Annuity 2000 Per Month 2024 – Annuity $2,000 Per Month in 2024: A Retirement Planning Guide is a valuable resource for individuals seeking to understand the potential of annuities as a retirement income stream. Annuities, which are financial products that provide regular payments for a set period, can offer a steady source of income during retirement.

An annuity fund is a collection of assets that are used to generate income for annuity payments. This article explores the concept of annuity funds: Annuity Fund Is 2024.

This guide delves into the different types of annuities, their advantages and disadvantages, and the potential impact of receiving $2,000 per month from an annuity. It also explores the current market trends and factors that could influence annuity payouts in 2024.

An annuity unit is a measure used to determine the amount of annuity payments. You can learn more about annuity units in this article: Annuity Unit Is 2024.

By providing a comprehensive overview of annuities, including their features, benefits, and considerations, this guide aims to empower individuals to make informed decisions about incorporating annuities into their retirement planning strategies. It emphasizes the importance of understanding annuity options, calculating potential returns, and seeking professional advice to ensure a secure and comfortable retirement.

Annuities are often used to provide a steady stream of income during retirement. Learn more about how annuities can be a source of income in 2024: Annuity Is Income 2024.

Contents List

Understanding Annuities: Annuity 2000 Per Month 2024

An annuity is a financial product that provides a stream of regular payments over a set period of time. These payments can be used to supplement income during retirement, provide financial security for loved ones, or simply offer a guaranteed source of income.

A deferred annuity is one that starts paying out at a later date. You can find more details about deferred annuities in this article: Annuity Is Deferred 2024. This can be a good option if you want to save for retirement but don’t need income right away.

Annuities are often purchased with a lump sum of money, and the insurance company then makes regular payments to the annuitant for a predetermined duration. The purpose of an annuity is to provide a steady stream of income, especially during retirement, when traditional employment income may cease.

The interest earned on an annuity is generally taxable. This article delves into the tax implications of annuity interest: Is Annuity Interest Taxable 2024.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. The most common types of annuities include:

- Fixed Annuities:These annuities guarantee a fixed rate of return, meaning that the payments will remain the same throughout the term of the annuity. This provides a predictable and reliable source of income, making them ideal for individuals seeking stability and security.

Annuity is a type of pension plan that provides regular payments for a set period of time, often used for retirement. You can find more information about how annuities work as a pension plan in 2024 in this article: Annuity Is Pension Plan 2024.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater risk. The payments are linked to the performance of underlying investments, such as stocks or mutual funds. This means that the amount of each payment can fluctuate based on market conditions.

Choosing between an annuity and a 401k can be a big decision. You can read more about comparing these two options in this article: Is Annuity Better Than 401k 2024. Both have pros and cons, so it’s important to consider your individual needs.

- Immediate Annuities:These annuities begin making payments immediately after the purchase. They are typically used by individuals who need a steady income stream right away, such as those retiring or transitioning to a new stage of life.

- Deferred Annuities:These annuities start making payments at a later date, such as at retirement. They are often used by individuals who are saving for retirement and want to grow their investment over time before receiving payments.

Advantages and Disadvantages of Annuities

Like any financial product, annuities have both advantages and disadvantages that should be carefully considered before making a purchase.

A single premium annuity is a type of annuity where you make one large payment upfront. This article explores an example of a single premium annuity: G Purchased A $50 000 Single Premium 2024.

- Advantages:

- Guaranteed income stream

- Protection against longevity risk

- Potential for tax-deferred growth

- Flexibility in payment options

- Disadvantages:

- Lower potential returns compared to other investments

- Potential for surrender charges if the annuity is withdrawn early

- Limited access to funds during the accumulation period

- Complexity of annuity contracts

Annuity Payments of $2,000 Per Month

Receiving $2,000 per month from an annuity can significantly impact an individual’s financial situation, especially during retirement. This consistent income stream can provide financial stability and peace of mind, allowing individuals to cover essential expenses, pursue personal goals, and enjoy their retirement years with greater financial freedom.

