Annuity 750k 2024 represents a significant financial goal for many individuals, offering the potential for substantial income security in the years to come. This comprehensive guide delves into the intricacies of annuities, exploring their various types, investment strategies, and tax implications.

Looking for information on annuity health services in Westmont, Illinois in 2024? Annuity Health Westmont Il 2024 will provide you with valuable resources. This article will discuss the various annuity health providers in Westmont, Illinois, offering insights into their services, contact information, and any special offers they may have.

We’ll analyze the impact of inflation on the value of your annuity, discuss how to maximize its potential, and provide insights into planning for a comfortable retirement.

Are you looking to purchase an annuity in 2024? Annuity Is Taxable Or Not 2024 will provide you with a comprehensive overview of annuity taxation in 2024. Understanding the tax implications is crucial when making financial decisions, and this article will help you navigate the complexities of annuity taxation.

Understanding annuities is crucial for anyone seeking to secure their financial future. From the basics of how annuities work to the nuances of investment strategies and tax considerations, this guide provides a clear and concise overview. We’ll explore the potential benefits and drawbacks of annuities, helping you make informed decisions about incorporating them into your financial plan.

Do you know what other terms are used to describe annuities in 2024? Annuity Is Also Known As 2024 will provide you with a comprehensive list. This article will explore the different names and synonyms used for annuities, helping you understand the various ways this financial product is referred to.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s designed to provide a steady income stream for individuals during retirement or other life stages. Annuities are often purchased with a lump sum of money, and the payments can be guaranteed for life or for a specific period.

Planning to invest in a $300,000 annuity in 2024? Annuity 300k 2024 will guide you through the process. This article will discuss the various factors to consider when investing in a $300,000 annuity, including the different types of annuities available and their potential returns.

Types of Annuities

Annuities are categorized into various types, each with its own features and benefits. Here’s a breakdown of the most common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment. The payments you receive are fixed and predictable, making them a good choice for those seeking stability and income security.

- Variable Annuities:These annuities invest your money in a range of sub-accounts, such as stocks, bonds, and mutual funds. Your payments can fluctuate depending on the performance of the underlying investments. Variable annuities offer the potential for higher returns, but they also come with higher risks.

Curious about the tax implications of immediate annuity income in 2024? Is Immediate Annuity Income Taxable 2024 will answer your questions. This article will explore the tax treatment of immediate annuity income, including the different types of annuities and their tax implications.

- Indexed Annuities:These annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer potential growth while providing some downside protection. Indexed annuities typically have a minimum guaranteed return, which ensures that you’ll receive at least a certain amount of income.

Curious about the implications of purchasing a $50,000 single premium annuity in 2024? G Purchased A $50 000 Single Premium 2024 will delve into the details. This article will discuss the benefits, risks, and tax implications associated with single premium annuities, providing insights for individuals considering this investment strategy.

Key Features and Benefits of Annuities

Annuities offer a range of features and benefits that make them an attractive investment option for many individuals.

Are there any annuities that are exempt from tax in 2024? Is Annuity Exempt From Tax 2024 will shed light on the tax-exempt aspects of annuities. This article will explore the different types of annuities that may be exempt from taxation, providing valuable insights for individuals seeking tax-advantaged retirement income.

- Guaranteed Income:Fixed annuities and some indexed annuities provide a guaranteed income stream, which can be crucial for financial planning, especially during retirement.

- Tax Advantages:Annuity payments are generally taxed as ordinary income, but the growth of your investment is tax-deferred until you begin receiving payments. This can help you accumulate wealth more quickly.

- Protection Against Market Volatility:Fixed annuities and some indexed annuities offer protection against market downturns, providing a level of security for your investment.

- Flexibility:Annuities offer various options for customization, allowing you to choose the payment frequency, duration, and investment strategy that best suits your needs.

Annuity of $750,000 in 2024: Annuity 750k 2024

The value of $750,000 in 2024 will be influenced by inflation. If inflation remains high, the purchasing power of $750,000 could be significantly eroded. However, if inflation remains low or falls, the value of $750,000 could hold up better.

What is an “annuity number” in 2024? Annuity Number 2024 will provide you with a detailed explanation. This article will cover the various aspects of annuity numbers, including their purpose, how they are assigned, and their significance in the financial world.

Factors Affecting Annuity Value

Several factors can affect the growth or decline of an annuity’s value, including:

- Interest Rates:Higher interest rates generally benefit fixed annuities, as they offer higher guaranteed returns. Conversely, lower interest rates can lead to lower returns.

- Market Performance:Variable annuities are tied to the performance of the stock market. If the market performs well, your annuity could grow significantly. However, if the market declines, your annuity’s value could decrease.

- Inflation:Inflation erodes the purchasing power of money over time. If inflation is high, the value of your annuity could decline, even if it’s growing in nominal terms.

- Investment Strategy:The investment strategy you choose for your annuity can significantly impact its value. A well-diversified investment portfolio with a mix of stocks, bonds, and other assets can help mitigate risk and maximize returns.

