Calculating An Annuity Payout 2024 can be a complex process, but understanding the factors that influence your payout is essential for making informed financial decisions. Annuities, essentially a stream of regular payments, are a popular retirement planning tool, offering a steady income stream for the future.

Planning to purchase an annuity with a principal amount of $200,000? This article on Annuity 200k 2024 can help you explore the options and potential returns for such an investment.

This guide will explore the intricacies of annuity payouts, helping you navigate the nuances of this financial instrument.

Purchasing an annuity is a big financial decision. Before you take the plunge, read this article on Annuity Is Purchased 2024 to learn about the process and factors to consider.

From defining annuities and their different types to delving into the factors that impact payout amounts, we’ll cover the key aspects of annuity calculations. Understanding how interest rates, mortality rates, and investment performance play a role in determining your payout is crucial for maximizing your retirement income.

Fixed annuities offer guaranteed interest rates and predictable income streams. Learn more about 4 Fixed Annuity 2024 to see if this type of annuity aligns with your financial goals.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period of time. It’s designed to provide a steady income stream for individuals during retirement or other life stages. Annuities are typically purchased with a lump sum payment, and the payments can be guaranteed for life or for a set period of time.

Annuity is a financial product that provides a stream of regular payments. Get a clear definition and explanation in this article on Annuity Is Meaning 2024.

Types of Annuities

Annuities come in various forms, each offering different features and benefits. Here’s a breakdown of the common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return on the invested principal, providing predictable payments. The interest rate is fixed for the duration of the annuity contract, making it a suitable option for those seeking stability and guaranteed income.

- Variable Annuities:These annuities offer a variable rate of return based on the performance of underlying investments, typically mutual funds. The payment amount fluctuates depending on the market performance, potentially offering higher returns but also carrying greater risk.

- Immediate Annuities:These annuities start paying out immediately after the purchase, providing an immediate income stream. They are ideal for those seeking immediate income, such as retirees or individuals with immediate financial needs.

- Deferred Annuities:These annuities begin paying out at a future date, allowing for the investment to grow over time before payments start. They are suitable for individuals planning for future income needs, such as retirement or a specific life event.

Key Features of an Annuity Contract

An annuity contract Artikels the terms and conditions of the agreement between the annuity provider and the annuitant. Key features to consider include:

- Payout Options:Annuities offer various payout options, such as a fixed monthly payment, a lump sum payment, or a combination of both. The chosen payout option influences the duration and frequency of payments.

- Guarantees:Some annuities offer guarantees, such as a minimum rate of return or a guaranteed lifetime income. These guarantees provide a level of security and protection against market fluctuations.

- Fees:Annuities typically involve fees, such as administrative fees, surrender charges, and mortality and expense charges. Understanding these fees is crucial for comparing different annuity options.

Factors Affecting Annuity Payouts

Several factors influence the amount of annuity payouts, impacting the income stream an individual receives.

Interest Rates

Interest rates play a significant role in determining annuity payouts. Higher interest rates generally result in larger annuity payouts, as the principal earns more interest over time. Conversely, lower interest rates lead to smaller payouts.

Planning for your annuity withdrawal? It’s important to know how much you’ll be taxed. This handy Annuity Withdrawal Tax Calculator 2024 can help you estimate your tax liability.

Mortality Rates

Mortality rates are crucial in annuity calculations, as they reflect the expected lifespan of the annuitant. Insurance companies use mortality tables to estimate the average lifespan of a population, which influences the amount of payments an individual will receive. Higher mortality rates generally result in smaller payouts, as the insurance company expects to pay out for a shorter period.

Understanding the tax implications of annuities is crucial. This article on Is Annuity For Life Insurance Taxable 2024 explains the tax treatment of annuity payments.

Investment Performance, Calculating An Annuity Payout 2024

For variable annuities, investment performance directly impacts annuity payouts. The value of the underlying investments fluctuates based on market conditions, affecting the amount of payments an individual receives. Strong investment performance leads to higher payouts, while poor performance results in lower payouts.

Calculating Annuity Payouts

Calculating annuity payouts involves considering various factors and applying specific formulas. The exact calculation method depends on the type of annuity and its features.

Step-by-Step Guide

- Determine the annuity type and payout option:Identify the type of annuity (fixed, variable, immediate, deferred) and the desired payout option (fixed monthly payment, lump sum, etc.).

- Gather the necessary information:Collect information such as the principal amount, interest rate, payout period, and any applicable fees.

