Annuity Is Pension 2024: Navigating the evolving landscape of retirement income solutions, this comprehensive guide delves into the intricacies of annuities and pensions, providing valuable insights for individuals seeking financial security in their golden years.

From understanding the fundamental differences between annuities and pensions to exploring the advantages and risks associated with each, this guide aims to empower readers with the knowledge and tools necessary to make informed decisions about their retirement income planning.

Whether or not getting an annuity is worth it depends on your individual circumstances and financial goals. Is Getting An Annuity Worth It 2024 helps you weigh the pros and cons of annuity investments.

Contents List

- 1 Understanding Annuities and Pensions in 2024

- 2 Annuity as a Retirement Income Solution

- 3 Types of Annuities and Their Features

- 4 Annuity vs. Other Retirement Savings Options

- 5 Considerations for Purchasing an Annuity

- 6 The Future of Annuities and Pensions: Annuity Is Pension 2024

- 7 Closure

- 8 Clarifying Questions

Understanding Annuities and Pensions in 2024

In the ever-evolving landscape of retirement planning, annuities and pensions continue to play a crucial role in securing financial well-being during the golden years. While both are designed to provide a steady stream of income after retirement, they differ significantly in their structure, funding, and risk profiles.

This article aims to shed light on the nuances of annuities and pensions in 2024, exploring their current state, benefits, drawbacks, and future prospects.

An annuity certain guarantees payments for a predetermined period, regardless of the annuitant’s lifespan. Is Annuity Certain 2024 explains the features and benefits of this type of annuity.

The Fundamental Differences Between Annuities and Pensions, Annuity Is Pension 2024

An annuity is a financial product that provides a guaranteed stream of income for a specified period, typically for life. You purchase an annuity with a lump sum or a series of payments, and the insurance company agrees to pay you a regular income stream in return.

Pensions, on the other hand, are employer-sponsored retirement plans that provide a regular income stream to employees after they retire. Pensions are typically funded by employer contributions and sometimes employee contributions.

Annuity funds are a popular way to save for retirement, but it’s important to understand how they work. Annuity Fund Is 2024 can help you learn about the different types of annuity funds available and how they can benefit your retirement planning.

Here’s a table highlighting the key differences between annuities and pensions:

| Feature | Annuity | Pension |

|---|---|---|

| Funding | Individual purchase | Employer contributions |

| Guaranteed Income | Yes, typically for life | Yes, but subject to plan rules |

| Risk | Investment risk (for variable annuities) | Plan funding risk |

| Flexibility | More flexible in terms of investment options and payout options | Less flexible, subject to plan rules |

The Current State of Pension Plans in 2024

Traditional defined-benefit pension plans, which guarantee a fixed income stream for life, have been declining in popularity in recent years. Many employers are transitioning to defined-contribution plans, such as 401(k)s, where employees bear the investment risk and responsibility for their retirement savings.

Annuity products are available in Kenya, providing retirement income solutions for individuals. Annuity Kenya 2024 highlights the specific features and regulations of annuities in Kenya.

This shift is primarily driven by factors such as rising healthcare costs, longer life expectancies, and increased market volatility. However, there are still some employers who offer traditional pension plans, particularly in the public sector.

The challenges facing pension plans in 2024 include:

- Funding Shortfalls:Many pension plans are struggling to meet their obligations due to low interest rates and stock market fluctuations.

- Regulatory Uncertainty:Changes in tax laws and regulations can impact pension plan funding and benefits.

- Demographic Shifts:Longer life expectancies and declining birth rates are putting pressure on pension systems.

