

Different Payout Methods and Formulas

There are various payout methods employed across different industries and platforms. Each method utilizes a specific formula to calculate the final payout amount. Here are some examples:

- Fixed Payout:This method involves a predetermined payout amount, regardless of earnings. For instance, a fixed salary is an example of a fixed payout.

Payout = Fixed Amount

- Percentage-Based Payout:This method calculates the payout as a percentage of earnings. For example, a commission-based payout, where a salesperson earns a percentage of their sales, is a common example.

Payout = Earnings- Percentage

- Tiered Payout:This method involves different payout rates based on the level of earnings achieved. For instance, a tiered commission structure might offer a higher percentage for exceeding a certain sales target.

Payout = Earnings- Percentage (based on tier)

- Revenue Share:This method distributes a portion of the total revenue generated by a business or project to contributors. For example, a website owner might share a percentage of ad revenue with content creators.

Payout = (Revenue- Share Percentage) – Fees

Key Components of Payout Calculations: How The Payout Amount Is Calculated

Payout calculations are crucial for understanding how much you can expect to receive from a particular investment or business venture. They involve several key components that interact to determine the final payout amount. These components are essential for making informed decisions and ensuring that you receive a fair return on your investment.

Revenue, Costs, and Profit Margins

Revenue, costs, and profit margins play a pivotal role in determining payouts. They provide a framework for analyzing the financial performance of a business and understanding how much money is available for distribution to stakeholders. Revenue represents the total income generated by a business from its operations.

Discover how Capital One Settlement Payout Updates has transformed methods in this topic.

Costs encompass all expenses incurred in generating that revenue, including expenses related to materials, labor, marketing, and administration. The difference between revenue and costs represents the profit margin, which indicates the profitability of the business.

The higher the profit margin, the more money is available for payouts.

A higher profit margin allows for larger payouts to investors, while a lower profit margin may result in smaller payouts or even losses.

Key Components and Their Impact, How the Payout Amount Is Calculated

The following table Artikels the key components of payout calculations and their impact on the final payout amount:

| Component | Impact on Payout |

|---|---|

| Revenue | Higher revenue generally leads to higher payouts. |

| Costs | Lower costs result in higher payouts. |

| Profit Margin | A higher profit margin indicates more money available for payouts. |

| Investment Amount | A larger investment amount typically results in larger payouts. |

| Investment Period | Longer investment periods often lead to higher payouts, as there is more time for investments to grow. |

| Return on Investment (ROI) | Higher ROI indicates a better return on investment and potentially larger payouts. |

Methods and Formulas for Payout Calculations

Calculating payouts involves determining the amount to be paid out based on specific criteria. Various methods and formulas are used depending on the context, such as commissions, bonuses, or revenue sharing.

Percentage-Based Payouts

Percentage-based payouts are commonly used in commission structures where a certain percentage of sales or revenue is paid out to the individual or team responsible. This method offers a direct correlation between performance and earnings, motivating individuals to strive for higher sales.

The formula for percentage-based payouts is:Payout = (Percentage/100)

Revenue

For example, if a salesperson earns a 10% commission on sales, and their total sales for the month are $10,000, their payout would be calculated as:Payout = (10/100)

$10,000 = $1,000

Flat-Rate Payouts

Flat-rate payouts involve a fixed amount paid out regardless of performance. This method is often used for tasks or projects with a defined scope and duration, ensuring a consistent income stream.

The formula for flat-rate payouts is:Payout = Fixed Amount

For instance, if a freelancer charges a flat rate of $500 for a website design project, their payout will be $500 regardless of the time spent or complexity of the project.

Tiered Payouts

Tiered payouts involve different payout rates based on performance levels. This method incentivizes individuals to achieve higher levels of performance by offering progressively higher payouts.

The formula for tiered payouts is:Payout = (Tier Rate/100)

Revenue

For example, a sales team might have a tiered commission structure where they earn a 5% commission on sales up to $50,000, a 10% commission on sales between $50,001 and $100,000, and a 15% commission on sales exceeding $100,000.

