What Rights Do Capital One Customers Have After the Breach? sets the stage for this compelling discussion, exploring the rights and resources available to individuals affected by the massive data breach that impacted millions. The breach, which occurred in 2019, exposed sensitive personal information, including Social Security numbers, credit card details, and addresses.

Discover how The Settlement’s Impact on Capital One Customers has transformed methods in this topic.

This incident raised significant concerns about data security and the legal protections afforded to consumers in the wake of such events.

Do not overlook the opportunity to discover more about the subject of Is Capital One Settlement Payout Happening in 2024?.

Understanding the legal landscape surrounding data breaches is crucial for individuals to protect themselves and navigate the complexities of recovering from such an incident. This article delves into the key federal and state regulations that govern data security and consumer rights, highlighting the specific actions customers can take to mitigate potential harm and safeguard their financial well-being.

Contents List

Understanding the Capital One Data Breach

In July 2019, Capital One, a major financial institution, experienced a significant data breach that affected millions of its customers. The breach, which was discovered and disclosed by Capital One, involved the theft of sensitive personal information from its systems.

This incident raised concerns about data security and the potential impact on affected individuals.

Understand how the union of Latest Updates on the Capital One Settlement Payout can improve efficiency and productivity.

The Nature and Scope of the Breach

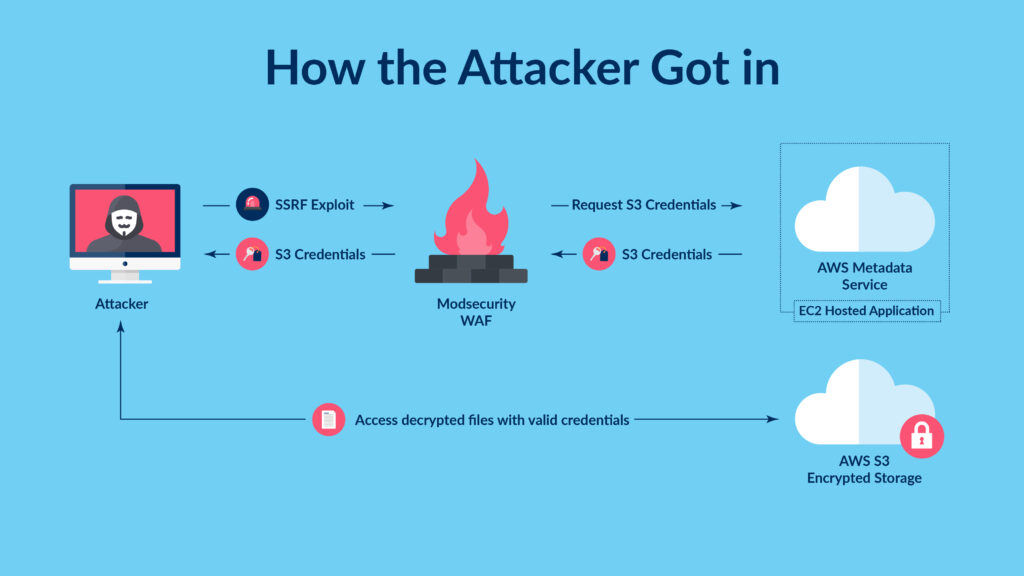

The Capital One data breach involved the unauthorized access and theft of data from the company’s systems. The breach was carried out by a hacker who exploited a vulnerability in a web application firewall, a security tool designed to protect web applications from attacks.

You also will receive the benefits of visiting What to Expect from the Capital One Settlement in 2024 today.

The hacker gained access to a server that contained sensitive customer information, including names, addresses, Social Security numbers, credit card numbers, and dates of birth.

Do not overlook the opportunity to discover more about the subject of How to Stay Informed on Capital One Payout Updates.

