Annuity Is Present Value 2024 is a crucial concept for anyone looking to plan for their financial future. Annuities, essentially a series of regular payments, are a powerful tool for retirement planning, investment, and debt management. Understanding the present value of an annuity helps you make informed decisions about your financial well-being, especially in today’s dynamic market.

The term “annuity drawdown” refers to the process of withdrawing funds from an annuity. Is Annuity Drawdown 2024 provides details on this process and its potential implications.

This article explores the fundamentals of annuities, delving into the key components that influence their present value. We’ll examine how factors like interest rates, payment frequency, and term affect the value of an annuity today. Additionally, we’ll discuss the applications of annuity present value in various financial scenarios, highlighting its importance in making informed decisions.

Looking for job opportunities in the annuity industry? Annuity Jobs 2024 can help you find relevant job openings and explore career paths in this field.

Contents List

Annuity Fundamentals

An annuity is a series of regular payments made over a set period of time. It’s a financial product designed to provide a steady stream of income, often used for retirement planning, but also for other financial goals. Think of it as a financial contract where you pay a lump sum upfront, and in return, you receive regular payments for a specific duration.

If you’re looking for information about annuities in Hong Kong, Annuity Hk 2024 is a good starting point. It covers the different types of annuities available in Hong Kong and their key features.

Key Components of an Annuity

To understand an annuity, you need to grasp its key components:

- Payment Amount:This is the fixed amount of money you receive at regular intervals. The payment amount can be adjusted based on your needs and the terms of the annuity.

- Interest Rate:The interest rate determines the growth of your investment and the overall return you earn. Higher interest rates lead to larger payments over time.

- Term:The term of the annuity defines the duration for which you receive payments. It can range from a few years to a lifetime.

Real-World Examples of Annuities

Annuities are versatile financial tools used in various scenarios:

- Retirement Planning:Annuities provide a consistent income stream during retirement, helping you maintain a comfortable lifestyle.

- Income Replacement:If you’re facing a temporary loss of income due to illness or disability, an annuity can provide financial support.

- Estate Planning:Annuities can be used to create a legacy by providing regular payments to beneficiaries after your passing.

Present Value of an Annuity: Annuity Is Present Value 2024

The present value of an annuity is the current worth of a series of future payments. It’s a crucial concept in financial planning as it helps you understand the value of an annuity today, taking into account the time value of money.

Curious about the definition of an annuity? Annuity Is Defined As Mcq 2024 offers a concise explanation and provides multiple-choice questions to test your understanding.

Time Value of Money and Annuity Present Value

The time value of money states that a dollar today is worth more than a dollar in the future. This is due to the potential for that dollar to earn interest over time. When calculating the present value of an annuity, we discount future payments to reflect their reduced worth in today’s terms.

Are annuities considered fixed income investments? Is Annuity Fixed Income 2024 clarifies this question, explaining the relationship between annuities and fixed income investments.

Factors Affecting Annuity Present Value

Several factors influence the present value of an annuity:

- Interest Rate:A higher interest rate leads to a lower present value, as future payments are discounted more heavily.

- Payment Frequency:More frequent payments generally result in a higher present value, as you receive money sooner.

- Term:A longer term typically leads to a higher present value, as you receive payments for a longer duration.

Calculating Present Value of an Annuity

Formula for Ordinary Annuity Present Value

PV = PMT- [1 – (1 + r)^-n] / r

Want to know what an annuity is? Annuity Is What 2024 provides a straightforward explanation of annuities, covering their purpose and how they work.

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Calculation Guide

- Identify the known variables:Determine the payment amount (PMT), interest rate (r), and number of periods (n).

- Plug the values into the formula:Substitute the known values into the present value formula.

- Calculate the present value:Solve the equation to determine the present value of the annuity.

Impact of Different Factors on Present Value, Annuity Is Present Value 2024

| Interest Rate | Payment Amount | Term (Years) | Present Value |

|---|---|---|---|

| 2% | $1,000 | 10 | $8,513.56 |

| 4% | $1,000 | 10 | $7,793.19 |

| 2% | $1,500 | 10 | $12,770.34 |

| 2% | $1,000 | 20 | $15,372.45 |

As you can see from the table, a higher interest rate, a larger payment amount, and a longer term all result in a higher present value.

