Annuity V Ira 2024 – Annuity vs. IRA 2024: Navigating these two popular retirement investment options can be overwhelming. Both offer tax advantages and potential for growth, but understanding their key differences is crucial for making informed financial decisions. This guide delves into the intricacies of annuities and IRAs, highlighting their strengths, weaknesses, and suitability for various financial situations.

Wondering if the interest earned on your annuity is taxable in 2024? You’re not alone! It’s a common question, and the answer can vary depending on the type of annuity you have. Check out this article: Is Annuity Interest Taxable 2024 for a clear explanation.

From the various types of annuities and IRAs to their tax implications and contribution limits, we’ll explore the factors that may influence your choice. We’ll also examine the latest tax laws and regulations for 2024, ensuring you’re equipped with the knowledge to make informed decisions about your retirement savings.

Contents List

Annuities vs. IRAs: A Comprehensive Guide for 2024

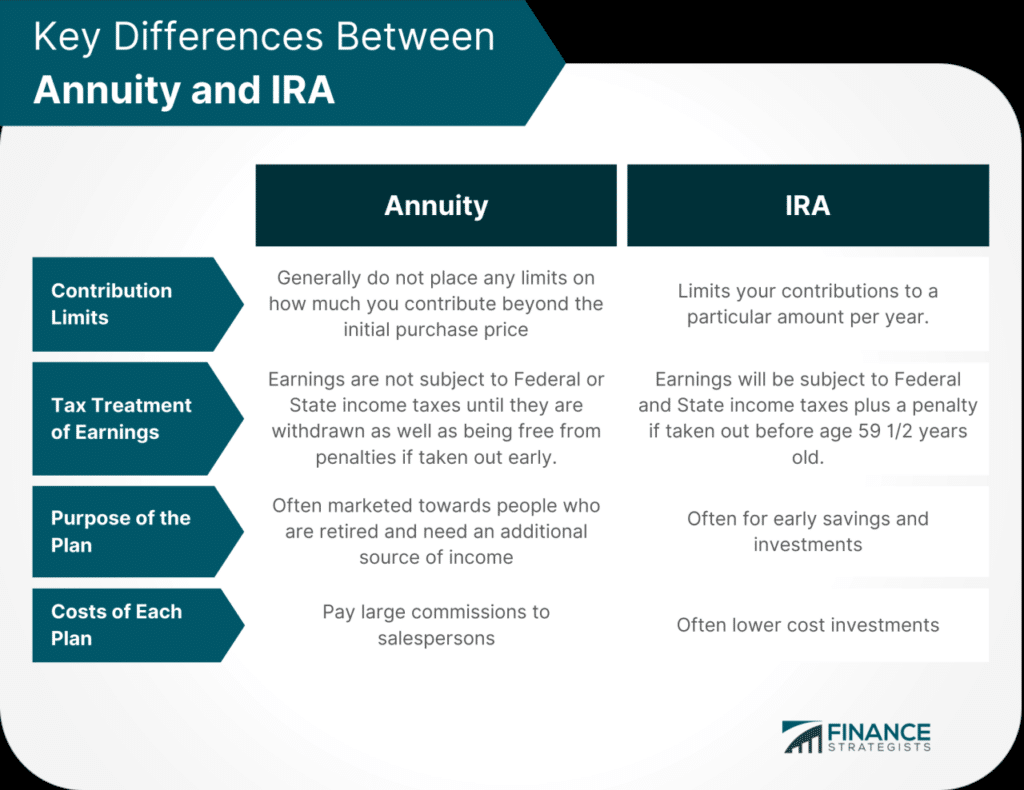

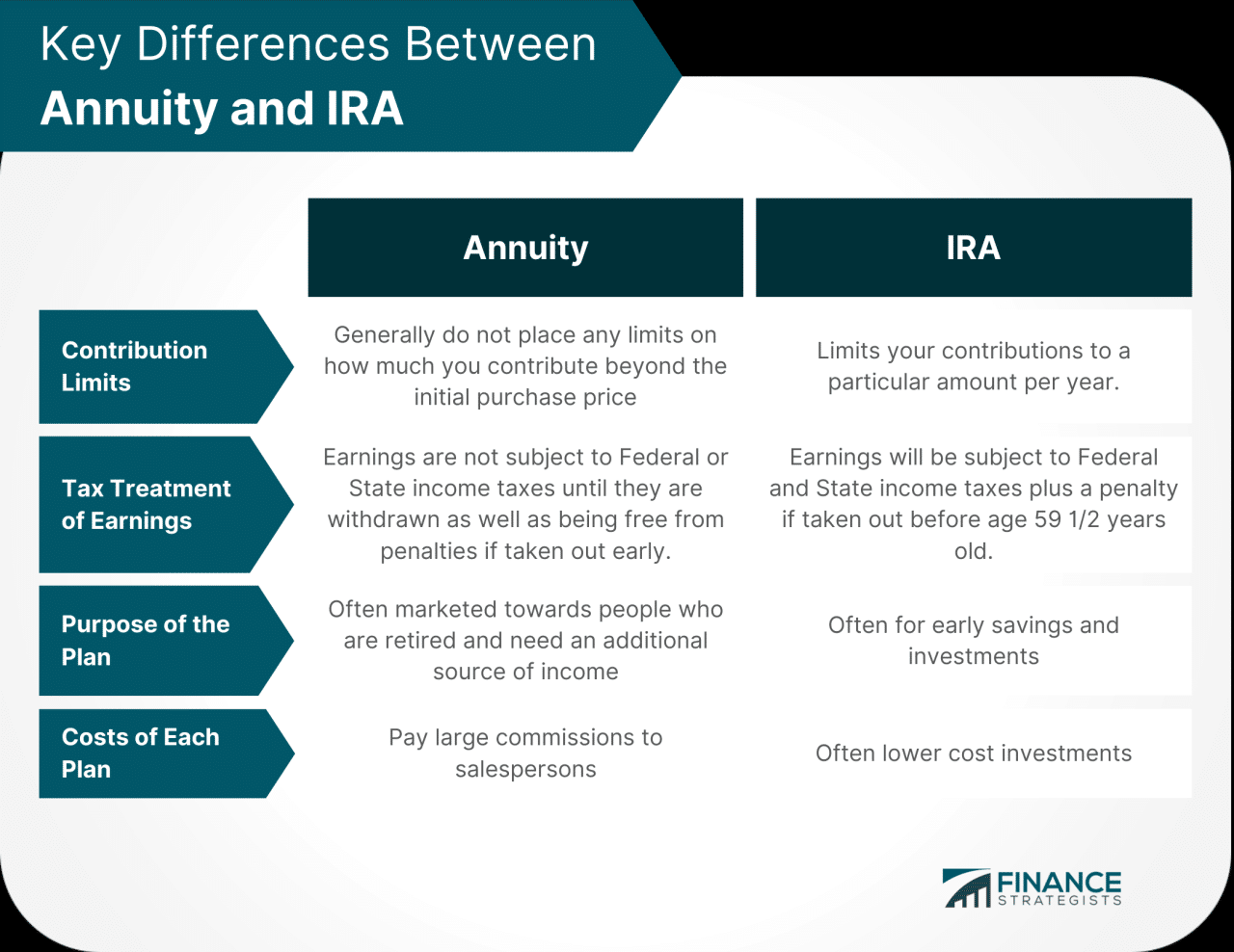

Annuities and IRAs are two popular retirement savings options that offer different features and benefits. Choosing the right option depends on your individual circumstances, financial goals, and risk tolerance. This guide will provide a comprehensive overview of annuities and IRAs, highlighting their key differences, tax implications, and potential risks and benefits.

Staying up-to-date on the latest annuity news is essential for making informed financial decisions. This article: Annuity News 2024 provides insights into recent developments and trends in the annuity market.

We’ll also discuss the latest updates and considerations for 2024.

If you’re wondering what an annuity is, you’re not alone! It’s a financial product that can help you secure a steady income stream in the future. To understand the basics, you can check out this article: Annuity Kya Hai 2024 which explains it in simple terms.

Introduction to Annuities and IRAs

Annuities are insurance contracts that provide a stream of income payments for a specified period or for life. They are often used as a way to generate retirement income, protect against outliving your savings, and provide tax-deferred growth. IRAs, on the other hand, are tax-advantaged retirement accounts that allow individuals to save for retirement on a tax-deferred or tax-free basis.

