Annuity Quotes 2024: Planning for retirement often involves navigating a complex landscape of investment options, and annuities stand out as a potential cornerstone of a secure financial future. This comprehensive guide delves into the world of annuities, exploring their various types, benefits, drawbacks, and the factors that influence their quotes in the current market.

We’ll break down how to obtain quotes from different providers, analyze current trends, and equip you with the knowledge to make informed decisions about incorporating annuities into your retirement strategy.

The duration of an annuity can vary depending on the specific type of annuity. To learn about the different duration options available, you can visit Annuity Is Indefinite Duration 2024 , which discusses the various duration possibilities for annuities.

Contents List

What are Annuities?

Annuities are financial products that provide a stream of regular payments, either for a fixed period or for the rest of your life. They are often used as a way to supplement retirement income, but they can also be used for other purposes, such as funding a child’s education or providing income for a surviving spouse.

Types of Annuities

There are many different types of annuities available, each with its own features and benefits. Here are some of the most common types:

- Fixed Annuities:These annuities guarantee a fixed rate of return, meaning that you will receive a predictable stream of payments for the life of the annuity. This type of annuity is ideal for those who want to protect their principal and receive a steady income stream.

Annuities are primarily designed to provide a steady stream of income, often during retirement. To learn more about the primary purpose of annuities, you can read An Annuity Is Primarily Used To Provide 2024 , which explains the main function of annuities.

- Variable Annuities:These annuities allow you to invest your money in a variety of sub-accounts, such as stocks, bonds, and mutual funds. The value of your annuity will fluctuate based on the performance of the underlying investments. This type of annuity is ideal for those who are willing to take on more risk in hopes of earning a higher return.

The regular payments you receive from an annuity are considered income, and they are typically taxed accordingly. For more information on the tax implications of annuities, you can check out Is Annuity Income 2024 , which delves into the tax treatment of annuity payments.

- Indexed Annuities:These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. They provide some protection against market losses, but they also have the potential to earn higher returns if the index performs well.

Insurance companies and financial institutions are typically the entities that issue annuities. You can find information about the different companies that offer annuities by visiting Annuity Issuer 2024 , which lists some of the major annuity providers.

- Immediate Annuities:These annuities begin paying out immediately after you purchase them. They are often used by people who need a guaranteed income stream right away, such as retirees.

- Deferred Annuities:These annuities start paying out at a later date, such as when you reach retirement age. They allow you to grow your savings tax-deferred and are often used as a way to save for retirement.

Benefits of Annuities

Annuities offer a number of benefits, including:

- Guaranteed Income:Fixed annuities provide a guaranteed income stream for life, which can provide peace of mind in retirement.

- Tax-Deferred Growth:Annuity earnings grow tax-deferred, meaning that you don’t have to pay taxes on them until you withdraw the money.

- Protection Against Market Losses:Some annuities, such as fixed and indexed annuities, offer protection against market losses.

- Death Benefit:Many annuities provide a death benefit, which pays out to your beneficiaries if you die before the annuity is fully paid out.

Drawbacks of Annuities

While annuities offer some benefits, they also have some drawbacks, including:

- Limited Liquidity:It can be difficult to access your money in an annuity, especially if it is a deferred annuity.

- High Fees:Annuities can have high fees, which can eat into your returns.

- Complex Contracts:Annuity contracts can be complex and difficult to understand.

- Potential for Market Risk:Variable annuities carry market risk, meaning that the value of your annuity can fluctuate based on the performance of the underlying investments.

Tax Implications of Annuity Income

The tax implications of annuity income can vary depending on the type of annuity and how it is structured. Generally, the payments you receive from an annuity are taxed as ordinary income. However, the earnings on a deferred annuity are not taxed until you withdraw the money.

Annuities are often described as a series of equal periodic payments, which makes them a predictable source of income. To learn more about the nature of these periodic payments, you can visit An Annuity Is A Series Of Equal Periodic Payments 2024 , which explains the concept of equal periodic payments in annuities.

It is important to consult with a financial advisor to understand the tax implications of annuity income.

Annuities are often considered a form of fixed income, as they provide predictable payments. To learn more about the fixed-income nature of annuities, you can read Is Annuity Fixed Income 2024 , which explores the relationship between annuities and fixed income investments.