Payout Methods and Formulas

| Method | Formula | Example |

|---|---|---|

| Percentage-Based | Payout = (Percentage/100)

|

Salesperson earns 10% commission on $10,000 sales: Payout = (10/100)

|

| Flat-Rate | Payout = Fixed Amount | Freelancer charges $500 for a website design project: Payout = $500 |

| Tiered | Payout = (Tier Rate/100)

|

Sales team earns 5% commission on sales up to $50,000, 10% on sales between $50,001 and $100,000, and 15% on sales exceeding $100,000. |

Factors Affecting Payout Amounts

Payout amounts are not static figures but are influenced by a multitude of factors, both internal and external to the organization. Understanding these factors is crucial for stakeholders to accurately predict and manage their expected returns.

External Factors Influencing Payout Calculations

External factors play a significant role in determining payout amounts. These factors are often beyond the control of the organization but can significantly impact its financial performance and, consequently, the payout calculations.

- Market Conditions:Fluctuations in the market, such as economic growth, interest rates, and inflation, directly influence the profitability of businesses. During periods of economic expansion, businesses tend to perform better, leading to higher profits and potentially larger payouts. Conversely, during recessions or periods of high inflation, businesses may face challenges, resulting in lower payouts.

For instance, in the technology sector, during periods of economic downturn, investors may demand higher returns, leading to lower payouts for venture capital firms.

- Industry Trends:Payout amounts can be affected by trends specific to the industry in which the organization operates. For example, the rise of e-commerce has led to increased competition in the retail sector, putting pressure on businesses to maintain profitability and potentially affecting payout amounts.

- Regulatory Changes:Changes in regulations, such as tax laws or accounting standards, can significantly impact payout calculations. For example, a change in tax laws might increase the tax burden on a company’s profits, leading to a decrease in the available amount for payouts.

Internal Factors Influencing Payout Calculations

Internal factors are those that are directly controlled by the organization and can be adjusted to optimize payout amounts.

- Company Performance:The financial performance of the company is a key determinant of payout amounts. Companies with strong earnings and profitability are more likely to offer higher payouts. For instance, a company that consistently exceeds its revenue targets and maintains high profit margins is likely to have a more generous payout policy.

- Individual Contributions:In certain cases, payout amounts can be influenced by the individual contributions of employees or stakeholders. For example, performance-based bonuses or profit-sharing arrangements can lead to variations in payout amounts based on individual performance.

- Contractual Agreements:Payout amounts can be predetermined by contractual agreements between the organization and its stakeholders. For example, a venture capital firm might have a specific agreement with a startup company that Artikels the terms of payouts based on certain milestones or performance metrics.

Comparing Internal and External Factors

| Factor | Internal | External |

|---|---|---|

| Control | Direct control by the organization | Factors beyond the organization’s control |

| Impact | Can be adjusted to optimize payout amounts | Can significantly influence payout amounts but are not directly controllable |

| Examples | Company performance, individual contributions, contractual agreements | Market conditions, industry trends, regulatory changes |

Transparency and Communication of Payout Calculations

Transparency and clear communication are crucial in payout calculations. When stakeholders understand how payout amounts are determined, it fosters trust, reduces confusion, and encourages fair play.

Importance of Transparency

Clear and transparent communication regarding payout calculations is vital for building trust and ensuring fairness. When stakeholders understand the factors that influence their payouts, they are more likely to feel confident in the system. Transparency also helps prevent disputes and misunderstandings, as everyone involved is aware of the process and the basis for the calculations.

Best Practices for Communication

Providing detailed and understandable information about payout procedures is essential for effective communication.

- Clearly Define Payout Criteria:Artikel the specific criteria used to calculate payouts, including eligibility requirements, performance metrics, and any relevant thresholds.

- Use Plain Language:Avoid technical jargon and complex terminology. Instead, use clear and concise language that is easy for everyone to understand.

