Is Annuity Payments Taxable 2024 – Is Annuity Payments Taxable in 2024? This question is crucial for anyone considering annuities as part of their retirement planning. Annuities, essentially contracts that provide a stream of income for a specific period, come in various forms, each with its own tax implications.

The concept of a perpetual annuity can be intriguing. Annuity Is Perpetual 2024 explores this type of annuity and its implications.

Understanding the taxability of annuity payments is vital for making informed financial decisions and maximizing potential tax benefits.

If you have questions about annuities, you’re not alone. Annuity Questions 2024 can help you find answers.

The Internal Revenue Service (IRS) has specific rules regarding the tax treatment of annuity payments, which can vary depending on factors such as the type of annuity, the annuitant’s age, and the terms of the contract. This guide delves into the intricacies of annuity taxation in 2024, exploring how payments are taxed, what factors influence taxability, and how to effectively manage tax implications for optimal financial outcomes.

When deciding on retirement income strategies, you might wonder, “Is an annuity better than drawdown?” Is Annuity Better Than Drawdown 2024 can help you make the right choice for your needs.

Contents List

Annuity Payments: A Guide to Taxability in 2024

Annuities are financial products that provide a stream of regular payments over a specified period. They are often used for retirement planning, but can also be used for other purposes such as income generation or estate planning. There are various types of annuities, each with its own unique features and tax implications.

The financial services industry offers many job opportunities. Annuity Jobs 2024 can help you explore career options in the annuity market.

Understanding the taxability of annuity payments is crucial for effective financial planning, as it can significantly impact your overall financial well-being.

Understanding LIC’s annuity offerings can be important. Is Annuity Lic 2024 can help you understand LIC’s role in the annuity market.

Tax Treatment of Annuity Payments

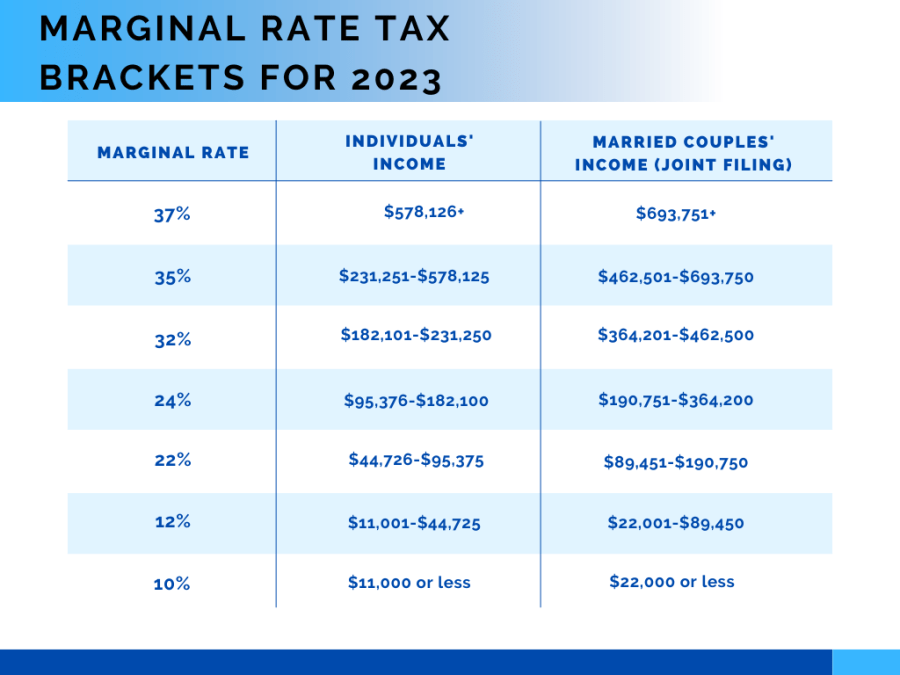

The tax treatment of annuity payments depends on several factors, including the type of annuity, the age of the annuitant, and the terms of the annuity contract. In general, annuity payments are taxed as ordinary income, meaning they are subject to federal and state income tax rates.

Annuity is a financial product that can provide a stream of income for life. It can be used for a variety of purposes, such as retirement planning, income replacement, or long-term care. You might wonder if an annuity is a life insurance policy.

Is Annuity A Life Insurance Policy 2024 can help you understand the difference.

