Calculating An Annuity 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, a popular financial instrument, are often used in retirement planning and offer a steady stream of income throughout your golden years.

Need to know if an annuity requires a license? Is Annuity Lic 2024 provides information about the licensing requirements for annuities, helping you understand the regulations surrounding this financial product.

This guide will delve into the intricacies of annuity calculations, providing you with the knowledge and tools necessary to make informed financial decisions in 2024.

Looking for an annuity with a guaranteed payout for 6 years? Annuity 6 Guaranteed 2024 explores the advantages and considerations of annuities that offer a 6-year guarantee, providing valuable insights for your financial planning.

We will explore the different types of annuities, their key features, and the factors that influence their value. From understanding the formula for calculating the present value of an annuity to analyzing the impact of current market conditions, this comprehensive guide will equip you with the knowledge to navigate the complex world of annuities.

Want to learn more about annuities with a payout of $400,000? Annuity 400k 2024 provides insights into the intricacies of annuities with this specific payout amount, helping you understand your options and make informed choices.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a specific period of time. It is essentially a contract between an individual and an insurance company where the individual makes a lump-sum payment or a series of payments in exchange for guaranteed future payments.

Wondering if your single-life annuity is taxable in 2024? You’re not alone! Is A Single Life Annuity Taxable 2024 provides a clear explanation of the tax implications for this type of annuity, so you can make informed financial decisions.

Annuities are often used for retirement planning, but they can also be used for other purposes, such as income generation, estate planning, or protecting against longevity risk.

Key Features of Annuities

Annuities are characterized by several key features, including:

- Guaranteed Payments:Annuities provide guaranteed payments, meaning the insurer promises to make regular payments for a specified period or for the lifetime of the annuitant. This provides financial security and predictability, especially during retirement.

- Accumulation Phase:In the accumulation phase, the annuitant makes contributions to the annuity contract. These contributions grow over time, often with the help of interest or investment returns. This phase is similar to saving for retirement.

- Distribution Phase:Once the annuitant reaches a certain age or meets specific conditions, the annuity enters the distribution phase. During this phase, the annuitant receives regular payments, either for a fixed period or for the rest of their life.

Types of Annuities

Annuities are available in various forms, each with its own characteristics and benefits. Here are some common types:

- Fixed Annuities:These annuities provide a fixed rate of return, guaranteeing a specific amount of income for the annuitant. The payments are typically based on a fixed interest rate that is set at the time of purchase. Fixed annuities offer stability and predictability, making them suitable for risk-averse individuals.

- Variable Annuities:Variable annuities offer the potential for higher returns but also come with higher risks. The investment returns in a variable annuity are linked to the performance of underlying investment options, such as mutual funds or stocks. The payments received by the annuitant can fluctuate based on the performance of these investments.

Have questions about annuities? Annuity Questions 2024 addresses common queries and concerns about annuities, offering valuable insights and guidance to help you understand this financial product.

- Immediate Annuities:Immediate annuities start paying out income immediately after the annuitant makes their initial investment. This type of annuity is suitable for individuals who need immediate income, such as retirees or those with immediate financial needs.

- Deferred Annuities:Deferred annuities begin paying out income at a later date, usually after a specified period of time. These annuities are often used for long-term financial planning, such as retirement savings.

Real-World Scenarios

Annuities are used in various real-world scenarios, including:

- Retirement Planning:Annuities are a popular tool for retirement planning, providing a guaranteed stream of income that can help supplement Social Security or other retirement savings.

- Income Generation:Annuities can be used to generate income during retirement or for other purposes, such as paying for healthcare expenses or supplementing a lower-paying job.

- Estate Planning:Annuities can be incorporated into estate planning strategies to provide income for beneficiaries or to protect assets from estate taxes.

- Longevity Risk Management:Annuities can help protect against longevity risk, which is the risk of outliving one’s savings. Annuities provide guaranteed payments for life, ensuring that individuals have a source of income even if they live longer than expected.

Annuity Calculations

Calculating the present value of an annuity is essential for understanding the value of this financial product and making informed decisions about purchasing or investing in an annuity. The present value of an annuity represents the current worth of a stream of future payments, taking into account the time value of money.

Formula for Present Value of an Annuity

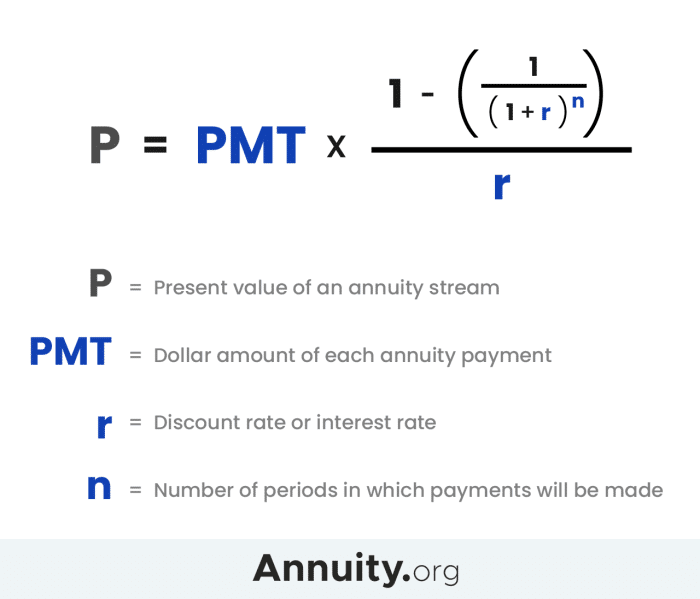

The present value (PV) of an annuity can be calculated using the following formula:

PV = PMT

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Calculation

To calculate the present value of an annuity, follow these steps:

- Identify the payment amount (PMT):Determine the amount of each regular payment that will be received from the annuity.

- Determine the interest rate (r):Find the interest rate per period. This is usually the annual interest rate divided by the number of payment periods per year.

- Calculate the number of periods (n):Determine the total number of payment periods over the life of the annuity.

- Plug the values into the formula:Substitute the values for PMT, r, and n into the present value formula.

- Calculate the present value (PV):Use a financial calculator or spreadsheet software to solve the equation and determine the present value of the annuity.

Example Calculation

Suppose you are considering an annuity that will pay you $10,000 per year for 20 years. The interest rate is 5% per year. To calculate the present value of this annuity, you would use the following steps:

- PMT = $10,000

- r = 5% = 0.05

- n = 20 years

Plugging these values into the formula, we get:

PV = $10,000

Are you wondering if an annuity is a single lump sum payment? Annuity Is A Single Sum 2024 clarifies the structure of annuities, explaining whether they are received as a single payment or a series of installments.

- [1

- (1 + 0.05)^-20] / 0.05

PV = $10,000

- [1

- (1.05)^-20] / 0.05

PV = $10,000

- [1

- 0.376889] / 0.05

PV = $10,000

Curious about the nature of an annuity and how it provides a steady stream of income? An Annuity Is A Stream Of 2024 explains the concept of annuities as a continuous source of income, providing valuable information for those considering this financial tool.

0.623111 / 0.05

PV = $124,622.20

Therefore, the present value of this annuity is $124,622.20.

Annuity Factors

Annuity factors are multipliers used in annuity calculations to simplify the process of determining the present value or future value of a stream of payments. These factors represent the discounted value of a series of future payments, taking into account the time value of money.

Types of Annuity Factors

There are two main types of annuity factors:

- Present Value Factor (PVF):This factor is used to calculate the present value of an annuity. It represents the discounted value of a series of future payments, taking into account the interest rate and the number of periods.

- Future Value Factor (FVf):This factor is used to calculate the future value of an annuity. It represents the compounded value of a series of future payments, taking into account the interest rate and the number of periods.

Using Annuity Tables or Online Calculators

Annuity factors can be found in annuity tables or calculated using online calculators. Annuity tables provide pre-calculated factors for different interest rates and time periods. Online calculators allow users to input the necessary information and obtain the corresponding annuity factor.

To use an annuity table, simply find the row corresponding to the interest rate and the column corresponding to the number of periods. The intersection of the row and column will give you the present value or future value factor.

To calculate the present value or future value of an annuity, multiply the payment amount by the appropriate annuity factor.

Online calculators are convenient for calculating annuity factors, as they provide a user-friendly interface and allow for easy adjustments to input variables.

Applications of Annuity Calculations

Annuity calculations have various applications in financial planning, particularly in areas such as retirement planning, estate planning, and insurance.

Seeking career opportunities in the annuity industry? Annuity Jobs 2024 provides insights into the types of jobs available in the annuity market, offering valuable information for those interested in this field.

Retirement Planning

Annuity calculations are crucial in retirement planning to determine the amount of income that can be generated from an annuity investment. By calculating the present value of an annuity, individuals can determine how much they need to invest today to receive a desired stream of income in retirement.

Do annuities qualify as a retirement plan? Is An Annuity A Qualified Retirement Plan 2024 examines the eligibility of annuities as a qualified retirement plan, providing clarity on their role in retirement savings.

Annuities can provide a guaranteed income stream, which can help retirees meet their living expenses and maintain their lifestyle.

Do annuities provide income? Annuity Is Income 2024 explains how annuities function as a source of income, shedding light on the tax implications and benefits of receiving annuity payments.

Estate Planning

Annuities can be used in estate planning to provide income for beneficiaries after the death of the annuitant. By purchasing an annuity that pays out to a beneficiary after the annuitant’s death, individuals can ensure that their loved ones have a source of income during their lifetime.

Considering an annuity versus an IRA? Annuity V Ira 2024 offers a comprehensive comparison of these two retirement savings options, helping you understand their differences and choose the best fit for your financial goals.

Annuities can also be used to minimize estate taxes, as the payments received from an annuity are not subject to estate taxes.

