Calculating Annuity Interest Rate 2024 is crucial for understanding the potential returns on your investment and making informed financial decisions. Annuities, a popular financial product, offer a steady stream of income for a set period or lifetime, making them attractive for retirement planning and other financial goals.

If you’re looking for a clear and concise definition of an annuity, Annuity Is Definition 2024 provides a comprehensive explanation.

This guide delves into the intricacies of annuity interest rate calculation, exploring the various methods and factors that influence this critical element. From understanding the different types of annuities to analyzing the impact of market conditions, we’ll provide a comprehensive overview to empower you with the knowledge you need to navigate the world of annuities.

Annuity contracts can come with various provisions. Annuity 72t 2024 explains the specific features and implications of a 72t annuity.

Contents List

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a specified period. It’s essentially a contract between you and an insurance company where you make a lump-sum payment or a series of payments, and in return, the insurance company agrees to pay you a fixed or variable stream of income for a set duration or for the rest of your life.

The way payments are made is an essential aspect of an annuity. Annuity Is Sequence Of Mode Of Payment 2024 delves into the different payment options and their implications.

Key Features of Annuities

Annuities are characterized by several key features, including:

- Guaranteed Payments:Annuities offer a guaranteed stream of income, providing financial security and predictability.

- Longevity Protection:They can help mitigate the risk of outliving your savings, ensuring you have a steady income source in retirement.

- Tax Advantages:Some annuity types offer tax deferral benefits, allowing your money to grow tax-deferred until you start receiving payments.

Types of Annuities

Annuities come in various forms, each with its own characteristics and suitability for different financial goals. Some common types include:

- Fixed Annuities:These offer a guaranteed fixed interest rate, providing predictable income payments. The downside is that they may not keep pace with inflation.

- Variable Annuities:These link your payments to the performance of underlying investments, offering the potential for higher returns but also carrying higher risk.

- Immediate Annuities:Payments begin immediately after you purchase the annuity.

- Deferred Annuities:Payments start at a later date, allowing your money to grow tax-deferred until you start receiving income.

Real-World Annuity Scenarios, Calculating Annuity Interest Rate 2024

Annuities are commonly used in various real-world scenarios, including:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, ensuring you have a reliable source of funds to cover your expenses.

- Income Supplement:They can supplement other income sources, providing additional financial security.

- Estate Planning:Annuities can be used to create a legacy for loved ones, providing them with a guaranteed stream of income after your passing.

Annuity Interest Rate Calculation Methods

Calculating the annuity interest rate is crucial for understanding the potential returns you can expect from an annuity. This rate determines the growth of your investment and the amount of income you’ll receive over time.

If you’re considering a single premium annuity, it’s essential to understand the implications of the premium amount. G Purchased A $50 000 Single Premium 2024 illustrates the factors to consider when choosing a single premium annuity.

Importance of Calculating Annuity Interest Rate

The annuity interest rate plays a pivotal role in determining the overall profitability of an annuity. It directly impacts the amount of income you receive and the growth of your investment. By understanding the interest rate, you can make informed decisions about choosing an annuity that aligns with your financial goals.

Annuity contracts are designed to provide a regular income stream, but their application can vary. Annuity Is Used In 2024 sheds light on the various ways annuities are used in today’s financial landscape.

