Annuity Is Variable 2024, a concept that is gaining traction in the financial world, presents a unique approach to retirement planning. It offers a blend of growth potential and income security, making it an intriguing option for those seeking a diversified portfolio.

Annuity contracts can be complex. Annuity Explained 2024 breaks down the key features and benefits of annuities in an easy-to-understand way. This resource can help you grasp the basics and make informed decisions about annuities.

This article delves into the intricacies of variable annuities, exploring their features, benefits, risks, and how they differ from traditional fixed annuities.

With the ever-changing market landscape, understanding how variable annuities function in the context of 2024 is crucial. We will examine current market conditions, regulatory trends, and potential investment strategies to help you navigate this complex investment option.

Inheriting an annuity can bring both opportunities and questions. What Happens When I Inherit An Annuity 2024 explores the process of inheriting an annuity and the options available to you. It’s essential to understand your rights and responsibilities as a beneficiary.

Contents List

Understanding Variable Annuities

Variable annuities are a type of insurance contract that offers the potential for investment growth while providing some protection against market downturns. They are different from traditional fixed annuities, which guarantee a fixed rate of return. Variable annuities allow investors to allocate their premiums to a variety of sub-accounts, each of which invests in a different mutual fund or exchange-traded fund (ETF).

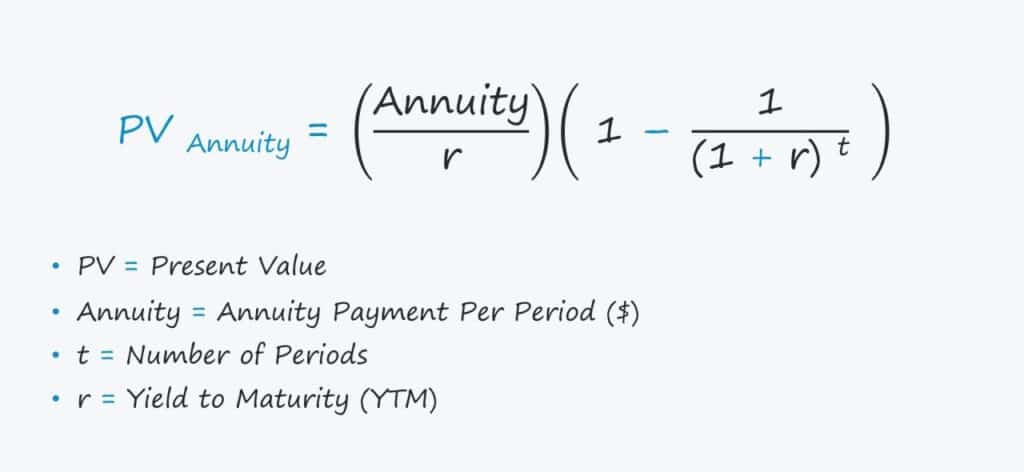

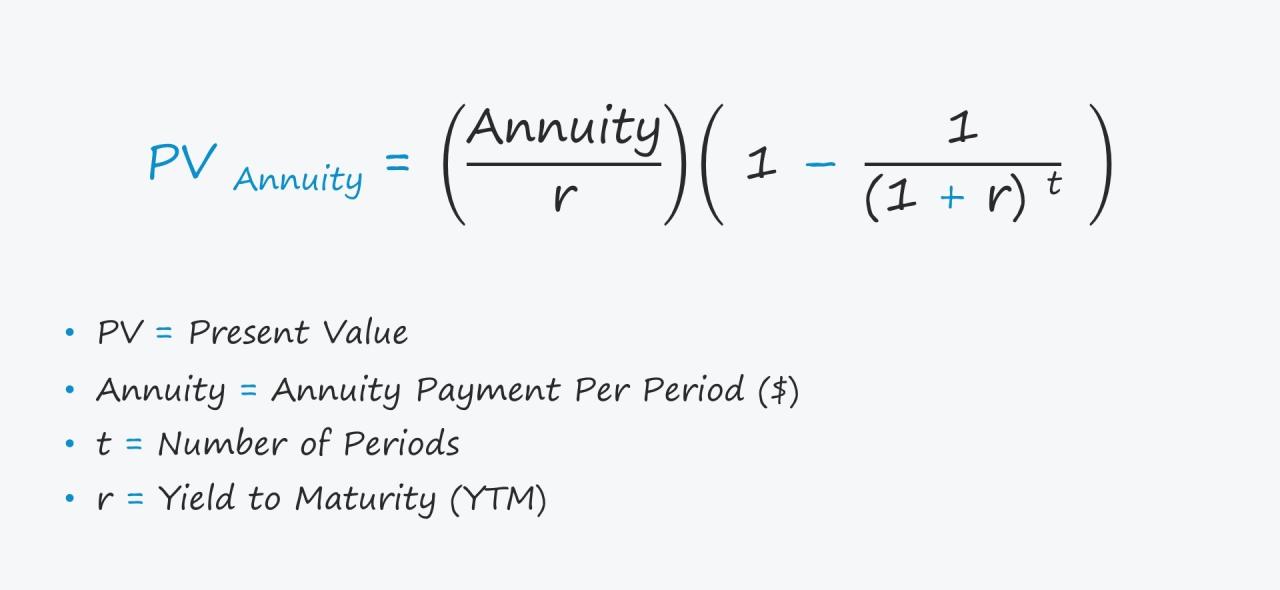

How does an annuity actually work? Annuity How It Works 2024 provides a step-by-step explanation of the annuity process, from the initial investment to the distribution of payments. Understanding how annuities work can help you determine if they’re a suitable investment for your financial goals.

The value of these sub-accounts fluctuates based on the performance of the underlying investments, so the returns on a variable annuity are not guaranteed.

Key Features of Variable Annuities

- Investment Growth Potential:Variable annuities offer the potential for higher returns than fixed annuities, as the value of the sub-accounts can increase over time.

