Calculating Annuity Ba Ii Plus 2024 unlocks the power of financial planning with the help of a trusty calculator. Whether you’re saving for retirement, planning a loan, or analyzing investments, understanding annuities is crucial. This guide will walk you through the essential concepts, functions, and applications of annuity calculations using the popular BA II Plus calculator.

Annuities can be a complex financial product, but they can also be a valuable tool for retirement planning. Annuity 9 Letters 2024 can help you get a better understanding of the basics of annuities.

From defining annuities and their types to exploring the key variables involved, we’ll demystify the process of calculating present and future values, and even delve into determining the ideal payment amounts. We’ll also showcase real-world examples to illustrate the practical implications of these calculations in various financial scenarios.

Contents List

Introduction to Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used in financial planning, retirement savings, and loan repayment. They are a powerful tool for managing money over time. There are different types of annuities, each with its own characteristics and applications.

Types of Annuities, Calculating Annuity Ba Ii Plus 2024

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Perpetuity:Payments continue indefinitely.

Present Value and Future Value of an Annuity

The present value (PV) of an annuity is the current value of a series of future payments, discounted to reflect the time value of money. The future value (FV) of an annuity is the accumulated value of a series of payments at a future point in time, considering interest earned over the period.

One of the biggest questions people have about annuities is whether or not they are taxable. Is Immediate Annuity Income Taxable 2024 ? Understanding the tax implications of annuities is crucial for proper financial planning.

Factors Affecting Annuity Calculations

Several factors influence annuity calculations, including:

- Interest Rate (I/Y):The rate at which the annuity grows or declines in value.

- Time Period (N):The length of time over which the annuity payments are made.

- Payment Amount (PMT):The amount of each payment.

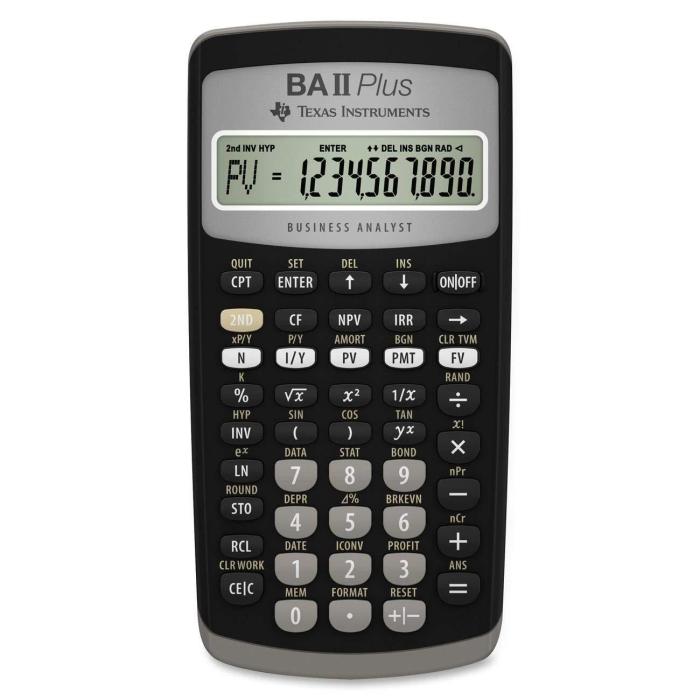

The BA II Plus Calculator

The BA II Plus calculator is a popular financial calculator designed for a wide range of financial calculations, including annuities. It offers a user-friendly interface and comprehensive functionality for handling annuity calculations.

Annuities are a financial product that can be used to provide a steady stream of income during retirement. Annuity Is The Value Of 2024 is a key factor to consider when making investment decisions.

Features and Functions

The BA II Plus calculator features dedicated keys for annuity calculations, such as PV (present value), FV (future value), PMT (payment), and N (number of periods). It also supports various interest rate and time period settings.

If you’re inheriting an annuity, it’s important to understand how it will be taxed. How Is Inherited Annuity Taxed 2024 can help you navigate the tax implications of inheriting an annuity.

Setting Up the Calculator

To set up the BA II Plus calculator for annuity calculations, follow these steps:

- Ensure the calculator is in the “END” mode for ordinary annuities or “BGN” mode for annuities due.

- Input the interest rate (I/Y) as a percentage.

- Input the number of periods (N).

- Input the payment amount (PMT).

- Input the present value (PV) or future value (FV), depending on the calculation type.

Key Input Variables

The following variables are crucial for annuity calculations:

- N:Number of periods (e.g., months, years).

- I/Y:Interest rate per period.

- PV:Present value of the annuity.

- PMT:Payment amount per period.

- FV:Future value of the annuity.

These variables are interconnected, and changing one variable can affect the others.

Calculating Present Value of an Annuity

The present value of an ordinary annuity is calculated using the following formula:

PV = PMT

When you’re considering annuities, it’s important to be aware of the tax implications. Is Annuity Payments Taxable 2024 ? The answer can depend on the type of annuity and how it’s structured.

