Annuity 5 2024 offers a comprehensive look at annuities, a financial tool that can play a significant role in your retirement planning. This guide delves into the fundamentals of annuities, explores their current landscape in 2024, and provides insights into how they can be used to create a secure and sustainable retirement income stream.

The world of finance is constantly evolving, and annuities are no exception. It’s essential to stay informed about the current state of the market and the factors that can influence your annuity. Check out this article to learn more about Annuity Uncertain 2024.

From understanding the different types of annuities to navigating the tax implications, this resource equips you with the knowledge you need to make informed decisions about incorporating annuities into your retirement strategy. Whether you are just starting to think about retirement or are nearing retirement, this guide will help you understand the potential benefits and risks associated with annuities.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments for a set period of time. They are often used as a way to supplement retirement income, but they can also be used for other purposes, such as funding a child’s education or providing income for a surviving spouse.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Some of the most common types include:

- Fixed annuities:These annuities guarantee a fixed rate of return, providing predictable income payments. They are generally considered to be less risky than variable annuities, but they may also offer lower potential returns.

- Variable annuities:These annuities invest in a portfolio of mutual funds, and the value of the annuity can fluctuate based on the performance of the underlying investments. They offer the potential for higher returns, but they also carry more risk.

- Indexed annuities:These annuities offer a return that is linked to the performance of a specific market index, such as the S&P 500. They offer the potential for growth while also providing some downside protection.

- Immediate annuities:These annuities begin making payments immediately after the purchase. They are typically used by people who need income right away.

- Deferred annuities:These annuities begin making payments at a later date, often during retirement. They are typically used by people who are saving for retirement.

Key Features and Benefits, Annuity 5 2024

Annuities offer a number of key features and benefits, including:

- Guaranteed income:Many annuities provide guaranteed income payments for life, ensuring that you will receive a regular stream of income even if you live longer than expected.

- Tax-deferred growth:The earnings on annuity investments grow tax-deferred, meaning that you will not have to pay taxes on them until you start receiving payments.

- Protection from market risk:Some annuities offer protection from market downturns, providing a safety net for your retirement savings.

- Flexibility:Annuities offer a variety of options to customize your payments and investment strategy.

Potential Risks and Drawbacks

While annuities offer a number of benefits, they also have some potential risks and drawbacks, including:

- Limited liquidity:Annuities are generally illiquid, meaning that it can be difficult to access your money before you start receiving payments.

- Fees and expenses:Annuities often come with fees and expenses, which can reduce your overall returns.

- Potential for lower returns:Annuities may not always provide the same high returns as other investments, such as stocks or bonds.

- Complexity:Annuities can be complex financial products, and it is important to understand the terms and conditions before purchasing one.

Annuities in 2024

The annuity market is constantly evolving, and the current economic climate is having a significant impact on annuity rates and products. It is important to stay informed about the latest trends and developments in the annuity market to make informed decisions about your retirement savings.

Like any financial product, annuities come with potential issues that you should be aware of. Read this article to learn about common Annuity Issues 2024 and how to navigate them.

Economic Climate and Interest Rates

The current economic climate is characterized by high inflation and rising interest rates. This has led to increased demand for fixed annuities, as investors seek to lock in a guaranteed rate of return. However, it has also led to lower annuity rates, as insurance companies are paying higher interest rates to attract deposits.

Annuity is a popular financial tool, but its role in modern financial planning can be complex. To get a clear picture of how it fits into your financial strategy, check out this article: Annuity Is 2024.

Regulatory Changes and Trends

The annuity market is subject to a variety of regulations, and there have been some recent changes that have impacted the industry. For example, the Department of Labor has issued new rules governing retirement advice, which could have an impact on the sale of annuities.

Many people think of annuities as life insurance products. While they share some similarities, there are key differences. To understand the relationship between annuities and life insurance, explore this article: Annuity Is A Life Insurance Product That 2024.

In addition, there has been a growing trend toward the use of variable annuities, as investors seek to take advantage of potential market growth.

Defining an annuity accurately is crucial for understanding its purpose and potential benefits. This article provides a clear and concise definition of what an annuity is: An Annuity Is Best Defined As 2024.

