Formula Annuity Bond 2024: A Comprehensive Guide delves into the world of these innovative financial instruments, exploring their definition, structure, and market dynamics. This guide examines the key features of Formula Annuity Bonds (FABs), analyzing their benefits and risks, and providing insights into the legal and regulatory landscape surrounding them.

Calculating the future value of an annuity is essential for financial planning. You can find a detailed guide on calculating annuity future values in 2024 here: Calculating Annuity Future Values 2024.

The year 2024 presents a unique backdrop for the FAB market, with evolving economic conditions and shifting investor preferences shaping the landscape. This guide examines the potential growth opportunities and challenges facing FABs, providing a comprehensive overview of this dynamic investment class.

Annuity funds are often considered unrestricted funds, meaning they can be used for various purposes. For a deeper understanding of this concept in 2024, explore this resource: Annuity Fund Is Unrestricted Fund 2024.

Contents List

- 1 Formula Annuity Bond: Definition and Overview

- 2 FAB in 2024: Market Trends and Outlook

- 3 Benefits and Risks of FABs

- 4 FAB Issuers and Investors: Formula Annuity Bond 2024

- 5 Understanding FAB Terms and Conditions

- 6 Valuation and Pricing of FABs

- 7 Legal and Regulatory Considerations for FABs

- 8 Last Recap

- 9 Expert Answers

Formula Annuity Bond: Definition and Overview

A Formula Annuity Bond (FAB) is a type of structured product that combines features of a bond and an annuity. It is designed to provide investors with a predictable stream of income over a defined period, while also offering the potential for capital appreciation.

An annuity is a financial product that provides a stream of income payments for a specific period. To understand how the future value of an annuity is calculated, you can explore this resource: Annuity Is Future Value 2024.

FABs are typically issued by financial institutions and are often used as a tool for retirement planning and wealth management.

Annuity loan calculators can help you estimate the potential payments for an annuity loan. To learn more about annuity loan calculators and how they work in 2024, you can explore this resource: Annuity Loan Calculator 2024.

Key Features of FABs

FABs are characterized by several key features that distinguish them from traditional bonds and annuities. These features include:

- Guaranteed Income Stream:FABs typically offer a guaranteed minimum income stream, which is paid out over a specified period. This provides investors with a predictable source of income during retirement or other life stages.

- Potential for Capital Appreciation:FABs may also offer the potential for capital appreciation, depending on the underlying assets and investment strategy. This can provide investors with the opportunity to grow their wealth over time.

- Maturity Date:FABs have a defined maturity date, after which the principal amount is typically repaid to investors. This provides investors with a clear timeframe for their investment.

- Formula-Based Return:FABs are structured based on a specific formula that determines the return on the investment. This formula may be based on factors such as interest rates, inflation, or the performance of a specific asset class.

Structure and Components of FABs

FABs are typically structured as follows:

- Principal Investment:Investors make an initial investment in the FAB, which is used to purchase the underlying assets.

- Underlying Assets:The principal investment is typically invested in a portfolio of assets, such as bonds, stocks, or real estate. The specific asset allocation will depend on the FAB’s investment strategy.

- Income Payments:The FAB issuer makes regular income payments to investors based on the performance of the underlying assets and the formula specified in the FAB contract.

- Maturity Payment:At maturity, the FAB issuer typically repays the principal amount to investors, along with any accrued interest or capital appreciation.

FAB in 2024: Market Trends and Outlook

The market for FABs is expected to continue evolving in 2024, driven by a combination of factors such as interest rate movements, inflation, and investor demand.

Annuity payments can vary based on the amount of principal invested. If you’re curious about the potential payouts for a $600,000 annuity in 2024, you can explore this article: Annuity 600 000 2024.

Key Factors Influencing the FAB Market

- Interest Rate Environment:Rising interest rates can impact the attractiveness of FABs, as investors may seek higher returns in fixed-income investments. However, FABs can offer a degree of protection against interest rate risk, depending on the structure and underlying assets.

- Inflation:High inflation can erode the purchasing power of income streams, making it more challenging for FABs to provide a steady stream of real income. FABs with inflation-linked features may be more appealing in such environments.

- Investor Demand:Demand for FABs can be influenced by factors such as retirement planning needs, risk tolerance, and market conditions. As individuals seek secure income streams and potential growth opportunities, FABs may continue to attract investor interest.

