Annuity 3 Year Rates 2024 offer a unique investment opportunity for those seeking guaranteed income and principal protection. These rates are influenced by various factors, including interest rates, inflation, and overall economic conditions. Understanding the current market dynamics and the different types of 3-year annuities available is crucial for making informed investment decisions.

This guide delves into the intricacies of 3-year annuity rates, providing insights into the factors that shape them, the different types available, and key considerations for choosing the right annuity for your financial goals. We’ll explore the benefits and drawbacks of these investments, compare them to other options, and provide illustrative examples to help you understand how 3-year annuities can be used to achieve your financial objectives.

When choosing between an annuity and an IRA, it’s essential to consider your individual financial goals. Annuity Vs Ira 2024 offers a comparison of these two retirement options. This can help you decide which one is right for you.

Contents List

Understanding Annuity Rates

Annuity rates represent the annual return you can expect to receive from an annuity contract. In simpler terms, it’s the interest rate that determines how much income you’ll get each year from your annuity investment. For example, a 3-year annuity rate of 4% means you’ll earn 4% of your principal each year for the next three years.

Factors Influencing 3-Year Annuity Rates in 2024

Several factors play a role in determining 3-year annuity rates in 2024. These include:

- Interest rates:The Federal Reserve’s monetary policy significantly impacts annuity rates. When interest rates rise, annuity providers can offer higher rates to attract investors. Conversely, falling interest rates lead to lower annuity rates.

- Inflation:High inflation erodes the purchasing power of your income, making it crucial for annuity providers to offer competitive rates to keep up with inflation. In 2024, inflation is expected to remain elevated, potentially impacting annuity rates.

- Market conditions:The overall health of the financial markets, including stock market performance and bond yields, can influence annuity rates. A strong market generally translates to higher annuity rates.

- Competition:The level of competition among annuity providers also affects rates. When competition is fierce, providers may offer more attractive rates to win customers.

- Annuity type:Different types of annuities, such as fixed, variable, and indexed annuities, have varying rates based on their specific features and risk profiles.

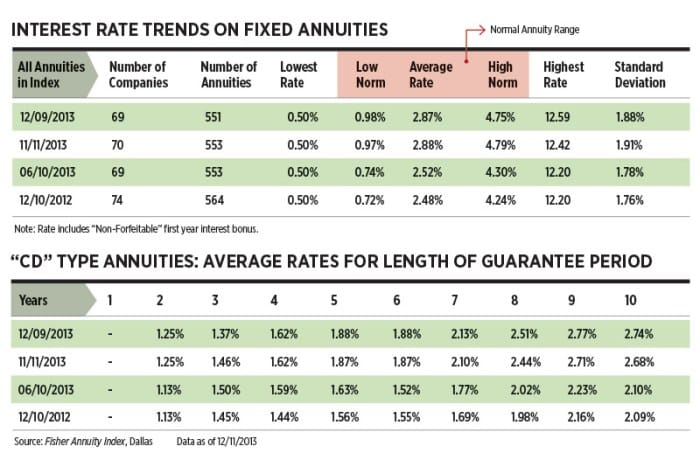

Historical Trend of 3-Year Annuity Rates

Over the past few years, 3-year annuity rates have fluctuated in response to changes in interest rates, inflation, and market conditions. For instance, during periods of low interest rates, such as in 2020 and 2021, annuity rates generally remained low.

Annuity Gator is a company that offers annuity products. Is Annuity Gator Legit 2024 provides information about the company’s legitimacy and its products. This can help you make informed decisions about your financial needs.

However, with the Federal Reserve’s recent interest rate hikes, annuity rates have started to rise in 2022 and 2023. It’s important to note that past performance is not indicative of future results.

When you’re considering an annuity, you’ll want to understand the surrender period. My Annuity Is Out Of Surrender 2024 provides insights into what happens when your annuity is out of the surrender period. Knowing this information can help you make informed decisions about your financial future.

Current Market Conditions

The current economic environment is characterized by a mix of positive and negative factors that can impact annuity rates. The Federal Reserve’s aggressive interest rate hikes have aimed to curb inflation, but this has also raised concerns about potential economic slowdown.

For couples, the joint life option can be a valuable feature of an annuity. Annuity Joint Life Option 2024 explains how this option works and its benefits. This information can help you decide if this option is right for you.

