Calculating An Annuity Factor 2024 is a crucial process for anyone involved in financial planning, investment, or loan calculations. Understanding annuity factors allows you to accurately assess the present and future value of a series of payments, making informed decisions about your financial future.

When an annuity is written, the life expectancy of the annuitant is a crucial factor. It determines the duration of payments and the overall payout. You can learn more about When An Annuity Is Written Whose Life 2024 on this website.

This guide explores the concept of annuity factors, explaining how they are calculated and used in various financial scenarios. We will delve into the formula, key variables, and real-world applications of annuity factors, highlighting their significance in today’s financial landscape.

Annuity 1099 forms in 2024 are used to report income from annuities. It’s important to understand the tax implications of annuity income and how it’s reported on your tax return. You can learn more about Annuity 1099 2024 on this website.

Contents List

Understanding Annuity Factors

Annuity factors are essential tools in financial calculations, particularly when dealing with streams of equal payments over a set period. They provide a way to simplify complex calculations by condensing multiple future cash flows into a single present value or future value.

Annuity 3-year rates in 2024 can fluctuate depending on market conditions. It’s important to compare rates from different providers to find the best deal. You can learn more about Annuity 3 Year Rates 2024 on this website.

This makes it easier to compare different investment options or loan scenarios.

Annuity versus IRA is a common topic for those planning for retirement. Both offer tax advantages, but there are key differences to consider. You can learn more about Annuity V Ira 2024 on this website.

The Concept of Annuity Factors

An annuity factor represents the present value of a series of equal payments, or an annuity, discounted back to the present time. It essentially translates future cash flows into their equivalent value today, considering the time value of money.

Purpose and Significance of Annuity Factors

Annuity factors play a crucial role in various financial calculations, including:

- Present Value Calculations:Annuity factors help determine the present value of a future stream of payments, allowing investors to compare different investment options based on their present worth.

- Future Value Calculations:They can also be used to calculate the future value of an annuity, helping individuals understand the total amount they will accumulate over time.

- Loan Amortization:Annuity factors are integral in calculating loan payments, allowing lenders to determine the monthly or periodic payments required to repay a loan over a specific term.

- Retirement Planning:Annuity factors help individuals estimate the amount of money they need to save for retirement, ensuring they have sufficient funds to meet their financial needs in their later years.

Real-World Applications of Annuity Factors

- Mortgage Payments:When taking out a mortgage, annuity factors are used to calculate the monthly payments based on the loan amount, interest rate, and loan term.

- Retirement Savings:Individuals use annuity factors to determine how much they need to save each month to reach their retirement goals, considering factors like expected returns and time horizon.

- Investment Analysis:Annuity factors are used to compare the present value of different investment options, allowing investors to make informed decisions about where to allocate their capital.

Calculating Annuity Factors: Calculating An Annuity Factor 2024

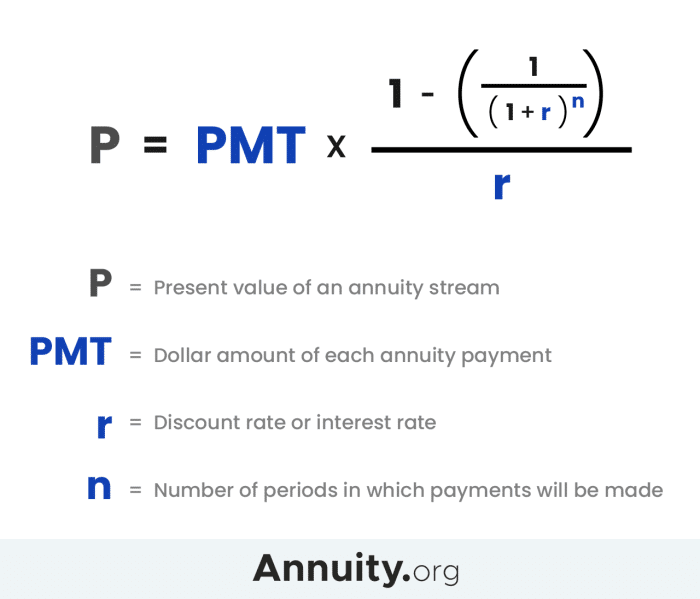

Annuity factors are calculated using a specific formula that takes into account the interest rate and the number of periods involved.

