Annuity Withdrawal Calculator 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuity withdrawal calculators are powerful tools that can help individuals plan for their retirement by projecting how long their annuity payments will last, based on various factors like starting balance, withdrawal rate, and investment growth.

Annuity terms can be a bit confusing, but Annuity Is Term 2024 breaks down the concept of annuity terms and their implications.

These calculators provide valuable insights into how different choices can impact the longevity of retirement funds, allowing individuals to make informed decisions about their financial future.

Whether you’re nearing retirement or just starting to plan for the future, understanding how an annuity withdrawal calculator works is crucial. This guide delves into the intricacies of these calculators, exploring their features, calculation methods, and practical applications. We’ll uncover how these tools can help you optimize your retirement income and make the most of your hard-earned savings.

The LIC annuity number is a unique identifier for your annuity policy. Annuity Number Lic 2024 provides information on obtaining and understanding your LIC annuity number.

Contents List

Annuity Withdrawal Calculator Overview

An annuity withdrawal calculator is a valuable tool that helps individuals estimate their potential income stream from an annuity contract over time. It provides a detailed projection of how much you can withdraw from your annuity each year, taking into account various factors like your initial investment, interest rate, and withdrawal rate.

There are many different types of annuities available, and choosing the right one can be a challenge. Annuity Uncertain 2024 explores the various types of annuities and the factors to consider when making a decision.

This calculator is particularly beneficial for retirees looking to create a sustainable income plan and ensure their financial security throughout their golden years.

An annuity is a financial product that provides a stream of payments over a set period of time. You might be wondering, “What is an annuity?” Well, An Annuity Is 2024 is a great place to start understanding the basics of annuities.

Primary Purposes and Benefits

The primary purpose of an annuity withdrawal calculator is to help individuals understand how their annuity will perform over time. It allows them to:

- Estimate their potential income stream: By inputting their annuity details, individuals can project their annual withdrawals, providing a clear picture of their future income.

- Assess the longevity of their annuity: The calculator helps determine how long their annuity funds will last, considering their withdrawal rate and investment growth.

- Compare different withdrawal strategies: By adjusting the withdrawal rate and other parameters, individuals can explore various scenarios and find the best strategy to meet their financial goals.

- Make informed decisions about their retirement planning: Armed with the insights from the calculator, individuals can confidently make decisions about their spending, investments, and overall retirement plan.

Real-World Scenarios

An annuity withdrawal calculator can be extremely useful in various real-world scenarios, such as:

- Retirement planning: Individuals can use the calculator to estimate their retirement income and plan their expenses accordingly.

- Estate planning: The calculator can help individuals determine how much they can leave to their beneficiaries after their lifetime annuity payments.

- Financial planning for long-term care: Individuals can use the calculator to assess their annuity’s potential to cover long-term care expenses.

- Decision-making for early retirement: The calculator can provide insights into the sustainability of early retirement based on annuity withdrawals.

Key Features and Inputs

Annuity withdrawal calculators typically incorporate various features and inputs to provide accurate projections. Some of the key elements include:

Essential Features and Inputs

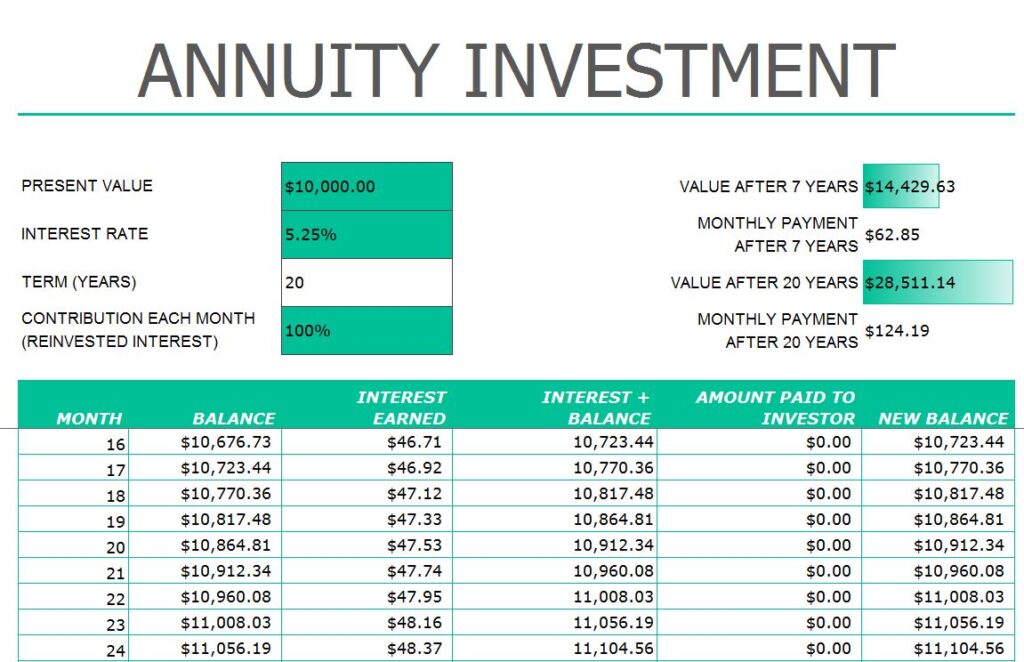

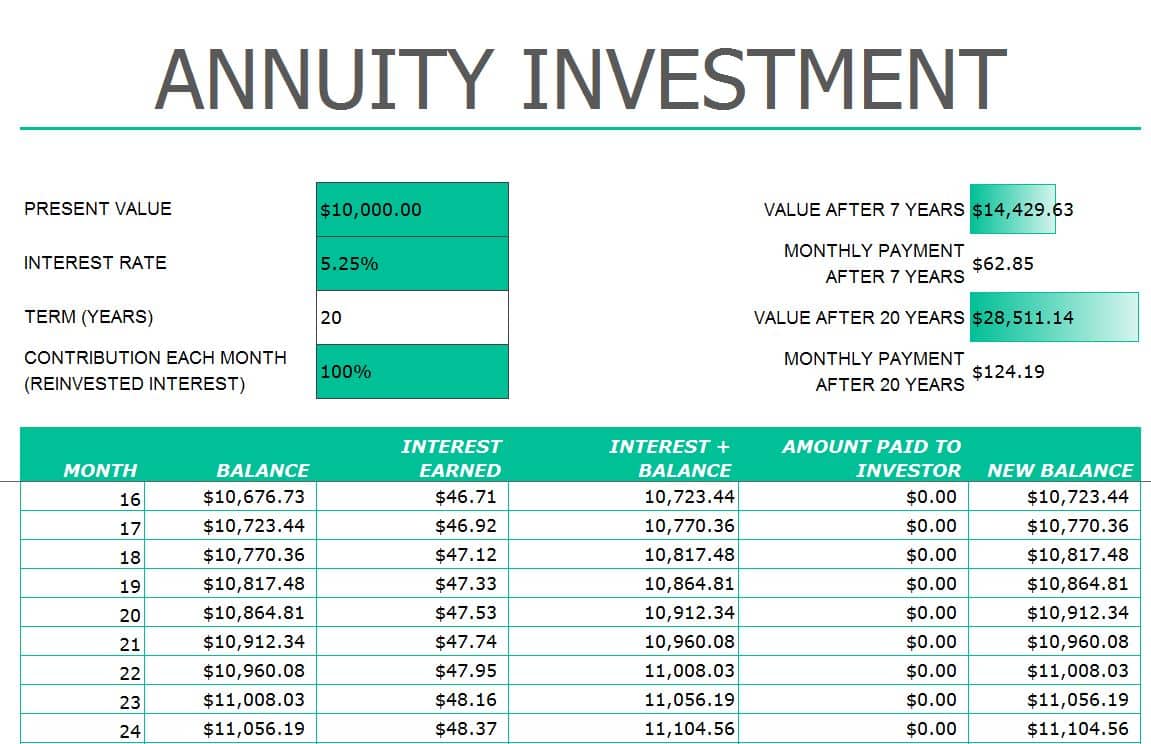

- Starting Balance: The initial amount invested in the annuity, which serves as the foundation for future withdrawals and growth.

- Withdrawal Rate: The percentage of the annuity balance that is withdrawn annually. This rate determines the amount of income generated each year.

- Investment Growth Rate: The anticipated annual return on the annuity investment. This rate reflects the expected growth of the annuity over time.

- Inflation Rate: The projected annual increase in the cost of goods and services. This factor is crucial for adjusting withdrawals to maintain purchasing power over time.

- Time Horizon: The duration for which the annuity payments are projected, typically representing the individual’s expected lifespan or retirement period.

- Tax Rate: The applicable tax rate on annuity withdrawals, which influences the after-tax income received.

