How Much Annuity For 80000 2024 – How Much Annuity For $80,000 in 2024? This question is at the forefront of many minds as individuals seek to secure their financial future. Annuities, with their potential for guaranteed income and tax advantages, offer a compelling solution for those looking to manage their retirement savings and navigate the complexities of longevity risk.

Stay up-to-date on the latest developments in the annuity world with this article on Annuity News 2024.

Understanding the different types of annuities, the factors influencing their payouts, and the intricacies of estimating payments for a specific investment amount like $80,000 in 2024, is crucial for making informed decisions.

Dreaming of retiring with a $1 million annuity? This article explores the specifics of Annuity 1 Million 2024 and its potential benefits.

This guide will delve into the world of annuities, exploring their various types, the factors that determine their payouts, and how to estimate payments for a $80,000 investment in 2024. We will examine the role of interest rates, annuity factors, and other key variables in shaping annuity payments.

Thinking about retiring with a comfortable income stream? An annuity might be the answer you’re looking for. To learn more about the potential penalties associated with withdrawing from an annuity before age 59 1/2, check out this article on Annuity 10 Penalty 2024.

By the end of this exploration, you will have a comprehensive understanding of annuities and their potential to meet your financial goals.

Looking to explore a 5-year annuity? Learn more about the potential benefits and features of Annuity 5 2024.

Contents List

Understanding Annuities: How Much Annuity For 80000 2024

An annuity is a financial product that provides a stream of regular payments over a specified period of time. Annuities are often used for retirement planning, but they can also be used for other purposes, such as income protection or estate planning.

There are different types of annuities available, each with its own features and benefits. Understanding the different types of annuities and how they work is essential for making an informed decision about whether an annuity is right for you.

Types of Annuities

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return on your investment. This means that you know exactly how much income you will receive each year, regardless of market fluctuations. Fixed annuities are a good option for people who want to protect their principal and receive a predictable income stream.

Need a general overview of annuities? This article provides a comprehensive look at Annuity General 2024 and its various aspects.

- Variable Annuities:Variable annuities offer the potential for higher returns, but they also carry more risk. The income you receive from a variable annuity is based on the performance of the underlying investment portfolio. If the market performs well, your payments will be higher.

However, if the market declines, your payments may be lower.

- Immediate Annuities:Immediate annuities begin paying out income immediately after you purchase them. This type of annuity is a good option for people who need income right away, such as retirees or those who have recently experienced a life-changing event.

- Deferred Annuities:Deferred annuities do not begin paying out income until a later date, such as retirement. This type of annuity is a good option for people who are saving for retirement and want to grow their investment over time.

Key Features and Benefits of Annuities, How Much Annuity For 80000 2024

- Guaranteed Income:Many annuities provide a guaranteed income stream, which can be a valuable source of financial security in retirement. This means that you can be sure that you will receive a certain amount of income each year, regardless of market conditions.

Thinking about setting up an annuity with a $30,000 contribution? This article delves into the specifics of Annuity 30k 2024.

- Tax Advantages:Annuities can offer tax advantages, depending on the type of annuity and how it is structured. For example, some annuities allow you to defer taxes on your investment earnings until you start receiving payments.

- Protection Against Longevity Risk:Annuities can help protect you against longevity risk, which is the risk that you will outlive your savings. By providing a guaranteed income stream, annuities can ensure that you have enough money to live on for the rest of your life.

Examples of How Annuities Can Be Used

- Retirement Income:Annuities can be a valuable source of retirement income. They can provide a steady stream of income that can supplement other retirement savings, such as Social Security or a 401(k).

- Income Protection:Annuities can be used to protect your income in the event of an unexpected event, such as a disability or job loss. For example, you can purchase an annuity that will provide you with income if you are unable to work.

- Estate Planning:Annuities can be used as part of your estate planning strategy. For example, you can use an annuity to provide income for your beneficiaries after you pass away.

Factors Influencing Annuity Payments

The amount of income you receive from an annuity depends on a number of factors, including your age, gender, interest rates, and the amount of your initial investment. The type of annuity you choose also plays a role in determining your payments.

Factors That Determine Annuity Payments

- Age:Younger people generally receive lower annuity payments than older people. This is because younger people have a longer life expectancy, so they are expected to receive payments for a longer period of time.

