Annuity 30 Years 2024, a comprehensive guide to understanding and utilizing annuities for long-term financial security. This guide delves into the intricacies of annuities, exploring their various types, features, and implications for your financial planning. It analyzes the current economic landscape and its impact on annuity rates, providing insights into the evolving annuity market in 2024.

A net present value (NPV) calculator can help you determine the present value of future annuity payments. To explore NPV calculations and how they apply to annuities, check out Annuity Npv Calculator 2024.

We will also discuss essential factors to consider when choosing an annuity, offering practical tips for selecting a reputable provider and navigating the process of purchasing and managing your annuity.

The taxability of annuities can vary depending on the type of annuity and how it’s structured. To understand how annuities are taxed in relation to life insurance, visit Is Annuity For Life Insurance Taxable 2024.

This guide is designed to equip you with the knowledge and understanding necessary to make informed decisions regarding your financial future. It covers topics such as fixed and variable annuities, the advantages and disadvantages of 30-year annuities, and the importance of consulting with a financial advisor.

Annuity hardship withdrawals can be a valuable option if you need access to your funds before retirement. To learn more about hardship withdrawals and their implications, visit Annuity Hardship Withdrawal 2024.

With this comprehensive guide, you will gain a thorough understanding of annuities and their potential role in achieving your financial goals.

Not all annuities are created equal. To determine if an annuity qualifies for tax advantages, check out Is Annuity A Qualified Plan 2024 for more information.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a specified period. It’s a popular option for individuals looking for guaranteed income, especially during retirement. Annuities can be structured in various ways, offering flexibility to meet different financial goals.

Understanding how annuities are taxed is crucial for making informed financial decisions. To find out more about the tax implications of annuity income, check out Is Annuity Income Taxable 2024.

Types of Annuities

Annuities are broadly categorized into two main types:

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The interest rate is fixed for the duration of the contract, making it a safe and stable investment option. However, the fixed rate might not keep pace with inflation, potentially reducing the purchasing power of your payments over time.

- Variable Annuities:Variable annuities offer the potential for higher returns but also carry greater risk. The payments are linked to the performance of underlying investments, such as mutual funds or stocks. This means your income stream can fluctuate depending on market conditions.

While variable annuities can provide the potential for growth, they also come with the risk of losing money if the investments perform poorly.

Key Features of Annuities

Annuities offer several key features that make them attractive to investors:

- Guaranteed Payments:Fixed annuities provide guaranteed income payments for a specific period, offering financial security and peace of mind.

- Potential Growth:Variable annuities offer the potential for higher returns, allowing your investment to grow over time. However, this potential growth comes with the risk of losing money.

- Tax Implications:Annuities have tax implications that vary depending on the type of annuity and how it’s structured. It’s crucial to consult with a financial advisor to understand the tax implications of an annuity before investing.

Comparing Fixed and Variable Annuities

Fixed and variable annuities have distinct characteristics that cater to different investment preferences:

| Feature | Fixed Annuity | Variable Annuity |

|---|---|---|

| Returns | Guaranteed rate of return | Linked to investment performance |

| Risk | Low risk | Higher risk |

| Growth Potential | Limited growth potential | Potential for higher growth |

| Income Stream | Predictable income stream | Fluctuating income stream |

Benefits and Risks of Annuities

Annuities offer potential benefits but also come with inherent risks:

- Benefits:

- Guaranteed income stream

- Potential for growth (variable annuities)

- Tax advantages

- Protection from market volatility

- Risks:

- Limited growth potential (fixed annuities)

- Potential for loss of principal (variable annuities)

- High fees and charges

- Lack of liquidity

30-Year Annuities

A 30-year annuity provides a stream of regular payments for a period of 30 years. This type of annuity is often chosen by individuals seeking long-term financial security, such as those planning for retirement.

While some annuities are designed to provide payments for a fixed period, others can offer lifetime income. To learn more about perpetual annuities, check out Annuity Is Perpetual 2024.

How a 30-Year Annuity Works

A 30-year annuity works by accumulating a lump sum of money, known as the principal, which is then invested to generate income. The annuity provider uses the invested principal and interest earned to make regular payments to the annuitant for 30 years.

When you win the lottery, you have a big decision to make: annuity or lump sum? Explore the pros and cons of each option in Annuity Or Lump Sum Lottery 2024 to make the right choice for your financial future.

The amount of each payment depends on factors such as the initial investment, interest rates, and the chosen payment schedule.

Factors Influencing Payout Amount

Several factors influence the payout amount of a 30-year annuity:

- Interest Rates:Higher interest rates generally result in larger annuity payments. However, interest rates can fluctuate over time, impacting the overall payout.

- Initial Investment:The amount of money you initially invest in the annuity directly affects the payout amount. A larger initial investment will generally lead to larger payments.