Growth Opportunities and Challenges

- Growth Opportunities:FABs offer potential growth opportunities in areas such as retirement planning, wealth management, and alternative investments. As the population ages and demand for retirement income solutions increases, FABs may become more prominent.

- Challenges:FABs also face challenges, including regulatory scrutiny, competition from other structured products, and the potential for market volatility. Issuers need to carefully manage risks and ensure transparency to attract and retain investors.

Benefits and Risks of FABs

FABs offer a range of benefits, but they also come with potential risks that investors should carefully consider before making an investment decision.

An annuity is a financial product that provides a guaranteed stream of income payments. If you’re looking for a clear explanation and examples of how annuities work, check out this article: Annuity Meaning With Example 2024.

Benefits of Investing in FABs

- Guaranteed Income Stream:FABs provide a guaranteed minimum income stream, which can be helpful for retirement planning or other income needs.

- Potential for Capital Appreciation:FABs may offer the potential for capital appreciation, depending on the underlying assets and investment strategy.

- Risk Mitigation:FABs can help mitigate certain risks, such as interest rate risk and inflation risk, depending on the structure and underlying assets.

- Transparency and Disclosure:FABs are typically subject to regulatory requirements that ensure transparency and disclosure of key information to investors.

Risks Associated with FAB Investments

- Credit Risk:FABs are subject to credit risk, which is the risk that the issuer may default on its obligations. Investors should carefully evaluate the creditworthiness of the issuer before investing in a FAB.

- Market Risk:FABs are subject to market risk, which is the risk that the value of the underlying assets may decline. This can impact the income stream and potential capital appreciation.

- Liquidity Risk:FABs may not be easily traded in the secondary market, which can make it difficult to sell the investment before maturity.

- Complexity:FABs can be complex financial instruments, and investors should understand the terms and conditions of the investment before making a decision.

Comparison with Other Investment Options

FABs can be compared with other investment options, such as traditional bonds, annuities, and structured notes. The best investment option for a particular investor will depend on their individual financial goals, risk tolerance, and investment horizon.

Annuity 401(k) plans are a popular retirement savings option, offering a way to grow your savings tax-deferred. To learn more about the specifics of Annuity 401(k) plans in 2024, you can check out this article: Annuity 401k 2024.

- Traditional Bonds:Traditional bonds offer a fixed interest rate and maturity date, but they do not typically provide the potential for capital appreciation. FABs may offer a more flexible return profile and potential for growth.

- Annuities:Annuities provide a guaranteed income stream for life, but they typically do not offer the potential for capital appreciation. FABs may offer a balance between income and growth potential.

- Structured Notes:Structured notes are similar to FABs in that they combine features of bonds and other investment products. However, structured notes may have more complex structures and higher risks.

FAB Issuers and Investors: Formula Annuity Bond 2024

FABs are issued by a variety of financial institutions, including banks, insurance companies, and investment firms. Investors in FABs can range from individuals to institutional investors, each with their own motivations for investing in this type of product.

Living annuities are designed to provide a stream of income for as long as you live. However, you might be wondering about the tax implications. To learn more about whether living annuities are taxable in 2024, you can read this article: Is A Living Annuity Taxable 2024.

Major Issuers of FABs

- Banks:Many banks issue FABs as part of their structured products offerings. Banks typically have strong credit ratings and access to a wide range of underlying assets.

- Insurance Companies:Insurance companies are also major issuers of FABs, often using them as part of their retirement planning products. Insurance companies have expertise in managing long-term liabilities and providing guaranteed income streams.

- Investment Firms:Investment firms, such as asset managers and hedge funds, may issue FABs as part of their investment strategies. These firms typically have specialized knowledge in specific asset classes and investment strategies.

Profile of Typical FAB Investors, Formula Annuity Bond 2024

- Individuals:Individuals seeking a guaranteed income stream, potential for capital appreciation, and risk mitigation may invest in FABs. These investors may be approaching retirement, looking for income during retirement, or seeking to manage their wealth.

- Institutional Investors:Institutional investors, such as pension funds, insurance companies, and endowments, may invest in FABs as part of their asset allocation strategies. These investors typically seek long-term investments with predictable income streams and potential for growth.