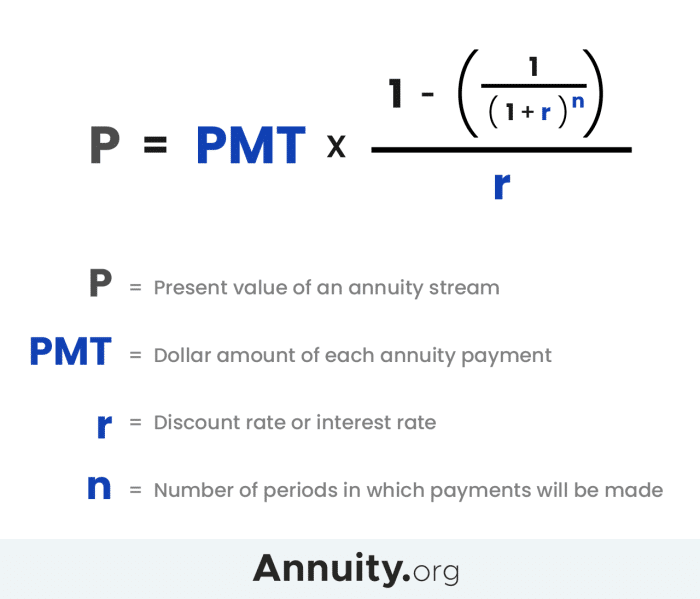

Formula for Calculating Annuity Interest Rate

The formula for calculating the annuity interest rate is:

Interest Rate = (PMT / PV)- (1 / n)

Annuity contracts can be complex, so it’s essential to understand the basics. An Annuity Is 2024 provides a comprehensive overview of what an annuity is and how it works.

Where:

- PMT= Periodic payment amount

- PV= Present value of the annuity

- n= Number of periods

Methods for Calculating Annuity Interest Rate

There are several methods for calculating the annuity interest rate, including:

- Financial Calculators:Many financial calculators have built-in functions for calculating annuity interest rates.

- Spreadsheets:Spreadsheets like Microsoft Excel or Google Sheets offer formulas and functions for calculating annuity interest rates.

- Online Tools:Several online tools and calculators are available that can help you determine the annuity interest rate.

Step-by-Step Guide for Manual Calculation

Here’s a step-by-step guide for manually calculating the annuity interest rate:

- Gather the necessary information:You’ll need the annuity payment amount (PMT), the present value (PV), and the number of periods (n).

- Plug the values into the formula:Substitute the values into the formula provided above.

- Solve for the interest rate:Calculate the interest rate using the formula.

Factors Affecting Annuity Interest Rates

Several factors influence annuity interest rates, making it essential to understand how these factors can impact your potential returns.

The specifics of an annuity can vary based on its features. Annuity Number 2024 explains the different types of annuities and their corresponding features.

Key Factors Influencing Annuity Interest Rates

Here are some key factors that influence annuity interest rates:

- Market Conditions:Interest rates in the broader market, such as those offered on bonds and other investments, directly impact annuity interest rates. When market interest rates rise, annuity interest rates tend to follow suit.

- Inflation:Inflation erodes the purchasing power of your money over time. To compensate for inflation, insurance companies may offer higher annuity interest rates.

- Risk Tolerance:Annuities with higher risk profiles, such as variable annuities, may offer higher interest rates, but they also carry the potential for greater losses.

- Annuity Type:Different types of annuities, such as fixed, variable, immediate, and deferred, can have varying interest rates based on their specific features and risk levels.

- Company Reputation and Financial Strength:The financial strength and reputation of the insurance company issuing the annuity can influence its interest rates. Companies with strong financial positions and a history of reliable performance may offer more competitive rates.

Impact of Factors on Interest Rates

These factors can significantly impact the annuity interest rate. For example:

- Rising Market Interest Rates:When market interest rates rise, insurance companies may offer higher annuity interest rates to remain competitive.

- High Inflation:During periods of high inflation, insurance companies may need to offer higher interest rates to compensate for the erosion of purchasing power.

- Higher Risk Tolerance:Variable annuities, which are linked to the performance of underlying investments, may offer higher interest rates due to their higher risk profile.

Real-World Applications of Annuity Interest Rate Calculation: Calculating Annuity Interest Rate 2024

Calculating annuity interest rates has numerous practical applications in financial planning and decision-making.

Many people wonder about the connection between annuities and IRAs. Is Annuity The Same As Ira 2024 clarifies the differences and similarities between these two retirement savings options.

Applications in Financial Planning

Annuity interest rate calculations are essential for:

- Retirement Planning:By calculating the potential income stream from an annuity, individuals can determine if it meets their retirement income needs.

- Investment Strategies:Annuity interest rates can help investors compare the returns of different annuity options and make informed investment decisions.