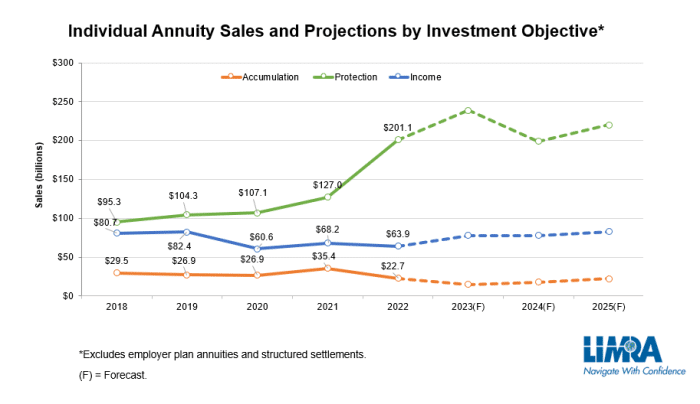

Predictions and Forecasts

The future of the annuity market is uncertain, but there are a number of factors that could impact its growth in 2024. For example, the Federal Reserve is expected to continue raising interest rates, which could lead to further pressure on annuity rates.

However, the growing demand for retirement income products could also lead to increased demand for annuities.

For those who prefer to learn about financial concepts in Hindi, this article provides a comprehensive explanation of what an annuity is in the language: Annuity Meaning In Hindi 2024.

It is important to note that these are just predictions, and the actual performance of the annuity market may differ. It is always a good idea to consult with a financial advisor to get personalized advice on annuities.

Annuities for Retirement Planning

Annuities can be a valuable tool for retirement planning, providing a stream of guaranteed income that can supplement Social Security benefits and other retirement savings. They can be used to meet a variety of retirement income needs, such as covering essential expenses, funding travel, or providing for a comfortable lifestyle.

Annuity products can be a valuable tool for managing your financial health. To understand the impact of annuities on your overall financial well-being, explore this article: Annuity Health 2024.

Retirement Income Strategy

Annuities can be used as part of a comprehensive retirement income strategy. They can be used to create a guaranteed income stream that will not be affected by market volatility or changes in interest rates. This can provide peace of mind and financial security in retirement.

While both annuities and pensions offer a stream of income, they differ in their structure and funding mechanisms. To understand the key distinctions, read this article: Is Annuity The Same As Pension 2024.

Comparison with Other Retirement Savings Options

Annuities are just one of many retirement savings options available. They offer a unique combination of guaranteed income and potential growth, but they also come with certain risks and drawbacks. It is important to compare annuities with other retirement savings options, such as 401(k)s, IRAs, and Roth IRAs, to determine which is right for you.

Purchasing an annuity involves careful consideration of various factors, including your financial goals and risk tolerance. This article provides insights into the process of Annuity Is Purchased 2024 , helping you make informed decisions.

Supplementing Social Security

Annuities can be used to supplement Social Security benefits, providing additional income that can help to cover your expenses in retirement. They can be particularly helpful for people who are concerned about the long-term sustainability of Social Security.

Annuity products are frequently used as a component of retirement planning. To gain a deeper understanding of how annuities contribute to retirement income, read this article: Is Annuity Retirement 2024.

Factors to Consider When Choosing an Annuity

When choosing an annuity, it is important to consider a number of factors, including:

- Your retirement income needs:How much income will you need in retirement? What expenses do you need to cover?

- Your risk tolerance:How comfortable are you with the potential for market volatility?

- Your time horizon:How long do you plan to live in retirement?

- Your financial goals:What are you hoping to achieve with your annuity?

- Fees and expenses:What are the fees and expenses associated with the annuity?

- Guarantees and protections:What guarantees and protections are offered by the annuity?

Tax Implications of Annuities

Annuities have unique tax implications that can affect your overall retirement income. It is important to understand the tax treatment of annuity payments to make informed decisions about your retirement savings.

Annuity is a financial product that can be a valuable tool for retirement planning. If you’re considering an annuity, you may have some questions about how it works. Check out this article for answers to frequently asked Annuity Questions 2024.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. This means that you will have to pay taxes on the portion of each payment that represents earnings. However, the tax treatment of annuity payments can vary depending on the type of annuity you purchase and the specific terms of your contract.

In the world of insurance, annuities are often associated with specific identification numbers. To learn more about these numbers and their significance, check out this article: Annuity Number Lic 2024.