An annuity of $250,000 in 2024 could provide a significant source of income for retirement. However, it’s important to consider your individual financial needs and goals before making a decision. You can find more information about Annuity 250k 2024 on this website.

Formula for Calculating Annuity Factors

Annuity Factor = (1- (1 + i)^-n) / i

Kathy’s annuity might be experiencing some changes in 2024. It’s important to stay informed about the latest updates and how they may affect your finances. You can find more information about Kathy’s Annuity Is Currently Experiencing 2024 on this website.

Where:

- i= Interest rate per period

- n= Number of periods

Key Variables Influencing Annuity Factors

The annuity factor is influenced by two key variables:

- Interest Rate:A higher interest rate results in a lower annuity factor, as the present value of future payments is discounted more heavily.

- Number of Periods:A longer time period (more periods) results in a lower annuity factor, as the present value of future payments is discounted over a longer time horizon.

Step-by-Step Guide to Calculating Annuity Factors

To calculate an annuity factor using a financial calculator, follow these steps:

- Input the interest rate (i) per period.

- Input the number of periods (n).

- Press the “PV” (Present Value) button to display the annuity factor.

Table of Annuity Factors

| Interest Rate (%) | 1 Year | 5 Years | 10 Years | 20 Years |

|---|---|---|---|---|

| 2 | 0.9804 | 4.7135 | 8.9826 | 16.3514 |

| 4 | 0.9615 | 4.4518 | 8.1109 | 14.8775 |

| 6 | 0.9434 | 4.2124 | 7.3601 | 13.5903 |

| 8 | 0.9259 | 3.9927 | 6.7101 | 12.4622 |

Annuity Factors in 2024

The current interest rate environment has a significant impact on annuity factors, and these factors are expected to evolve in 2024.

X share annuities in 2024 can offer a unique investment opportunity, but it’s essential to understand the risks and potential returns involved. You can learn more about X Share Annuity 2024 on this website.

Current Interest Rate Environment and its Impact on Annuity Factors

In 2024, interest rates are expected to remain relatively low due to ongoing economic uncertainty and inflation. This low-interest rate environment will likely result in higher annuity factors compared to previous years. As interest rates are lower, the present value of future payments is discounted less heavily, leading to a higher annuity factor.

Insights into the Evolution of Annuity Factors in 2024

Annuity factors are expected to fluctuate in 2024, influenced by factors such as inflation, economic growth, and central bank policies. As the economy recovers and inflation stabilizes, interest rates may start to rise, leading to a gradual decline in annuity factors.

An annuity is a financial product that provides a stream of regular payments for a specific period. You can learn more about Annuity What Is It Definition 2024 on this website.

Comparison of Annuity Factors from Previous Years to those Expected in 2024

Comparing annuity factors from previous years to those expected in 2024, we can observe a general trend of higher annuity factors in 2024 due to the low-interest rate environment. However, it’s important to note that these factors can vary significantly depending on the specific interest rate and time period.

Applications of Annuity Factors

Annuity factors have numerous applications in financial calculations, helping individuals and businesses make informed decisions about investments, loans, and retirement planning.

Annuity drawdown in 2024 refers to the process of withdrawing funds from an annuity. It’s important to understand the terms and conditions of your annuity before making any withdrawals. You can learn more about Is Annuity Drawdown 2024 on this website.

Calculating Present Value and Future Value of Annuities

Annuity factors are used to calculate the present value and future value of annuities, which are streams of equal payments over a specific period.

An annuity estimator is a valuable tool for estimating the potential income from an annuity. It considers factors like principal, interest rates, and payment periods. You can learn more about Annuity Estimator 2024 on this website.

- Present Value of an Annuity:To calculate the present value of an annuity, multiply the annuity payment by the corresponding annuity factor.