- Tax Deferral:Earnings from variable annuities are not taxed until they are withdrawn, providing tax advantages for long-term investors.

- Death Benefit:Many variable annuities include a death benefit that guarantees a minimum payout to beneficiaries if the annuitant dies before the annuity begins.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income payments or protection against market losses.

How Variable Annuities Differ from Fixed Annuities

Variable annuities differ from fixed annuities in several key ways:

- Returns:Fixed annuities guarantee a fixed rate of return, while variable annuities offer the potential for higher returns but also the risk of losses.

- Investment Control:Investors have more control over their investments in variable annuities, as they can choose from a variety of sub-accounts.

- Fees:Variable annuities typically have higher fees than fixed annuities, due to the investment management and administrative costs.

Examples of Investment Options in Variable Annuities

Variable annuities offer a wide range of investment options, including:

- Equity Funds:Invest in stocks and offer the potential for high growth.

- Bond Funds:Invest in bonds and offer lower risk and potentially lower returns than equity funds.

- Target-Date Funds:Designed to adjust their asset allocation over time, becoming more conservative as retirement approaches.

- Money Market Funds:Invest in short-term debt securities and offer low risk and liquidity.

Variable Annuities in 2024

The current market conditions and regulatory landscape are shaping the outlook for variable annuities in 2024.

Winning the lottery can be life-changing, but how does an annuity play into it? Annuity Lottery 2024 examines the concept of receiving lottery winnings in the form of an annuity. This option can offer a steady stream of income over time.

Current Market Conditions and Their Impact

The current market is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors are likely to impact the performance of variable annuities in the following ways:

- Volatility:Increased market volatility can lead to greater fluctuations in the value of sub-accounts, making it more difficult to predict returns.

- Interest Rates:Rising interest rates can make it more expensive for insurance companies to offer variable annuities, potentially leading to higher fees.

- Inflation:Inflation erodes the purchasing power of returns, making it harder to achieve financial goals.

