Annuity Statement Is 2024, a phrase that likely sparks curiosity among those seeking financial security. As we enter a new year, the landscape of annuity statements is evolving. Whether you’re a seasoned investor or just starting to explore retirement planning, understanding these changes is crucial.

A reversionary annuity is a type of annuity that provides payments to a beneficiary after the death of the original annuitant. This type of annuity can be a valuable tool for estate planning. You can find out more about reversionary annuities at Annuity Is Reversionary 2024.

This guide delves into the latest updates, providing insights into the key elements of annuity statements, their purpose, and how to navigate them effectively.

If you inherit an annuity, you’ll be responsible for paying taxes on the income received. The tax treatment of inherited annuities can be complex, so it’s important to seek guidance from a tax professional. For more information, you can check out How Is Inherited Annuity Taxed 2024.

Imagine a financial roadmap that guides you through your retirement savings. Annuity statements serve as this roadmap, providing a clear picture of your investments, interest earned, and withdrawals. This year, the landscape of annuity statements has shifted, reflecting new regulations, industry trends, and evolving investment strategies.

Annuity payments are generally taxed as ordinary income. However, there are some exceptions to this rule, such as if the annuity is a qualified retirement plan. You can learn more about the tax treatment of annuities at How Annuity Is Taxed 2024.

By understanding these changes, you can make informed decisions about your financial future.

Annuity is a popular investment choice for individuals who want to receive regular payments for life. There are many different types of annuities available, each with its own unique features and benefits. You can learn more about annuity leads at Annuity Leads 2024.

Contents List

Understanding Annuity Statements

Annuity statements are crucial documents that provide a detailed overview of your annuity contract’s performance. They are essential for monitoring your investment growth, understanding your account activity, and making informed financial decisions.

An annuity is a type of insurance product that provides a guaranteed stream of income for life. It’s often used as a retirement plan, but it can also be used for other purposes. You can learn more about annuities as a pension plan at Annuity Is Pension Plan 2024.

