Is An Annuity Qualified Or Nonqualified 2024? This question is crucial for anyone considering annuities as part of their retirement planning. Annuities, financial products designed to provide a stream of income during retirement, come in various forms, each with its own tax implications.

Annuity Gator is a popular provider, but is it legit? Discover the answer in this article about Is Annuity Gator Legit 2024.

Understanding the distinction between qualified and non-qualified annuities is vital for maximizing your tax benefits and ensuring you make informed financial decisions.

This guide will delve into the intricacies of annuity qualification, exploring the factors that determine whether an annuity is classified as qualified or non-qualified. We’ll discuss the tax treatment of both types of annuities, highlighting the potential tax advantages and disadvantages.

By understanding these nuances, you can navigate the complex world of annuities with confidence and make choices that align with your financial goals.

An annuity is a financial instrument with a specific definition. Take this Annuity Is Defined As Mcq 2024 to test your understanding.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It is often used for retirement planning, as it can provide a steady income stream in later years. Annuities are typically purchased with a lump sum payment, and the insurance company then makes regular payments to the annuitant, either for life or for a specific period of time.

Have questions about annuities? Find answers to common Annuity Questions 2024 and learn more about this financial product.

The payments can be fixed or variable, depending on the type of annuity.

Types of Annuities

There are many different types of annuities available, each with its own unique features and benefits. Some common types of annuities include:

- Fixed annuities:These annuities provide a guaranteed rate of return, which means that the payments you receive will be fixed for the life of the annuity. Fixed annuities are generally considered to be less risky than variable annuities, as the payments are not subject to market fluctuations.

Annuity payments are often structured as a series of regular payments. Learn more about Annuity Is A Series Of 2024 and how they work.

- Variable annuities:These annuities invest your money in a variety of sub-accounts, such as stocks, bonds, or mutual funds. The value of your annuity will fluctuate based on the performance of the investments. Variable annuities can offer the potential for higher returns, but they also carry more risk than fixed annuities.

- Indexed annuities:These annuities offer a guaranteed minimum rate of return, but they also have the potential to earn higher returns based on the performance of a specific index, such as the S&P 500.

- Immediate annuities:These annuities begin making payments immediately after you purchase them. Immediate annuities are often used by retirees who need a steady income stream right away.

- Deferred annuities:These annuities do not begin making payments until a later date, such as at retirement. Deferred annuities are often used by people who are saving for retirement and want to defer taxes on their earnings.

Tax Implications of Annuities

The tax implications of annuities can be complex, and they depend on a number of factors, including the type of annuity, the source of the contributions, and the age of the annuitant. In general, the earnings on annuities are taxed as ordinary income when they are distributed.

Before investing in an annuity, it’s important to be aware of potential Annuity Issues 2024 to make informed decisions.

However, there are some exceptions to this rule. For example, if you contribute to a qualified annuity, such as a 401(k) or a traditional IRA, the earnings will grow tax-deferred. This means that you will not have to pay taxes on the earnings until you withdraw them in retirement.

If you contribute to a non-qualified annuity, the earnings will be taxed as ordinary income when they are distributed. This is because non-qualified annuities are not subject to the same tax-deferral rules as qualified annuities.

Annuity contracts are often used as a voluntary retirement vehicle. This article explores Annuity Is A Voluntary Retirement Vehicle 2024 and its benefits.

Qualified vs. Non-Qualified Annuities

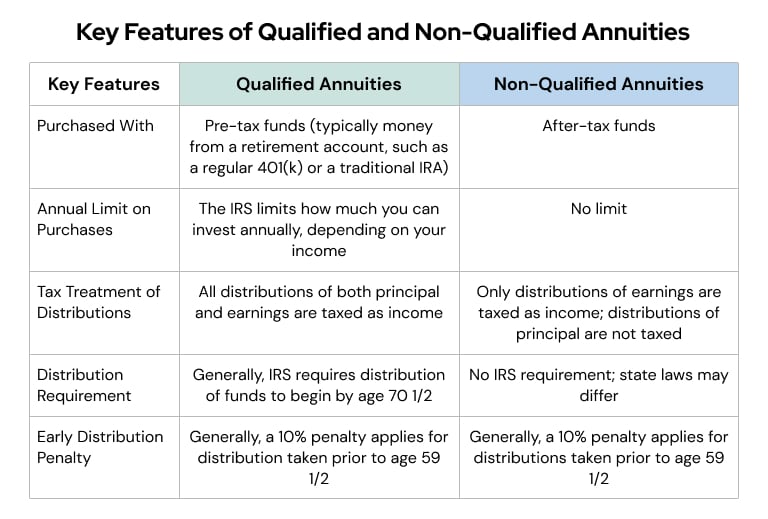

The tax treatment of an annuity depends on whether it is classified as a qualified or non-qualified annuity. Understanding this distinction is crucial for making informed financial decisions.