An annuity is a series of payments, often used for retirement income. Learn more about how annuities function as payments in 2024: Annuity Is Payment 2024.

How to Use Annuity Payments

An annuity payment of $2,000 per month can be used for a variety of purposes, including:

- Covering essential expenses:Housing, utilities, groceries, healthcare, and transportation are among the essential expenses that can be covered with annuity payments.

- Savings:A portion of the annuity payments can be set aside for future needs, such as unexpected medical expenses or travel plans.

- Investments:Annuity payments can be reinvested to generate further growth, potentially enhancing the overall financial portfolio.

- Discretionary spending:Annuity payments can also be used for leisure activities, hobbies, or other discretionary spending that enhances the quality of life.

Tax Implications of Annuity Payments

The tax implications of annuity payments depend on the specific type of annuity and the individual’s tax situation. In general, the portion of annuity payments representing the return of principal is not taxable, while the portion representing earnings is taxable as ordinary income.

It’s crucial to consult with a tax advisor to understand the specific tax implications of your annuity payments.

If you’re new to annuities, it can be helpful to understand what they are and how they work. This article provides a basic explanation with an example: Annuity Meaning With Example 2024.

Annuities in 2024

The annuity market is constantly evolving, and there have been some notable changes and trends in 2024. Understanding these developments can help individuals make informed decisions when considering annuities.

If you’re curious about what an annuity is, this article can help you understand the basics: Annuity Kya Hai 2024. Annuities are financial products that can be a valuable part of your retirement planning.

Updates and Changes in 2024

- Regulatory changes:The regulatory landscape for annuities has seen some adjustments in 2024, potentially affecting the availability and features of certain annuity products. It’s essential to stay informed about these changes and their potential impact on your financial planning.

- Market trends:Market conditions, including interest rates and inflation, can significantly influence annuity payouts. In 2024, the market has experienced volatility, leading to some adjustments in annuity rates. Understanding these trends can help you make informed decisions about your annuity choices.

- Interest rate environment:The current interest rate environment has a direct impact on annuity payouts. As interest rates fluctuate, annuity rates may adjust accordingly. It’s important to monitor interest rate trends and their potential impact on your annuity income.

Factors Affecting Annuity Choices

Choosing the right annuity involves careful consideration of several factors that are unique to each individual’s circumstances. These factors help determine the most suitable annuity type and features for your specific needs and financial goals.

Key Factors to Consider

- Age:Your age is a crucial factor, as it influences your investment horizon and the time you have to accumulate funds before retirement. Younger individuals may opt for variable annuities with higher growth potential, while older individuals may prefer fixed annuities for guaranteed income.

When it comes to retirement savings, you might be wondering whether an annuity or an IRA is the right choice for you. This article explores the differences between these two options: Annuity Or Ira 2024. Understanding the pros and cons of each can help you make an informed decision.

- Financial goals:Your financial goals, such as retirement income, long-term care, or legacy planning, will shape your annuity choices. Understanding your specific objectives will help you select an annuity that aligns with your desired outcomes.

- Risk tolerance:Your risk tolerance, or your willingness to accept potential losses in exchange for higher returns, plays a significant role in annuity selection. Individuals with a higher risk tolerance may choose variable annuities, while those with a lower risk tolerance may prefer fixed annuities.

A contingent annuity is one that depends on a certain event, such as the death of a beneficiary. Learn more about this type of annuity: Annuity Contingent Is 2024.

- Investment horizon:Your investment horizon, or the length of time you plan to hold your annuity, also influences your choices. A longer investment horizon allows for more time to recover from market fluctuations, making variable annuities a more attractive option.

