Calculating Annuity Payments In Excel 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial planning and investment. This guide provides a comprehensive overview of annuities, exploring their purpose, key components, and different types.

Annuity payments can be structured in different ways, and it’s important to understand how they work. You can find more information about this on When An Annuity Is Written Whose Life 2024. For example, some annuities pay out a fixed amount each month, while others pay out a variable amount depending on the performance of the underlying investments.

We’ll delve into the powerful PMT function in Excel 2024, showcasing its ability to calculate annuity payments with ease and accuracy. From creating detailed annuity tables to visualizing payment trends, this guide equips you with the knowledge and tools to confidently navigate the complexities of annuity calculations.

Whether you’re a seasoned investor seeking to optimize your retirement planning or a novice exploring the world of financial instruments, understanding annuities is essential. This guide simplifies the process, providing practical examples and step-by-step instructions to demystify annuity calculations and empower you to make informed financial decisions.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a period of time. Annuities are commonly used in financial planning, retirement savings, and insurance. They offer a predictable stream of income, making them a valuable tool for managing finances.

Key Components of an Annuity

An annuity is defined by several key components:

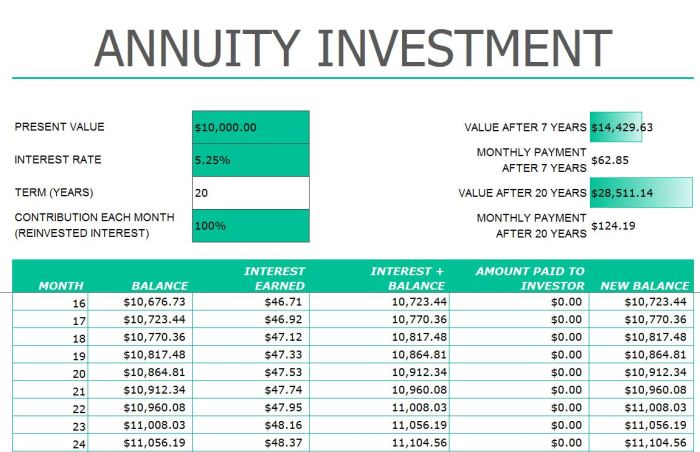

- Present Value (PV):The current value of the annuity’s future payments. This is the amount you would need to invest today to receive the annuity payments.

- Future Value (FV):The total value of the annuity at the end of the payment period. This is the sum of all payments plus accumulated interest.

- Interest Rate (i):The rate of return earned on the annuity’s investment. This is typically expressed as an annual percentage.

- Payment Amount (PMT):The amount of each regular payment made over the annuity’s term.

- Time Period (n):The total number of payment periods in the annuity. This could be monthly, quarterly, annually, or any other frequency.

Types of Annuities

Annuities can be classified into different types based on the timing of payments and other factors:

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity offers a higher future value than an ordinary annuity, as the payments earn interest for an additional period.

- Perpetuity:An annuity that continues indefinitely. These are often used in situations where a constant stream of income is desired, such as charitable endowments.

Annuities can be a valuable part of a retirement savings plan, especially in conjunction with other retirement accounts like an NPS. You can find more information about this on Annuity Nps 2024. This article explores the benefits and drawbacks of using annuities in conjunction with an NPS, helping you make informed decisions about your retirement savings.

Annuity vs. Lump Sum Payment

An annuity provides a stream of payments over time, while a lump sum payment is a single, one-time payment. The choice between an annuity and a lump sum depends on individual financial goals and risk tolerance.

- Annuity:Offers a steady income stream, potentially providing a greater sense of financial security. However, the return may be lower than a lump sum investment, especially if interest rates are high.

- Lump Sum Payment:Provides greater flexibility to invest or spend the money as desired. However, it requires careful management to ensure the funds last over time.

Calculating Annuity Payments in Excel 2024

Excel’s PMT function simplifies the calculation of annuity payments. This function requires five key inputs:

- Rate:The interest rate per period.

- Nper:The total number of payment periods.

- PV:The present value of the annuity.