Information Compromised

The stolen data included a range of sensitive information that could be used for identity theft and fraud. This included:

- Social Security numbers

- Credit card numbers

- Names

- Addresses

- Dates of birth

- Phone numbers

- Email addresses

- Credit card expiration dates

- Credit card security codes

- Credit card balances

- Credit card transaction history

Timeline of the Breach and Capital One’s Response

The Capital One data breach occurred over a period of several months in 2019. The hacker gained access to the company’s systems in March 2019 and continued to steal data until July 2019. Capital One discovered the breach on July 17, 2019, and immediately took steps to secure its systems and investigate the incident.

The company notified affected customers on July 29, 2019, and offered free credit monitoring and identity theft protection services to those whose information was compromised.

Federal and State Regulations

The Capital One data breach highlighted the importance of data security and the need for strong legal protections for consumer data. Several federal and state laws are designed to protect consumer data and address data breaches.

For descriptions on additional topics like Why the Capital One Payout Has Been Delayed, please visit the available Why the Capital One Payout Has Been Delayed.

Relevant Federal Laws

Several federal laws protect consumer data and address data breaches, including:

- The Fair Credit Reporting Act (FCRA): This law regulates the collection, use, and disclosure of consumer credit information. It also provides consumers with certain rights regarding access to their credit reports and the correction of errors.

- The Gramm-Leach-Bliley Act (GLBA): This law requires financial institutions to protect the confidentiality and security of customer information, including non-public personal information. It also provides consumers with certain rights regarding the disclosure of their personal information.

Applicable State Laws

In addition to federal laws, many states have their own laws regarding data breaches and consumer rights. These state laws often provide additional protections for consumers, such as requiring businesses to notify affected individuals about data breaches, providing free credit monitoring services, and covering the costs of identity theft protection.

Comparing and Contrasting Requirements and Protections

The requirements and protections offered by federal and state laws vary. For example, some states require businesses to notify affected individuals about data breaches within a specific timeframe, while other states do not have such requirements. Similarly, some states offer more robust protections for consumers, such as covering the costs of identity theft protection, while other states provide more limited protections.

Enhance your insight with the methods and methods of When Will Capital One Finish Paying Settlements?.

Consumer Rights After a Data Breach

Capital One customers whose information was compromised in the data breach have certain rights under federal and state laws. These rights are designed to help consumers mitigate the risks of identity theft and fraud.

Enhance your insight with the methods and methods of When Will Capital One Start Payouts?.

Specific Rights for Capital One Customers

Capital One customers whose information was compromised in the data breach have the right to:

- Free credit monitoring and identity theft protection services: Capital One offered these services to all affected customers for a period of one year.

- Access to their credit reports: Consumers can access their credit reports for free from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

- Dispute inaccurate information in their credit reports: Consumers can dispute any inaccurate information in their credit reports with the credit bureaus.

- Place fraud alerts on their credit reports: Fraud alerts can help prevent identity thieves from opening new accounts in a consumer’s name.

- Freeze their credit reports: Freezing a credit report prevents anyone from accessing it, including potential lenders and creditors.

Steps to Mitigate the Risk of Identity Theft

To mitigate the risk of identity theft, customers should take the following steps:

- Report the breach to the credit bureaus: This will allow the credit bureaus to monitor the consumer’s credit reports for any suspicious activity.

- Report the breach to law enforcement: Filing a police report can be helpful in the event that the consumer becomes a victim of identity theft.

- Review credit reports regularly: Consumers should review their credit reports at least once a year to look for any suspicious activity.

- Change passwords for online accounts: Customers should change their passwords for any online accounts that may have been compromised.

- Be cautious about phishing scams: Phishing scams are attempts to trick people into revealing their personal information. Consumers should be wary of emails or phone calls that ask for personal information.

How to Freeze Credit Reports and Place Fraud Alerts, What Rights Do Capital One Customers Have After the Breach?

To freeze or place a fraud alert on your credit report, you can contact the three major credit bureaus:

- Equifax: https://www.equifax.com/

- Experian: https://www.experian.com/

- TransUnion: https://www.transunion.com/

Capital One’s Responsibilities and Actions

Capital One has taken several steps to address the data breach and protect its customers. These steps include notifying affected customers, providing credit monitoring services, and investigating the incident.