Potential Tax Benefits

Annuities can offer some potential tax benefits, such as:

- Tax-deferred growth:The earnings on annuity investments grow tax-deferred, meaning that you will not have to pay taxes on them until you start receiving payments.

- Potential for tax-free withdrawals:Some annuities offer the potential for tax-free withdrawals, such as those used to cover medical expenses or long-term care.

Minimizing Taxes on Annuity Income

There are a number of strategies that you can use to minimize taxes on annuity income, such as:

- Choosing the right type of annuity:Some annuities are more tax-efficient than others. For example, a fixed annuity may be more tax-efficient than a variable annuity.

- Timing your withdrawals:You may be able to minimize taxes by timing your withdrawals strategically. For example, you may want to take withdrawals during years when your tax bracket is lower.

- Using tax-loss harvesting:If you have losses on other investments, you may be able to use tax-loss harvesting to offset gains from your annuity.

Potential Tax Penalties

There are some potential tax penalties associated with annuities, such as:

- Early withdrawal penalty:You may have to pay a penalty if you withdraw money from your annuity before age 59 1/2.

- Tax on excess distributions:You may have to pay taxes on excess distributions from your annuity if you withdraw more than the required minimum distribution each year.

Choosing the Right Annuity: Annuity 5 2024

With so many different types of annuities available, it can be difficult to choose the right one for your needs. It is important to consider a number of factors, including your retirement income needs, your risk tolerance, and your financial goals.

Factors to Consider

Here is a checklist of factors to consider when selecting an annuity:

- Your retirement income needs:How much income will you need in retirement? What expenses do you need to cover?

- Your risk tolerance:How comfortable are you with the potential for market volatility?

- Your time horizon:How long do you plan to live in retirement?

- Your financial goals:What are you hoping to achieve with your annuity?

- Fees and expenses:What are the fees and expenses associated with the annuity?

- Guarantees and protections:What guarantees and protections are offered by the annuity?

- Tax implications:How will the annuity be taxed?

- Flexibility:How flexible are the annuity’s terms and conditions?

- Reputation of the provider:What is the reputation of the annuity provider?

Comparing Annuity Options

Here is a table comparing different annuity options based on key features and benefits:

| Annuity Type | Key Features | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Guaranteed rate of return | Predictable income payments | Lower potential returns |

| Variable Annuity | Investment in mutual funds | Potential for higher returns | Market volatility |

| Indexed Annuity | Return linked to market index | Potential for growth with downside protection | Limited upside potential |

| Immediate Annuity | Payments begin immediately | Immediate income | Limited flexibility |

| Deferred Annuity | Payments begin at a later date | Time to grow your savings | Potential for lower returns |

Finding a Reputable Provider

It is important to choose an annuity provider with a strong reputation and a track record of financial stability. You can research potential providers online or by talking to a financial advisor.

Seeking Professional Financial Advice

Annuities can be complex financial products, and it is important to seek professional financial advice before purchasing one. A financial advisor can help you understand the terms and conditions of an annuity and determine if it is right for your individual needs.

An annuity is essentially a series of payments that provide a guaranteed stream of income. If you’re interested in learning more about the structure of these payments, this article provides a comprehensive explanation of An Annuity Is A Series Of 2024.

Last Point

In conclusion, annuities offer a valuable tool for individuals seeking to secure their retirement income. By understanding the different types of annuities, their potential benefits and risks, and the tax implications, you can make informed decisions about incorporating them into your retirement plan.

Remember to seek professional financial advice to determine if an annuity is right for you and to develop a comprehensive retirement strategy that meets your individual needs.

Answers to Common Questions

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of the underlying investments. Fixed annuities offer stability and predictable income, while variable annuities offer the potential for higher returns but also carry more risk.

How do I choose the right annuity provider?

An annuity is a contract that guarantees a stream of payments over a specific period of time. It’s often used to supplement retirement income, and understanding the formula behind it is crucial. Learn more about the Annuity Loan Formula 2024 to make informed decisions.

Look for a reputable provider with a strong financial track record and excellent customer service. Consider factors like fees, investment options, and the provider’s commitment to transparency and ethical practices.

What are the tax implications of annuity withdrawals?

Withdrawals from an annuity are generally taxed as ordinary income. However, there may be exceptions depending on the type of annuity and the withdrawal method used.