- Provide Detailed Explanations:Offer comprehensive explanations of the payout calculations, including step-by-step guides or examples.

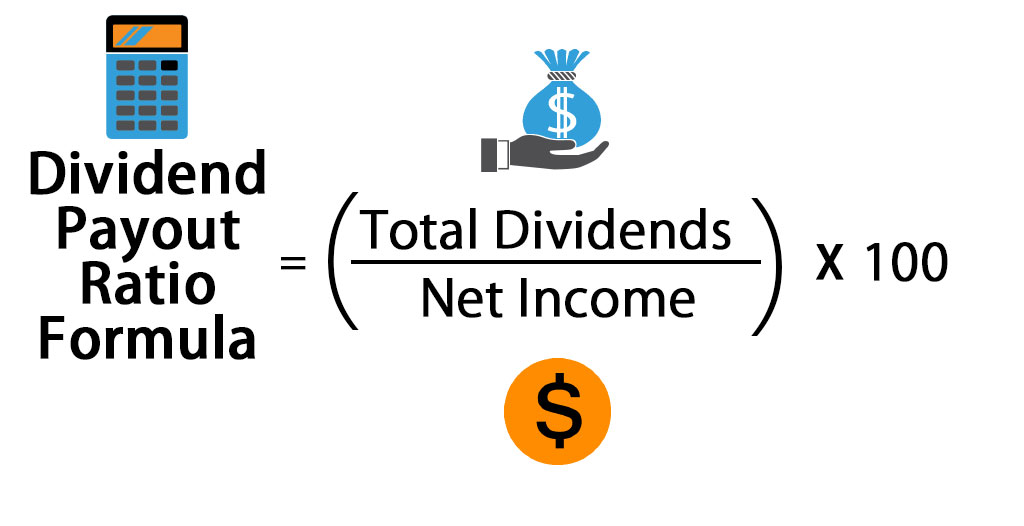

- Use Visual Aids:Employ charts, graphs, or tables to illustrate payout calculations and make the information more accessible.

- Offer Accessible Resources:Provide readily available resources, such as FAQs, tutorials, or contact information, to address any questions or concerns.

- Regularly Review and Update Communication:Ensure that payout information is kept up-to-date and reflects any changes in the calculation process.

Sample Communication Template

A well-structured communication template can help effectively explain payout calculations to stakeholders. Consider including the following elements:

Payout Calculation ExplanationIntroduction:Briefly introduce the purpose of the payout calculation and its importance to stakeholders. Payout Criteria:Clearly define the criteria used to determine payout amounts, including eligibility requirements, performance metrics, and any relevant thresholds. Calculation Methodology:Provide a step-by-step explanation of the payout calculation process, using plain language and visual aids where appropriate.

Examples:Offer realistic examples to illustrate how the payout calculations work in practice. FAQs:Address common questions or concerns that stakeholders might have regarding payout calculations. Contact Information:Provide contact information for any further questions or clarifications. Conclusion:Reiterate the importance of transparency and encourage stakeholders to reach out with any questions or feedback.

Last Point

By understanding the intricacies of payout calculations, individuals and organizations can gain valuable insights into their financial dealings. This knowledge empowers them to make informed decisions, optimize their earnings, and ensure fair compensation for their efforts. Whether you are an individual seeking to understand your earnings or a business owner aiming to optimize payout strategies, this guide provides a comprehensive framework for navigating the complex world of payout calculations.

FAQ Section

How often are payouts typically made?

Payout frequency can vary depending on the specific agreement or industry. Common payout schedules include weekly, bi-weekly, monthly, or quarterly.

What are some common deductions from payouts?

Deductions from payouts can include taxes, insurance premiums, retirement contributions, and other applicable fees.

Are there any legal regulations governing payout calculations?

Yes, specific laws and regulations may govern payout calculations in certain industries, such as labor laws related to minimum wage and overtime pay.