6 Percent Annuity 2024 sets the stage for a deep dive into the world of fixed income investments, exploring how these annuities can provide a steady stream of income in a fluctuating market. This guide delves into the intricacies of 6 percent annuities, examining their mechanics, potential benefits, and risks.

For those seeking clarity on the tax implications of single life annuities, Is A Single Life Annuity Taxable 2024 provides detailed information on the taxability of these specific annuity types.

We’ll also discuss factors to consider when choosing an annuity, analyzing current market trends and projections for the year ahead.

If you’re looking for information about annuities from 2021 to 2024, Annuity 2021 2024 offers insights into the annuity market during this period, highlighting key trends and developments.

From understanding the basics of annuities to navigating the complexities of different types and market conditions, this comprehensive resource aims to equip readers with the knowledge needed to make informed decisions about investing in 6 percent annuities in 2024.

Calculating the cost of borrowing with an annuity can be tricky. Annuity Loan Calculator 2024 offers a convenient tool for estimating loan costs associated with annuities, helping you make informed financial decisions.

Contents List

Introduction to 6 Percent Annuities

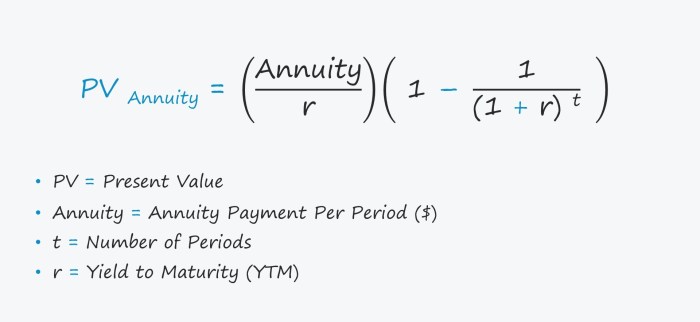

A 6 percent annuity is a type of financial product that provides a guaranteed stream of income for a specific period, often throughout retirement. It works by allowing individuals to invest a lump sum of money, which then earns a fixed interest rate, typically around 6 percent per year.

Wondering what an annuity is and how it works? Annuity Is 2024 provides a comprehensive overview of annuities, explaining their purpose and how they can benefit you.

This interest rate is guaranteed for the duration of the annuity, ensuring a predictable income stream.

If you’re looking for a fun way to learn about annuities, Annuity Unscramble 2024 offers an interactive experience, helping you unscramble the word “annuity” while learning about its key concepts.

Annuities are an essential component of financial planning, especially for retirement. They offer a reliable way to generate consistent income during the golden years, providing financial security and peace of mind. The concept of an annuity is based on the principle of converting a lump sum of money into a series of regular payments, effectively transforming a single asset into a continuous income stream.

Investing in a 6 percent annuity in 2024 can offer several potential benefits. The fixed interest rate provides stability and predictability in an uncertain economic environment, safeguarding against inflation and market volatility. This guaranteed income stream can help individuals meet their essential expenses, maintain their lifestyle, and achieve their financial goals during retirement.

Joint ownership of annuities can be a beneficial option for couples. Annuity Joint Ownership 2024 explores the advantages and considerations of joint annuity ownership, providing insights into how it can work for you.

Factors Affecting 6 Percent Annuity Returns

Several economic factors influence the returns on 6 percent annuities. Interest rates play a crucial role, as they directly impact the amount of interest earned on the invested capital. The current interest rate environment, characterized by low rates, can affect the attractiveness of 6 percent annuities compared to other investment options.

Reversionary annuities are a unique type of annuity that can provide income to a beneficiary after the original annuitant passes away. Annuity Is Reversionary 2024 delves into the intricacies of reversionary annuities, explaining their features and potential benefits.

However, it’s important to note that annuities are not solely dependent on interest rates. Other factors, such as inflation, market volatility, and the financial health of the issuing company, can also influence returns. Inflation can erode the purchasing power of annuity payments, while market volatility can affect the value of the underlying investments.

Navigating the world of annuities can be confusing. Annuity Number 2024 delves into the different types of annuities, explaining their unique features and potential benefits.

Types of 6 Percent Annuities

The market offers various types of 6 percent annuities, each with unique features, benefits, and risks. Understanding these differences is crucial for selecting the most suitable annuity for individual needs and financial goals.

Tax implications are a major concern for many people. Is Annuity For Life Insurance Taxable 2024 tackles this question, providing guidance on the taxability of annuities tied to life insurance.