Impact of Input Values

The values of these inputs significantly influence the projected annuity duration and income stream. For instance, a higher starting balance or investment growth rate generally leads to a longer annuity duration and higher annual withdrawals. Conversely, a higher withdrawal rate or inflation rate can shorten the annuity duration and reduce the purchasing power of withdrawals.

If you’re looking for information about annuity health services in Westmont, Illinois, Annuity Health Westmont Il 2024 provides a helpful resource with details on local providers and options.

| Input | Value | Projected Annuity Duration (Years) |

|---|---|---|

| Starting Balance | $100,000 | 25 |

| $200,000 | 35 | |

| Withdrawal Rate | 4% | 30 |

| 6% | 20 | |

| Investment Growth Rate | 5% | 25 |

| 7% | 30 |

Calculation Methods and Assumptions

Annuity withdrawal calculators employ various calculation methods to project future income streams and annuity durations. These methods are based on underlying assumptions that can impact the accuracy of the projections.

An ordinary annuity is a common type of annuity. To understand the nuances of ordinary annuities, Annuity Is Ordinary 2024 provides a clear explanation of this type of annuity.

Common Calculation Methods

- Fixed Annuity Method: This method assumes a fixed annual withdrawal amount throughout the annuity period, ignoring investment growth and inflation. It provides a simple but potentially inaccurate estimate.

- Variable Annuity Method: This method accounts for investment growth and inflation, adjusting the annual withdrawal amount accordingly. It provides a more realistic projection but relies on assumptions about future market performance.

- Monte Carlo Simulation: This advanced method uses random simulations to generate a range of possible outcomes based on different market scenarios. It provides a more comprehensive and robust projection but can be complex to understand.

Underlying Assumptions

The accuracy of annuity withdrawal calculations depends on the underlying assumptions used. Some common assumptions include:

- Investment Returns: The calculator assumes a specific investment growth rate, which can vary depending on market conditions and investment strategy.

- Inflation Rate: The calculator assumes a specific inflation rate, which can fluctuate over time and impact the purchasing power of withdrawals.

- Withdrawal Rate: The calculator assumes a consistent withdrawal rate throughout the annuity period, which may not reflect real-world circumstances.

- Tax Rate: The calculator assumes a specific tax rate on annuity withdrawals, which can change over time and impact after-tax income.

Comparison of Methods

| Method | Strengths | Limitations |

|---|---|---|

| Fixed Annuity Method | Simple and easy to understand | Ignores investment growth and inflation, potentially inaccurate |

| Variable Annuity Method | Accounts for investment growth and inflation, more realistic | Relies on assumptions about future market performance, can be sensitive to changes in market conditions |

| Monte Carlo Simulation | Provides a range of possible outcomes, more comprehensive and robust | Complex to understand, can be computationally intensive |

Factors Influencing Annuity Withdrawals

Several factors can influence annuity withdrawal strategies and the overall longevity of annuity funds. It is essential to consider these factors when planning withdrawals.

For those interested in understanding annuities in Tamil, Annuity Meaning In Tamil 2024 provides a detailed explanation of the concept in the Tamil language.

Key Factors

- Inflation: Inflation erodes the purchasing power of money over time. It is crucial to consider inflation when planning withdrawals to maintain a consistent standard of living.

- Taxes: Annuity withdrawals are generally taxable income. Understanding the tax implications of withdrawals is essential for maximizing after-tax income.

- Market Volatility: Market fluctuations can impact the value of the annuity investment and affect the amount available for withdrawal.

- Personal Financial Goals: Individuals’ financial goals, such as retirement income needs, estate planning objectives, and long-term care expenses, can influence their withdrawal strategies.

- Risk Tolerance: Individuals’ risk tolerance determines their willingness to accept market volatility and potential fluctuations in their annuity income.

Impact of Inflation, Taxes, and Market Volatility

Inflation can significantly impact annuity withdrawals. To maintain purchasing power, individuals may need to adjust their withdrawal rate over time to keep pace with rising prices. Taxes can also reduce the after-tax income from annuity withdrawals. It is essential to consider the tax implications when planning withdrawals to maximize net income.

A perpetual annuity is a type of annuity that pays out indefinitely. Annuity Is Perpetual 2024 explores the characteristics and implications of perpetual annuities.

Market volatility can create uncertainty in annuity income. Individuals with a lower risk tolerance may prefer to withdraw a smaller amount to minimize potential losses.

