Annuity Is Which Account 2024: As you approach retirement, ensuring a steady income stream becomes paramount. Annuities, often viewed as a complex financial instrument, can play a crucial role in achieving your financial goals. This guide delves into the intricacies of annuities, demystifying their workings and exploring their potential benefits in retirement planning.

From understanding the various types of annuities available to navigating the tax implications and selecting the right provider, we’ll equip you with the knowledge to make informed decisions about incorporating annuities into your retirement strategy.

Contents List

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments for a specific period. It is a contract between you and an insurance company where you make a lump sum payment or a series of payments in exchange for guaranteed income payments in the future.

Think of it like a retirement savings plan that provides a steady income stream once you retire.

Types of Annuities

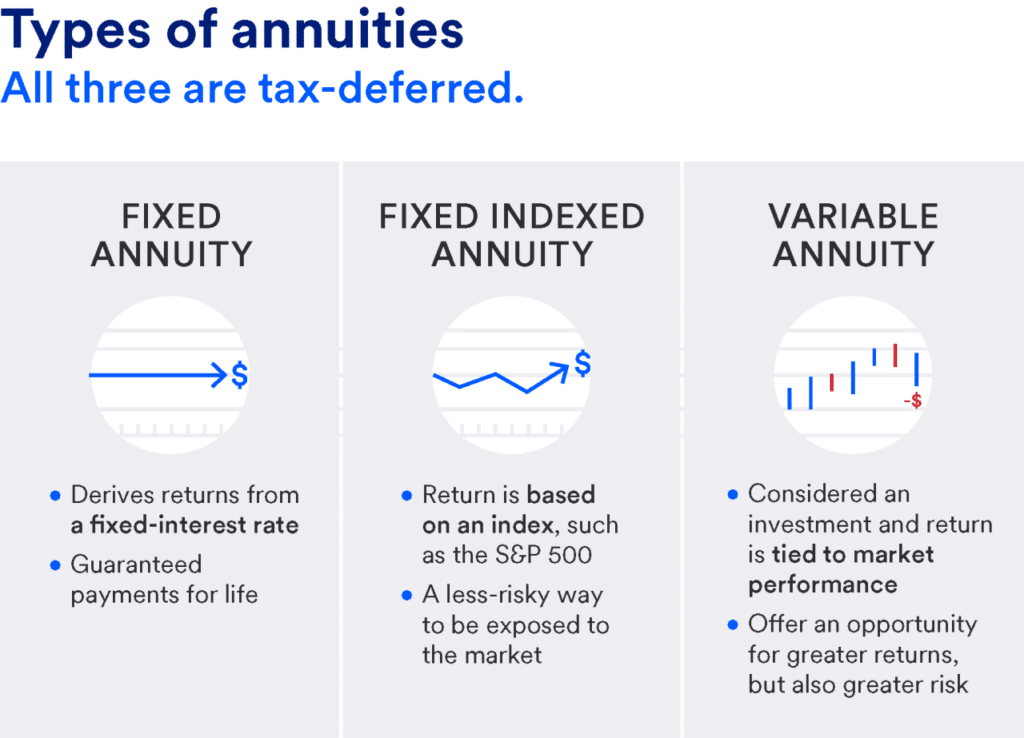

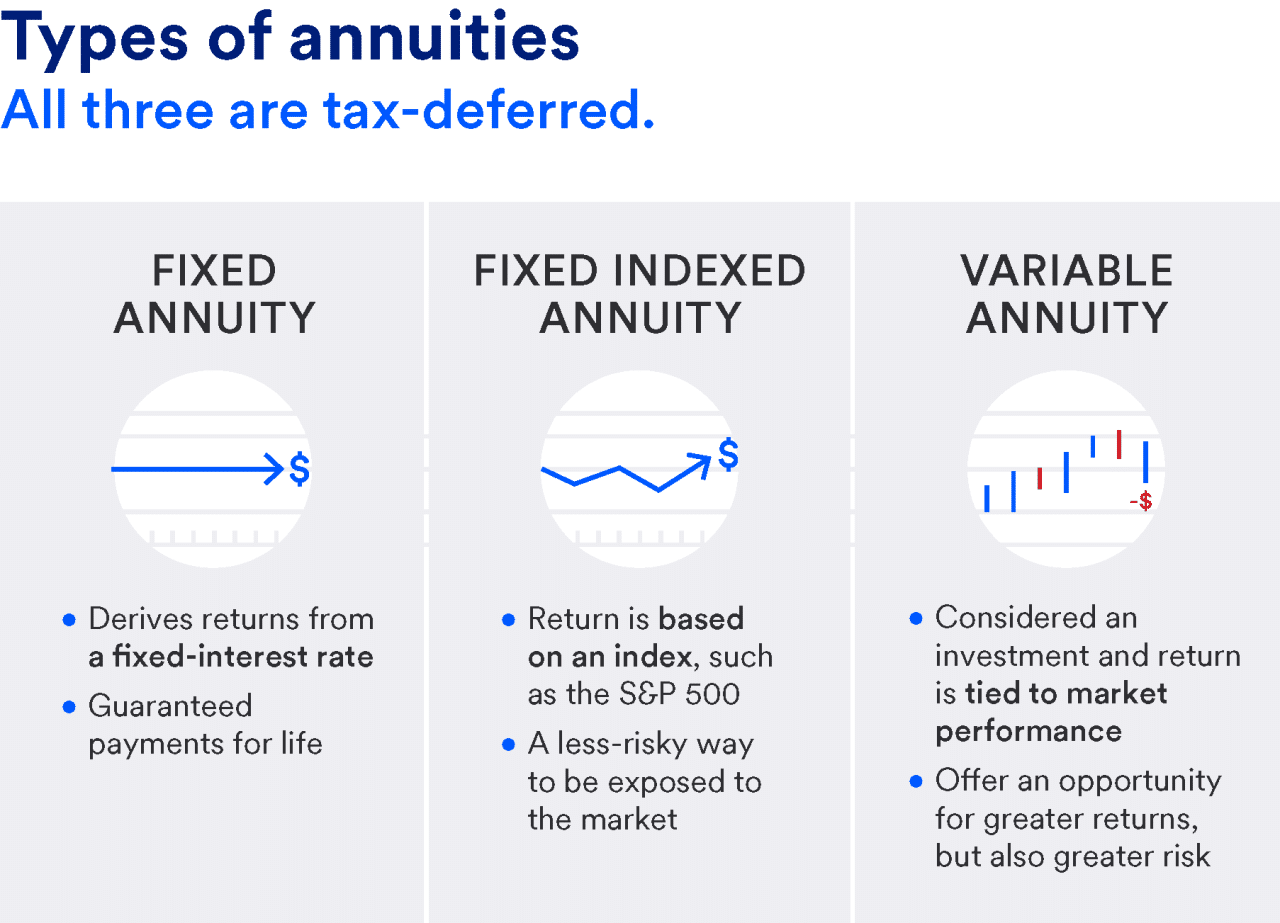

Annuities come in various forms, each with its own set of features and benefits. Here are some common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment. The payments you receive are fixed and predictable, regardless of market fluctuations. They provide stability and security, making them ideal for individuals seeking guaranteed income.

- Variable Annuities:These annuities offer the potential for higher returns but also carry a higher risk. The payments you receive are tied to the performance of the underlying investments, which could fluctuate based on market conditions. Variable annuities are suitable for investors who are comfortable with a higher level of risk in pursuit of potential growth.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. They are ideal for individuals who need a steady income stream right away, such as retirees who have just left the workforce.

- Deferred Annuities:These annuities start making payments at a later date, often during retirement. They allow you to accumulate wealth over time and defer taxes on your earnings until you begin receiving payments.

Key Features and Benefits of Annuities

Annuities offer several key features and benefits that make them attractive to investors:

