Annuity Calculator Bankrate 2024 provides a powerful tool for planning your retirement income. It allows you to explore different annuity options, understand their potential payouts, and make informed decisions about your financial future. Whether you’re seeking a steady stream of income, guaranteed returns, or protection against market volatility, an annuity can be a valuable component of your retirement strategy.

Investing in an annuity can be a strategic move, but it’s essential to consider the safety and security of your investment. Our article on Is Annuity Safe 2024 addresses this important question.

This calculator takes into account factors such as your age, investment amount, interest rates, and desired payout frequency. It helps you visualize how your annuity might grow over time and provides insights into the potential benefits and risks associated with different annuity types.

Planning for retirement? An annuity withdrawal calculator can help you estimate your monthly income. Explore the Annuity Withdrawal Calculator 2024 and understand how to make the most of your retirement savings.

By understanding the key features and considerations involved, you can make informed decisions about the best annuity for your individual needs.

With various annuity options available, choosing the best one for your needs can be challenging. Our article on Annuity Which Is Best 2024 provides insights to guide you in making the right decision.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. They are often used as a retirement savings tool, but can also be used for other purposes, such as income replacement or long-term care.

Understanding your LIC annuity number is essential for managing your investments. Our guide on Annuity Number Lic 2024 provides detailed information about this important identifier.

Annuities are generally purchased with a lump sum of money, and the payments can be made for a fixed period of time, for life, or for a combination of both.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Some of the most common types of annuities include:

- Fixed Annuities:These annuities offer a guaranteed rate of return on your investment. This means that you know exactly how much income you will receive each year, regardless of market fluctuations. Fixed annuities are typically considered to be less risky than variable annuities, but they may also offer lower returns.

Are you pursuing a career in banking and finance? If so, understanding annuities is crucial. Our article on Annuity Jaiib 2024 provides insights into this financial instrument and its relevance to the Jaiib exam.

- Variable Annuities:These annuities invest your money in a variety of assets, such as stocks, bonds, and mutual funds. The returns on your investment will vary depending on the performance of the underlying assets. Variable annuities can offer the potential for higher returns than fixed annuities, but they also carry a higher level of risk.

Annuity payments can provide a steady stream of income during retirement. Learn more about the process and the role of annuitants in our article on K Is An Annuitant Currently Receiving Payments 2024.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. Immediate annuities are often used by people who are already retired or who are planning to retire soon.

- Deferred Annuities:These annuities do not begin making payments until a later date. Deferred annuities are often used by people who are saving for retirement many years in the future.

Key Features of Annuities

Annuities are characterized by several key features, including:

- Principal:The initial lump sum of money that you invest in the annuity.

- Interest:The rate of return that you earn on your investment. This can be fixed or variable, depending on the type of annuity.

- Payments:The regular payments that you receive from the annuity. These payments can be made monthly, quarterly, annually, or at other intervals.

- Duration:The length of time that the annuity will make payments. This can be a fixed period of time, such as 10 or 20 years, or it can be for life.

Pros and Cons of Annuities, Annuity Calculator Bankrate 2024

Annuities can be a valuable retirement savings tool, but they also have some potential drawbacks. Here are some of the pros and cons of annuities:

- Pros:

- Guaranteed income stream: Annuities can provide a guaranteed income stream for life, which can be helpful in retirement.

- Tax deferral: The earnings on your annuity investment are typically tax-deferred, meaning that you won’t have to pay taxes on them until you begin receiving payments.

- Protection from market risk: Fixed annuities offer protection from market risk, as your investment is guaranteed a certain rate of return.

- Cons:

- High fees: Annuities can have high fees, which can eat into your returns.

- Limited liquidity: Annuities are not as liquid as other investments, such as stocks or bonds. You may have to pay surrender charges if you withdraw your money before a certain period of time.

- Potential for low returns: Fixed annuities may offer lower returns than other investments, especially if interest rates are low.

The Role of Bankrate in Annuity Calculations

Bankrate’s annuity calculator is a valuable tool that can help you understand the potential payouts and costs of different annuity options. It allows you to input various factors, such as your age, investment amount, interest rate, and payment period, to get a personalized estimate of your annuity’s projected income stream.

How Bankrate’s Annuity Calculator Works

Bankrate’s annuity calculator is designed to be user-friendly and straightforward. It uses a series of inputs and calculations to determine the estimated payouts of an annuity based on the information you provide. The calculator takes into account factors such as the type of annuity, the interest rate, the payment period, and the amount of the initial investment.