An Overview of Annuity Products Available in the Market

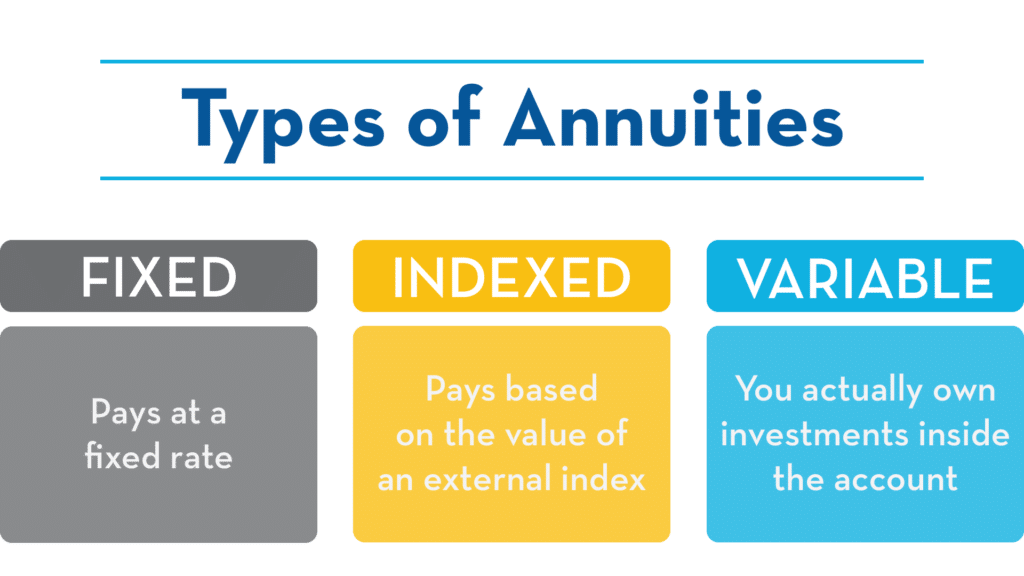

The annuity market offers a diverse range of products designed to meet various retirement income needs. Some common types of annuities include:

- Fixed Annuities:These provide a guaranteed fixed rate of return, offering predictable income payments. They are typically less risky than variable annuities.

- Variable Annuities:These offer the potential for higher returns, but also carry investment risk. The income payments are tied to the performance of underlying investment funds.

- Indexed Annuities:These provide a return linked to the performance of a specific index, such as the S&P 500. They offer potential growth with some downside protection.

- Immediate Annuities:These start paying out income immediately after purchase. They are often used for immediate retirement income needs.

- Deferred Annuities:These provide income payments at a later date, typically after a specified period. They allow for tax-deferred growth of the principal.

Annuity as a Retirement Income Solution

Annuities can be a valuable tool for retirement income planning, offering several advantages over traditional pensions and other retirement savings vehicles. They can provide a guaranteed income stream, protect against longevity risk, and offer flexibility in payout options.

The number of annuity contracts issued each year can vary significantly. Annuity Number 2024 provides insights into the current trends and factors influencing the issuance of annuity contracts.

Advantages of Using Annuities for Retirement Income Planning

- Guaranteed Income:Annuities can provide a guaranteed income stream for life, ensuring a steady source of income even in the face of market volatility.

- Longevity Risk Protection:Annuities can help protect against outliving your savings. They provide a stream of income for as long as you live, regardless of how long you live.

- Flexibility:Annuities offer various payout options, allowing you to choose the income stream that best suits your needs. You can choose a fixed amount, a variable amount, or a combination of both.

- Tax Advantages:Some annuities offer tax-deferred growth, allowing your money to grow tax-free until you start receiving payments.

Real-World Examples of How Annuities Can Supplement or Replace Traditional Pensions

Annuities can play a crucial role in supplementing or replacing traditional pensions, especially for individuals who are concerned about outliving their savings or who want to ensure a steady income stream during retirement. For example, a retiree who has a small pension from a previous employer might consider purchasing an annuity to provide additional income.

Or, a retiree who is concerned about the longevity risk associated with their retirement savings might choose to use an annuity to provide a guaranteed income stream for life.

Whether annuity payments qualify as earned income can have implications for taxes and social security benefits. Is Annuity Earned Income 2024 provides information on how annuity income is treated for tax purposes.

Potential Risks and Drawbacks Associated with Annuities

While annuities offer several advantages, it’s essential to be aware of their potential risks and drawbacks:

- Illiquidity:Once you purchase an annuity, your money is typically locked in for a specified period, making it difficult to access your funds in an emergency.

- Fees and Expenses:Annuities can have high fees and expenses, which can erode your returns.

- Investment Risk:Variable annuities carry investment risk, as the income payments are tied to the performance of underlying investment funds.

- Inflation Risk:Fixed annuities may not keep pace with inflation, leading to a decline in purchasing power over time.

Types of Annuities and Their Features

Annuities are available in various forms, each offering distinct features and benefits. Understanding the different types of annuities can help you choose the one that best aligns with your retirement goals and risk tolerance.

Annuity health refers to the financial health of an annuity contract. Annuity Health 2024 discusses factors that can impact the health of an annuity and strategies for maintaining its stability.