Motivations of Issuers and Investors

- Issuers:Issuers of FABs are motivated by factors such as generating revenue, managing their own liabilities, and providing investment solutions to meet investor demand. FABs can provide issuers with a way to access capital and diversify their investment portfolios.

- Investors:Investors in FABs are motivated by factors such as seeking guaranteed income streams, potential for capital appreciation, risk mitigation, and tax advantages. FABs can provide investors with a way to achieve their financial goals, such as retirement planning or wealth preservation.

A $750,000 annuity can provide a significant stream of income payments. To learn more about the potential payouts and other aspects of a $750,000 annuity in 2024, you can explore this article: Annuity 750k 2024.

Understanding FAB Terms and Conditions

FABs are complex financial instruments with a range of terms and conditions that investors should carefully understand before making an investment decision. These terms and conditions can vary depending on the specific FAB structure and issuer.

There are various types of annuities, and understanding the different options is crucial. For a comprehensive overview of 9 different types of annuities in 2024, you can read this article: 9 Annuity 2024.

Key Terms and Conditions

- Maturity Date:The date on which the principal amount of the FAB is repaid to investors.

- Coupon Rate:The annual interest rate paid on the principal amount of the FAB.

- Underlying Assets:The assets in which the principal investment is invested.

- Formula:The mathematical formula that determines the return on the investment.

- Minimum Income Guarantee:The guaranteed minimum income stream paid to investors over the life of the FAB.

- Capital Appreciation Potential:The potential for the value of the FAB to increase over time.

- Call Provision:A provision that allows the issuer to redeem the FAB before maturity.

- Put Provision:A provision that allows the investor to sell the FAB back to the issuer before maturity.

Implications of Different FAB Structures and Features

Different FAB structures and features can have significant implications for the return profile, risk profile, and overall investment characteristics of the FAB. Investors should carefully consider these factors before making a decision.

- Underlying Assets:The choice of underlying assets can significantly impact the return and risk profile of the FAB. For example, a FAB invested in high-yield bonds may offer higher potential returns but also higher credit risk.

- Formula:The formula used to determine the return can also have a significant impact on the investment. Some formulas may be more sensitive to interest rate movements or market volatility than others.

- Call and Put Provisions:Call and put provisions can impact the liquidity and potential return of the FAB. For example, a call provision may allow the issuer to redeem the FAB at a lower price than the market value, while a put provision may allow the investor to sell the FAB back to the issuer at a higher price.

Are you wondering if you can continue working while receiving an annuity? It’s a common question, and the answer depends on the specific terms of your annuity contract. You can find more information about working while receiving an annuity in 2024 here: Can You Receive Annuity And Still Work 2024.

Examples of Common FAB Clauses and Their Impact

- Interest Rate Cap:A clause that limits the maximum interest rate that can be paid on the FAB. This can help mitigate interest rate risk but may also limit potential returns.

- Inflation Adjustment:A clause that adjusts the income payments or principal amount of the FAB based on inflation. This can help protect investors from inflation erosion but may also result in lower returns.

- Early Redemption Fee:A fee charged if the investor redeems the FAB before maturity. This can discourage investors from selling the FAB early but may also limit liquidity.

Valuation and Pricing of FABs

Valuing and pricing FABs is a complex process that involves considering a range of factors, including the underlying assets, the formula used to determine the return, and market conditions.

Single premium annuities are a popular option for those looking for a guaranteed income stream. To learn more about the specifics of a $50,000 single premium annuity in 2024, you can check out this article: G Purchased A $50 000 Single Premium 2024.

Methods Used to Value FABs

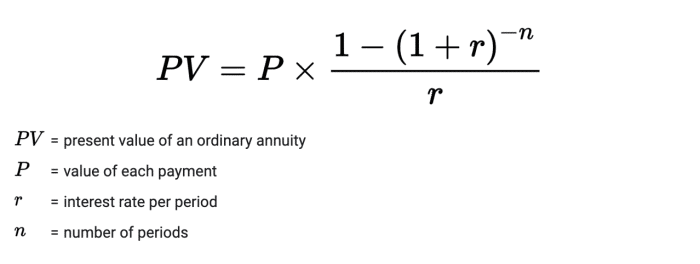

- Discounted Cash Flow (DCF) Analysis:This method involves discounting the future cash flows expected from the FAB back to their present value.

- Option Pricing Models:These models are used to value the embedded options in FABs, such as call and put provisions.