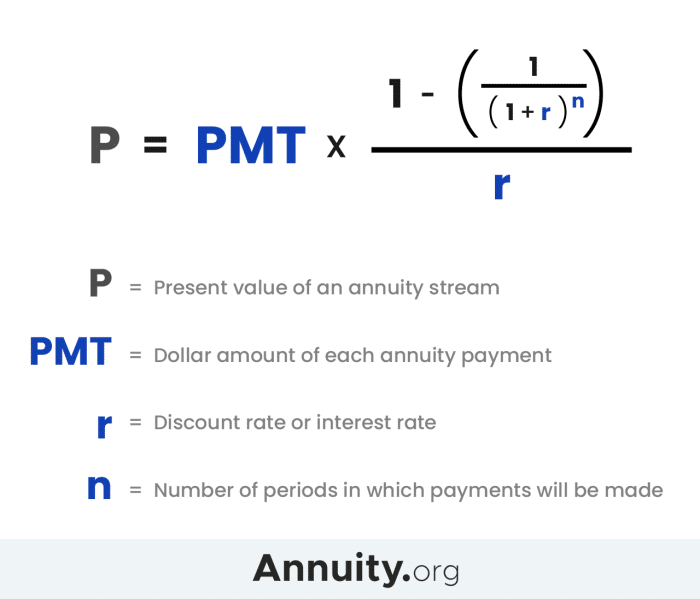

- Apply the appropriate annuity formula:Use the relevant annuity formula based on the annuity type and payout option. Common formulas include the present value of an annuity, the future value of an annuity, and the annuity payment formula.

- Calculate the annuity payouts:Plug the gathered information into the chosen formula and calculate the annuity payouts. This will determine the amount of payments an individual will receive.

Annuity Formulas

Present Value of an Annuity:PV = PMT – [1 – (1 + r)^-n] / r

If you’re considering an annuity in the UK, it’s essential to research current annuity rates. This article on Annuity Rates Uk 2024 provides insights into the market and helps you find competitive rates.

Future Value of an Annuity:FV = PMT – [(1 + r)^n – 1] / r

Looking for information on annuities specifically designed for individuals turning 65? This article on Annuity 65 2024 can help you understand the unique features and benefits.

Annuity Payment Formula:PMT = PV – r / [1 – (1 + r)^-n]

Where:

- PV = Present Value

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Periods

Resources and Tools

Various resources and tools are available to assist with annuity payout calculations. Online calculators, financial software, and annuity providers offer calculators and resources to help individuals estimate annuity payouts.

If you’re considering an annuity, it’s crucial to understand the difference between an ordinary annuity and an annuity due. This article on Annuity Due Is 2024 explains the key distinctions and helps you make an informed decision.

Annuity Payout Options

Annuities offer different payout options, each with its own advantages and disadvantages. Understanding these options is crucial for choosing the most suitable one based on individual needs and goals.

Want to know more about annuities that offer payouts for a specific period? This article on Annuity 5 Year Payout 2024 explains the structure and potential benefits of these annuities.

Payout Options Table

| Payout Option | Description |

|---|---|

| Fixed Monthly Payment | Provides a consistent monthly income stream for a specified period or for life. |

| Lump Sum Payment | Pays out the entire annuity value as a single lump sum. |

| Combination of Payments | Offers a combination of monthly payments and a lump sum payment. |

| Life Annuity | Pays out monthly payments for the rest of the annuitant’s life. |

| Period Certain Annuity | Guarantees payments for a specific period, even if the annuitant dies before the end of the period. |

| Joint Life Annuity | Provides payments as long as at least one of two annuitants is alive. |

Pros and Cons of Payout Options

| Payout Option | Pros | Cons |

|---|---|---|

| Fixed Monthly Payment | Provides predictable income, suitable for budgeting. | May not provide for inflation or unexpected expenses. |

| Lump Sum Payment | Provides flexibility and control over funds. | Risk of mismanaging funds or outliving savings. |

| Combination of Payments | Combines the benefits of regular income and a lump sum. | May require careful planning to manage both payment streams. |

| Life Annuity | Guarantees lifetime income, protecting against outliving savings. | Payments stop upon death, leaving no inheritance. |

| Period Certain Annuity | Provides guaranteed income for a set period, even if the annuitant dies. | Payments may continue after the annuitant’s death, potentially reducing the total payout. |

| Joint Life Annuity | Provides income for both annuitants as long as at least one is alive. | Payments stop when the last annuitant dies, leaving no inheritance. |

Tax Implications of Annuity Payouts

Receiving annuity payments has tax implications that individuals need to understand. The tax treatment of annuity payouts depends on the type of annuity and the specific features of the contract.