If you’re considering investing in a fixed annuity within your IRA, it’s important to understand the tax implications and potential benefits. This article: Fixed Annuity In Ira 2024 provides insights into the advantages and considerations of this type of investment.

Both annuities and IRAs can play a significant role in your retirement planning strategy.

An annuity can be a valuable financial tool for retirement planning, but it’s important to consider if it’s the right choice for your individual circumstances. This article: Annuity Is It A Good Idea 2024 explores the pros and cons of annuities to help you determine if they are a good fit for you.

Annuities, Annuity V Ira 2024

Annuities are insurance contracts that provide a stream of income payments for a specified period or for life. They are often used as a way to generate retirement income, protect against outliving your savings, and provide tax-deferred growth.

The date an annuity begins to make payments is an important factor to consider when planning for retirement. To understand how the start date of an annuity works, you can check out this article: Annuity Date Is 2024 for a clear explanation.

Types of Annuities

- Fixed Annuities:These annuities provide a guaranteed rate of return, offering predictable income payments. The interest rate is fixed for a specific period, typically for a year or longer. Fixed annuities are considered low-risk, but they may not offer significant growth potential.

People often wonder if an annuity is a form of life insurance. While they both offer financial protection, they function differently. To understand the key differences, you can explore this article: Is Annuity Life Insurance 2024 for a clear explanation.

- Variable Annuities:These annuities invest in mutual funds or sub-accounts, allowing for the potential for higher returns. The value of the annuity fluctuates based on the performance of the underlying investments. Variable annuities carry more risk than fixed annuities, but they offer the potential for higher returns.

The term “annuity” refers to a financial product that provides a series of regular payments over a set period. Understanding the concept of an annuity is important for making informed financial decisions. This article: Annuity Is Term 2024 defines the term “annuity” and explains its key characteristics.

- Indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth without the downside risk of a variable annuity. Indexed annuities provide a minimum guaranteed return, and the actual return may be higher depending on the index performance.

Annuity and 401(k) are both retirement savings plans, but they differ in their structure and features. To understand the key differences and which might be a better fit for you, you can read this article: Annuity Vs 401k 2024 which provides a clear comparison.

Tax Implications of Annuities

Annuities offer tax-deferred growth, meaning that you don’t pay taxes on the earnings until you withdraw them. However, withdrawals from an annuity are generally taxed as ordinary income. If you withdraw your contributions before age 59 1/2, you may also have to pay a 10% early withdrawal penalty.

The way annuities are taxed can vary depending on the type of annuity and the specific terms of your contract. Understanding how your annuity income will be taxed is crucial for financial planning. This article: How Annuity Is Taxed 2024 provides a comprehensive explanation of annuity taxation.

Risks and Benefits of Annuities

Annuities offer potential benefits, such as guaranteed income payments, tax-deferred growth, and protection against outliving your savings. However, they also come with certain risks, including:

- Limited Liquidity:Annuities are generally illiquid, meaning that it can be difficult to access your money before the payout period.

- Fees and Expenses:Annuities can have high fees and expenses, which can erode your returns.

- Guarantees:While some annuities offer guaranteed income payments, they may not keep up with inflation.

IRAs

IRAs are tax-advantaged retirement accounts that allow individuals to save for retirement on a tax-deferred or tax-free basis. They offer a variety of investment options, including stocks, bonds, mutual funds, and ETFs.

An annuity is essentially a series of payments that are guaranteed over a specific period. These payments can provide a stable income stream during retirement or other life stages. Want to know more about how annuities work as a series of payments?

Check out this article: Annuity Is A Series Of 2024 for a comprehensive explanation.

Types of IRAs

- Traditional IRA:Contributions to a traditional IRA are tax-deductible, and you pay taxes on the withdrawals in retirement. This type of IRA is generally best suited for individuals who expect to be in a lower tax bracket in retirement.

- Roth IRA:Contributions to a Roth IRA are not tax-deductible, but withdrawals in retirement are tax-free. This type of IRA is generally best suited for individuals who expect to be in a higher tax bracket in retirement.

- SEP IRA:This type of IRA is available to self-employed individuals and small business owners. It allows for larger contributions than traditional or Roth IRAs, but it also comes with stricter withdrawal rules.

Tax Benefits and Contribution Limits

The tax benefits and contribution limits for IRAs vary depending on the type of IRA and your age. For 2024, the maximum contribution limit for traditional and Roth IRAs is $6,500, or $7,500 if you are 50 or older. You may be able to contribute more to a SEP IRA, but the maximum contribution limit is subject to change.

The value of an annuity can fluctuate based on factors like interest rates and market performance. Understanding how these factors influence its value is crucial for making informed financial decisions. This article: Annuity Is The Value Of 2024 explores the factors that affect the value of an annuity.

IRA Withdrawal Rules

You can generally withdraw money from your IRA without penalty after age 59 1/2. However, if you withdraw money before age 59 1/2, you may have to pay a 10% early withdrawal penalty. There are some exceptions to this rule, such as for medical expenses, first-time home purchases, and education expenses.

The calculation of annuity payments can be a bit complex, involving factors like your initial investment, interest rates, and payment schedule. To understand how these factors play into the calculation, check out this article: How Annuity Is Calculated 2024 for a detailed explanation.

Last Point

Ultimately, the decision between an annuity and an IRA depends on your individual financial goals, risk tolerance, and time horizon. By carefully weighing the pros and cons of each option and considering your unique circumstances, you can choose the retirement savings strategy that aligns best with your aspirations.

An annuity is a financial product that provides regular payments over a set period of time. It’s like a financial plan that helps you manage your money for the future. To get a better grasp on how annuities work, you can read this article: Annuity Meaning With Example 2024 which provides a simple explanation with examples.

This guide has provided you with a solid foundation for understanding the key differences and considerations for 2024, empowering you to make informed decisions about your retirement future.

Key Questions Answered: Annuity V Ira 2024

What are the potential risks associated with annuities?

Annuities can have certain risks, including the potential for low returns, the possibility of losing principal, and the complexity of understanding different annuity options. It’s crucial to carefully research and understand the risks involved before investing in an annuity.

How do I choose between a traditional IRA and a Roth IRA?

The decision between a traditional IRA and a Roth IRA depends on your current tax bracket, your anticipated tax bracket in retirement, and your income level. If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial.

Conversely, if you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better choice.

What are the contribution limits for IRAs in 2024?

Annuity contracts can seem complex, but they are essentially a way to receive regular payments over time. It’s a financial tool that can provide a steady stream of income during retirement. Want to learn more about how annuities work in 2024?

This resource: Annuity How It Works 2024 will give you a good understanding of the basics.

The contribution limit for traditional and Roth IRAs in 2024 is $6,500 for individuals under age 50 and $7,500 for those 50 and older. These limits may change annually, so it’s essential to check the latest guidelines.