- FV:The future value of the annuity (optional, defaults to 0). This is the value you want to have at the end of the annuity period.

- Type:Indicates whether payments are made at the beginning (1) or end (0) of each period. 0 for ordinary annuity, 1 for annuity due.

Step-by-Step Guide to Using the PMT Function

To calculate the annuity payment using the PMT function in Excel, follow these steps:

- Open a new Excel spreadsheet.

- Enter the relevant information in separate cells.For example, you might enter the interest rate in cell A1, the number of periods in cell A2, the present value in cell A3, and the future value in cell A4. The type is entered as 0 or 1.

- In a new cell, type the following formula:

=PMT(A1, A2, A3, A4, 0). This formula will calculate the payment amount for an ordinary annuity. - Press Enter.Excel will display the calculated payment amount.

Annuity payments are typically made in a series of equal payments over a period of time. If you’re looking for more information on this, you can check out Annuity Is A Series Of Equal Payments 2024. This article explores the concept of annuities and how they work, including the different types of annuities and their features.

Adjusting the PMT Function for Different Annuity Types

To calculate payments for an annuity due, simply change the `Type` argument in the PMT function to

An annuity is a financial product that can provide a stream of income for a certain period of time. If you’re looking for a concise definition, you can find one on Annuity Is What 2024. This article provides a clear and simple explanation of what an annuity is and how it works.

For example, the formula for an annuity due would be:

=PMT(A1, A2, A3, A4, 1).If you’re trying to decide between an annuity and an IRA, you can find helpful information on Annuity Or Ira 2024. This article compares the two retirement savings options, highlighting their key differences and helping you determine which one is right for you.

Annuities are also available in Kenya. If you’re interested in learning more about them, you can check out Annuity Kenya 2024. This article provides information on the different types of annuities available in Kenya, as well as the regulations surrounding them.

Creating an Annuity Table in Excel 2024

An annuity table provides a clear breakdown of how annuity payments are applied to principal and interest over time. This helps visualize the amortization process.

Annuities can be a valuable tool for retirement planning, but it’s important to understand the different types of annuities available. One article that can help you with this is Annuity Is Single Payment 2024. This article explores the different types of annuities and their features, allowing you to choose the best option for your individual needs.

Designing an Annuity Table

To create an annuity table in Excel, you can follow these steps:

- Create a table with columns for:Year, Beginning Balance, Payment, Interest, Principal Reduction, and Ending Balance.

- Enter the initial values.The first row of the table should include the initial present value (PV) in the Beginning Balance column.

- Calculate the interest earned each year.In the Interest column, use the formula

=Beginning BalanceInterest Rate. This will calculate the interest earned based on the beginning balance and the interest rate. - Calculate the principal reduction each year.In the Principal Reduction column, use the formula

=PaymentInterest. This will determine how much of the payment goes towards reducing the principal balance. - Calculate the ending balance each year.In the Ending Balance column, use the formula

=Beginning BalancePrincipal Reduction. This will show the remaining principal balance after each payment. - Copy the formulas down the table.To extend the table for the entire annuity period, simply copy the formulas down the table for the remaining years.

Annuities can provide a guaranteed return, which can be attractive to investors. You can learn more about the potential returns on annuities by reading 7 Annuity Return 2024. This article explores the different factors that can affect annuity returns, as well as the potential benefits and risks.

Visualizing Annuity Payments

Visualizing annuity payments can enhance understanding and provide valuable insights into the impact of different factors on the amortization process.

Charting Annuity Payments Over Time, Calculating Annuity Payments In Excel 2024

To visualize the annuity payments over time, you can create a line chart.

- Select the Year and Payment columns.

- Go to the Insert tab and choose Line Chart.

- Customize the chart as needed.You can add labels, change colors, and adjust the chart’s appearance to enhance readability.

There are specific rules that apply to annuities, including the 59 1/2 rule. You can find more information on this rule on Annuity 59 1/2 Rule 2024. This article explains the 59 1/2 rule and how it can affect your annuity withdrawals.