Curious about the monthly income you can expect from an 80,000 annuity? Find out in our article on How Much Does A 80 000 Annuity Pay Per Month 2024 , where we explore the factors influencing annuity payouts.

Using the Bankrate Annuity Calculator

To use the Bankrate annuity calculator, simply follow these steps:

- Visit the Bankrate website and navigate to the annuity calculator section.

- Select the type of annuity you are interested in, such as a fixed annuity, a variable annuity, or an immediate annuity.

- Enter your age, the amount of your investment, and the interest rate you are expecting.

- Choose the payment period you desire, such as monthly, quarterly, or annually.

- Click on the “Calculate” button to generate your personalized results.

Key Inputs and Outputs

The Bankrate annuity calculator requires several key inputs, including:

- Age:Your current age, which is used to calculate the estimated duration of your annuity payments.

- Investment Amount:The initial lump sum of money you are planning to invest in the annuity.

- Interest Rate:The expected rate of return on your annuity investment. This can be a fixed rate or a variable rate, depending on the type of annuity you choose.

- Payment Period:The frequency of your annuity payments, such as monthly, quarterly, or annually.

The calculator then provides you with several key outputs, including:

- Projected Payout:The estimated amount of income you will receive from the annuity over the chosen payment period.

- Total Interest Earned:The estimated amount of interest you will earn on your investment over the life of the annuity.

- Present Value:The current value of the future stream of annuity payments.

Factors Influencing Annuity Calculations

Several factors can influence the calculations used to determine the payout of an annuity. These factors include interest rates, the time value of money, inflation, and taxes.

Interest Rates

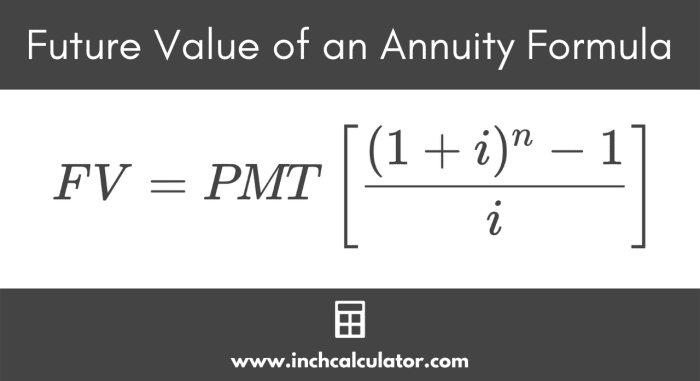

Interest rates play a crucial role in annuity calculations. The higher the interest rate, the greater the potential for your annuity to grow over time. This is because the interest earned on your investment is compounded, meaning that you earn interest on both your initial investment and the accumulated interest.

Are annuities considered qualified retirement plans? Explore the tax implications and eligibility criteria for annuities in our article on Is Annuity A Qualified Plan 2024.

For example, a higher interest rate on a fixed annuity will lead to larger payments over the life of the annuity.

Time Value of Money

The time value of money is a fundamental concept in finance that states that a dollar today is worth more than a dollar in the future. This is because money can be invested and earn interest over time. The time value of money is reflected in annuity calculations, as the future value of the annuity payments is discounted to their present value.

Annuity contracts offer a variety of features and benefits. Explore the different types and their characteristics in our article on Annuity Is 2024.

Inflation

Inflation is a measure of the rate at which the prices of goods and services increase over time. Inflation can erode the purchasing power of your annuity payments, meaning that you may not be able to buy as much with your payments in the future as you can today.

For example, if the inflation rate is 3%, the purchasing power of your annuity payments will decrease by 3% each year.

Seeking financial security in retirement? Annuities can provide guaranteed income payments. Learn more about the guarantees offered by annuities in our article on Is Annuity Guaranteed 2024.

Taxes

Taxes can also impact the growth of your annuity. The earnings on your annuity investment are typically tax-deferred, meaning that you won’t have to pay taxes on them until you begin receiving payments. However, once you start receiving payments, the payments are typically taxed as ordinary income.

Considering an annuity with a substantial sum of 400k? Explore the potential benefits and strategies for managing such an investment in our article on Annuity 400k 2024.

Choosing the Right Annuity

Selecting the right annuity depends on your individual circumstances, risk tolerance, and financial goals. There are various factors to consider when choosing an annuity, including the type of annuity, fees, surrender charges, and guarantees.