Insurance

Annuity calculations are also used in the insurance industry. Insurance companies use these calculations to determine the premiums for life insurance policies and to calculate the payouts for annuity contracts. Insurance companies use annuity factors to discount future payouts to their present value, which helps them to set appropriate premiums and ensure financial stability.

Are you looking for a secure investment with a guaranteed return? Annuity 5 Year Guarantee 2024 explores the benefits and considerations of annuities that offer a 5-year guarantee, helping you understand how they can fit into your financial strategy.

Case Studies

Here are some case studies illustrating the practical applications of annuity calculations:

- Retirement Planning:A 65-year-old retiree wants to receive $50,000 per year for the rest of their life. Assuming an interest rate of 4%, they can calculate the present value of this annuity using the formula or an annuity table. This calculation will help them determine how much they need to invest today to receive the desired income stream.

- Estate Planning:A wealthy individual wants to leave a legacy for their children. They can purchase an annuity that pays out to their children after their death. By calculating the present value of this annuity, they can ensure that their children receive a sufficient income stream after their passing.

- Insurance:An insurance company uses annuity calculations to determine the premiums for a life insurance policy. They consider the age of the insured, their health status, and the expected payout amount to calculate the appropriate premium. This calculation ensures that the insurance company has enough funds to cover potential future payouts.

Factors Influencing Annuity Calculations

Several factors can influence the value of an annuity, including interest rates, inflation, and the time period.

If you’re in the UK and need to calculate the potential value of an annuity, Annuity Calculator Uk 2024 offers a comprehensive guide to using annuity calculators to determine your estimated payout.

Interest Rates

Interest rates play a significant role in annuity calculations. Higher interest rates generally result in higher annuity values, as the investment grows at a faster rate. Conversely, lower interest rates lead to lower annuity values. This is because the present value of future payments is discounted at a lower rate when interest rates are lower.

Are annuities linked to health insurance? Annuity Health Insurance 2024 explores the relationship between annuities and health insurance, clarifying any potential connections and considerations.

Inflation

Inflation erodes the purchasing power of money over time. When inflation is high, the future value of an annuity may be less than its present value, as the payments received in the future will have less purchasing power. This is why it is important to consider inflation when making annuity calculations.

Time Period

The time period over which the annuity payments are made also affects the annuity value. Longer time periods generally result in higher annuity values, as the payments are received for a longer period. Shorter time periods lead to lower annuity values, as the payments are received for a shorter period.

Impact on Financial Outcomes

Changes in these factors can significantly affect the financial outcomes of annuity investments. For example, if interest rates rise after an individual purchases an annuity, the value of the annuity may increase. However, if interest rates fall, the value of the annuity may decrease.

Similarly, if inflation is higher than expected, the purchasing power of the annuity payments may be eroded, reducing the overall value of the investment.

Annuity Calculations in 2024

In 2024, the annuity market is expected to continue evolving, influenced by factors such as interest rate trends, regulatory changes, and investor preferences. Here are some key considerations for annuity calculations in 2024:

Market Conditions

The current market conditions, including interest rates and inflation, will have a significant impact on annuity calculations. Interest rates are expected to remain elevated in 2024, which could benefit annuity investors. Higher interest rates generally lead to higher annuity values, as the investment grows at a faster rate.

However, inflation remains a concern, potentially eroding the purchasing power of annuity payments.

Trends and Developments, Calculating An Annuity 2024

The annuity market is expected to see continued innovation in 2024, with new product offerings and features designed to meet the evolving needs of investors. There is a growing demand for annuities that provide flexibility, such as variable annuities with a wider range of investment options.

Additionally, there is increasing interest in annuities that offer features such as guaranteed lifetime income or protection against market downturns.

Regulatory Landscape

The regulatory landscape for annuities is constantly evolving. In 2024, there may be new regulations or guidance related to annuity products, which could impact the way annuities are priced and sold. It is important for investors to stay informed about any changes in regulations that may affect their annuity investments.

Final Thoughts: Calculating An Annuity 2024

Understanding annuity calculations in 2024 is essential for individuals seeking financial security and planning for the future. This guide has provided you with a comprehensive overview of the topic, covering everything from the basics of annuities to the current market landscape.

Armed with this knowledge, you can make informed decisions about your financial future and confidently navigate the complexities of annuity investments.

FAQ Overview

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type of annuity and the individual’s tax situation. It’s essential to consult with a tax professional to understand the specific tax implications for your situation.

Considering an annuity with a payout of $500,000? Annuity 500k 2024 delves into the specifics of annuities with this level of payout, exploring potential options and factors to consider when making your decision.

How do I choose the right annuity for my needs?

The best annuity for you will depend on your individual financial goals, risk tolerance, and time horizon. It’s crucial to consult with a financial advisor to determine the most suitable annuity for your circumstances.

Are annuities safe investments?

Annuities can provide a degree of security, but they are not risk-free. The value of your annuity can be affected by factors such as interest rates, inflation, and the financial health of the insurance company issuing the annuity.