Comparing Annuity Options

The following table summarizes the key features of different annuity types and their suitability for various scenarios:

| Annuity Type | Features | Suitability |

|---|---|---|

| Fixed Annuity | Guaranteed rate of return, predictable payments | Individuals seeking stability and security, those with a lower risk tolerance, and those nearing retirement |

| Variable Annuity | Potential for higher returns, linked to market performance | Individuals with a higher risk tolerance, those with a longer investment horizon, and those seeking growth potential |

| Immediate Annuity | Payments begin immediately, suitable for immediate income needs | Individuals retiring or transitioning to a new stage of life, those needing a steady income stream right away |

| Deferred Annuity | Payments start at a later date, allowing for investment growth | Individuals saving for retirement, those wanting to grow their investment over time |

Annuity Calculations and Projections

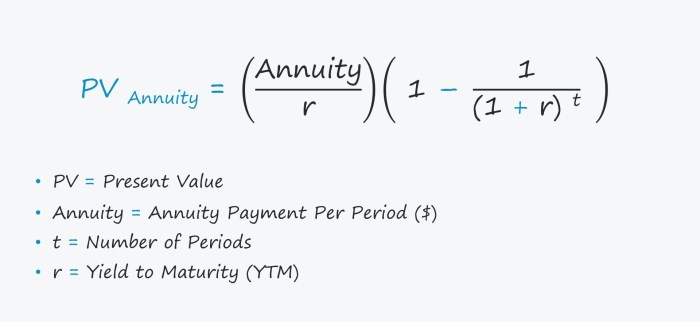

Calculating the present value of an annuity is essential for understanding its potential worth and making informed financial decisions. This calculation helps determine the lump sum amount needed to purchase an annuity that will provide a specific stream of payments.

Annuities can offer a certain level of flexibility, depending on the type of annuity you choose. This article explores the flexibility of annuities: Is Annuity Flexible 2024.

Present Value Calculation, Annuity 2000 Per Month 2024

The present value (PV) of an annuity can be calculated using the following formula:

PV = PMT

An annuity is essentially a series of payments, often spread out over a set period of time. This article provides more details about the nature of an annuity: An Annuity Is A Series Of 2024.

- [1

- (1 + r)^-n] / r

Where:

- PV = Present value

- PMT = Periodic payment amount (e.g., $2,000 per month)

- r = Interest rate per period (e.g., monthly interest rate)

- n = Number of periods (e.g., total number of months)

Annuity Growth Projections

The following table shows the potential growth of an annuity over time, considering different interest rates and investment periods:

| Interest Rate | Investment Period (Years) | Total Value at Maturity |

|---|---|---|

| 3% | 10 | $266,000 |

| 3% | 20 | $609,000 |

| 5% | 10 | $319,000 |

| 5% | 20 | $939,000 |

Seeking Professional Advice

Planning for retirement with annuities involves various factors, including investment strategies, tax implications, and individual circumstances. It’s crucial to seek professional financial advice from a qualified advisor who can provide personalized guidance and help you make informed decisions that align with your financial goals and risk tolerance.

Conclusive Thoughts

Understanding annuities and their potential role in retirement planning can be crucial for individuals seeking financial security. By carefully considering the various factors, including your financial goals, risk tolerance, and investment horizon, you can make informed decisions about whether an annuity is a suitable option for your retirement planning.

Remember to seek professional financial advice to tailor a retirement plan that meets your specific needs and aspirations.

Expert Answers

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments, offering potential for higher returns but also higher risk.

Can I withdraw my annuity payments early?

The ability to withdraw annuity payments early depends on the specific terms of the annuity contract. Some annuities may impose penalties for early withdrawals.

How do I choose the right annuity for me?

The best annuity for you depends on your individual circumstances, including your age, financial goals, risk tolerance, and investment horizon. It’s essential to consult with a financial advisor to determine the most suitable annuity option.

What are the tax implications of annuity payments?

Annuity payments are typically taxed as ordinary income. The specific tax treatment may vary depending on the type of annuity and the individual’s tax situation.

Are annuities regulated?

Yes, annuities are regulated by state and federal agencies to protect consumers and ensure fair market practices.