Impact on Annuity Rates

The Federal Reserve’s interest rate increases have generally led to higher annuity rates. However, the economic outlook remains uncertain, with potential risks of a recession. If the economy weakens, annuity rates might decline as providers adjust their risk assessments.

If you’re considering selling annuity leads, it’s essential to be aware of the regulations and best practices. Annuity Leads 2024 offers insights into the annuity lead market. This can help you understand the potential opportunities and challenges.

Role of Interest Rates and Inflation

Interest rates and inflation play a crucial role in shaping annuity rates. When interest rates rise, annuity providers can offer higher rates to attract investors. However, high inflation can also erode the purchasing power of annuity payments, making it essential for providers to offer competitive rates to compensate for inflation.

An annuity is a financial product that provides a stream of income payments over a specified period. Annuity Is Defined As 2024 provides a comprehensive definition of annuities and their various types. This information can help you understand the different options available.

Risks and Opportunities

Investing in 3-year annuities in 2024 presents both risks and opportunities. On the one hand, the potential for higher interest rates could lead to increased annuity payouts. On the other hand, economic uncertainty and potential for a recession could impact annuity rates negatively.

Annuity payments are calculated based on several factors, including your age, the amount of your initial investment, and the interest rate. How Annuity Is Calculated 2024 provides a detailed explanation of how annuity payments are calculated. This can help you understand how your annuity will work.

Types of 3-Year Annuities

The market offers various types of 3-year annuities, each with its own features and benefits. Understanding the differences between these types is essential for making an informed decision.

Fixed Annuities

Fixed annuities provide a guaranteed interest rate for the duration of the contract, typically three years in this case. This offers predictable income and principal protection. However, the fixed rate may not keep up with inflation, potentially leading to lower returns in real terms.

Variable Annuities

Variable annuities invest in a portfolio of mutual funds or other securities. The returns fluctuate based on the performance of these investments. This offers the potential for higher returns but also carries more risk. Variable annuities are not suitable for risk-averse investors.

Indexed Annuities

Indexed annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth while providing a minimum guaranteed return. However, the returns are capped, limiting potential upside.

Annuity contracts can be complex, so it’s natural to have questions. Annuity Questions 2024 addresses common questions about annuities. This resource can help you make the best decisions for your financial needs.

Examples of Annuity Products

Leading annuity providers offer various 3-year annuity products. For example, XYZ Insurance offers a fixed annuity with a guaranteed 4% interest rate for three years. ABC Financial provides a variable annuity linked to a diversified stock portfolio. DEF Life offers an indexed annuity tied to the S&P 500 with a 2% minimum guaranteed return.

The JAIIB (Junior Associate of the Indian Institute of Bankers) exam covers various financial topics, including annuities. Annuity Jaiib 2024 provides information about how annuities are covered in the JAIIB exam. This can be helpful for students preparing for the exam.

Key Considerations for Choosing a 3-Year Annuity

Selecting the right 3-year annuity requires careful consideration of your individual needs and circumstances. Here’s a checklist of factors to evaluate:

Risk Tolerance and Investment Goals

Assess your risk tolerance and investment goals. If you’re risk-averse and prioritize guaranteed income, a fixed annuity might be suitable. If you’re willing to take on more risk for the potential of higher returns, a variable or indexed annuity might be a better option.

Annuity is often considered a life insurance product, but it’s important to understand its unique characteristics. Annuity Is A Life Insurance Product That 2024 explains the key features of annuities and how they differ from traditional life insurance. This can help you make an informed decision about your financial needs.

Annuity Rates and Features

Compare annuity rates and features from different providers. Consider factors such as the guaranteed interest rate, minimum guaranteed return, fees, and surrender charges. It’s essential to understand the terms and conditions of each annuity product.

Annuity payments can be provided by various entities, including insurance companies and financial institutions. Annuity Is Given By 2024 explains who provides annuities and the different types of annuities available. This can help you understand your options.

Financial Advisor Consultation

Consult with a financial advisor specializing in annuities to get personalized guidance. They can help you understand your options and choose an annuity that aligns with your financial goals and risk profile.

Benefits and Drawbacks of 3-Year Annuities: Annuity 3 Year Rates 2024

3-year annuities offer both advantages and disadvantages. Understanding these pros and cons is essential for making an informed investment decision.

Annuity payments can be a great way to supplement your retirement income, but it’s important to understand how they are taxed. How Annuity Is Taxed 2024 explains the tax treatment of annuity payments in detail. This knowledge can help you make informed decisions about your retirement planning.