When looking into annuities, you’ll often hear the term “annuity.” Annuity Is 2024 provides a simple explanation of this term and its significance in the financial world.

Role of Personal Financial Goals and Risk Tolerance, Annuity Withdrawal Calculator 2024

Individuals’ financial goals play a crucial role in determining their annuity withdrawal strategy. For example, someone with a long-term care plan may withdraw more from their annuity to cover potential expenses. Risk tolerance also influences withdrawal decisions. Individuals with a higher risk tolerance may be willing to accept more volatility in their annuity income, while those with a lower risk tolerance may prefer a more conservative approach.

Kathy’s experience with annuities might be helpful to you. Kathy’s Annuity Is Currently Experiencing 2024 provides a real-world example of an annuity and its potential impact.

Practical Applications and Considerations

Annuity withdrawal calculators are valuable tools for retirement planning and other financial decisions. They provide insights into the potential income stream and longevity of annuity funds, allowing individuals to make informed choices about their financial future.

If you’re considering an annuity, it’s important to understand the options available to you. Annuity Options 2024 provides an overview of the different types of annuities and their features.

Retirement Planning

Annuity withdrawal calculators can help individuals estimate their retirement income needs and plan their expenses accordingly. By adjusting the withdrawal rate and other parameters, individuals can explore different scenarios and determine the best strategy to meet their retirement goals.

An annuity is essentially a series of payments. An Annuity Is A Series Of 2024 delves deeper into the structure of annuities and how payments are distributed over time.

Adjusting Withdrawal Strategies

It is essential to adjust annuity withdrawal strategies based on changing circumstances, such as unexpected expenses, changes in market conditions, or changes in health status. Annuity withdrawal calculators can help individuals assess the impact of these changes and adjust their withdrawal plan accordingly.

One of the key features of an annuity is its tax-deferred status. Is Annuity Tax Deferred 2024 explains the tax implications of annuities and how they can impact your financial planning.

Minimizing Taxes and Maximizing Longevity

To minimize taxes and maximize the longevity of annuity funds, individuals can consider strategies such as:

- Tax-efficient withdrawal strategies: Utilizing strategies such as Roth conversions or qualified charitable distributions can minimize tax liabilities on annuity withdrawals.

- Withdrawal timing: Carefully timing withdrawals to take advantage of tax breaks or minimize tax liability can help preserve annuity funds for a longer period.

- Investment diversification: Diversifying investments within the annuity can help mitigate risk and potentially enhance long-term growth.

Resources and Tools: Annuity Withdrawal Calculator 2024

There are numerous online resources and tools available to help individuals plan their annuity withdrawals. Here are some reputable options:

Online Annuity Withdrawal Calculators

| Calculator | Features | Link |

|---|---|---|

| [Calculator Name 1] | [List of features] | [Link to calculator] |

| [Calculator Name 2] | [List of features] | [Link to calculator] |

| [Calculator Name 3] | [List of features] | [Link to calculator] |

Informative Articles and Guides

- [Link to article 1]

- [Link to article 2]

- [Link to article 3]

Closure

As you embark on your retirement planning journey, utilizing an annuity withdrawal calculator can be an invaluable asset. By considering the factors discussed in this guide, you can gain a comprehensive understanding of your annuity’s potential and make informed decisions that align with your financial goals and aspirations.

Remember, a well-planned retirement strategy, informed by reliable tools and resources, can pave the way for a secure and fulfilling future.

FAQ

What is the difference between a fixed and variable annuity?

Annuity health plans can be an important part of retirement planning. Annuity Health 2024 delves into the details of annuity health plans and their benefits.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments, offering potential for higher growth but also greater risk.

How often can I withdraw from my annuity?

The withdrawal frequency depends on the terms of your annuity contract. Some annuities allow monthly withdrawals, while others may have different payout schedules.

Can I withdraw more than my required minimum distribution?

Yes, you can usually withdraw more than the minimum distribution, but doing so may shorten the lifespan of your annuity.

What happens if I die before my annuity is fully withdrawn?

If you’re interested in learning more about annuities in Hindi, Annuity Ka Hindi Meaning 2024 offers a comprehensive explanation of the concept in the Hindi language.

The remaining balance of your annuity may be paid out to a beneficiary, according to the terms of your contract.

Are there any tax implications for annuity withdrawals?

Yes, annuity withdrawals are generally taxed as ordinary income. Consult a financial advisor for specific tax guidance.