- Loan Repayment:Annuities can be used to structure loan repayments, and calculating the interest rate helps determine the total cost of borrowing.

Examples of Real-World Impact

Here are some examples of how annuity interest rate calculations can impact real-world scenarios:

- Retirement Income:A retiree who needs $50,000 per year in income can use annuity interest rate calculations to determine how much they need to invest in an annuity to generate that income stream.

- Investment Comparison:An investor comparing two annuity options with different interest rates can use calculations to determine which option offers the higher potential return.

- Loan Repayment:A borrower considering a loan with an annuity repayment structure can calculate the interest rate to determine the total cost of borrowing over the loan term.

Tips for Choosing an Annuity

Choosing the right annuity involves careful consideration of various factors, including interest rates, fees, and other features.

For those seeking information in Hindi, Annuity Kya Hai 2024 offers a detailed explanation of annuities in the Hindi language.

Tips for Choosing an Annuity Based on Interest Rates

Here are some tips for choosing an annuity based on interest rates:

- Compare Interest Rates:Don’t settle for the first annuity you find. Shop around and compare interest rates from different insurance providers.

- Consider the Annuity Type:Fixed annuities typically offer lower interest rates but provide greater predictability, while variable annuities have the potential for higher returns but also carry higher risk. Choose an annuity type that aligns with your risk tolerance and financial goals.

- Factor in Fees:While interest rates are important, don’t overlook fees. High fees can significantly eat into your potential returns.

Importance of Comparing Annuity Offerings

Comparing annuity offerings from different providers is crucial for finding the best deal. Interest rates, fees, and other features can vary significantly from one provider to another. By comparing multiple options, you can ensure you’re getting the most competitive terms.

If you’re considering a long-term financial plan, you might be curious about Annuity Issuer 2024. These institutions play a crucial role in providing individuals with a steady stream of income during retirement.

Checklist for Evaluating Annuity Options

Here’s a checklist for evaluating annuity options:

- Interest Rate:Compare interest rates from different providers.

- Fees:Review fees associated with the annuity, such as surrender charges, administrative fees, and mortality and expense charges.

- Guarantee:Understand the guarantees offered by the annuity, such as the guarantee of principal or income payments.

- Flexibility:Consider the flexibility of the annuity, such as the ability to withdraw funds or change payment options.

- Company Reputation:Research the financial strength and reputation of the insurance company issuing the annuity.

Final Thoughts

By understanding the factors that influence annuity interest rates and employing the right calculation methods, you can make well-informed decisions about your financial future. Whether you’re planning for retirement, seeking investment opportunities, or managing debt, mastering annuity interest rate calculation is an essential step towards achieving your financial goals.

Annuity contracts can have various stipulations, including the designation of a beneficiary. Annuity No Beneficiary 2024 explores the implications of having an annuity without a designated beneficiary.

Questions and Answers

What are the risks associated with annuities?

Understanding the religious implications of financial products is important, especially for those following Islamic principles. If you’re wondering about the permissibility of annuities, you can explore the details on Is Annuity Halal 2024 to make an informed decision.

Annuities carry risks like market volatility, inflation, and the possibility of losing principal. It’s essential to carefully consider these risks before investing.

How often are annuity interest rates adjusted?

The frequency of interest rate adjustments depends on the type of annuity. Fixed annuities have a fixed interest rate, while variable annuities fluctuate with market performance.

For couples who want to ensure their financial security even after one partner passes away, a Annuity Joint And Survivor 2024 can be a valuable option. This type of annuity guarantees a stream of income for the surviving spouse.

Can I withdraw my money from an annuity before maturity?

Withdrawal options vary depending on the annuity contract. Early withdrawals may incur penalties.

What is the difference between a fixed and a variable annuity?

Fixed annuities offer a guaranteed interest rate, while variable annuities provide the potential for higher returns but also carry greater risk.

Annuity contracts can have a range of features. Annuity 9 Letters 2024 explores the characteristics of a specific type of annuity contract.

Many individuals seek lifelong income security. Is Annuity For Life 2024 discusses the options available for annuities that provide income for the rest of your life.