If you’re looking for some laughs, check out these Annuity Jokes 2024. They’re sure to tickle your funny bone and maybe even teach you a thing or two about annuities.

Qualified Annuities

A qualified annuity is an annuity that is purchased with pre-tax contributions, such as those made to a 401(k) or a traditional IRA. The earnings on a qualified annuity grow tax-deferred, meaning that you will not have to pay taxes on the earnings until you withdraw them in retirement.

Qualified annuities are subject to certain rules and regulations, including contribution limits and withdrawal penalties. For example, if you withdraw money from a qualified annuity before age 59 1/2, you may be subject to a 10% early withdrawal penalty, in addition to ordinary income tax on the withdrawal.

Non-Qualified Annuities

A non-qualified annuity is an annuity that is purchased with after-tax contributions. The earnings on a non-qualified annuity are taxed as ordinary income when they are distributed. This means that you will have to pay taxes on the earnings each year, even if you do not withdraw any money from the annuity.

Non-qualified annuities are generally more flexible than qualified annuities, as they are not subject to the same contribution limits and withdrawal penalties. However, the tax implications of non-qualified annuities can be more complex, and it is important to consult with a tax advisor before making any decisions about non-qualified annuities.

Comparing Tax Treatment, Is An Annuity Qualified Or Nonqualified 2024

The key difference between qualified and non-qualified annuities lies in their tax treatment. Qualified annuities offer tax-deferred growth, while non-qualified annuities are taxed on earnings annually. This distinction has significant implications for your overall tax burden and investment strategy.

Here is a table summarizing the key differences in tax treatment between qualified and non-qualified annuities:

| Annuity Type | Contribution Source | Tax Treatment | Example |

|---|---|---|---|

| Qualified Annuity | Pre-tax contributions (401(k), IRA) | Tax-deferred growth; taxed at withdrawal | Contributions made with pre-tax dollars, earnings grow tax-free until withdrawal in retirement. |

| Non-Qualified Annuity | After-tax contributions | Taxed on earnings annually | Contributions made with after-tax dollars, earnings are taxed each year, regardless of withdrawals. |

Taxation of Annuity Distributions: Is An Annuity Qualified Or Nonqualified 2024

The taxability of annuity distributions depends on the type of annuity and the source of the contributions. It’s crucial to understand the tax implications of different annuity scenarios to plan effectively.

Taxability Based on Annuity Type

Annuity distributions are generally taxed as ordinary income. However, the specific tax treatment varies depending on the type of annuity:

- Qualified Annuities:Distributions from qualified annuities, such as 401(k)s and IRAs, are taxed as ordinary income at the time of withdrawal. However, the contributions were made with pre-tax dollars, so you’ve already received a tax benefit. This means that you’re essentially paying taxes on the earnings only.

- Non-Qualified Annuities:Distributions from non-qualified annuities are taxed as ordinary income, and the portion of the distribution that represents the original contributions is considered tax-free. This is because the contributions were made with after-tax dollars.

Tax-Deferred vs. Tax-Free Growth

Annuity growth can be either tax-deferred or tax-free, depending on the type of annuity. This distinction impacts the tax implications of your investment:

- Tax-Deferred Growth:Qualified annuities offer tax-deferred growth, meaning that earnings are not taxed until withdrawal. This allows your investment to grow tax-free for a longer period.

- Tax-Free Growth:Certain annuities, like Roth IRAs, offer tax-free growth. This means that both contributions and earnings are tax-free at withdrawal. However, contributions are made with after-tax dollars, so you’ve already paid taxes on them.

Early Withdrawal Penalties

Early withdrawals from annuities can be subject to tax penalties, especially for qualified annuities. These penalties aim to discourage early withdrawals and encourage long-term savings. The penalty for early withdrawals from qualified annuities is generally 10% of the amount withdrawn, in addition to ordinary income tax.

There are different methods for calculating annuity payments. This article explores the Annuity Method 2024 and its implications.

However, there are exceptions to the early withdrawal penalty. For example, you may be able to withdraw money from a qualified annuity without penalty if you are 59 1/2 or older, or if you meet certain other requirements, such as for a first-time home purchase or medical expenses.

The date an annuity starts paying out is important. This article discusses the Annuity Date Is 2024 and how it affects your retirement planning.