- Payment Schedule:The frequency of payments, whether monthly, quarterly, or annually, can affect the total amount received over the 30-year period.

Advantages and Disadvantages of a 30-Year Annuity

A 30-year annuity offers both advantages and disadvantages compared to shorter-term annuities:

- Advantages:

- Long-term financial security

- Potential for higher returns over a longer period

- Protection from market volatility for a longer duration

- Disadvantages:

- Longer time horizon, making it less flexible for immediate financial needs

- Potential impact of inflation over a longer period

- Higher initial investment required

Impact of Inflation on a 30-Year Annuity

Inflation can significantly impact the purchasing power of annuity payments over a 30-year period. If inflation rises faster than the annuity’s interest rate, the real value of the payments could decline. To mitigate this risk, investors can consider variable annuities that offer the potential for growth to keep pace with inflation.

Annuities in 2024: Annuity 30 Years 2024

The annuity market continues to evolve in response to changing economic conditions and regulatory landscapes. Understanding the current trends and developments is crucial for investors considering annuities in 2024.

Economic Landscape and Its Impact

The economic outlook for 2024 is uncertain, with factors such as inflation, interest rates, and geopolitical events influencing market conditions. These factors can impact annuity rates and investment strategies. For example, rising interest rates can potentially lead to higher annuity payouts, but they can also increase the cost of borrowing, potentially affecting investment returns.

Getting quotes for an annuity online can be a convenient way to compare options and find the best fit for your retirement planning. Check out Annuity Quotes Online 2024 for more information and to start exploring your options.

Regulations and Changes Affecting Annuities

Regulatory changes can significantly impact the annuity market. In 2024, there may be new regulations or updates to existing ones that affect the structure, pricing, or availability of annuities. Investors should stay informed about these changes to ensure they understand the implications for their investment decisions.

If you’re considering annuities in India, understanding the tax implications is essential. To learn more about how annuities are taxed in India, visit Is Annuity Taxable In India 2024.

Key Trends and Developments

The annuity market is witnessing several key trends and developments in 2024:

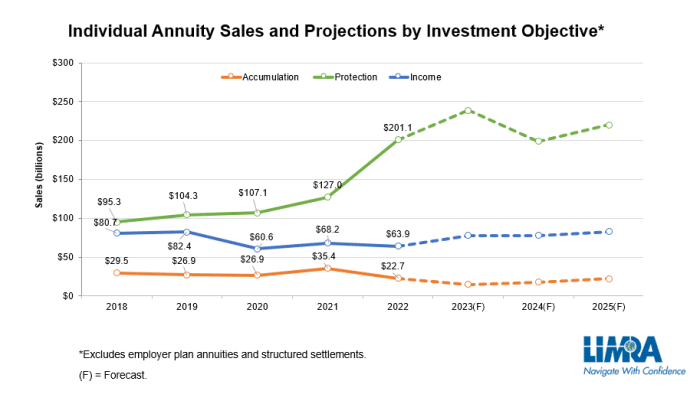

- Increased Demand for Income Annuities:As individuals seek guaranteed income streams during retirement, demand for income annuities is expected to rise.

- Growing Popularity of Variable Annuities:Variable annuities offer the potential for higher returns and are becoming increasingly popular among investors seeking growth potential.

- Focus on Transparency and Disclosure:Regulatory bodies are emphasizing transparency and disclosure in the annuity market, requiring providers to provide clear and concise information to investors.

Outlook for Annuities in the Coming Years

The outlook for annuities in the coming years is positive, driven by factors such as an aging population, increasing retirement needs, and the search for guaranteed income. However, investors should carefully consider their financial goals, risk tolerance, and time horizon before making any investment decisions.

Consulting with a financial advisor can provide valuable insights and guidance.

Factors to Consider When Choosing an Annuity

Choosing the right annuity requires careful consideration of several factors:

Comparing Annuity Providers and Offerings

| Provider | Annuity Type | Interest Rate | Fees | Other Features |

|---|---|---|---|---|

| Provider A | Fixed Annuity | 3.5% | 1.5% | Death benefit, guaranteed income for life |

| Provider B | Variable Annuity | Market-linked | 2.0% | Investment options, potential for growth |

| Provider C | Indexed Annuity | Linked to a specific index | 1.0% | Protection from downside risk, potential for growth |

Essential Factors to Consider

- Financial Goals:What are your financial goals for the annuity? Are you seeking guaranteed income, growth potential, or a combination of both?

- Risk Tolerance:How much risk are you willing to take? Fixed annuities offer low risk, while variable annuities carry greater risk.

- Time Horizon:How long do you need the annuity payments to last? A 30-year annuity is suitable for long-term financial planning, while shorter-term annuities may be more appropriate for immediate needs.