If you have questions about annuities, you’re not alone! This article on Annuity Questions 2024 addresses some of the most common inquiries and provides helpful answers.

Tax Treatment of Annuities

Generally, annuity payouts are taxed as ordinary income. The portion of each payment that represents a return of the original investment is tax-free, while the remaining portion is taxed as income. The tax treatment of different annuity types may vary:

- Fixed Annuities:Payouts from fixed annuities are typically taxed as ordinary income. The tax rate depends on the individual’s tax bracket.

- Variable Annuities:Payouts from variable annuities are taxed as ordinary income, with the tax rate based on the individual’s tax bracket. The growth in the underlying investments is generally taxed as capital gains when withdrawn.

- Immediate Annuities:Payouts from immediate annuities are taxed as ordinary income. The tax rate depends on the individual’s tax bracket.

- Deferred Annuities:Payouts from deferred annuities are taxed as ordinary income. The tax rate depends on the individual’s tax bracket.

Tax Impact on Annuity Payouts

Taxes can significantly impact the amount of income received from an annuity. For example, a 20% tax rate on annuity payments means that 20% of each payment will be withheld for taxes, reducing the net income received. It’s essential to consider the tax implications when choosing an annuity and planning for retirement income.

Annuity Payouts in 2024

Annuity payouts in 2024 may be influenced by several factors, including economic conditions, interest rate trends, and regulatory changes. Predicting the exact impact on annuity payouts is challenging, but it’s crucial to stay informed about potential changes.

Potential Changes in 2024

While specific predictions are difficult, it’s possible that interest rate changes could impact annuity payouts in 2024. Rising interest rates may lead to higher annuity payouts, while falling rates could result in lower payouts. Regulatory changes, such as updates to annuity regulations or tax policies, could also affect annuity payouts.

It’s a common question: are annuities considered life insurance policies? Find out the answer in this article on Is Annuity A Life Insurance Policy 2024.

It’s important to consult with a financial advisor or annuity provider for the most up-to-date information.

Economic Factors

Economic factors, such as inflation and economic growth, can influence annuity payouts. High inflation can erode the purchasing power of annuity payments, making them less valuable over time. Economic growth can potentially lead to higher interest rates, potentially boosting annuity payouts.

It’s crucial to consider these economic factors when evaluating annuity options and planning for retirement income.

Wrap-Up

As you plan for your retirement, understanding the complexities of annuities and their payouts is paramount. By grasping the factors that influence your annuity income, you can make informed choices that align with your financial goals. Whether you’re considering purchasing an annuity or already receive payments, this guide has provided a comprehensive overview of the essential aspects of annuity payouts.

Remember to consult with a financial advisor for personalized advice tailored to your specific circumstances.

FAQ Guide: Calculating An Annuity Payout 2024

What are the main types of annuities?

Annuities can be broadly classified as fixed, variable, immediate, and deferred. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry greater risk. Immediate annuities start making payments right away, while deferred annuities have a delay before payments begin.

There are many different types of annuities available. Explore the 8 Annuities 2024 to discover the options that best fit your financial goals and risk tolerance.

How do I choose the best payout option for me?

While both annuities and pensions provide regular income streams, they have important differences. This article on Is Annuity The Same As Pension 2024 clarifies the distinctions between these two financial instruments.

Selecting the right payout option depends on your individual needs and goals. Consider factors such as your age, health, and desired income stream. A financial advisor can help you determine the best option based on your unique circumstances.

Are annuity payouts taxable?

Yes, annuity payouts are generally taxable. The specific tax treatment depends on the type of annuity and the terms of your contract. Consult with a tax professional for guidance on the tax implications of your annuity.

Understanding how annuities are taxed under the Income Tax Act 2024 can be confusing. For detailed information, check out this article on Annuity Under Income Tax Act 2024. It provides a clear breakdown of the rules and regulations.

What are the potential changes to annuity payouts in 2024?

The regulatory landscape for annuities is constantly evolving. Stay informed about any changes or updates that might impact your annuity payout in 2024. Consulting with a financial advisor can help you stay abreast of the latest developments.