- Guaranteed Income:Many annuities provide guaranteed income payments for life, ensuring a steady stream of income even if you live longer than expected.

- Tax Deferral:The earnings from an annuity are typically tax-deferred, meaning you won’t have to pay taxes on them until you begin receiving payments.

- Protection from Market Volatility:Fixed annuities offer protection from market fluctuations, providing stability and peace of mind.

- Death Benefit:Some annuities offer a death benefit, which pays out to your beneficiary if you pass away before the annuity payments are exhausted.

How Annuities Work

An annuity works by converting a lump sum payment or a series of payments into a stream of regular income payments. Here’s how it works:

Purchasing an Annuity, Annuity Is Which Account 2024

You can purchase an annuity with a lump sum payment or through regular contributions. The amount you pay determines the size of the annuity payments you will receive.

Receiving Payments

Once you purchase an annuity, you will begin receiving payments according to the terms of the contract. The frequency of payments can be monthly, quarterly, annually, or even in a lump sum.

Interest Rates and Investment Growth

The interest rates and investment growth play a crucial role in determining the size of your annuity payments.

- Fixed Annuities:The interest rate is fixed for the duration of the contract, guaranteeing a predictable income stream.

- Variable Annuities:The payments are tied to the performance of the underlying investments, which can fluctuate based on market conditions. The interest rate is not fixed and can vary over time.

Funding an Annuity

You can fund an annuity in several ways:

- Lump Sum Payment:You can purchase an annuity with a single lump sum payment.

- Regular Contributions:You can make regular contributions to an annuity over time, such as monthly payments.

Annuities and Retirement Planning: Annuity Is Which Account 2024

Annuities play a significant role in retirement income planning, providing a guaranteed income stream that can help you meet your financial needs during your golden years.

Guaranteed Income Streams

Annuities can provide guaranteed income streams, ensuring you have a steady source of income even if you live longer than expected. This can help you avoid running out of money in retirement and maintain a comfortable lifestyle.

