Calculate Annuity Bond 2024: This comprehensive guide explores the intricate world of annuity bonds, delving into their mechanics, investment strategies, and the factors that influence their value in the current market. Prepare to gain valuable insights into this unique investment instrument and discover how to make informed decisions for your financial future.

Annuity funds are a popular way to save for retirement, offering tax-deferred growth and guaranteed income payments. Annuity Fund Is 2024 explains the benefits and drawbacks of annuity funds, helping you decide if they’re right for you.

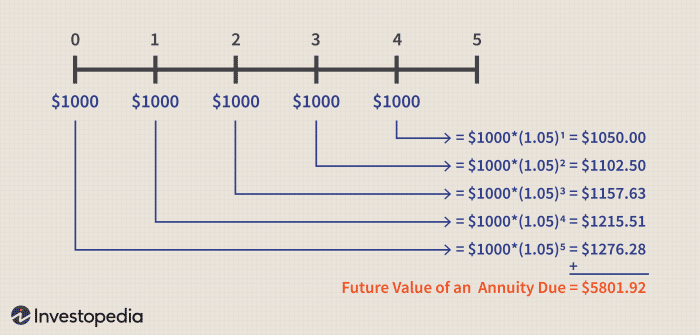

Annuity bonds are a type of fixed-income security that offers a stream of regular payments over a specified period. They are often seen as a valuable tool for retirement planning and income generation, offering a predictable stream of income that can help to supplement other retirement savings.

When purchasing an annuity, it’s essential to have a “free look” period to review the contract. Annuity 30 Day Free Look 2024 explains the free look period and your rights as a policyholder.

However, understanding the nuances of annuity bonds, including their calculation, valuation, and investment strategies, is crucial for maximizing their potential benefits.

Understanding the tax implications of annuity payments is crucial. Is Annuity Earned Income 2024 discusses the tax treatment of annuities and can help you plan for your tax obligations.

Closure: Calculate Annuity Bond 2024

As you embark on your journey into the world of annuity bonds, remember that careful analysis and informed decision-making are essential for success. By understanding the factors that influence their value, the various investment strategies available, and the current market conditions, you can position yourself to make the most of these unique financial instruments.

Determining how much annuity you need can be a complex calculation. How Much Annuity For 40 000 2024 can help you understand the factors that affect your annuity needs, such as your age, lifestyle, and desired income level.

Whether you’re seeking a steady stream of income during retirement or aiming to diversify your investment portfolio, annuity bonds can play a significant role in achieving your financial goals.

John Hancock is a well-known provider of annuities. Annuity John Hancock 2024 offers information about John Hancock’s annuity products and services, helping you compare them to other options.

FAQ Overview

What are the tax implications of annuity bond investments?

If you’re considering an annuity, you’ll want to research the different types and providers available. Annuity $400 000 2024 can help you understand the factors to consider when choosing an annuity, including the amount of payout and the duration of the payments.

The tax treatment of annuity bond investments varies depending on the specific type of annuity bond and your jurisdiction. It’s essential to consult with a qualified tax advisor to understand the tax implications of your specific investment.

How do I choose the right annuity bond for my needs?

The best annuity bond for you will depend on your individual circumstances, including your risk tolerance, investment goals, and time horizon. It’s recommended to seek advice from a financial advisor to determine the most suitable option for your needs.

Annuity payments can be a valuable source of income in retirement, but it’s important to understand the different types of annuities available. Annuity Is Given By 2024 provides a helpful overview of the basics of annuities, including how they work and the various options you may have.

Are annuity bonds suitable for everyone?

Annuity bonds may not be suitable for everyone. They can be complex investments with certain risks, and it’s crucial to understand these risks before making any investment decisions. Consulting with a financial advisor can help you determine if annuity bonds are a suitable investment for your individual situation.

Using Excel to calculate annuity payments can be helpful. Annuity Is Excel 2024 provides tips and resources for using Excel to model and analyze annuity scenarios.

Annuities have a variety of uses, from retirement income to long-term care planning. Annuity Is Used In 2024 explores the diverse ways annuities can be used to meet your financial goals.

Choosing the right annuity can be overwhelming, with numerous options available. 9 Annuity 2024 highlights some of the key factors to consider when selecting an annuity.

Understanding the tax implications of annuities is essential. Annuity Is Qualified 2024 provides insight into qualified annuities and their tax benefits.

Annuities can provide a guaranteed income stream for life, but the duration of payments can vary. Annuity Is Indefinite Duration 2024 explains the different types of annuity durations and how they affect your payments.

Annuities offer a steady stream of income, which can be a valuable asset in retirement. Is Annuity Stream 2024 discusses the benefits and drawbacks of annuity income streams.

Annuities and pensions are both retirement income sources, but they have key differences. Is Annuity Same As Pension 2024 compares and contrasts annuities and pensions, helping you understand their distinctions.

Annuities can be viewed as the opposite of investments. An Annuity Is Sometimes Called The Flip Side Of 2024 explains this concept and highlights the key differences between annuities and investments.