Maximizing Annuity Value

Here are some strategies to maximize the value of an annuity in 2024:

- Choose the Right Annuity Type:Consider your risk tolerance, income needs, and investment goals when selecting an annuity type. If you’re seeking guaranteed income and stability, a fixed annuity might be a good option. If you’re willing to take on more risk for the potential of higher returns, a variable annuity might be more suitable.

Looking to understand the formula used for calculating annuity loans in 2024? Annuity Loan Formula 2024 will break down the formula and its application. This article will provide a clear explanation of the formula, along with examples and practical applications.

- Diversify Your Investments:Don’t put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk and maximize returns over the long term.

- Consider a Roth Annuity:A Roth annuity allows you to contribute after-tax dollars, but your withdrawals in retirement are tax-free. This can be a beneficial option for individuals who expect to be in a higher tax bracket in retirement.

Tax Implications of Annuities

Understanding the tax treatment of annuity payments is crucial for financial planning. Here’s a breakdown of how annuities are typically taxed:

Tax Treatment of Annuity Payments, Annuity 750k 2024

When you receive annuity payments, the portion of the payment that represents your original investment is tax-free. However, the portion of the payment that represents earnings is taxed as ordinary income.

Are annuities considered pensions in 2024? Annuity Is Pension 2024 will explain the differences between annuities and pensions. This article will delve into the key characteristics of each, providing a clear understanding of their respective roles in retirement planning.

Tax Implications of Withdrawing from an Annuity

Withdrawing from an annuity before age 59 1/2 typically incurs a 10% penalty, plus any applicable taxes. However, there are some exceptions to this rule, such as if you have a qualifying medical expense or disability. Consult with a tax advisor to determine the specific tax implications of withdrawing from your annuity.

Minimizing Tax Liability

Here are some strategies to minimize tax liability related to annuities:

- Delaying Withdrawals:If possible, delay withdrawals from your annuity until you’re in a lower tax bracket, such as during retirement.

- Choosing a Roth Annuity:A Roth annuity allows you to contribute after-tax dollars, so your withdrawals in retirement are tax-free.

- Working with a Tax Advisor:Consult with a tax advisor to develop a tax strategy that minimizes your tax liability related to your annuity.

Annuity Investment Strategies

Investing an annuity of $750,000 in 2024 requires a thoughtful strategy to balance risk and return. Here’s a breakdown of investment options and strategies:

Investment Options for Annuity Holders

- Fixed Income Investments:Bonds, CDs, and other fixed-income securities provide a steady stream of income and can help preserve capital during market downturns. These investments are typically less volatile than stocks but offer lower potential returns.

- Equities:Stocks represent ownership in companies and can offer significant growth potential over the long term. However, stocks are also more volatile than fixed income investments, so they carry higher risk.

- Real Estate:Real estate can provide income through rent and potential appreciation in value. However, real estate investments can be illiquid and require significant capital and management expertise.

- Alternative Investments:Alternative investments, such as private equity, hedge funds, and commodities, can offer diversification and potentially higher returns. However, these investments are often complex and require specialized knowledge and experience.

Managing Risk and Maximizing Returns

Here are some strategies for managing risk and maximizing returns with an annuity investment:

- Diversify Your Portfolio:Don’t put all your eggs in one basket. Diversifying your investments across different asset classes can help mitigate risk and maximize returns over the long term.

- Rebalance Regularly:As your investments grow or decline, it’s important to rebalance your portfolio to maintain your desired asset allocation. Rebalancing helps ensure that you’re not taking on too much risk or missing out on potential growth opportunities.

- Consider a Financial Advisor:A financial advisor can help you develop a personalized investment strategy that aligns with your risk tolerance, income needs, and investment goals. They can also help you monitor your portfolio and make adjustments as needed.

Annuity Planning and Retirement

Annuities play a significant role in retirement planning by providing a steady stream of income. They can help ensure financial security during retirement, allowing individuals to live comfortably and pursue their passions.

Income Security in Retirement

Annuities can provide a guaranteed income stream during retirement, which can be essential for covering living expenses, healthcare costs, and other financial obligations. Fixed annuities and some indexed annuities offer a guaranteed income stream that’s not subject to market volatility, providing peace of mind for retirees.

Are you unsure about the taxability of annuity income received from LIC in 2024? Is Annuity Received From Lic Taxable 2024 will answer your questions. This article will delve into the specific tax implications of annuities received from LIC, providing a clear understanding of how they are taxed in India.

