Annuity 70 1/2 2024: Retirement Planning Guide delves into the complexities of retirement income strategies, focusing on the crucial age of 70 1/2 and the implications of Required Minimum Distributions (RMDs) from retirement accounts. This guide provides a comprehensive overview of annuities, their different types, and how they can be utilized to secure a comfortable retirement.

Annuity is a financial product that provides regular payments for a set period of time. If you are interested in learning more about the characteristics of an annuity, you can find out more in this article, Annuity 7 Letters 2024.

It is important to understand the different types of annuities and their features before making a decision.

We explore the significance of age 70 1/2 in relation to RMDs, analyzing the impact on annuity withdrawals and potential tax implications. Furthermore, we examine the latest annuity rules and regulations for 2024, providing insights into current interest rates and investment options available.

An “annuitant” is a person who receives annuity payments. Learn more about the responsibilities of an annuitant in this article, K Is An Annuitant Currently Receiving Payments 2024. Annuity payments are often a source of income for retirees and can help them maintain their standard of living.

By dissecting the pros and cons of annuities, we aim to equip readers with the knowledge needed to make informed decisions about their retirement income.

Annuity is a financial product that is available in New Zealand. You can find out more about annuity products available in New Zealand by visiting this article, Annuity Nz 2024. It is important to understand the tax implications and other details of annuity products in your specific location.

This guide offers a balanced perspective, considering both the advantages and disadvantages of annuities, including guaranteed income, tax benefits, and protection against market volatility. We also discuss potential drawbacks such as surrender charges, limited liquidity, and investment risks. In addition to annuities, we explore alternative retirement income strategies, such as traditional IRAs, Roth IRAs, and 401(k) plans, providing a comparative analysis of their features and benefits.

Through illustrative examples, we demonstrate how annuities can impact retirement income and tax situations, helping readers visualize the potential outcomes of different annuity choices.

Many people wonder if they can still work while receiving annuity payments. You can find the answer to this question in this article, Can You Receive Annuity And Still Work 2024. The answer depends on the specific type of annuity you have and your individual circumstances.

Contents List

Annuity Basics

An annuity is a financial product that provides a stream of regular payments, either for a fixed period or for the rest of your life. Annuities are often used in retirement planning to provide a guaranteed income stream, especially for those who are concerned about outliving their savings.

Annuity payments are often tax-deferred, meaning that taxes are not paid until the money is withdrawn. To learn more about the tax implications of annuities, you can check out this article, Is Annuity Tax Deferred 2024. This can be a significant advantage, as it allows your money to grow tax-free for a longer period of time.

Types of Annuities

There are several different types of annuities, each with its own features and benefits. Here’s a breakdown of some common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return for a set period. The payments you receive are fixed and predictable, making them ideal for those seeking stability and security.

- Variable Annuities:These annuities invest in a portfolio of stocks, bonds, or other assets. Your payments can fluctuate based on the performance of your investments, potentially offering higher returns but also carrying more risk.

- Indexed Annuities:These annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer the potential for growth while providing some protection against market downturns.

Examples of Annuity Use in Retirement Planning

Annuities can be used in a variety of ways to supplement retirement income. Here are some examples:

- Guaranteed Income Stream:Annuities can provide a steady stream of income that you can rely on throughout your retirement years.

- Protection Against Longevity Risk:Annuities can help you protect against the risk of outliving your savings, as they can provide income for as long as you live.

- Tax Advantages:Some annuities offer tax-deferred growth, which means that you don’t have to pay taxes on your earnings until you start withdrawing them.

Age 70 1/2 and Annuities

Turning 70 1/2 is a significant milestone in retirement planning, as it marks the age when you are required to start taking Required Minimum Distributions (RMDs) from your retirement accounts.

An “x share annuity” is a type of annuity that is tied to the performance of a specific investment. You can find more information about this type of annuity in this article, X Share Annuity 2024. It is important to understand the risks and rewards associated with this type of annuity before investing.

Required Minimum Distributions (RMDs)

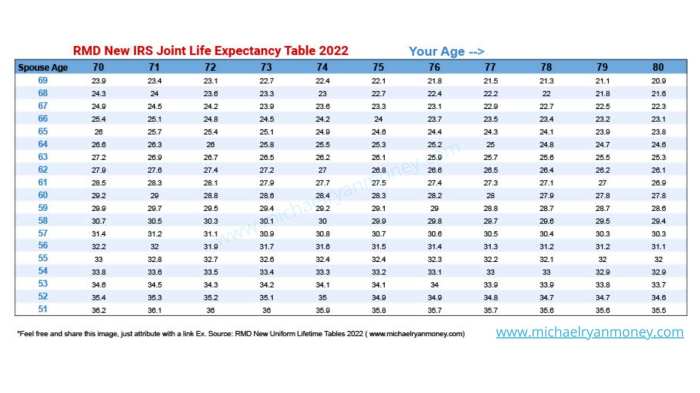

RMDs are annual withdrawals that you must take from your traditional IRA, 401(k), and other qualified retirement accounts. The amount you are required to withdraw each year is based on your age and the balance of your account.