Regulatory Changes and Industry Trends

The insurance industry is constantly evolving, and there are several regulatory changes and industry trends that could impact variable annuities in 2024.

- Increased Scrutiny:Regulators are paying more attention to the fees and disclosures associated with variable annuities, aiming to protect consumers.

- Focus on Transparency:The industry is moving towards greater transparency in fees and investment options, making it easier for investors to compare products.

- Innovation in Products:Insurance companies are developing new variable annuity products with features designed to meet the changing needs of investors.

Potential Investment Strategies for Variable Annuities

Given the current market conditions, investors may consider the following strategies when investing in variable annuities:

- Diversification:Allocate investments across a range of asset classes to reduce risk.

- Long-Term Perspective:Avoid making short-term investment decisions based on market fluctuations.

- Fee-Consciousness:Carefully consider the fees associated with different variable annuity products.

Advantages and Disadvantages of Variable Annuities

Variable annuities offer both potential benefits and risks. It’s important to carefully weigh these factors before making a decision.

An annuity is primarily used to provide a stream of income, often during retirement. An Annuity Is Primarily Used To Provide 2024 explains how annuities can help ensure a consistent income stream for the future. They can be a valuable tool for financial planning and retirement security.

Potential Benefits of Variable Annuities

- Growth Potential:The potential for higher returns than fixed annuities can help investors reach their financial goals faster.

- Tax Deferral:Earnings are not taxed until withdrawn, allowing for tax-efficient growth over time.

- Protection Against Market Downturns:Some variable annuities offer guarantees that protect against market losses, providing peace of mind.

Potential Risks of Variable Annuities, Annuity Is Variable 2024

- Market Volatility:The value of sub-accounts can fluctuate based on market conditions, leading to potential losses.

- Fees:Variable annuities typically have higher fees than fixed annuities, which can erode returns.

- Complexity:Variable annuities can be complex, requiring investors to understand the investment options and risks involved.

Comparison with Other Investment Options

Variable annuities are just one investment option among many. It’s important to compare them with other investment options, such as mutual funds, exchange-traded funds (ETFs), and individual stocks.

- Mutual Funds and ETFs:Offer lower fees and more investment flexibility than variable annuities, but may not provide the same level of protection against market losses.

- Individual Stocks:Offer the potential for higher returns but also higher risk. They may not provide the same level of diversification or protection as variable annuities.

Considerations for Choosing a Variable Annuity

When choosing a variable annuity, it’s important to consider several key factors.

While annuities can be structured in various ways, they often involve a single lump sum payment. Annuity Is A Single Sum 2024 explores this concept and explains how a single sum payment can be used to fund an annuity.

Key Factors to Consider

- Fees:Carefully review the fees associated with the annuity, including management fees, administrative fees, and surrender charges.

- Investment Options:Choose an annuity with a wide range of investment options that align with your investment goals and risk tolerance.

- Guarantees:Understand the guarantees offered by the annuity, such as death benefits, living benefits, and minimum income payments.

- Financial Advisor:Consult with a qualified financial advisor who can help you understand the risks and benefits of variable annuities and choose the right product for your needs.

Research and Comparison

Before choosing a variable annuity, it’s essential to research and compare different products. Consider the following:

- Read Product Disclosures:Carefully review the prospectus and other product disclosures to understand the fees, risks, and benefits.

- Compare Fees and Investment Options:Compare the fees and investment options of different variable annuities to find the best value.

- Seek Independent Advice:Consult with a financial advisor who can provide unbiased advice and help you choose the right product.

Working with Financial Advisors

A financial advisor can play a valuable role in helping you choose a variable annuity. Here’s how to work with them:

- Clearly Define Your Goals:Explain your financial goals, risk tolerance, and time horizon to your advisor.

- Ask Questions:Don’t hesitate to ask questions about the fees, risks, and benefits of variable annuities.

- Get Recommendations:Ask your advisor for recommendations on variable annuity products that meet your needs.