Finding a Reputable Annuity Provider

It’s crucial to find a reputable and reliable annuity provider. Look for providers with a strong track record, competitive rates, and transparent fees. You can research providers online, read reviews, and consult with financial advisors for recommendations.

Importance of Consulting with a Financial Advisor

Consulting with a financial advisor before purchasing an annuity is highly recommended. An advisor can help you understand your financial needs, assess your risk tolerance, and choose the annuity that aligns with your goals. They can also explain the complex tax implications of annuities and ensure you make informed decisions.

Annuities can be a valuable tool for retirement planning, but they’re not right for everyone. Explore the pros and cons of annuities and determine if they’re a good fit for your situation by reading Annuity Is It A Good Idea 2024.

Annuity Illustrations

Here are some illustrations of how a 30-year annuity can be used for different financial planning purposes:

Retirement Planning

| Scenario | Initial Investment | Interest Rate | Monthly Payment |

|---|---|---|---|

| Scenario 1 | $100,000 | 4% | $500 |

| Scenario 2 | $200,000 | 5% | $1,000 |

In Scenario 1, a $100,000 investment at a 4% interest rate generates a monthly payment of $500 for 30 years. This provides a consistent income stream for retirement, supplementing other sources of income.

Income Generation

| Scenario | Initial Investment | Interest Rate | Annual Payment |

|---|---|---|---|

| Scenario 1 | $500,000 | 3% | $20,000 |

| Scenario 2 | $1,000,000 | 4% | $40,000 |

In Scenario 1, a $500,000 investment at a 3% interest rate generates an annual payment of $20,000 for 30 years. This provides a stable income stream for individuals seeking additional income outside of traditional employment.

Annuity Gator is a popular resource for comparing annuity options and finding the best deals. If you’re looking for comprehensive information and reviews, visit Annuity Gator 2024 for more details.

Legacy Planning

Annuities can also be used for legacy planning, ensuring that loved ones receive a financial benefit after your passing. Some annuities offer death benefits, which pay a lump sum to beneficiaries upon the annuitant’s death.

An annuitant is someone who receives payments from an annuity contract. To learn more about the process of receiving annuity payments, visit K Is An Annuitant Currently Receiving Payments 2024.

Flowchart of Annuity Purchasing and Management, Annuity 30 Years 2024

The following flowchart illustrates the process of purchasing and managing an annuity:

[Flowchart depicting the steps involved in purchasing and managing an annuity, including:

- Consultation with a financial advisor

- Choosing an annuity provider

- Determining the type and structure of the annuity

- Making the initial investment

- Receiving regular payments

- Managing the annuity over time]

This flowchart provides a visual representation of the key steps involved in the annuity process, from initial consultation to ongoing management.

Want to understand the basics of annuities? Khan Academy offers a great resource for learning about different financial concepts, including annuities. Head over to Annuity Khan Academy 2024 for a comprehensive explanation.

Last Point

As you embark on your financial planning journey, consider the potential of annuities as a powerful tool for securing your future. By understanding the different types of annuities, their features, and the current economic landscape, you can make informed decisions that align with your financial goals.

Remember to consult with a qualified financial advisor to determine the best course of action for your specific needs and circumstances. Investing in your financial future is an essential step towards a secure and fulfilling life, and understanding annuities can play a vital role in this process.

User Queries

What is the minimum initial investment required for a 30-year annuity?

John Hancock is a well-known provider of annuities, offering various options to meet your specific retirement needs. Learn more about their annuity offerings at Annuity John Hancock 2024.

The minimum initial investment for a 30-year annuity varies depending on the provider and the specific annuity plan. It’s best to consult with a financial advisor or review the terms and conditions of the annuity provider.

Are there any tax benefits associated with 30-year annuities?

Yes, there are tax benefits associated with annuities, but they vary depending on the type of annuity and the specific tax laws in your jurisdiction. It’s crucial to consult with a tax professional to understand the tax implications of your annuity.

Annuity contracts can be a great way to secure a consistent income stream during retirement, providing financial stability for your later years. Learn more about how annuities work and how they can benefit you by visiting Annuity Is A Voluntary Retirement Vehicle 2024.

How do I choose a reputable annuity provider?

To choose a reputable annuity provider, consider factors such as the provider’s financial stability, track record, customer reviews, and the transparency of their fees and terms. It’s also advisable to consult with a financial advisor who can provide unbiased recommendations.

Can I withdraw funds from a 30-year annuity before the end of the term?

While you can often withdraw funds from an annuity before the end of the term, there may be penalties or fees associated with early withdrawals. The specific terms and conditions vary depending on the annuity provider and plan.

How can I calculate the potential payout amount of a 30-year annuity?

The potential payout amount of a 30-year annuity depends on several factors, including the initial investment, interest rates, chosen payment schedule, and the type of annuity. Most annuity providers offer calculators or tools to estimate potential payouts based on your specific circumstances.