Comparing Different Types of Annuities

| Annuity Type | Key Characteristics | Pros | Cons |

|---|---|---|---|

| Fixed Annuity | Guarantees a fixed interest rate and income payments. | Predictable income stream, low risk. | Limited growth potential, vulnerable to inflation. |

| Variable Annuity | Income payments are tied to the performance of underlying investment funds. | Potential for higher returns, investment flexibility. | Investment risk, higher fees. |

| Indexed Annuity | Returns are linked to the performance of a specific index, with some downside protection. | Potential for growth, downside protection. | Limited growth potential, complex investment options. |

| Immediate Annuity | Starts paying out income immediately after purchase. | Immediate income stream, guaranteed payments. | Limited flexibility, lower returns compared to deferred annuities. |

| Deferred Annuity | Provides income payments at a later date, typically after a specified period. | Tax-deferred growth, potential for higher returns. | Long-term commitment, may not be suitable for immediate income needs. |

Selecting the Most Appropriate Annuity Based on Individual Circumstances

The best type of annuity for you will depend on your individual circumstances, including your retirement goals, risk tolerance, and time horizon. For example, a retiree who is seeking a guaranteed income stream and is risk-averse might consider a fixed annuity.

On the other hand, a retiree who is willing to take on more risk and has a longer time horizon might choose a variable annuity. It’s essential to consult with a qualified financial advisor to determine the most suitable annuity type for your specific needs.

Annuity contracts can be a part of a pension plan, but they are not the same thing. Annuity Is Pension Plan 2024 explains the differences between these two retirement income options.

Annuity vs. Other Retirement Savings Options

Annuities are just one of many retirement savings options available. Understanding how annuities compare to other popular retirement vehicles can help you make informed decisions about your retirement planning.

Comparing Annuities with IRAs and 401(k)s

| Feature | Annuity | IRA | 401(k) |

|---|---|---|---|

| Funding | Individual purchase | Individual contributions | Employer contributions and employee contributions |

| Guaranteed Income | Yes, typically for life | No | No |

| Tax Advantages | Tax-deferred growth, tax-free withdrawals in some cases | Tax-deferred growth, tax-free withdrawals in some cases | Tax-deferred growth, tax-free withdrawals in some cases |

| Investment Flexibility | Variable annuities offer investment flexibility | Wide range of investment options | Investment options vary depending on the plan |

| Risk | Investment risk (for variable annuities), longevity risk | Investment risk | Investment risk, plan funding risk |

The Potential Role of Annuities within a Diversified Retirement Portfolio

Annuities can play a valuable role within a diversified retirement portfolio, providing a guaranteed income stream and protecting against longevity risk. They can complement other retirement savings vehicles like IRAs and 401(k)s, helping to ensure a steady flow of income during retirement.

Joint ownership of an annuity allows multiple individuals to share in the benefits. Annuity Joint Ownership 2024 discusses the different types of joint ownership options available.

However, it’s crucial to consider the potential risks and drawbacks of annuities and to ensure that they fit within your overall financial plan.

The tax implications of annuities can vary depending on the type of annuity and its source. Is Annuity For Life Insurance Taxable 2024 provides insights into the tax treatment of annuity payments from life insurance policies.

Suitability of Annuities for Different Risk Tolerance Levels

Annuities can be suitable for investors with varying risk tolerance levels. Fixed annuities are generally suitable for risk-averse investors who prioritize guaranteed income. Variable annuities offer more growth potential but carry higher investment risk and may be more appropriate for investors with a higher risk tolerance.

Considerations for Purchasing an Annuity

Purchasing an annuity is a significant financial decision that requires careful consideration. It’s essential to weigh your options, understand the terms and conditions, and seek professional advice before making a commitment.

The annuity loan formula is used to calculate the periodic payments on a loan. Annuity Loan Formula 2024 provides a detailed explanation of this formula and its applications.

Key Factors to Consider Before Purchasing an Annuity

- Your Retirement Goals:What are your income needs during retirement? How long do you expect to live? What level of risk are you comfortable with?

- Your Financial Situation:How much money do you have available to invest in an annuity? What other retirement savings vehicles do you have?

- The Annuity’s Terms and Conditions:What are the fees and expenses associated with the annuity? What is the guaranteed interest rate or return? What are the payout options?