Comparing Annuity Types

The type of annuity you choose will depend on your risk tolerance and financial goals. If you are risk-averse, you may prefer a fixed annuity, which offers a guaranteed rate of return. However, if you are willing to take on more risk, you may consider a variable annuity, which has the potential for higher returns but also carries a higher level of risk.

Key Considerations

Here are some key considerations when choosing an annuity:

- Fees:Annuities can have high fees, which can eat into your returns. Be sure to compare the fees of different annuities before making a decision.

- Surrender Charges:Surrender charges are fees that you may have to pay if you withdraw your money from the annuity before a certain period of time. These charges can be substantial, so it’s important to understand them before you invest.

- Guarantees:Some annuities offer guarantees, such as a minimum rate of return or a death benefit. These guarantees can provide peace of mind, but they may also come with higher fees.

Real-World Examples

Here are some real-world examples of annuity scenarios:

- A retiree who wants a guaranteed income stream for life might purchase a fixed annuity. This type of annuity provides predictable payments, but the returns may be lower than other investments.

- An investor who is willing to take on more risk might choose a variable annuity. This type of annuity has the potential for higher returns, but it also carries a higher level of risk.

- A person who is saving for a long-term goal, such as a child’s education, might purchase a deferred annuity. This type of annuity allows you to defer payments until a later date, which can be helpful if you need to access your money before retirement.

An annuity provides a regular stream of income, often for a set period or for life. Learn more about this financial instrument and its key features in our article on An Annuity Is A Stream Of 2024.

Annuity Calculations in 2024: Annuity Calculator Bankrate 2024

The current market conditions and the latest trends in annuity rates and investment strategies are important considerations when evaluating annuity calculations in 2024. Interest rates, inflation, and economic growth are all factors that can influence annuity payouts.

Market Conditions and Their Impact

In 2024, the market is expected to face continued volatility due to factors such as inflation, geopolitical uncertainty, and central bank policies. These factors can impact interest rates, which in turn affect annuity payouts. Higher interest rates generally lead to higher annuity payouts, while lower interest rates can result in lower payouts.

Choosing between an annuity and a 401k can be a tough decision. Our article on Annuity Vs 401k 2024 helps you understand the pros and cons of each option to make an informed choice.

Trends in Annuity Rates and Investment Strategies

Annuity rates have been fluctuating in recent years, influenced by factors such as interest rate changes and market performance. In 2024, some trends to watch include:

- Rising interest rates:As interest rates rise, annuity rates may also increase, potentially offering higher payouts to investors.

- Increased demand for guaranteed income:With market volatility, investors may be seeking more guaranteed income streams, which could lead to increased demand for annuities.

- Innovation in annuity products:The annuity market is constantly evolving, with new products and features being introduced. This innovation could offer investors more options and potentially better returns.

Future Outlook for Annuities

The future outlook for annuities in 2024 and beyond is uncertain, as it is influenced by a range of economic and market factors. However, annuities are likely to continue to play a role in retirement planning, particularly for individuals seeking guaranteed income streams and protection from market risk.

Considering an annuity with a lump sum of 30k? Learn about the potential benefits and drawbacks of such an investment in our article on Annuity 30k 2024.

As the market evolves, it’s essential to stay informed about the latest trends and developments in the annuity market to make informed investment decisions.

Annuity home loans are becoming increasingly popular in 2024, offering a way to secure your dream home with predictable monthly payments. To learn more about this financing option, check out our guide on Annuity Home Loan 2024.

Outcome Summary

As you navigate the complexities of retirement planning, using the Annuity Calculator Bankrate 2024 can empower you to make confident choices. By exploring different scenarios, understanding the impact of various factors, and considering your risk tolerance and financial goals, you can create a personalized retirement income plan that aligns with your aspirations.

Remember, seeking professional financial advice is crucial in making informed decisions about your retirement savings.

FAQ Compilation

Is the Bankrate Annuity Calculator free to use?

Yes, the Bankrate Annuity Calculator is available for free use on their website.

What types of annuities can I explore with the calculator?

The Bankrate calculator allows you to compare and contrast different annuity types, including fixed, variable, immediate, and deferred annuities.

How accurate are the results provided by the calculator?

The calculator provides estimates based on the information you input. However, it’s important to remember that actual annuity payouts may vary depending on market conditions and other factors.

Can I use the calculator to compare different annuity providers?

The Bankrate calculator is designed to help you understand annuity concepts and explore different scenarios. For specific comparisons between annuity providers, you may need to consult with a financial advisor.