Advantages and Disadvantages of Annuities for Retirement

Here’s a breakdown of the advantages and disadvantages of annuities for retirement planning:

- Advantages:

- Guaranteed income stream

- Tax-deferred growth

- Protection against market volatility

- Flexibility and customization options

- Disadvantages:

- Potential for lower returns compared to other investments

- Fees and surrender charges

- Limited access to your funds

Annuity Providers and Market Trends

The annuity market is diverse, with numerous providers offering a range of products. Here’s a look at key providers and market trends:

Key Annuity Providers

Some of the major annuity providers in the market include:

- AIG

- Prudential

- MetLife

- New York Life

- Transamerica

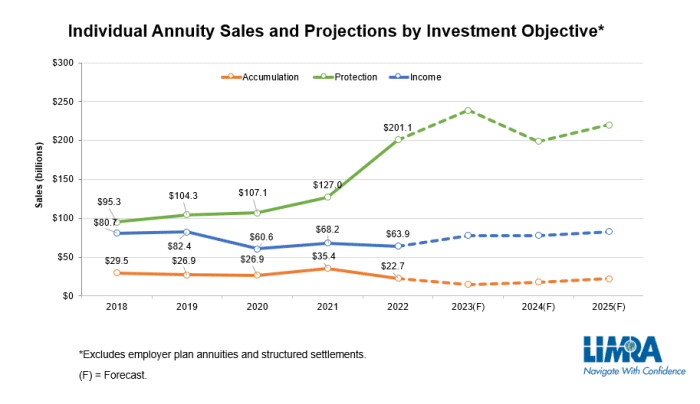

Current Trends in the Annuity Market

The annuity market is constantly evolving, driven by factors such as interest rates, inflation, and investor preferences. Here are some key trends:

- Growth of Indexed Annuities:Indexed annuities have gained popularity due to their potential for growth while providing some downside protection.

- Increased Demand for Guaranteed Income:As individuals approach retirement, they are increasingly seeking guaranteed income streams to ensure financial security.

- Focus on Longevity:Annuities are becoming more tailored to meet the needs of individuals with longer life expectancies.

Factors Influencing Annuity Popularity

Several factors contribute to the popularity of annuities, including:

- Retirement Planning:Annuities provide a reliable income stream for retirement, which can be crucial for individuals seeking financial security.

- Tax Advantages:The tax-deferred growth of annuity investments can help individuals accumulate wealth more quickly.

- Market Volatility:Annuities offer protection against market downturns, providing a level of security for investments.

- Flexibility:Annuities offer various customization options, allowing individuals to tailor their investment strategy to their specific needs.

Case Studies: Annuities in Action

To illustrate the potential outcomes of different annuity scenarios, here’s a table showcasing various annuity types, investment strategies, and projected returns:

| Annuity Type | Investment Strategy | Projected Returns | Advantages | Disadvantages |

|---|---|---|---|---|

| Fixed Annuity | Conservative, with a focus on fixed income investments | 3% annual return | Guaranteed income stream, low risk | Potential for lower returns compared to other investments |

| Variable Annuity | Aggressive, with a higher allocation to equities | 6% annual return (estimated) | Potential for higher returns, flexibility in investment choices | Higher risk, returns are not guaranteed |

| Indexed Annuity | Linked to the performance of the S&P 500 | 4% annual return (estimated) | Potential for growth, some downside protection | Returns may be limited by the performance of the underlying index |

These are just hypothetical scenarios, and actual returns may vary depending on market conditions and investment performance. It’s essential to consult with a financial advisor to determine the best annuity strategy for your individual circumstances.

Conclusion

As you navigate the world of annuities, remember that careful planning and informed decision-making are paramount. By understanding the various factors that influence annuity performance, you can position yourself to maximize your financial potential and achieve your retirement goals.

Is an annuity a form of life insurance in 2024? Is Annuity Life Insurance 2024 will clarify the differences between annuities and life insurance. This article will discuss the key features and benefits of each, helping you understand the distinctions between these financial products.

This guide serves as a starting point, providing valuable insights and tools to help you make informed decisions about annuities and their role in your financial future.

Popular Questions

How do I choose the right type of annuity for my needs?

The best type of annuity for you depends on your individual circumstances, risk tolerance, and financial goals. Consulting with a financial advisor can help you determine the most suitable option.

Are you concerned about the taxability of annuity payments in 2024? Is Annuity Payments Taxable 2024 provides insights into the tax implications of annuity payments. Understanding how annuity payments are taxed is crucial for planning your finances, and this article will provide clear explanations and examples.

Are annuities a good investment for everyone?

Annuities can be a valuable part of a diversified retirement portfolio, but they are not suitable for everyone. It’s essential to carefully consider your financial situation and goals before making a decision.

Thinking about using an annuity for your home loan in 2024? Annuity Home Loan 2024 provides valuable information on how annuities can be utilized for home loans. It will discuss the benefits, drawbacks, and different types of annuity-based home loans available in 2024.

What are the risks associated with annuities?

Wondering if your annuity income is considered capital gains in 2024? Is Annuity Income Capital Gains 2024 will help you understand the tax implications of your annuity income. This article will discuss the specific tax treatment of annuity income, including whether it’s considered capital gains, ordinary income, or a combination of both.

Like any investment, annuities carry some risks. These may include market risk, interest rate risk, and the potential for losing principal. It’s crucial to understand these risks before investing.