Charting Interest and Principal Payments

To illustrate the breakdown of interest and principal payments, you can create a stacked column chart.

Annuity payments can be calculated based on the present value of the annuity. You can learn more about this concept on Annuity Is Present Value 2024. This article explains how the present value of an annuity is determined and how it can be used to make informed decisions about your retirement planning.

- Select the Year, Interest, and Principal Reduction columns.

- Go to the Insert tab and choose Stacked Column Chart.

- Customize the chart as needed.Add labels, change colors, and adjust the chart’s appearance to highlight the relationship between interest and principal payments.

Annuity is a financial product that provides a stream of payments over a period of time, and you can learn more about it by reading this article on Annuity Is Meaning 2024. This stream of payments can be used for various purposes, such as retirement income, income replacement, or long-term care.

Real-World Applications of Annuity Calculations

Annuity calculations have numerous real-world applications in personal finance, retirement planning, and business investments.

Personal Finance

Annuities are commonly used for retirement planning, providing a steady stream of income during retirement years. They can also be used to fund educational expenses or other long-term financial goals.

If you’re looking to learn more about annuities in New Zealand, you can find helpful information on Annuity Nz 2024. This article covers the different types of annuities available in New Zealand, as well as the tax implications of annuities.

Retirement Planning

Annuities are a popular retirement planning tool, offering a guaranteed stream of income. They can help individuals ensure financial security during their retirement years.

If you’re interested in learning more about the specific details of annuities, you can find helpful information on Annuity 9 2024. This article provides a comprehensive overview of annuities, including their advantages and disadvantages, as well as how to choose the right annuity for your needs.

Business Investments

Annuities are also used in business investments, such as lease payments and debt financing. They can help businesses manage cash flow and make predictable payments over time.

Advantages and Disadvantages of Annuities

Annuities offer several advantages, such as guaranteed income and tax-deferred growth. However, they also have some drawbacks, including potential for lower returns than other investments and potential for surrender charges.

Common Annuity Products

There are various types of annuity products available in the market, including:

- Fixed Annuities:Offer a guaranteed interest rate, providing predictable income payments.

- Variable Annuities:Offer the potential for higher returns but also carry more risk. The interest rate fluctuates based on the performance of underlying investments.

- Indexed Annuities:Offer a return linked to the performance of a specific index, such as the S&P 500.

Closing Notes: Calculating Annuity Payments In Excel 2024

Mastering the art of annuity calculations in Excel 2024 opens doors to a world of financial possibilities. By understanding the fundamentals of annuities and leveraging the power of Excel’s PMT function, you gain the ability to effectively manage your finances, plan for your future, and make informed investment choices.

Whether you’re aiming for a comfortable retirement, securing your financial future, or simply seeking to maximize your returns, this guide provides the foundation for confident and successful financial decision-making.

An annuity is a type of investment that can provide a steady stream of income in retirement. To learn more about the different types of annuities, check out this article on Annuity Is Which Account 2024. These can be purchased with a lump sum or through regular payments, and the payments can be guaranteed for life or for a set period of time.

FAQ Resource

What are the limitations of using the PMT function in Excel 2024 for annuity calculations?

The PMT function assumes a constant interest rate and payment amount throughout the annuity period. It may not be suitable for annuities with variable interest rates or payments.

If you’re looking to understand how annuities work, you can find a helpful explanation on An Annuity Is A Stream Of 2024. Essentially, an annuity is a contract between you and an insurance company where you make a payment or a series of payments, and in return, you receive a stream of income payments later on.

Can I use the PMT function to calculate the future value of an annuity?

No, the PMT function is specifically designed to calculate the payment amount. To calculate the future value, you can use the FV function in Excel.

How can I adjust the PMT function for annuities due?

For annuities due, where payments are made at the beginning of each period, you need to adjust the number of periods in the PMT function by subtracting 1. This ensures that the calculation considers the payment made at the beginning of the first period.

What are some common annuity products available in the market?

Some common annuity products include fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type offers different features and benefits, so it’s important to carefully consider your financial goals and risk tolerance before choosing an annuity product.