- Gender:Women generally receive lower annuity payments than men. This is because women tend to live longer than men.

- Interest Rates:Interest rates play a significant role in determining annuity payments. Higher interest rates generally lead to higher annuity payments. This is because the annuity provider can earn more money on your investment, allowing them to pay you more.

- Initial Investment:The amount of your initial investment is a major factor in determining your annuity payments. The larger your initial investment, the higher your payments will be.

Impact of Annuity Type on Payment Amount

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return, so your payments will be predictable. However, the payments may be lower than those offered by variable annuities, which have the potential for higher returns.

- Variable Annuities:Variable annuities offer the potential for higher returns, but they also carry more risk. Your payments will be based on the performance of the underlying investment portfolio, so they may fluctuate over time.

- Immediate Annuities:Immediate annuities begin paying out income immediately, so your payments will be higher than those offered by deferred annuities. This is because the annuity provider has less time to earn money on your investment.

- Deferred Annuities:Deferred annuities do not begin paying out income until a later date, so your payments will be lower than those offered by immediate annuities. This is because the annuity provider has more time to earn money on your investment.

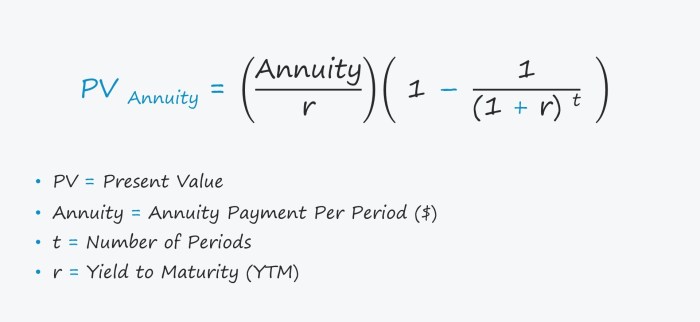

Annuity Factor

The annuity factor is a number that is used to calculate annuity payments. It is based on a number of factors, including your age, gender, and the interest rate. The annuity factor is multiplied by your initial investment to determine your annual payment.

Are you considering an annuity in the UK? Find out if your annuity income is taxable in this article on Is Annuity Income Taxable In Uk 2024.

Estimating Annuity Payments for $80,000 in 2024

The following table provides estimated monthly and annual payments for different annuity types based on a $80,000 initial investment in 2024. These estimates are based on realistic assumptions for interest rates, annuity factors, and other relevant variables. However, it is important to note that actual payments may vary depending on individual circumstances and market conditions.

Want to understand the components of your annuity statement? This article delves into the details of Annuity Statement Is 2024.

Estimated Annuity Payments

| Annuity Type | Payment Frequency | Estimated Monthly Payment | Estimated Annual Payment |

|---|---|---|---|

| Fixed Annuity | Monthly | $500 | $6,000 |

| Variable Annuity | Monthly | $450

Want to explore how annuities can play a role in your health insurance planning? Check out this resource on Annuity Health Insurance 2024 to learn more about the potential benefits.

|

$5,400

Understand the structure of annuities and how they work as a series of payments by exploring this article on Annuity Is A Series Of 2024.

|

| Immediate Annuity | Monthly | $650 | $7,800 |

| Deferred Annuity | Monthly | $400 | $4,800 |

Annuity Payment Considerations

When choosing an annuity, it is important to consider your individual financial circumstances, risk tolerance, and investment goals. Different annuity types have different advantages and disadvantages, so it is important to carefully weigh your options before making a decision.

Wondering about the tax implications of annuities in India? Find out if your annuity income is taxable by reading this article on Is Annuity Taxable In India 2024.

Individual Financial Circumstances

- Age:Your age is a major factor to consider when choosing an annuity. Younger people may prefer a variable annuity, which has the potential for higher returns, while older people may prefer a fixed annuity, which provides a guaranteed income stream.

Want to know whether your annuity is considered qualified or nonqualified? This article clarifies the distinction: Is An Annuity Qualified Or Nonqualified 2024.

- Income:Your income level can also influence your annuity choice. If you have a high income, you may be able to afford a higher-risk annuity. However, if you have a lower income, you may prefer a lower-risk annuity.

- Expenses:Your expenses should also be considered when choosing an annuity. If you have high expenses, you may need a higher income stream from your annuity.