Key Components of an Annuity Statement

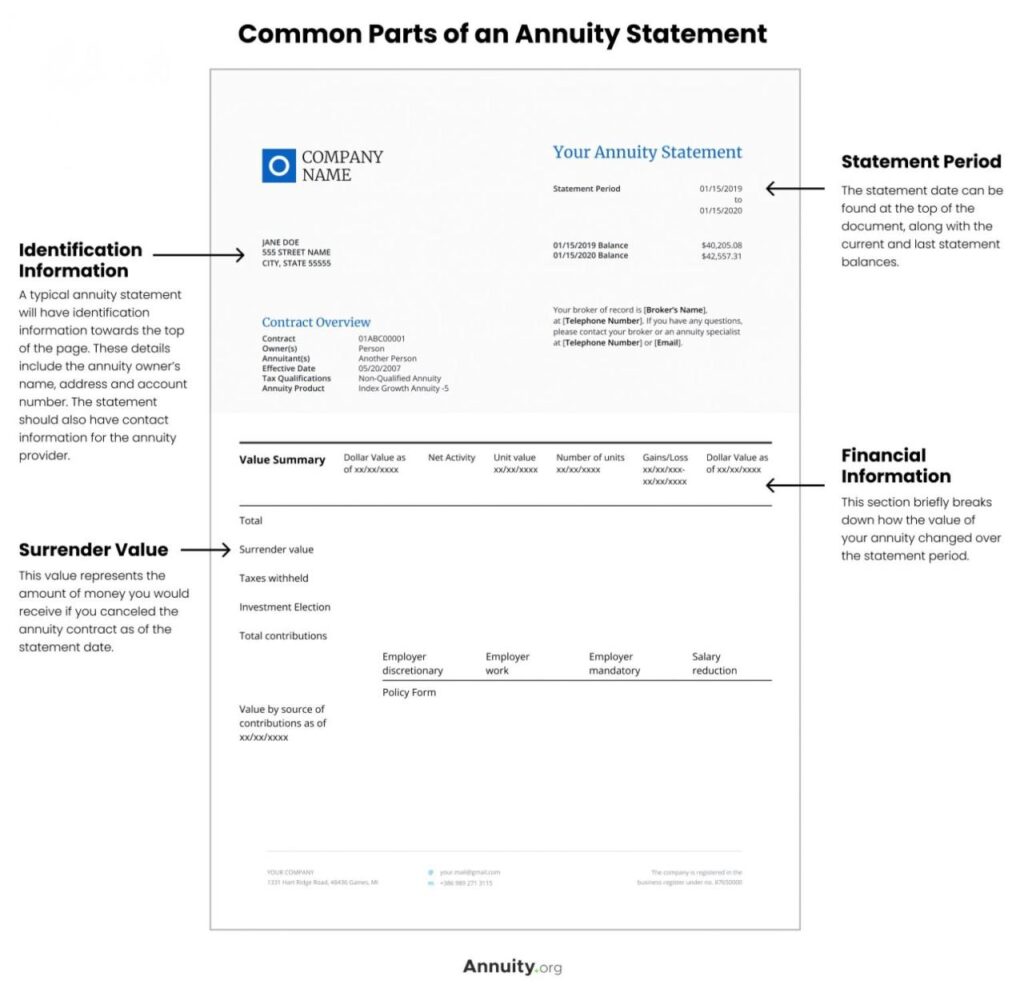

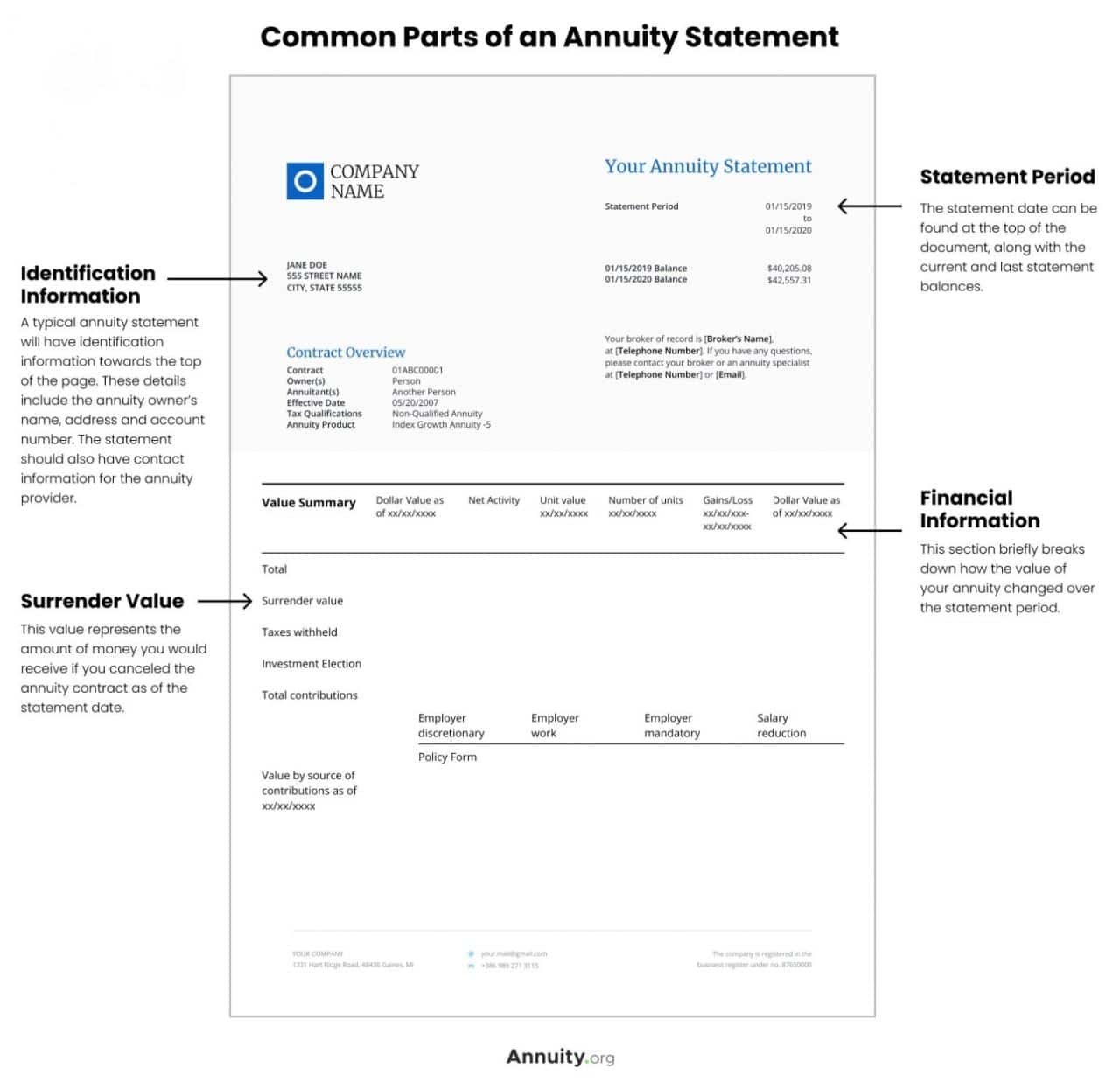

Annuity statements typically include the following key components:

- Account Balance:This represents the current market value of your annuity contract, reflecting the principal amount invested and any accumulated interest or gains.

- Interest Earned:This component Artikels the amount of interest accrued on your annuity contract during the statement period. Interest rates can vary depending on the type of annuity and market conditions.

- Withdrawals Made:This section details any withdrawals you have made from your annuity contract during the statement period. It includes the date, amount, and type of withdrawal.

Reading and Interpreting an Annuity Statement, Annuity Statement Is 2024

Understanding your annuity statement is straightforward. Here’s a step-by-step guide:

- Review the Statement Header:Begin by checking the statement’s date and your account information, ensuring accuracy.

- Examine the Account Balance:Note the current market value of your annuity contract and compare it to previous statements to assess growth or decline.

- Analyze Interest Earned:Evaluate the interest rate applied to your account and compare it to the projected rate. This helps gauge the performance of your investment.

- Track Withdrawals:Review the withdrawals section to ensure all transactions are accurate and aligned with your financial plan.

- Contact Your Annuity Provider:If you have any questions or require clarification about any information on your statement, don’t hesitate to reach out to your annuity provider.

Annuity Statement Changes in 2024

The year 2024 brought about some significant changes to annuity statements, primarily driven by new regulations and industry trends aimed at enhancing transparency and consumer protection.

Annuity income is considered taxable income in India, and the tax rate will depend on your individual income bracket. There are some exceptions to this rule, so it’s always a good idea to consult with a tax advisor to ensure you’re taking advantage of any available deductions.

You can learn more about the taxability of annuity income in India at Is Annuity Income Taxable In India 2024.

New Regulations and Industry Trends

- Enhanced Disclosure Requirements:The industry witnessed an increase in disclosure requirements, ensuring annuity statements provide more comprehensive and detailed information about fees, charges, and investment performance.

- Focus on Consumer Protection:Regulatory changes emphasized consumer protection, with a particular focus on ensuring clear and understandable language in annuity statements. This aims to empower consumers to make informed decisions about their annuity contracts.

- Digitalization and Online Access:The shift towards digitalization accelerated, with more annuity providers offering online access to statements, enabling customers to easily view and manage their accounts digitally.

Comparing Annuity Statements from 2023 to 2024

The most notable difference between annuity statements from 2023 and 2024 lies in the increased emphasis on transparency and consumer protection. The 2024 statements provide more detailed information about fees, charges, and investment performance, making it easier for consumers to understand the intricacies of their annuity contracts.

Annuity income is generally taxable in the UK. The tax rate will depend on your individual circumstances and the type of annuity you have. You can find out more about the tax treatment of annuities in the UK at Is Annuity Income Taxable In Uk 2024.

Types of Annuities and Their Statements: Annuity Statement Is 2024

Different types of annuities have distinct features and statement formats. Understanding these differences is crucial for interpreting your annuity statement accurately.

Annuity is a popular choice for retirement planning because it offers a guaranteed stream of income for life. However, it’s important to understand that annuity is a voluntary retirement vehicle and not a requirement. You can find out more about annuities as a retirement vehicle at Annuity Is A Voluntary Retirement Vehicle 2024.

Types of Annuities and Their Statement Formats

Here’s a table summarizing the key characteristics of different annuity statements:

| Annuity Type | Statement Format | Key Features |

|---|---|---|

| Fixed Annuities | Standard statement format, with detailed information about interest rates, account balance, and withdrawals. | Guaranteed interest rate, predictable income stream, low risk. |

| Variable Annuities | Includes investment performance data, showing the value of underlying sub-accounts and potential gains or losses. | Investment growth potential, higher risk, variable income stream. |

| Indexed Annuities | Displays the performance of the underlying index and the interest rate credited to the account. | Potential for growth tied to a specific index, limited downside risk. |

Analyzing Annuity Statement Data

Analyzing annuity statement data is essential for tracking your investment performance and making informed financial decisions. By understanding the key metrics and trends, you can monitor your annuity’s growth and adjust your investment strategy if needed.