Further details about What to Do If Your Capital One Payout Is Delayed is accessible to provide you additional insights.

Steps Taken to Address the Breach

Capital One’s response to the data breach included the following steps:

- Notifying affected customers: The company notified all affected customers by mail and email.

- Providing credit monitoring services: Capital One offered free credit monitoring and identity theft protection services to all affected customers for a period of one year.

- Investigating the incident: Capital One conducted a thorough investigation into the data breach to determine the cause of the breach and the extent of the data stolen.

- Taking steps to improve security: The company implemented new security measures to prevent future breaches.

Compensation or Financial Assistance Offered

While Capital One offered credit monitoring and identity theft protection services, it did not offer any financial compensation to affected customers.

Obtain a comprehensive document about the application of How to Get the Latest News on Capital One Settlement that is effective.

Analysis of Capital One’s Response

Capital One’s response to the data breach was generally considered to be prompt and comprehensive. The company took steps to notify affected customers, provide credit monitoring services, and investigate the incident. However, the breach raised concerns about data security and the potential impact on customer trust and confidence.

Protecting Yourself from Future Breaches: What Rights Do Capital One Customers Have After The Breach?

Data breaches are a growing concern, and it is important for individuals to take steps to protect their personal information. This includes being aware of potential risks and taking proactive measures to enhance data security.

Best Practices for Protecting Personal Information

Here are some best practices for protecting your personal information:

- Be cautious about sharing personal information online: Avoid sharing sensitive information, such as Social Security numbers, credit card numbers, or dates of birth, on websites or social media platforms.

- Use strong passwords and multi-factor authentication: Create strong passwords that are unique for each account and enable multi-factor authentication whenever possible.

- Be wary of phishing scams: Phishing scams are attempts to trick people into revealing their personal information. Be cautious of emails or phone calls that ask for personal information.

- Monitor your credit reports regularly: Check your credit reports at least once a year to look for any suspicious activity.

- Consider using a credit monitoring service and identity theft protection plan: These services can help you detect and prevent identity theft.

Importance of Strong Passwords and Multi-Factor Authentication

Strong passwords and multi-factor authentication are essential for protecting your online accounts. Strong passwords should be at least 12 characters long and include a mix of uppercase and lowercase letters, numbers, and symbols. Multi-factor authentication adds an extra layer of security by requiring you to provide two or more forms of identification, such as a password and a code sent to your phone.

Benefits of Using a Credit Monitoring Service and Identity Theft Protection Plan

Credit monitoring services and identity theft protection plans can help you detect and prevent identity theft. These services monitor your credit reports for suspicious activity and alert you to potential problems. Identity theft protection plans can also provide assistance with recovering from identity theft, such as helping you file police reports and dispute fraudulent charges.

Final Summary

The Capital One data breach serves as a stark reminder of the importance of data security and the need for robust legal frameworks to protect consumers. While the breach exposed vulnerabilities in the financial sector, it also highlighted the resilience of individuals and the power of collective action.

Obtain recommendations related to Is There Still Time to Claim Capital One Settlement? that can assist you today.

By understanding their rights, taking proactive steps to mitigate risks, and staying informed about evolving data privacy regulations, consumers can empower themselves to navigate the complex landscape of data security and protect their personal information.

Key Questions Answered

What is the best way to monitor my credit after the Capital One breach?

Capital One offers free credit monitoring services to affected customers. You can also consider using a third-party credit monitoring service to provide additional layers of protection.

Should I file a police report if my information was compromised in the breach?

While not always necessary, filing a police report can be beneficial for documenting the incident and potentially assisting with fraud prevention.

What steps can I take to prevent future data breaches?

Use strong passwords, enable multi-factor authentication, be cautious about phishing scams, and regularly review your credit reports for suspicious activity.