Risk Tolerance

- Risk-Averse:If you are risk-averse, you may prefer a fixed annuity, which provides a guaranteed income stream. Fixed annuities are less likely to lose value, but they also have lower potential returns.

- Risk-Tolerant:If you are risk-tolerant, you may prefer a variable annuity, which has the potential for higher returns. However, variable annuities are also more likely to lose value, so they are not suitable for everyone.

Investment Goals

- Retirement Income:If your goal is to generate retirement income, you may prefer an immediate annuity, which begins paying out income immediately. However, if you are saving for retirement and want to grow your investment over time, you may prefer a deferred annuity.

Reaching the age of 70 1/2? Learn more about the impact on your annuity options in this article on Annuity 70 1/2 2024.

- Income Protection:If your goal is to protect your income in the event of an unexpected event, you may prefer an annuity that provides income protection. This type of annuity will pay you a certain amount of income if you are unable to work.

- Estate Planning:If your goal is to provide income for your beneficiaries after you pass away, you may prefer an annuity that can be used as part of your estate planning strategy.

Choosing a Reputable Annuity Provider

- Research:Before choosing an annuity provider, it is important to research their reputation and track record. You can check online reviews and ratings to get an idea of what other customers have experienced.

- Compare:Compare quotes from multiple annuity providers to find the best rates and terms. Make sure to understand the fees and charges associated with each annuity.

- Ask Questions:Don’t hesitate to ask questions about the annuity and the provider. Make sure you understand the terms and conditions of the annuity before you sign any paperwork.

Annuity Investment Strategies

Annuities can be a valuable part of a diversified investment portfolio. They can provide a guaranteed income stream, tax advantages, and protection against longevity risk. However, it is important to understand the potential risks and rewards associated with investing in annuities before making a decision.

Integrating Annuities into a Diversified Portfolio

- Income Generation:Annuities can be used to generate a steady stream of income, which can supplement other retirement savings, such as Social Security or a 401(k).

- Risk Management:Annuities can be used to manage risk in a portfolio. For example, a fixed annuity can provide a guaranteed income stream, which can help protect against market volatility.

- Tax Planning:Annuities can be used to reduce taxes. For example, some annuities allow you to defer taxes on your investment earnings until you start receiving payments.

Potential Risks and Rewards

- Risk:Annuities can be subject to market risk, interest rate risk, and inflation risk. Market risk is the risk that the value of your investment will decline. Interest rate risk is the risk that interest rates will rise, reducing the value of your annuity.

Inflation risk is the risk that inflation will erode the purchasing power of your annuity payments.

- Reward:Annuities can provide a guaranteed income stream, tax advantages, and protection against longevity risk. They can also offer the potential for higher returns than other investments, such as bonds or CDs.

Managing Annuity Investments

- Review Regularly:It is important to review your annuity investments regularly to make sure they are still meeting your needs. You may need to adjust your investment strategy as your financial circumstances change.

- Seek Professional Advice:If you are unsure about how to manage your annuity investments, seek professional advice from a financial advisor. A financial advisor can help you develop an investment strategy that is tailored to your individual needs and goals.

Conclusion

Annuities, with their ability to provide guaranteed income and tax advantages, can be a valuable tool for managing retirement savings and mitigating longevity risk. By carefully considering your financial circumstances, risk tolerance, and investment goals, you can make informed decisions about whether an annuity is the right fit for you.

With the right strategy and a reputable provider, annuities can play a significant role in securing your financial future.

Key Questions Answered

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments. Fixed annuities offer greater security, while variable annuities have the potential for higher returns but also come with greater risk.

Curious about the Bengali meaning of “annuity”? This article provides a comprehensive overview of the term in Bengali: Annuity Is Bengali Meaning 2024.

How do I choose the right annuity provider?

Still unsure about what an annuity is? No worries! We’ve got you covered. You can find a detailed explanation of annuities and how they work in this article: Annuity Explained 2024.

Look for a reputable and reliable provider with a strong track record, low fees, and a clear understanding of your financial needs. Consider researching different providers, reading reviews, and consulting with a financial advisor.

Can I withdraw money from an annuity before retirement?

Most annuities have withdrawal options, but they may come with penalties or restrictions. It’s important to understand the terms of your annuity contract before making any withdrawals.