Annuity payments are generally considered earned income, which means they are subject to income tax. However, there are some exceptions to this rule, such as if the annuity is a qualified retirement plan. You can learn more about the tax treatment of annuity income at Is Annuity Earned Income 2024.

Tracking Investment Performance

Here’s how to analyze your annuity statement data to track investment performance:

- Compare Account Balances:Review the account balance over time to identify growth or decline. This helps assess the overall performance of your annuity.

- Analyze Interest Earned:Track the interest earned on your annuity, comparing it to the projected rate and market conditions. This provides insight into the performance of your investment.

- Review Withdrawals:Monitor your withdrawal activity, ensuring it aligns with your financial plan and does not negatively impact your long-term investment goals.

Calculating the Annual Rate of Return

To calculate the annual rate of return on your annuity, you can use the following formula:

Annual Rate of Return = [(Ending Account Balance

Whether an annuity is a good investment for you depends on your individual circumstances and financial goals. It’s important to weigh the pros and cons carefully before making a decision. You can find more information about annuities as an investment at Annuity Is It A Good Investment 2024.

Beginning Account Balance) + Withdrawals] / Beginning Account Balance

Annuity is a long-term investment that provides regular payments for a set period of time. It’s often used as a retirement vehicle, but there are many other ways to use an annuity. If you’re considering investing in an annuity, it’s important to understand how it works and the potential tax implications.

Annuity Is Perpetual 2024 is a good place to start.

For example, if your annuity’s beginning balance was $10,000, the ending balance was $11,000, and you made no withdrawals, the annual rate of return would be 10%.

Annuity Statement Security and Fraud Prevention

Safeguarding your annuity statements and protecting your personal information is paramount. Annuity fraud is a growing concern, so it’s essential to be aware of potential risks and take preventive measures.

Safeguarding Annuity Statements

- Secure Storage:Store your annuity statements in a safe and secure location, away from prying eyes.

- Shred Sensitive Documents:Dispose of old or outdated annuity statements by shredding them to prevent identity theft.

- Online Security:If you access your annuity statements online, use strong passwords and enable two-factor authentication for enhanced security.

Annuity Fraud Prevention

- Be Skeptical:Be wary of unsolicited calls, emails, or letters claiming to be from your annuity provider, especially if they ask for personal information.

- Verify Information:If you receive a suspicious communication, contact your annuity provider directly to verify its legitimacy.

- Report Suspicious Activity:If you suspect annuity fraud, report it to the authorities, including the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

Concluding Remarks

Navigating the world of annuity statements can seem daunting, but with the right knowledge and resources, it becomes a powerful tool for financial empowerment. As you analyze your annuity statement, remember to consider your investment goals, risk tolerance, and long-term financial plans.

By understanding the nuances of these statements and staying informed about industry updates, you can confidently manage your retirement savings and achieve your financial aspirations.

Question & Answer Hub

What are the main benefits of having an annuity?

Annuities offer a guaranteed stream of income for life, which can provide financial security during retirement. They also offer tax advantages and potential growth opportunities.

How often should I receive an annuity statement?

Most annuity providers issue statements quarterly or annually, depending on the type of annuity and your account settings.

What if I notice discrepancies or errors on my annuity statement?

Contact your annuity provider immediately to report any discrepancies or errors. They will investigate the issue and provide a resolution.

Annuity lottery is a type of lottery where the prize is paid out as an annuity. This means that the winner receives regular payments over a period of time, rather than a lump sum. You can find out more about annuity lotteries at Annuity Lottery 2024.

An annuity is a contract that provides a guaranteed stream of income for a set period of time. It’s often used as a retirement vehicle, but it can also be used for other purposes. You can learn more about the definition of an annuity at Annuity Is Definition 2024.

The permissibility of annuities in Islam is a complex issue that depends on a number of factors, including the specific terms of the annuity contract. It’s always a good idea to consult with a knowledgeable Islamic scholar to get guidance on this matter.

You can find out more about the permissibility of annuities in Islam at Is Annuity Halal 2024.

An annuity is a type of investment that provides regular payments for a set period of time. These payments are considered income and are generally subject to income tax. You can find out more about annuities as income at Annuity Is Income 2024.