Factors Influencing Annuity Qualification

The qualification of an annuity, determining whether it’s treated as qualified or non-qualified, is influenced by several factors. Understanding these factors is essential for making informed decisions about your annuity investment.

Contributions and Funding Sources

The source of the contributions used to purchase an annuity is a primary factor in determining its qualification. Contributions made with pre-tax dollars, such as those made to a 401(k) or a traditional IRA, generally result in a qualified annuity.

Wondering if the death benefit from an annuity is taxable? Find out in this article about Is Annuity Death Benefit Taxable 2024.

Conversely, contributions made with after-tax dollars, such as those made to a non-qualified annuity, result in a non-qualified annuity.

Employer-Sponsored Retirement Plans

Annuities purchased through employer-sponsored retirement plans, such as 401(k)s and 403(b)s, are generally considered qualified annuities. These plans are subject to specific tax rules and regulations, and contributions are made with pre-tax dollars, making them eligible for tax-deferred growth.

Annuity payments are a form of income, but understanding how they are taxed is important. Learn more about Is Annuity Income 2024 and how it affects your tax obligations.

Annuity Payments for Qualified Expenses

If you use annuity payments for qualified expenses, such as medical expenses or education, the tax treatment may be affected. Certain expenses may qualify for tax deductions or credits, depending on your specific circumstances. It’s important to consult with a tax advisor to understand the tax implications of using annuity payments for specific expenses.

Shopping for an annuity in Canada? Find out the latest rates and options in this article about Annuity Quotes Canada 2024.

Illustrative Examples

Here are some illustrative examples of different annuity scenarios and their tax implications:

| Annuity Type | Contribution Source | Tax Treatment | Example |

|---|---|---|---|

| Traditional IRA | Pre-tax contributions | Tax-deferred growth; taxed at withdrawal | A person contributes $5,000 per year to a Traditional IRA. The earnings grow tax-free until withdrawal in retirement. |

| 401(k) | Pre-tax contributions | Tax-deferred growth; taxed at withdrawal | An employee contributes $10,000 per year to their employer’s 401(k) plan. The contributions and earnings are not taxed until withdrawal. |

| Non-Qualified Annuity | After-tax contributions | Taxed on earnings annually | An individual invests $20,000 in a non-qualified annuity. The earnings are taxed each year, even if no withdrawals are made. |

| Roth IRA | After-tax contributions | Tax-free growth and withdrawals | A person contributes $6,000 per year to a Roth IRA. Both contributions and earnings are tax-free at withdrawal. |

Flowchart for Determining Annuity Qualification

The following flowchart Artikels the steps involved in determining the qualification of an annuity:

Start

Annuity options can be confusing, but understanding the different Annuity Kinds 2024 is crucial for making informed decisions about your retirement planning.

Is the annuity purchased with pre-tax contributions?

- Yes:Qualified Annuity (e.g., 401(k), Traditional IRA)

- No:Continue

Is the annuity purchased with after-tax contributions?

- Yes:Non-Qualified Annuity (e.g., non-qualified variable annuity)

- No:Continue

Is the annuity purchased through an employer-sponsored retirement plan?

- Yes:Qualified Annuity (e.g., 401(k), 403(b))

- No:Non-Qualified Annuity

End

Closing Notes

As you embark on your retirement planning journey, understanding the intricacies of annuities, particularly the distinction between qualified and non-qualified options, is essential. This guide has provided a comprehensive overview of the key factors that influence annuity qualification, shedding light on the tax implications associated with each type.

Retirement planning in New Zealand? Explore the options and features of Annuity Nz 2024 to see if they align with your financial goals.

Remember, seeking professional financial advice tailored to your individual circumstances is crucial for making informed decisions regarding your retirement savings.

Clarifying Questions

What are the main differences between qualified and non-qualified annuities?

Qualified annuities are typically funded with pre-tax contributions, offering tax-deferred growth and tax-free withdrawals at retirement. Non-qualified annuities, on the other hand, are funded with after-tax contributions, leading to taxable growth and withdrawals.

Can I withdraw money from a qualified annuity before retirement?

Yes, but early withdrawals from qualified annuities are generally subject to taxes and penalties. However, certain exceptions exist, such as withdrawals for qualified expenses like education or medical costs.

Testing your knowledge about annuities? Take this Annuity Is A Mcq 2024 to see how much you know about these financial instruments.

How do I determine if an annuity is qualified or non-qualified?

The primary factors determining an annuity’s qualification are the source of contributions (pre-tax or after-tax) and the type of retirement plan involved. It’s best to consult with a financial advisor to clarify your specific situation.