- Fixed Annuities: These annuities offer a guaranteed fixed interest rate for the entire duration of the contract. This provides predictable income payments, but the returns may not keep pace with inflation.

- Variable Annuities: These annuities offer the potential for higher returns, but they also carry higher risk. The interest rate is linked to the performance of underlying investments, such as stocks or bonds, which can fluctuate in value.

- Indexed Annuities: These annuities offer a combination of guaranteed income and potential for growth. The interest rate is tied to the performance of a specific index, such as the S&P 500, providing some protection against inflation and market volatility.

Considerations for Choosing a 6 Percent Annuity, 6 Percent Annuity 2024

Choosing the right 6 percent annuity requires careful consideration of several factors, including financial goals, risk tolerance, and time horizon. Individuals with a high risk tolerance and a long time horizon may opt for variable annuities, while those seeking guaranteed income and stability may prefer fixed annuities.

Figuring out the duration of your annuity payments can be crucial. Annuity Number Of Periods Calculator 2024 is a handy tool for calculating the number of periods your annuity will last, helping you plan for the future.

Tax implications are another crucial consideration. Annuities may offer tax advantages, such as tax-deferred growth or tax-free withdrawals, depending on the type of annuity and the individual’s tax situation. It’s essential to consult with a financial advisor to understand the tax implications of investing in a 6 percent annuity.

Annuities are primarily used for a specific purpose. Annuity Is Primarily Used To Provide 2024 clarifies the primary purpose of annuities, helping you understand how they can be used to meet your financial goals.

Comparing different annuity options is essential to find the best fit for your needs. Factors to consider include the interest rate, fees, surrender charges, and death benefits. It’s advisable to obtain quotes from multiple reputable financial institutions and carefully analyze the terms and conditions before making a decision.

Estimating the tax implications of annuity withdrawals can be challenging. Annuity Withdrawal Tax Calculator 2024 provides a valuable tool for calculating the potential tax liability on your annuity withdrawals, helping you plan for the future.

6 Percent Annuity in 2024: Market Trends and Outlook

The market for 6 percent annuities is constantly evolving, influenced by economic conditions, interest rates, and investor demand. In 2024, the market is expected to remain competitive, with financial institutions offering various products to meet diverse investor needs.

Understanding the 60-day rollover rule is crucial for those dealing with annuities. Annuity 60 Day Rollover 2024 explains the rules and regulations surrounding annuity rollovers, helping you make informed decisions.

While the current low interest rate environment may pose challenges for 6 percent annuities, the potential for growth and stability remains attractive for investors seeking predictable income streams. As the economy recovers and interest rates rise, the demand for 6 percent annuities is likely to increase, driving competition and innovation in the market.

Industry experts and financial analysts are optimistic about the future of 6 percent annuities, citing their potential to provide financial security and peace of mind during retirement. However, it’s essential to conduct thorough research, seek professional advice, and carefully evaluate the risks and benefits before making an investment decision.

End of Discussion

As we conclude our exploration of 6 percent annuities in 2024, it’s clear that these financial instruments offer a compelling opportunity for investors seeking predictable income streams. By carefully considering the various factors discussed in this guide, including your financial goals, risk tolerance, and market conditions, you can make informed decisions about whether a 6 percent annuity is the right fit for your portfolio.

Remember, consulting with a financial advisor can provide valuable insights and personalized guidance tailored to your specific circumstances.

Inheriting an annuity can be exciting, but it’s important to understand the tax implications. I Inherited An Annuity Is It Taxable 2024 explores the taxability of inherited annuities, providing valuable information for planning purposes.

Clarifying Questions: 6 Percent Annuity 2024

What are the tax implications of investing in a 6 percent annuity?

The tax implications of a 6 percent annuity can vary depending on the type of annuity and the specific terms of the contract. It’s important to consult with a tax professional for personalized advice.

Are 6 percent annuities guaranteed to provide a return?

While fixed annuities offer guaranteed interest rates, it’s important to understand that these rates may not keep pace with inflation, potentially reducing the purchasing power of your income over time.

How can I find reputable providers of 6 percent annuities?

If you’re considering an annuity in 2024, you’ll likely want to know if it’s a safe investment. Is Annuity Safe 2024 addresses this concern, providing insights into the current market and potential risks.

You can research reputable financial institutions by seeking recommendations from trusted sources, checking online reviews, and comparing annuity products and their terms.