Comparison with Other Retirement Savings Options

Annuities are often compared to other retirement savings options such as 401(k)s and IRAs. While 401(k)s and IRAs offer tax-deferred growth, they do not provide guaranteed income streams. Annuities, on the other hand, can provide guaranteed income payments, offering a greater level of certainty in retirement.

- 401(k):A 401(k) is a retirement savings plan offered by employers. Contributions are typically made through payroll deductions and grow tax-deferred. However, 401(k)s do not provide guaranteed income streams. You are responsible for managing your investments and withdrawals in retirement.

- IRA:An IRA is an individual retirement account that allows you to save for retirement. Contributions are tax-deductible, and earnings grow tax-deferred. Like 401(k)s, IRAs do not provide guaranteed income streams.

Annuities and Taxes

Understanding the tax implications of annuities is crucial for maximizing your returns and minimizing your tax liabilities.

Tax Implications of Annuity Payments

The tax treatment of annuity payments depends on the type of annuity and the specific terms of the contract.

- Fixed Annuities:Payments from fixed annuities are typically taxed as ordinary income.

- Variable Annuities:Payments from variable annuities are taxed as a combination of ordinary income and capital gains.

Tax Treatment of Annuity Contributions and Withdrawals

Annuity contributions are not tax-deductible, but the earnings on the contributions are typically tax-deferred until you begin receiving payments.

Tips for Minimizing Tax Liabilities

Here are some tips for minimizing your tax liabilities associated with annuities:

- Consider a Deferred Annuity:A deferred annuity allows you to defer taxes on your earnings until you begin receiving payments.

- Take Advantage of Tax-Advantaged Accounts:You can use tax-advantaged accounts such as 401(k)s and IRAs to shelter your annuity contributions from taxes.

- Consult with a Tax Advisor:A tax advisor can help you develop a tax strategy that minimizes your tax liabilities.

Considerations When Choosing an Annuity

Choosing the right annuity is essential for meeting your financial goals. Here are some key factors to consider:

Interest Rates and Fees

The interest rate offered by an annuity determines the size of your payments. Higher interest rates lead to larger payments. You should also consider the fees associated with the annuity, such as administrative fees, surrender charges, and mortality and expense charges.

Guarantees

Some annuities offer guarantees, such as a guaranteed rate of return or a guaranteed minimum income stream. These guarantees can provide peace of mind and protect your investment from market fluctuations.

Annuity Providers

Different annuity providers offer various types of annuities with different features and benefits. You should compare and contrast the offerings of different providers to find the best option for your needs.

Suitability for Individual Financial Goals

Before purchasing an annuity, it’s essential to assess whether it’s suitable for your individual financial goals. Consider your risk tolerance, time horizon, and income needs.

- Risk Tolerance:Are you comfortable with a higher level of risk in pursuit of potential growth, or do you prefer a more conservative approach with a guaranteed income stream?

- Time Horizon:How long do you plan to hold the annuity? A longer time horizon may allow you to take on more risk.

- Income Needs:How much income do you need in retirement? Annuities can help you meet your income needs and ensure a comfortable lifestyle.

Annuities in 2024

The annuity market is constantly evolving, with new products and features emerging to meet the changing needs of investors.

Recent Changes and Trends

In recent years, there has been a growing trend towards variable annuities, which offer the potential for higher returns but also carry a higher level of risk. This is due to the low interest rate environment, which has made fixed annuities less attractive to investors.

Opportunities and Challenges

Annuities offer both opportunities and challenges for investors in 2024.

- Opportunities:Annuities can provide a guaranteed income stream, which can be valuable in a volatile market. They can also offer tax-deferred growth, which can help you maximize your returns.

- Challenges:Annuities can be complex products with high fees. You should carefully consider the terms of the contract and compare different providers before making a decision.

Market Conditions and Annuity Performance

Market conditions can significantly impact annuity performance. For example, rising interest rates can make fixed annuities more attractive, while falling interest rates can make variable annuities more appealing.

Final Thoughts

Annuities, when carefully considered and chosen, can offer a valuable tool for retirement income planning. By understanding their features, benefits, and potential drawbacks, you can determine if they align with your individual financial objectives. Whether you’re seeking guaranteed income streams, tax advantages, or simply a way to diversify your retirement portfolio, annuities can potentially enhance your overall financial security.

Questions Often Asked

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments. Fixed annuities offer stability and predictable income, while variable annuities offer the potential for higher returns but also carry greater risk.

Are annuities right for everyone?

Not necessarily. Annuities can be beneficial for individuals seeking guaranteed income, tax advantages, and potential growth, but they may not be suitable for everyone. It’s essential to assess your individual financial goals, risk tolerance, and time horizon before making a decision.

What are the fees associated with annuities?

Annuities come with various fees, including administrative fees, mortality and expense charges, and surrender charges. It’s important to carefully review the fee structure before investing in an annuity.