- The Insurance Company’s Financial Strength:It’s essential to choose an annuity from a financially sound insurance company. Research the company’s financial ratings and track record.

Tips for Negotiating Favorable Terms and Conditions

- Shop Around:Compare annuities from multiple insurance companies to find the best rates and terms.

- Negotiate Fees:Don’t be afraid to negotiate fees and expenses. Some insurance companies may be willing to lower their fees for larger investments.

- Understand the Fine Print:Carefully read the annuity contract and understand all the terms and conditions before you sign.

The Importance of Seeking Professional Financial Advice

It’s highly recommended to consult with a qualified financial advisor before purchasing an annuity. A financial advisor can help you assess your retirement goals, understand the different types of annuities available, and determine the most suitable option for your specific needs.

An annuity is a financial product that provides a stream of regular payments over a specified period. An Annuity Is 2024 offers a comprehensive overview of the concept and purpose of annuities.

They can also help you navigate the complexities of annuity contracts and ensure that you are making an informed decision.

The Future of Annuities and Pensions: Annuity Is Pension 2024

The future of annuities and pensions is likely to be shaped by a confluence of factors, including demographic shifts, economic conditions, and technological advancements. As life expectancies continue to rise and traditional pension plans become less common, annuities are poised to play an increasingly important role in retirement planning.

The permissibility of annuities in Islam is a matter of debate. Is Annuity Halal 2024 explores the Islamic perspectives on annuities and their compliance with Sharia principles.

Impact of Changing Demographics and Economic Conditions

The aging population and rising life expectancies will continue to increase the demand for retirement income solutions. This trend, coupled with the decline of traditional pensions, is expected to drive growth in the annuity market. However, economic conditions, such as interest rates and inflation, can significantly impact annuity returns.

As interest rates remain low, fixed annuities may offer lower returns, while variable annuities will be subject to market volatility.

Emerging Trends and Innovations in the Annuity Market

The annuity market is evolving rapidly, with new products and features emerging to meet the changing needs of retirees. Some notable trends include:

- Hybrid Annuities:These combine features of fixed and variable annuities, offering some guaranteed income with the potential for growth.

- Annuities with Longevity Riders:These provide additional income payments for those who live longer than expected.

- Annuities with Guaranteed Minimum Income Benefits:These offer a guaranteed minimum income stream, even if the underlying investments perform poorly.

Predictions about the Future Role of Annuities in Retirement Planning

As the retirement landscape continues to evolve, annuities are likely to play a more prominent role in retirement income planning. They can provide a guaranteed income stream, protect against longevity risk, and offer flexibility in payout options. However, it’s essential to carefully consider the risks and drawbacks of annuities and to choose the product that best aligns with your individual needs and goals.

Closure

In an era marked by evolving retirement landscapes and changing economic realities, understanding the role of annuities and pensions is crucial for individuals seeking a secure and fulfilling retirement. This guide has provided a comprehensive overview of these financial instruments, highlighting their potential benefits and risks.

By carefully considering individual circumstances, risk tolerance, and financial goals, individuals can make informed decisions about incorporating annuities and pensions into their retirement income strategies, ultimately ensuring a brighter and more secure future.

Clarifying Questions

What are the tax implications of annuities?

An annuity is a series of payments made over a specific period of time. An Annuity Is A Series Of 2024 dives into the details of how these payments are structured and calculated.

The tax treatment of annuities can vary depending on the type of annuity and the individual’s circumstances. Generally, the payouts from an annuity are taxed as ordinary income. However, some annuities may offer tax-deferred growth, meaning that taxes are not paid until the funds are withdrawn.

It’s essential to consult with a tax professional to understand the specific tax implications of an annuity.

How do I choose the right annuity for me?

Choosing the right annuity depends on your individual needs, risk tolerance, and financial goals. Factors to consider include the type of annuity, the payout options, the fees, and the guarantees. It’s recommended to consult with a financial advisor to determine the most suitable annuity for your situation.

What are the risks associated with annuities?

A joint and survivor annuity ensures that payments continue to be made to the surviving spouse after the death of the primary annuitant. Annuity Joint And Survivor 2024 explores the advantages and considerations of this type of annuity.

Annuities come with certain risks, including the risk of losing money if the annuity provider fails or if the investment performance is poor. Additionally, some annuities may have surrender charges, which can be incurred if the annuity is withdrawn before a certain period.

It’s crucial to understand the risks before purchasing an annuity.