Factors Influencing Annuity Quotes

Annuity quotes can vary significantly depending on a number of factors, including:

Age

Your age is one of the most important factors that will affect your annuity quote. The older you are, the lower your annuity payout will be, as you are expected to live longer and receive more payments. This is because the insurance company is taking on more risk by guaranteeing you a stream of income for a longer period of time.

Health

Your health can also impact your annuity quote. If you are in good health, you are expected to live longer, which means the insurance company will have to pay out more money over time. As a result, your annuity payout will be lower.

Annuities come in different forms, depending on the type of payments and the duration of the contract. To understand the different types of annuities, you can visit Annuity Kinds 2024 , which provides a detailed overview of the various annuity types.

Conversely, if you have health issues, your annuity payout may be higher, as you are expected to live a shorter life.

In certain situations, you might need to withdraw funds from your annuity before the planned payout date. To learn about the process and conditions for early withdrawals, you can read Annuity Hardship Withdrawal 2024 , which provides information about hardship withdrawals from annuities.

Investment Choices

If you choose a variable annuity, your annuity quote will be based on the performance of the underlying investments. If you choose a fixed annuity, your quote will be based on the interest rate offered by the insurance company.

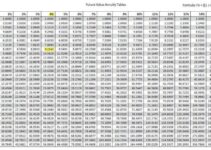

Interest Rates

Interest rates play a significant role in determining annuity payouts. When interest rates are high, insurance companies can offer higher annuity payouts, as they can earn more on their investments. Conversely, when interest rates are low, annuity payouts tend to be lower.

Market Conditions

Market conditions can also impact annuity quotes. When the stock market is performing well, insurance companies may offer higher annuity payouts, as they are more confident about their ability to earn a return on their investments. Conversely, when the stock market is performing poorly, annuity payouts may be lower.

The Hindi meaning of “annuity” is important for understanding the concept in a different language. To learn the Hindi translation of “annuity,” you can visit Annuity Ka Hindi Meaning 2024 , which provides the Hindi equivalent of this financial term.

Obtaining Annuity Quotes

Getting annuity quotes is a straightforward process, but it is important to shop around and compare quotes from different providers.

Step-by-Step Guide

- Determine your needs:Before you start getting quotes, consider your financial goals, risk tolerance, and income needs. This will help you narrow down your choices and choose the right type of annuity for you.

- Contact multiple providers:Get quotes from at least three different insurance companies to compare rates and features.

- Review the quotes carefully:Pay attention to the interest rate, fees, death benefit, and other terms and conditions of each annuity.

- Ask questions:Don’t be afraid to ask questions about the annuity contract and how it works. Make sure you understand all the terms and conditions before you make a decision.

Comparing Quotes, Annuity Quotes 2024

When comparing annuity quotes, it is important to consider the following factors:

- Interest rate:The interest rate will determine how much your annuity will grow over time.

- Fees:Annuities can have a variety of fees, including administrative fees, surrender charges, and mortality charges. Make sure you understand all the fees associated with each annuity.

- Death benefit:The death benefit is the amount of money that will be paid to your beneficiaries if you die before the annuity is fully paid out.

- Guarantee period:The guarantee period is the length of time that the annuity will pay out a guaranteed income stream.

Annuity contracts can be complex, so it is important to read them carefully and ask questions if you don’t understand anything. You should also consider consulting with a financial advisor to help you understand the terms and conditions of the contract.

The start date of an annuity is an important factor to consider, as it determines when the payments will begin. For information about the start date of annuities, you can check out Annuity Date Is 2024 , which provides details about the annuity start date.

Annuity Quotes in 2024: Trends and Insights

The annuity market is constantly evolving, and there are a number of trends and insights that are shaping annuity quotes in 2024.

While annuities are serious financial instruments, they can also be the subject of lighthearted humor. For some light-hearted content related to annuities, you can visit Annuity Jokes 2024 , which features a collection of jokes about annuities.

Trends in Annuity Pricing

Annuity pricing is influenced by a number of factors, including interest rates, market conditions, and competition among insurance companies. In 2024, we are seeing a trend of higher annuity payouts, as interest rates have been rising. This is good news for those who are looking to purchase an annuity, as they can potentially earn a higher return on their investment.

The permissibility of annuities according to Islamic law is a matter of debate. For information about the Islamic perspective on annuities, you can visit Is Annuity Halal 2024 , which discusses the halal status of annuities.