Annuity is a popular financial tool used to provide a consistent stream of income for individuals. This article, Annuity Is Primarily Used To Provide 2024 , explores the primary uses of annuities. It can be used to supplement retirement income, provide income for life, or even fund specific expenses.

RMDs and Annuity Withdrawals

If you have an annuity, you will need to factor in RMDs when determining your withdrawal strategy. You may be able to withdraw your RMD from your annuity or from other retirement accounts. The specific rules for RMDs and annuities can be complex, so it’s important to consult with a financial advisor.

Annuity payments may be subject to taxes, depending on the specific type of annuity and your individual circumstances. To learn more about the tax implications of annuity payments, you can visit this article, Is Annuity Exempt From Tax 2024.

It is important to seek professional advice to ensure you understand the tax implications of your annuity.

Tax Implications of RMDs

RMDs are generally taxable as ordinary income. If you withdraw your RMD from an annuity, the portion of the withdrawal that represents earnings will be taxed.

Managing RMDs and Maximizing Annuity Benefits

There are several strategies you can use to manage RMDs and maximize the benefits of your annuity. These strategies may include:

- Timing Your Withdrawals:You can choose to take your RMDs at different times throughout the year, depending on your tax situation.

- Converting to a Roth IRA:If you have a traditional IRA, you may be able to convert it to a Roth IRA, which can eliminate RMDs and provide tax-free withdrawals in retirement.

- Using a Qualified Charitable Distribution (QCD):You can use a QCD to make a tax-free charitable donation directly from your IRA, which can reduce your RMD and provide tax benefits.

Annuity Considerations in 2024

The annuity landscape is constantly evolving, with new rules and regulations being implemented each year. Here are some key considerations for annuities in 2024:

Changes to Annuity Rules and Regulations

It’s essential to stay up-to-date on any changes to annuity rules and regulations that may affect your retirement planning. This could include changes to tax laws, investment options, or other factors.

When someone inherits an annuity, they may have options for how to manage the funds. You can learn more about the process of inheriting an annuity in this article, What Happens When I Inherit An Annuity 2024. It is important to seek professional advice to ensure you make the best decisions for your financial situation.

Annuity Interest Rates and Investment Options

Annuity interest rates and investment options can fluctuate based on market conditions. It’s important to compare rates and options from different providers to find the best deal for your needs.

Impact of Economic Conditions

Economic conditions can have a significant impact on annuity performance. For example, rising interest rates can lead to higher annuity payouts, while inflation can erode the purchasing power of your annuity payments.

Annuity is a financial product that can be structured in different ways, including as a series of payments. To learn more about the different types of annuity series, you can visit this article, Annuity Is Series 2024. Choosing the right annuity series can help you achieve your financial goals.

Pros and Cons of Annuities

Annuities can be a valuable tool for retirement planning, but they also come with certain drawbacks. Here’s a breakdown of the pros and cons:

Advantages of Annuities, Annuity 70 1/2 2024

- Guaranteed Income:Annuities can provide a guaranteed stream of income for a set period or for the rest of your life.

- Tax Benefits:Some annuities offer tax-deferred growth, which means that you don’t have to pay taxes on your earnings until you start withdrawing them.

- Protection Against Market Volatility:Annuities can provide some protection against market downturns, as they can offer a guaranteed rate of return or link their returns to a specific market index.

Disadvantages of Annuities

- Potential Surrender Charges:If you withdraw from an annuity before a certain period, you may have to pay surrender charges.

- Limited Liquidity:Annuities can be illiquid, meaning that it can be difficult to access your funds quickly.

- Possible Investment Risks:Variable annuities carry investment risks, as the value of your investments can fluctuate.

Comparison of Annuity Types

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuity | Guaranteed rate of return, predictable payments, low risk | Limited growth potential, lower interest rates than variable annuities |

| Variable Annuity | Potential for higher returns, investment flexibility | Investment risks, potential for losses, higher fees than fixed annuities |

| Indexed Annuity | Potential for growth, some protection against market downturns | Limited growth potential compared to variable annuities, complex features |

Alternative Retirement Income Strategies

Annuities are not the only retirement income strategy available. Here are some other options to consider:

Traditional IRAs, Roth IRAs, and 401(k) Plans

- Traditional IRAs:These accounts offer tax-deductible contributions and tax-deferred growth, but withdrawals are taxed in retirement.

