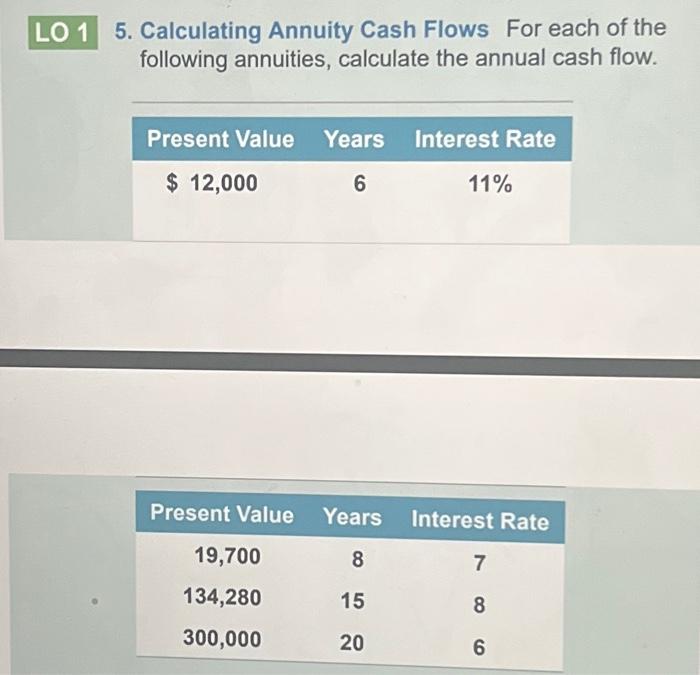

Calculating Annuity Cash Flows 2024 is a crucial skill for anyone seeking to understand and manage their financial future. Annuities, a type of financial product, offer a stream of regular payments over a defined period, making them a popular choice for retirement planning, investment strategies, and loan repayment.

As you approach retirement, understanding the tax implications of your retirement savings is crucial. If you have an annuity, you might wonder, is an annuity subject to RMD in 2024 ? The answer depends on the specific type of annuity you have.

This guide delves into the intricacies of annuity cash flow calculations, providing a comprehensive understanding of the factors influencing these flows, and exploring real-world applications.

In today’s uncertain economic landscape, many individuals are looking for secure investment options. But is an annuity a good investment in 2024 ? It depends on your individual financial goals and risk tolerance.

We will begin by defining annuities and their key characteristics, explaining the difference between ordinary annuities and annuities due, and discussing the concepts of present value and future value. Next, we will delve into the methods used to calculate annuity payments, highlighting the importance of the time value of money and providing practical examples using different calculation methods.

Annuity contracts often include a specific number that determines the payment schedule and amount. If you’re interested in learning more about these details, you can find information on annuity number in 2024.

Ending Remarks

Understanding the nuances of annuity cash flow calculations is essential for making informed financial decisions. By considering the impact of interest rates, time periods, and initial principal amounts, individuals can effectively plan for their financial future. As we navigate the ever-changing economic landscape of 2024, understanding the impact of inflation and interest rate trends on annuity calculations becomes increasingly important.

Annuity contracts are designed to provide a reliable income stream during retirement. An annuity is primarily used to provide a guaranteed income stream, often for a specific period of time.

This guide serves as a valuable resource for individuals seeking to maximize their financial well-being through the strategic use of annuities.

Annuity contracts can be complex, and many individuals have questions about these financial products. If you’re considering an annuity, it’s essential to understand the details. You can find answers to common questions on annuity questions in 2024.

Query Resolution: Calculating Annuity Cash Flows 2024

What are the different types of annuities?

For many individuals seeking a steady income stream in retirement, an annuity with a high return rate is attractive. If you’re looking for an annuity with an 8 percent return in 2024 , you might find options available, but it’s important to research carefully.

Annuities come in various forms, including fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type has its unique features and risk profiles, offering different benefits and drawbacks.

Looking to secure a steady stream of income in your retirement years? You might want to consider an annuity of 200k in 2024. These financial products can provide a guaranteed income stream for a set period of time, offering peace of mind for your future.

How do I choose the right annuity for my needs?

Choosing the right retirement savings plan is essential for a comfortable future. You might be wondering, how does an annuity compare to a 401k in 2024 ? Both offer advantages, but the best option depends on your specific circumstances.

Selecting the appropriate annuity depends on your individual financial goals, risk tolerance, and time horizon. It is essential to consult with a financial advisor to determine the annuity that best aligns with your specific needs.

What are the tax implications of annuities?

The tax implications of annuities can be complex and vary depending on the type of annuity and the distribution method. It is crucial to understand the tax treatment of annuity payments to make informed decisions.

When it comes to financial planning in India, understanding the tax implications of different investment options is crucial. If you’re considering an annuity, you might be wondering, is annuity taxable in India 2024 ? The answer is, it depends.

An annuity is a financial product that provides a stream of income for a set period of time. An annuity is defined as a series of payments made over a specific duration.

When it comes to managing your retirement savings, understanding the rules and regulations is crucial. If you’re considering a rollover of your annuity, you might be wondering about the timeframe. An annuity 60-day rollover in 2024 refers to the period you have to move funds from one annuity to another.

If you’re considering an annuity in the UK, you’ll want to compare different options and get quotes. Annuity quotes in the UK in 2024 can vary depending on factors like your age, health, and the type of annuity you’re seeking.

Annuity contracts are often seen as the opposite of a lump sum payment. An annuity is sometimes called the flip side of a lump sum payment, as it provides a steady stream of income over time.

Annuity calculations can be complex, but there’s a formula used to determine the payments. The annuity formula is a mathematical equation that takes into account factors like the principal amount, interest rate, and payment period.

When considering annuity options, it’s helpful to understand the different types available. There are 7 main types of annuities in 2024 , each with its own unique features and benefits.