Factors Affecting Taxability, Is Annuity Payments Taxable 2024

Several factors influence the taxability of annuity payments. Understanding these factors is essential for accurately calculating your tax liability and maximizing your financial benefits.

Considering an annuity? Is Getting An Annuity Worth It 2024 is a great resource to help you weigh the pros and cons.

- Annuity Contract Terms:The terms of your annuity contract play a crucial role in determining how your payments are taxed. For example, if your annuity contract specifies that a portion of your payments represents a return of your principal investment, that portion may be tax-free.

Annuity is a financial instrument that provides regular payments over a set period. Annuity Is 2024 offers a deeper dive into this financial tool.

- Age of the Annuitant:The age of the annuitant can affect the taxability of annuity payments. If you start receiving annuity payments before age 59 1/2, you may be subject to a 10% penalty on the taxable portion of your payments.

- Deductions and Credits:There are certain deductions and credits available for annuity payments, which can help reduce your tax liability. For example, you may be able to deduct medical expenses related to your annuity payments or claim a credit for certain types of annuities.

If you’re looking for information about annuity numbers from LIC, Annuity Number Lic 2024 provides insights.

Reporting Annuity Income

It is crucial to report annuity income accurately on your tax return. Failure to do so can result in penalties and interest charges. The following table Artikels the relevant tax forms and schedules for reporting annuity income.

An annuity contract is a legally binding agreement. Annuity Contract Is 2024 can help you understand the key elements of an annuity contract.

| Tax Form | Schedule | Description |

|---|---|---|

| Form 1040 | Schedule B | Interest and Ordinary Dividends |

| Form 1040 | Schedule C | Profit or Loss from Business |

| Form 1040 | Schedule D | Capital Gains and Losses |

| Form 1040 | Schedule E | Supplemental Income and Loss |

Planning for Annuity Tax Implications

There are several strategies you can use to minimize the tax burden on your annuity payments. Consulting with a tax professional can help you develop a personalized plan to optimize your tax benefits. Here are some general strategies to consider:

- Timing of Payments:If possible, try to structure your annuity payments to receive them in years when your tax bracket is lower. This can help reduce your overall tax liability.

- Annuity Type:The type of annuity you choose can also affect the taxability of your payments. For example, a variable annuity may offer more tax-advantaged growth than a fixed annuity.

- Tax-Advantaged Accounts:Consider using tax-advantaged accounts such as IRAs or 401(k)s to hold your annuity payments. This can help reduce your tax liability in retirement.

Epilogue

Navigating the tax landscape of annuities can be complex, but understanding the fundamentals is crucial for making informed decisions. While this guide provides a comprehensive overview, it’s essential to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

Many people have questions about the tax implications of annuities, especially when they are used for life insurance. Is Annuity For Life Insurance Taxable 2024 can help you understand the rules.

By proactively addressing tax implications, you can ensure your annuity payments contribute effectively to your financial well-being and retirement goals.

Clarifying Questions: Is Annuity Payments Taxable 2024

What are the different types of annuities?

Annuities can be categorized into two main types: fixed annuities and variable annuities. Fixed annuities provide a guaranteed rate of return, while variable annuities offer returns based on the performance of underlying investments.

Are all annuity payments taxed the same way?

Inheriting an annuity can be a great way to receive regular payments, but it’s important to understand the tax implications. I Inherited An Annuity Is It Taxable 2024 explains how the IRS treats inherited annuities.

No, the tax treatment of annuity payments depends on various factors, including the type of annuity, the annuitant’s age, and the terms of the contract. It’s important to understand the specific tax rules that apply to your annuity.

How do I report annuity income on my tax return?

Annuity income is typically reported on Form 1040, Schedule B, and Form 1099-R. The specific forms and schedules may vary depending on the type of annuity and the terms of the contract.

Can I deduct any expenses related to my annuity?

In some cases, you may be able to deduct certain expenses related to your annuity, such as premiums paid or investment management fees. Consult with a tax professional to determine your eligibility for deductions.

If you’re concerned about the religious implications of annuities, Is Annuity Halal 2024 explores this topic in detail.

Annuity payments can be a source of income, but are they considered earned income? Is Annuity Earned Income 2024 can help you understand the tax treatment of annuity payments.

For those who speak Bengali, Annuity Is Bengali Meaning 2024 provides a translation and explanation of the term “annuity” in Bengali.