Case Studies and Examples

Here are some examples of how variable annuities might be used in a financial plan:

Hypothetical Scenario

John is a 55-year-old investor with a long-term investment horizon. He is looking for a way to grow his savings for retirement while also protecting against market downturns. He decides to invest in a variable annuity with a guaranteed minimum income benefit.

Understanding the Annuity Exclusion Ratio 2024 is crucial when considering annuities. This ratio determines how much of your annuity payments are considered taxable income. It’s a key factor in evaluating the overall financial benefits of an annuity.

This benefit provides him with a guaranteed stream of income during retirement, even if the market performs poorly. He allocates his investments across a range of asset classes, including equity funds, bond funds, and target-date funds, to diversify his portfolio and reduce risk.

Tax implications are important to consider when dealing with annuities. Is Annuity From Lic Taxable 2024 provides insight into the taxability of annuities. Understanding the tax rules surrounding annuities can help you make informed financial decisions.

Table Comparing Performance

| Investment Option | Average Annual Return (5 Years) |

|---|---|

| Equity Fund | 10.0% |

| Bond Fund | 5.0% |

| Target-Date Fund | 7.5% |

This table shows the average annual returns of different variable annuity investment options over a five-year period. As you can see, equity funds have the potential for higher returns but also higher risk. Bond funds offer lower risk and potentially lower returns.

Annuity is a word that can be easily unscrambled. Annuity Unscramble 2024 is a fun way to test your vocabulary skills and learn about annuities in a lighthearted way.

Target-date funds provide a balanced approach, adjusting their asset allocation over time.

An Annuity Certain Is An Example Of 2024 provides guaranteed payments for a fixed period, regardless of your lifespan. This type of annuity can offer peace of mind, knowing you’ll receive regular income for a specific duration.

Visual Representation of Growth and Risk

A visual representation of the potential growth and risk associated with a variable annuity investment might show a graph with two lines. The first line represents the potential growth of the investment, which could be upward sloping with some fluctuations.

The second line represents the potential for losses, which could be downward sloping with steeper fluctuations. The gap between the two lines represents the potential range of outcomes, illustrating the risk and reward associated with the investment.

Annuities can be structured to provide payments for a specific duration or indefinitely. Annuity Is Indefinite Duration 2024 explores the concept of annuities with no predetermined end date. This type of annuity can be particularly appealing for those seeking long-term financial security.

Last Word: Annuity Is Variable 2024

Variable annuities, like any investment, come with their own set of advantages and disadvantages. While they offer the potential for growth, it’s essential to acknowledge the inherent risks associated with market volatility. Understanding these factors, considering your financial goals, and seeking expert guidance are crucial steps in determining if a variable annuity aligns with your individual needs.

Expert Answers

What is the difference between a fixed annuity and a variable annuity?

An Annuity Home Loan 2024 is a mortgage option where you make fixed monthly payments for a set period. This type of loan can offer predictable budgeting and financial stability. It’s important to compare different loan options before making a decision.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments. This means that the value of a variable annuity can fluctuate with market conditions.

Are variable annuities suitable for everyone?

Are you wondering if an annuity is a type of life insurance? Is Annuity Life Insurance 2024 explores the differences between these financial products. Understanding their distinct characteristics can help you determine which option best suits your needs.

Variable annuities are best suited for individuals with a longer investment horizon and a higher risk tolerance, as they offer the potential for growth but also carry the risk of loss.

The Annuity Method 2024 refers to the specific way an annuity is structured and how payments are calculated. There are different methods available, each with its own advantages and disadvantages. It’s essential to choose the method that best aligns with your financial goals and risk tolerance.

What are the tax implications of variable annuities?

Wondering if Annuity Gator is a legit company in 2024? Is Annuity Gator Legit 2024 dives into the details, helping you make an informed decision. It’s important to understand the ins and outs of annuities before investing, and this article can help you navigate the complexities.

The tax implications of variable annuities can be complex and depend on various factors, such as the type of annuity, the investment options chosen, and the distribution method. It is essential to consult with a tax professional to understand the specific tax implications for your situation.