- Future Value of an Annuity:To calculate the future value of an annuity, multiply the annuity payment by the future value annuity factor.

Loan Amortization Schedules

Annuity factors are essential in creating loan amortization schedules, which detail the breakdown of loan payments over time. The annuity factor is used to calculate the principal and interest components of each payment, ensuring the loan is repaid in full within the agreed-upon term.

Calculating an annuity due in 2024 involves adjusting the formula to account for payments made at the beginning of each period. This can affect the overall value of the annuity. You can learn more about Calculating An Annuity Due 2024 on this website.

Retirement Planning Calculations

Annuity factors are crucial in retirement planning calculations, helping individuals determine how much they need to save each month to reach their retirement goals. They are used to estimate the present value of future retirement income streams, ensuring individuals have sufficient funds to meet their financial needs in their later years.

Annuity 9 in 2024 might be a good choice for those looking for a long-term investment strategy. However, it’s important to understand the potential risks and rewards involved. You can find more information about Annuity 9 2024 on this website.

Additional Considerations

While annuity factors are powerful tools in financial calculations, it’s essential to consider their limitations and potential risks.

Calculating an annuity in Excel can be a useful tool for financial planning. There are various formulas and functions that can help you determine the future value of your annuity. You can learn more about Calculating Annuity In Excel 2024 on this website.

Limitations and Assumptions of Annuity Factors

Annuity factors rely on several assumptions, including:

- Constant Interest Rates:Annuity factors assume a constant interest rate over the entire period, which may not always be the case in reality.

- Regular Payments:They assume that payments are made at regular intervals, which may not be feasible in certain situations.

- No Default:Annuity factors assume that payments will be made on time and in full, without any defaults or missed payments.

Potential Risks and Uncertainties Affecting Annuity Factor Calculations

Several risks and uncertainties can affect annuity factor calculations, including:

- Interest Rate Fluctuations:Changes in interest rates can significantly impact the present value and future value of annuities.

- Inflation:Inflation can erode the purchasing power of future payments, making annuity factors less accurate in real terms.

- Economic Uncertainty:Economic downturns or recessions can lead to lower interest rates and increased financial risks, affecting annuity factor calculations.

Selecting the Appropriate Annuity Factor, Calculating An Annuity Factor 2024

When selecting an annuity factor for a specific situation, it’s important to consider:

- Interest Rate:Choose an interest rate that reflects the current market conditions and your expected rate of return.

- Time Period:Select a time period that aligns with the duration of the annuity or loan.

- Payment Frequency:Ensure that the annuity factor is based on the same payment frequency as the annuity payments.

Ultimate Conclusion

As we’ve seen, calculating an annuity factor is a powerful tool for financial analysis. By understanding the principles behind these calculations, you can gain valuable insights into the present and future value of your financial commitments. Whether you are planning for retirement, managing a loan, or investing for the future, mastering annuity factors can provide a solid foundation for making sound financial decisions.

FAQ Overview

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity assumes payments are made at the end of each period, while an annuity due assumes payments are made at the beginning of each period. This difference affects the calculation of the annuity factor.

Annuity 4 percent in 2024 can be a good option for those seeking guaranteed income, but remember to consider the terms and conditions before making a decision. You can learn more about Annuity 4 Percent 2024 on this website.

How do changes in interest rates impact annuity factors?

Higher interest rates generally result in higher annuity factors, while lower interest rates lead to lower annuity factors. This is because higher interest rates increase the future value of the payments.

The Annuity Lottery in 2024 is a great opportunity to win a substantial amount of money. But remember to understand the rules and regulations before participating. You can learn more about Annuity Lottery 2024 on this website.

Are there any online calculators available for calculating annuity factors?

Yes, many online calculators are available that can help you calculate annuity factors based on your specific needs. Simply search for “annuity factor calculator” on the internet.

What are some common mistakes to avoid when calculating annuity factors?

Ensure you are using the correct formula, inputting accurate variables, and accounting for the timing of payments. Also, remember that annuity factors are based on assumptions, so it’s important to consider potential risks and uncertainties.