Emerging Annuity Products

Insurance companies are constantly developing new annuity products to meet the needs of consumers. Some of the emerging annuity products in 2024 include:

- Variable annuities with guaranteed income riders:These annuities offer the potential for growth in the market, while also providing a guaranteed income stream in retirement.

- Indexed annuities with higher caps:These annuities offer the potential for higher returns, while still providing some protection against market losses.

- Annuities with longevity riders:These annuities provide a higher payout if you live longer than expected.

Impact of Regulatory Changes

Regulatory changes can also impact annuity quotes. For example, the Department of Labor’s fiduciary rule, which went into effect in 2017, requires financial advisors to act in the best interests of their clients when recommending annuities. This has led to some insurance companies offering more transparent and consumer-friendly annuity products.

While annuities and IRAs are both retirement savings tools, they have different features and tax implications. To learn about the differences between annuities and IRAs, you can read Is Annuity The Same As Ira 2024 , which explains the distinctions between these two retirement savings options.

Choosing the Right Annuity: Annuity Quotes 2024

Choosing the right annuity can be a complex decision, as there are many different types of annuities available. Here are some factors to consider when selecting an annuity:

Checklist for Choosing an Annuity

- Your financial goals:What are you hoping to achieve with an annuity? Are you looking for guaranteed income in retirement, or are you looking for growth potential?

- Your risk tolerance:How much risk are you willing to take? Are you comfortable with the possibility of losing some of your investment, or do you prefer a more conservative approach?

- Your income needs:How much income will you need in retirement? This will help you determine how much of your savings you need to allocate to an annuity.

- The annuity’s features:Compare the features of different annuities, such as the interest rate, fees, death benefit, and guarantee period.

- The insurance company’s financial stability:Choose an insurance company with a strong financial track record. You can check the company’s ratings with organizations such as A.M. Best and Standard & Poor’s.

Comparing Annuity Types

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuities | Guaranteed income stream, protection against market losses | Lower potential returns, limited liquidity |

| Variable Annuities | Potential for higher returns, tax-deferred growth | Market risk, high fees |

| Indexed Annuities | Potential for higher returns, protection against market losses | Lower potential returns than variable annuities, complex contracts |

| Immediate Annuities | Guaranteed income stream, no waiting period | Lower potential returns than deferred annuities, limited flexibility |

| Deferred Annuities | Tax-deferred growth, potential for higher returns | Limited liquidity, high fees |

Using Annuity Quotes to Make Informed Decisions

Annuity quotes can be a valuable tool for making informed investment decisions. By comparing quotes from different providers, you can find the best annuity for your needs and goals. It is important to consult with a financial advisor to help you understand the complexities of annuities and make the best decision for your situation.

Last Recap

Understanding annuity quotes in 2024 is crucial for individuals seeking reliable income streams during retirement. By carefully evaluating the factors that influence quotes, comparing offers from multiple providers, and considering your individual financial goals, you can navigate the complexities of annuities and choose the option that best aligns with your needs.

While annuities are primarily used for retirement planning, they can also be used for other purposes, such as healthcare expenses. You can explore the link between annuities and healthcare by visiting Annuity Health Insurance 2024 , which discusses the potential role of annuities in managing health costs.

Remember, seeking professional financial advice can provide valuable insights and personalized guidance for your retirement planning journey.

Popular Questions

What are the most common types of annuities available in 2024?

The most common types include fixed annuities, variable annuities, and indexed annuities. Each type offers different features and risk levels, so it’s essential to understand the nuances of each before making a decision.

How often should I review my annuity quotes?

It’s advisable to review your annuity quotes at least annually, or more frequently if market conditions change significantly. This ensures you’re getting the best possible rates and benefits.

An annuity is a financial product that provides a stream of regular payments, often for a set period of time. You can learn more about the basics of annuities by reading about Annuity Is A Series Of Equal Payments 2024 , which provides a simple explanation of this concept.

Are there any tax advantages to owning an annuity?

Yes, annuity income is generally taxed as ordinary income, but there are specific tax benefits associated with certain annuity types, such as tax-deferred growth and potential tax-free withdrawals.

Can I withdraw money from an annuity before retirement?

Most annuities allow for partial withdrawals, but there may be penalties associated with early withdrawals, depending on the specific terms of the contract.