Are annuities the same as IRAs? Is Annuity The Same As Ira 2024 explores the similarities and differences between these retirement savings options.

Applications of Annuity Present Value

Financial Decision-Making

The present value of an annuity plays a vital role in various financial decisions:

- Retirement Planning:Calculating the present value of future retirement income helps you determine how much you need to save today to achieve your desired retirement lifestyle.

- Loan Amortization:Understanding the present value of loan payments allows you to compare different loan options and choose the one that’s most cost-effective.

- Investment Analysis:Present value calculations help you evaluate the profitability of different investment opportunities by comparing their present values.

Comparing Investment Options

Investors can use the present value of an annuity to compare different investment options. For example, let’s say you have two investment choices:

- Investment A:A lump sum investment that pays a 5% annual return for 10 years.

- Investment B:An annuity that pays $1,000 per year for 10 years at a 4% interest rate.

By calculating the present value of both investments, you can determine which one offers a better return on your investment. The investment with the higher present value is generally the more attractive option.

Is an annuity considered income? Is Annuity Income 2024 explores this question, providing insights into how annuities are classified for tax purposes.

Determining Fair Market Value

The present value of an annuity is also used to determine the fair market value of an annuity contract. This is important for investors who want to buy or sell an annuity contract.

Are interest payments from an annuity taxable? Is Annuity Interest Taxable 2024 delves into the taxability of annuity interest, helping you understand your potential tax liabilities.

Annuity Present Value in 2024

Market Conditions and Impact on Present Value

In 2024, the present value of annuities is influenced by several factors, including interest rate levels and economic conditions. Interest rates are expected to remain volatile, potentially impacting the present value of annuities. For example, if interest rates rise, the present value of an annuity will decrease, as future payments are discounted more heavily.

Wondering if an annuity is guaranteed in 2024? Is Annuity Guaranteed 2024 explores this question, diving into the details of how annuities work and the potential guarantees they offer.

Factors Influencing Interest Rates

Several factors can influence interest rates, including:

- Inflation:Higher inflation rates generally lead to higher interest rates, as lenders demand a higher return to compensate for the erosion of purchasing power.

- Economic Growth:Strong economic growth often leads to higher interest rates, as businesses and consumers demand more credit.

- Monetary Policy:Central banks can influence interest rates through their monetary policy decisions, such as adjusting the federal funds rate.

Future Outlook for Annuities

Annuities are likely to remain relevant in financial planning, particularly for individuals seeking guaranteed income streams. However, the specific impact of interest rate fluctuations and market conditions on the present value of annuities will need to be carefully considered. Consulting with a financial advisor can provide valuable insights and help you make informed decisions about annuity investments.

If you’re receiving annuity payments, you’re considered an annuitant. K Is An Annuitant Currently Receiving Payments 2024 explains this term and its implications for those receiving annuity payments.

Final Conclusion

In conclusion, understanding the present value of an annuity is essential for making sound financial decisions. By analyzing the current market conditions and the factors that influence interest rates, you can gain valuable insights into the future of annuities and their role in your financial planning.

Is income from an annuity taxable? Annuity Is Taxable 2024 discusses the tax implications of annuities, including how income from them is taxed.

Whether you’re planning for retirement, managing debt, or investing your savings, a solid grasp of annuity present value empowers you to navigate the financial landscape with confidence.