- [1

- (1 + i)^-n] / i

Where:

- PV = Present value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

Examples

To calculate the present value of an annuity with a payment of $1,000 per year for 10 years at an interest rate of 5%, you would input the following values into the BA II Plus calculator:

- N = 10

- I/Y = 5

- PMT = 1000

- FV = 0

Pressing the “PV” key would display the present value of the annuity.

Implications of Interest Rates and Time Periods

A higher interest rate or a longer time period generally results in a lower present value. This is because the future payments are discounted at a higher rate or over a longer period.

Calculating Future Value of an Annuity

The future value of an ordinary annuity is calculated using the following formula:

FV = PMT

When you’re considering annuities, it’s important to understand who is providing them. Annuity Is Given By 2024 can vary, and it’s essential to research the provider’s reputation and financial stability.

- [(1 + i)^n

- 1] / i

Where:

- FV = Future value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

Examples

To calculate the future value of an annuity with a payment of $1,000 per year for 10 years at an interest rate of 5%, you would input the following values into the BA II Plus calculator:

- N = 10

- I/Y = 5

- PMT = 1000

- PV = 0

Pressing the “FV” key would display the future value of the annuity.

To get a better grasp on how annuities work, it’s helpful to understand the underlying math. Annuity Equation 2024 can help you see how the different variables interact to determine the payout amount.

Impact of Compounding Interest

Compounding interest plays a significant role in determining the future value of an annuity. As interest is earned on both the principal and accumulated interest, the future value grows exponentially over time.

Deciding between an annuity and a lump sum can be a difficult choice. Annuity Or Lump Sum 2024 can help you weigh the pros and cons of each option and make the best decision for your situation.

Calculating Annuity Payments: Calculating Annuity Ba Ii Plus 2024

The payment amount of an annuity can be calculated using the following formula:

PMT = PV

- i / [1

- (1 + i)^-n]

Where:

- PMT = Payment amount

- PV = Present value

- i = Interest rate per period

- n = Number of periods

Examples

To calculate the payment amount of an annuity with a present value of $10,000, an interest rate of 5%, and a term of 10 years, you would input the following values into the BA II Plus calculator:

- N = 10

- I/Y = 5

- PV = 10000

- FV = 0

Pressing the “PMT” key would display the payment amount.

Many people are interested in learning more about annuities, especially those with a specific amount in mind. Annuity 50k 2024 can help you see what kind of monthly payments you might receive with a $50,000 investment.

Relationship Between Payment Amount, Interest Rate, and Time Period

The payment amount is directly proportional to the present value and interest rate. A higher present value or interest rate will result in a higher payment amount. The payment amount is inversely proportional to the time period. A longer time period will result in a lower payment amount.

Understanding the formula behind annuities can be helpful for making informed decisions. Annuity Formula Is 2024 can help you calculate the present value of a future stream of payments.

Applications of Annuity Calculations

Annuity calculations have numerous applications in finance, including:

Retirement Planning

Annuity calculations are essential for retirement planning, helping individuals determine the amount of savings needed to generate a desired retirement income.

Loan Amortization

Annuity calculations are used to calculate the monthly payments on loans, such as mortgages and auto loans.

Annuities are often seen as a reliable source of income during retirement. However, it’s important to understand that Annuity Is Perpetual 2024. This means that they have a finite lifespan and will eventually run out.

Investment Analysis

Annuity calculations are used to analyze the returns on investments, such as bonds and stocks.

If you’re looking for a specific type of annuity, you might be interested in finding out more about Annuity Health Westmont Il 2024. This can help you learn about the specific features and benefits of this type of annuity.

Significance in Financial Decision-Making

Annuity calculations provide valuable insights into the time value of money, helping individuals make informed financial decisions regarding savings, investments, and borrowing.

Last Point

By mastering annuity calculations with the BA II Plus, you gain the tools to confidently make informed financial decisions. Whether you’re a seasoned investor or just starting your financial journey, understanding annuities empowers you to plan for the future, manage debt effectively, and optimize your financial well-being.

Expert Answers

How do I reset the BA II Plus calculator for annuity calculations?

Let’s say Kathy is considering an annuity. Kathy’s Annuity Is Currently Experiencing 2024. It’s important for her to understand the factors that might influence the performance of her annuity.

To reset the calculator, press the [2nd] key followed by the [CLR TVM] key. This will clear all the stored values for the TVM variables (N, I/Y, PV, PMT, FV).

What are the different modes on the BA II Plus for annuity calculations?

The BA II Plus has two modes for annuity calculations: END mode (for ordinary annuities) and BEGIN mode (for annuities due). You can switch between these modes by pressing the [2nd] key followed by the [BGN] key.

One common question people have is whether or not annuities are taxable. In India, the answer is yes, Is Annuity Taxable In India 2024 ? You’ll want to be aware of the tax implications of annuities before you invest.

Can I use the BA II Plus calculator for other financial calculations besides annuities?

Yes, the BA II Plus calculator is a versatile tool that can handle various financial calculations, including bond pricing, amortization schedules, and depreciation calculations.

If you’re looking to get a better understanding of how annuities work, you can start by using an Annuity Estimator 2024 to see what kind of payouts you might receive. This can help you make informed decisions about your retirement planning.