Benefits

3-year annuities offer several benefits, including:

- Guaranteed income:Fixed annuities provide a guaranteed income stream for the next three years, offering financial stability and predictability.

- Principal protection:Fixed annuities protect your principal from market fluctuations, providing peace of mind during periods of economic uncertainty.

- Tax-deferred growth:The earnings on annuities are typically tax-deferred, allowing your investment to grow tax-free until you start receiving payments.

Drawbacks

3-year annuities also have some drawbacks, such as:

- Limited flexibility:Annuities typically have surrender charges for early withdrawals, limiting your flexibility to access your funds.

- Potential for lower returns:Compared to other investment options, such as stocks or bonds, annuities may offer lower returns, especially during periods of high market growth.

- Inflation risk:Fixed annuities do not protect against inflation, meaning your purchasing power could decline over time.

Comparison with Other Investment Options

When compared to other investment options, such as stocks or bonds, 3-year annuities offer a balance between potential returns and risk. Stocks offer the potential for higher returns but also carry greater volatility. Bonds provide more stability but typically offer lower returns.

Many people wonder if annuity income is taxable. Is Annuity Income Taxable 2024 provides information about the tax implications of annuity income. Understanding this can help you make informed decisions about your retirement planning.

Annuities offer a middle ground, providing a guaranteed income stream with principal protection.

Illustrative Examples

Here’s a table showcasing hypothetical 3-year annuity rates from different providers. This table is for illustrative purposes only and does not reflect actual rates, which can vary based on factors such as your age, health, and investment amount.

Annuity jokes are a great way to lighten the mood when discussing retirement planning. Annuity Jokes 2024 offers a collection of funny jokes related to annuities. This can help you approach this topic with a sense of humor.

| Provider | Annuity Type | Interest Rate | Minimum Guaranteed Return |

|---|---|---|---|

| XYZ Insurance | Fixed Annuity | 4.00% | N/A |

| ABC Financial | Variable Annuity | N/A | N/A |

| DEF Life | Indexed Annuity | N/A | 2.00% |

For example, let’s say you have $100,000 to invest in a 3-year fixed annuity with XYZ Insurance offering a 4% interest rate. You would receive $4,000 in annual income for the next three years. This guaranteed income can provide financial stability and help you meet your financial goals, such as covering living expenses or supplementing retirement income.

Additional Resources and Information

For more information on annuities and 3-year annuity rates, you can refer to the following resources:

Reputable Websites and Organizations, Annuity 3 Year Rates 2024

- The National Association of Insurance Commissioners (NAIC): https://www.naic.org/

- The Securities and Exchange Commission (SEC): https://www.sec.gov/

- The Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

Financial Advisors

You can find financial advisors specializing in annuities by contacting:

- The Financial Planning Association (FPA): https://www.fpanet.org/

- The National Association of Personal Financial Advisors (NAPFA): https://www.napfa.org/

Books and Articles

- “The Annuity Handbook” by Kenneth R. Van Leeuwen

- “Annuities: A Guide to the Basics” by The American Council of Life Insurers

- “Understanding Annuities” by The National Association of Insurance Commissioners

Wrap-Up

As you navigate the complex world of annuities, remember that careful planning and informed decision-making are key. By understanding the nuances of 3-year annuity rates and the various factors influencing them, you can make well-informed choices that align with your financial goals and risk tolerance.

Consulting with a financial advisor specializing in annuities can provide personalized guidance and help you find the best annuity product for your individual needs.

Query Resolution

What are the current 3-year annuity rates?

Current 3-year annuity rates vary depending on the provider, type of annuity, and other factors. It’s best to contact different annuity providers for personalized quotes.

How do I choose the right 3-year annuity for me?

Consider your risk tolerance, investment goals, and time horizon. Consult with a financial advisor to determine the best annuity product for your needs.

If you’re considering an annuity, you might wonder if the income you receive is taxable. The answer is that it depends. Is Immediate Annuity Income Taxable 2024 provides a detailed breakdown of how annuity income is taxed. You’ll want to understand the tax implications before making any decisions.

Are 3-year annuities right for everyone?

No, 3-year annuities may not be suitable for everyone. They offer guaranteed income and principal protection, but they may provide lower returns compared to other investment options. Consider your individual financial situation and consult with a financial advisor.