Essential FAQs

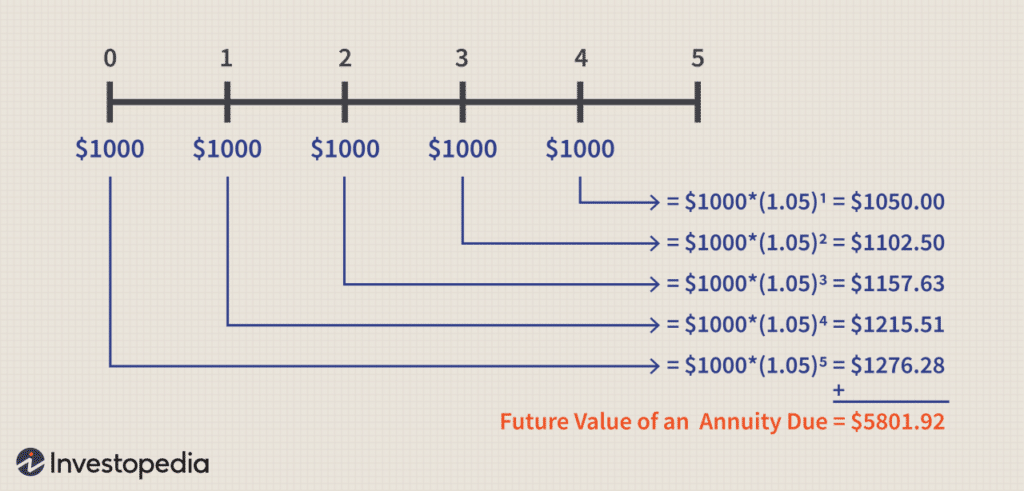

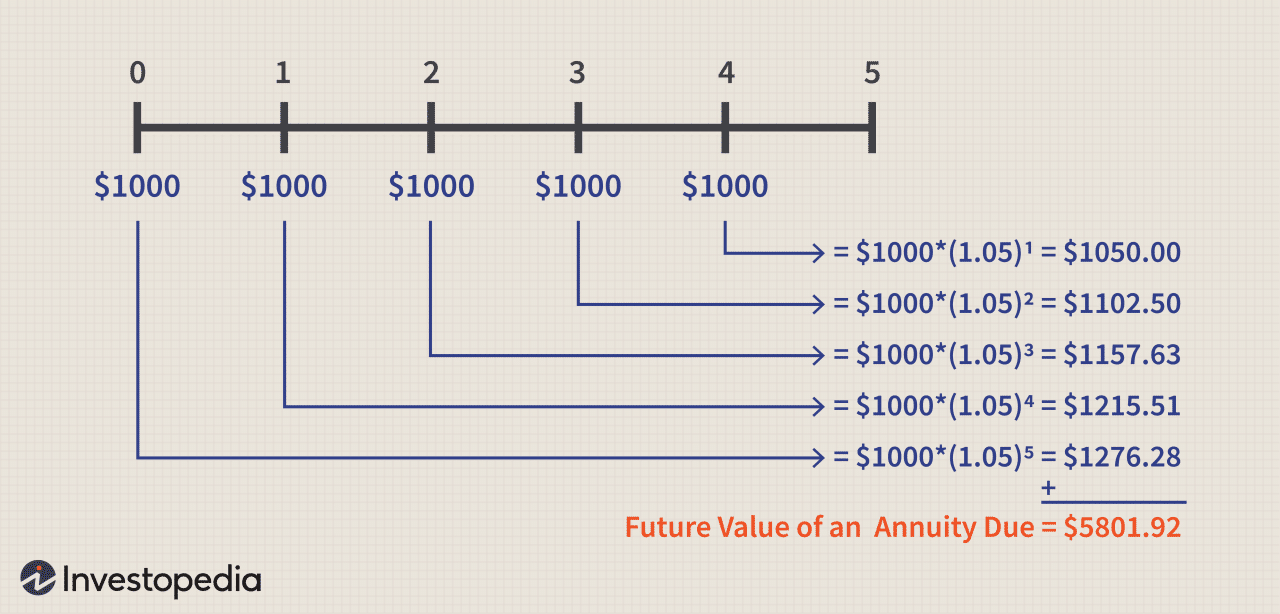

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference in timing affects the present value calculation.

How can I calculate the present value of an annuity without a financial calculator?

While a financial calculator is the most convenient method, you can also use a spreadsheet program like Excel or Google Sheets. There are built-in functions that can calculate the present value of an annuity.

Are annuities a good investment option for everyone?

Annuities can be a valuable part of a diversified investment portfolio, but they are not suitable for everyone. It’s essential to consider your individual financial goals, risk tolerance, and time horizon before making any investment decisions.

Are annuities a good or bad investment? Annuity Is Good Or Bad 2024 provides a balanced perspective on the pros and cons of annuities, helping you determine if they’re right for you.

Understanding the formula used to calculate annuity payments is crucial. Annuity Formula Is 2024 explains the formula and how it’s used to determine your future annuity payments.

An annuity can be a single lump sum payment or a series of payments over time. Annuity Is A Single Sum 2024 explores the different types of annuities and their payment structures.