- Roth IRAs:These accounts offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

- 401(k) Plans:These plans are offered by employers and allow employees to save for retirement on a pre-tax basis.

Comparison of Retirement Income Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Annuities | Guaranteed income, tax benefits, protection against market volatility | Potential surrender charges, limited liquidity, possible investment risks |

| Traditional IRAs | Tax-deductible contributions, tax-deferred growth | Taxable withdrawals in retirement |

| Roth IRAs | Tax-free withdrawals in retirement | Non-deductible contributions |

| 401(k) Plans | Employer matching contributions, tax-deferred growth | Limited investment options, potential for employer-imposed restrictions |

Illustrative Examples

Let’s consider a hypothetical scenario of an individual named Sarah, who is turning 70 1/2 in 2024 and is exploring annuity options.

If you are looking for a way to receive a steady stream of income, an annuity may be a good option for you. You can find out more about annuity payments of $2000 per month in this article, Annuity 2000 Per Month 2024.

Annuity payments can be customized to meet your individual needs and financial goals.

Sarah’s Retirement Planning

Sarah has a significant amount of savings in her retirement accounts, and she wants to ensure that she has a reliable income stream throughout her retirement years. She is considering purchasing an annuity to supplement her other retirement income sources.

The life expectancy of the annuitant is an important factor in determining the amount of annuity payments. You can learn more about how life expectancy affects annuity payments in this article, When Annuity Is Written Whose Life Expectancy 2024.

It is important to consider your own life expectancy when choosing an annuity.

Annuity Options for Sarah

Sarah has several annuity options available to her, including:

- Fixed Annuity:This option would provide Sarah with a guaranteed rate of return and predictable payments.

- Variable Annuity:This option would offer Sarah the potential for higher returns, but it would also carry more investment risk.

- Indexed Annuity:This option would link Sarah’s returns to the performance of a specific market index, offering the potential for growth while providing some protection against market downturns.

Benefits and Drawbacks of Annuity Choices

Each annuity option has its own benefits and drawbacks. Sarah needs to carefully consider her risk tolerance, investment goals, and financial situation before making a decision.

There are various types of annuities, each with its own set of features and benefits. To understand the different types of annuities and their examples, you can refer to this article, Annuity Examples 2024. It is important to choose an annuity that aligns with your financial goals and risk tolerance.

Impact on Retirement Income and Taxes

The annuity Sarah chooses will impact her retirement income and tax situation. For example, a fixed annuity would provide her with a guaranteed income stream, but the payments may be lower than those from a variable annuity.

Annuity can be used as a retirement savings plan in India, where it is linked to the National Pension System (NPS). For more information about annuities and their connection to the NPS, check out this resource, Annuity Nps 2024.

Annuities offer a secure and predictable way to receive retirement income.

Conclusive Thoughts: Annuity 70 1/2 2024

As you approach retirement, understanding the nuances of annuities and their impact on your financial future is crucial. By carefully considering your individual circumstances, exploring various options, and seeking professional advice, you can make informed decisions that align with your retirement goals.

Annuity is a financial product that provides regular payments for a set period of time. You can learn more about the definition of an annuity by visiting this article, Annuity Is Defined As Mcq 2024. Annuity payments can be used for a variety of purposes, such as retirement income, income for life, or to cover specific expenses.

This guide provides a foundation for navigating the complexities of retirement planning, equipping you with the knowledge to make confident choices and secure a comfortable and fulfilling retirement.

FAQ Section

What are the different types of annuities?

Annuities come in various forms, including fixed, variable, and indexed annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities provide potential growth but also carry investment risk. Indexed annuities link returns to a specific market index, offering a balance between growth and protection.

How do RMDs affect annuity withdrawals?

RMDs must be taken from retirement accounts, including annuities, starting at age 70 1/2. These withdrawals are taxable as ordinary income. The amount of RMD depends on the account balance and life expectancy.

What are the tax implications of annuity withdrawals?

The tax implications of annuity withdrawals depend on the type of annuity and the withdrawal method. Generally, withdrawals from traditional annuities are taxed as ordinary income, while withdrawals from Roth annuities are tax-free.

What are some alternative retirement income strategies besides annuities?

Other retirement income strategies include traditional IRAs, Roth IRAs, and 401(k) plans. These accounts offer tax advantages and potential growth opportunities, but they may not provide guaranteed income like annuities.