- Monte Carlo Simulation:This method involves running multiple simulations to estimate the potential range of outcomes for the FAB, taking into account factors such as interest rates, inflation, and market volatility.

Factors Influencing the Pricing of FABs

- Interest Rates:Interest rate movements can significantly impact the value of FABs. Higher interest rates can reduce the present value of future cash flows, leading to lower prices.

- Underlying Assets:The performance of the underlying assets can also impact the pricing of FABs. Higher asset prices can lead to higher FAB prices.

- Risk Profile:The risk profile of the FAB, including credit risk and market risk, can also influence pricing. Higher risk FABs may be priced at a discount to lower risk FABs.

- Market Demand:The demand for FABs in the market can also impact pricing. Higher demand can lead to higher prices.

Relationship Between FAB Valuation and Market Conditions

The valuation of FABs is closely tied to market conditions. Changes in interest rates, inflation, and market volatility can all impact the pricing of FABs. Investors should monitor market conditions and consider how these factors may affect the value of their FAB investments.

Annuity NPV calculators are valuable tools for assessing the profitability of an annuity investment. You can find more information about annuity NPV calculators and how they work in 2024 here: Annuity Npv Calculator 2024.

Legal and Regulatory Considerations for FABs

FABs are subject to a range of legal and regulatory requirements that aim to protect investors and ensure the fair and transparent operation of the market. These requirements can vary depending on the jurisdiction in which the FAB is issued.

Immediate annuities provide a stream of income payments right away. However, you might be curious about the tax treatment of this income. To find out if immediate annuity income is taxable in 2024, read this article: Is Immediate Annuity Income Taxable 2024.

Legal Framework Surrounding FABs

- Securities Laws:FABs are typically regulated as securities, and issuers must comply with relevant securities laws, such as registration requirements and disclosure obligations.

- Contract Law:The terms and conditions of FABs are governed by contract law, which sets out the rights and obligations of the issuer and investors.

- Financial Services Regulations:Financial institutions issuing FABs must comply with relevant financial services regulations, such as capital adequacy requirements and consumer protection rules.

Relevant Regulations and Compliance Requirements

- Prospectus Requirements:Issuers of FABs must prepare a prospectus that provides investors with detailed information about the investment, including the risks, terms and conditions, and financial performance.

- Disclosure Obligations:Issuers must make ongoing disclosures to investors about the performance of the FAB and any material changes to the investment.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations:Issuers must comply with AML and KYC regulations to prevent money laundering and other financial crimes.

Potential Legal and Regulatory Risks Associated with FABs

- Misleading or Incomplete Disclosure:Issuers that provide misleading or incomplete information to investors may face legal liability.

- Breach of Contract:Issuers that fail to meet their obligations under the FAB contract may be subject to legal action by investors.

- Regulatory Fines and Penalties:Issuers that violate regulatory requirements may face fines and penalties.

- Reputational Damage:Legal and regulatory issues can damage the reputation of FAB issuers and make it difficult to attract investors in the future.

Last Recap

Understanding Formula Annuity Bonds in 2024 is crucial for investors seeking to diversify their portfolios and capitalize on evolving market trends. This guide has provided a comprehensive overview of FABs, including their structure, benefits, risks, and market dynamics. By carefully evaluating FABs within the broader investment landscape, investors can make informed decisions that align with their financial goals and risk tolerance.

Expert Answers

What are the tax implications of investing in Formula Annuity Bonds?

Tax implications for FAB investments can vary depending on your jurisdiction and the specific structure of the bond. It’s essential to consult with a tax advisor to understand the tax treatment of FABs in your particular situation.

How do I choose the right Formula Annuity Bond for my investment portfolio?

Choosing the right FAB depends on your investment goals, risk tolerance, and financial situation. Consider factors such as maturity date, interest rate, and the issuer’s creditworthiness. Consulting with a financial advisor can help you make an informed decision.

Annuity death benefits can be a valuable source of income for beneficiaries. However, it’s important to understand the tax implications. To learn more about whether or not annuity death benefits are taxable in 2024, check out this article: Is Annuity Death Benefit Taxable 2024.

Are Formula Annuity Bonds suitable for all investors?

FABs are not suitable for all investors. They carry inherent risks, and their complexity may not be suitable for those unfamiliar with fixed-income investments. It’s crucial to understand the risks involved and consult with a financial professional before investing.