Annuity Calculator Compounded Monthly 2024 offers a powerful tool for understanding how your savings can grow over time. It allows you to explore the potential of annuities, which are financial products that provide a steady stream of income, often used for retirement planning.

Annuity payments can be a valuable source of income for individuals over 85 years old. Find out more about annuities for seniors here: Annuity 85 Years Old 2024.

This calculator takes into account the impact of compound interest, a key factor in maximizing your returns, and specifically focuses on the benefits of monthly compounding, which can significantly accelerate your financial growth.

There are various methods for calculating annuity payments. To explore different annuity calculation methods, check out this article: Annuity Method 2024.

By utilizing an annuity calculator, you can gain valuable insights into the future value of your investments, making informed decisions about your financial goals. This calculator is particularly useful for individuals looking to secure their financial future, especially those seeking to create a reliable income stream for retirement or other long-term financial objectives.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. Annuities are often used for retirement planning, as they can provide a guaranteed income stream for life. There are several different types of annuities, each with its own unique features and benefits.

Types of Annuities

- Fixed Annuities:These annuities offer a guaranteed interest rate and payment amount. They are considered low-risk and provide predictable income.

- Variable Annuities:These annuities invest in a portfolio of stocks, bonds, or other assets. The interest rate and payment amount can fluctuate based on the performance of the underlying investments.

- Immediate Annuities:These annuities begin making payments immediately after the purchase. They are often used for retirement income or to supplement existing income.

- Deferred Annuities:These annuities begin making payments at a later date, typically after a specified period of time. They are often used for retirement planning or to save for a future expense.

Using Annuities for Retirement Income

Annuities can be a valuable tool for generating income in retirement. They can provide a reliable source of income, regardless of market fluctuations. For example, an individual can purchase an immediate annuity with a lump sum of money, which will then provide them with a guaranteed monthly income for life.

An annuity is a life insurance product that provides a stream of guaranteed income payments. Learn more about how annuities work as life insurance products here: An Annuity Is A Life Insurance Product That 2024.

Alternatively, they can purchase a deferred annuity, which will grow over time and provide them with a larger income stream in retirement.

The taxability of annuity payments can be complex. You can learn more about whether annuities are taxable or not in this article: Annuity Is Taxable Or Not 2024.

Monthly Compounding

Compound interest is the interest earned on both the principal amount and the accumulated interest. This means that your money grows exponentially over time. When interest is compounded monthly, it is calculated and added to the principal balance 12 times a year.

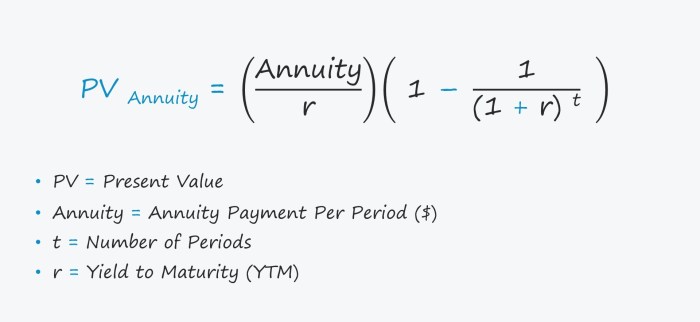

Calculating the present value of an annuity is an important step in understanding the true value of the investment. You can find a detailed guide on calculating annuity present value here: Calculating A Annuity 2024.

This results in more frequent compounding and greater overall growth compared to less frequent compounding periods.

If you’re considering an annuity that pays out $1 million in 2024, you’ll need to factor in the tax implications. It’s important to understand how annuities are taxed, which can vary depending on the type of annuity. For a comprehensive guide on annuity taxation, check out this resource: How Annuity Is Taxed 2024.

Benefits of Monthly Compounding

- Higher Returns:Monthly compounding allows interest to be earned on interest more frequently, resulting in significantly higher returns over the long term.

- Increased Future Value:The more frequently interest is compounded, the higher the future value of an investment will be. This is especially beneficial for long-term investments like annuities.

- Time Value of Money:Compounding allows you to take advantage of the time value of money, which states that money today is worth more than the same amount of money in the future due to its potential to earn interest.

Demonstrating the Power of Monthly Compounding

Imagine investing $10,000 in an annuity that earns a 5% annual interest rate. If interest is compounded annually, your investment will grow to $16,386 after 10 years. However, if interest is compounded monthly, your investment will grow to $16,470 after 10 years.

An annuity is a financial product that provides a stream of regular payments. To understand the basics of annuities, explore this definition: Annuity Is Definition 2024.

This difference may seem small, but it highlights the power of monthly compounding over the long term.

An annuity contract is a legal document that outlines the terms of the annuity. To learn more about annuity contracts, visit this article: Annuity Contract Is 2024.

Annuity Calculator Functionality: Annuity Calculator Compounded Monthly 2024

An annuity calculator is a tool that helps you determine the future value of an annuity based on specific inputs. These calculators are essential for understanding the potential growth of an annuity and making informed financial decisions.

Key Inputs and Outputs

- Principal Amount:The initial amount of money invested in the annuity.

- Interest Rate:The annual interest rate earned on the annuity.

- Time Horizon:The length of time the annuity will grow.

- Compounding Frequency:The number of times interest is compounded per year.

- Future Value:The estimated value of the annuity at the end of the specified time horizon.

Using an Annuity Calculator

To use an annuity calculator, simply input the required information, such as the principal amount, interest rate, time horizon, and compounding frequency. The calculator will then calculate the estimated future value of the annuity.

Comparing Annuity Options

Annuity calculators can also be used to compare different annuity options. For example, you can use a calculator to compare the future value of an annuity with monthly compounding to an annuity with annual compounding. This can help you identify the option that is most likely to meet your financial goals.

Annuity M is a type of annuity that offers a fixed payment amount. For more information on Annuity M, visit this link: Annuity M 2024.

Factors Affecting Annuity Growth

Several factors can influence the growth of an annuity, including interest rates, investment returns, and the time horizon. It is essential to consider these factors when making annuity decisions.

Key Factors Influencing Annuity Growth

- Interest Rates:Higher interest rates generally result in faster annuity growth. However, interest rates can fluctuate, so it is important to consider potential interest rate changes.

- Investment Returns:For variable annuities, investment returns can significantly impact the growth of the annuity. It is essential to choose investments that align with your risk tolerance and financial goals.

- Time Horizon:The longer the time horizon, the more time the annuity has to grow. This is because of the power of compounding, where interest is earned on both the principal and accumulated interest.

Impact of Inflation

Inflation can erode the purchasing power of annuity payments over time. This means that the same amount of money will buy less goods and services in the future. It is essential to consider the impact of inflation when planning for retirement.

There are various types of annuities available, and understanding the differences is essential. For a breakdown of three common annuity types, visit this article: 3 Annuity 2024.

Adjusting for Inflation

To adjust annuity calculations for inflation, you can use an inflation-adjusted interest rate. This rate takes into account the expected rate of inflation. For example, if the nominal interest rate is 5% and the inflation rate is 2%, the inflation-adjusted interest rate would be 3%.

Annuity Calculator Usage Scenarios

Annuity calculators are widely used by individuals and financial advisors to assess the suitability of annuities for different financial goals. They provide valuable insights into the potential growth of annuities and help make informed financial decisions.

Real-World Examples

- Retirement Planning:Individuals can use annuity calculators to determine how much they need to save for retirement and how much income an annuity can provide.

- College Savings:Parents can use annuity calculators to estimate how much they need to save for their children’s college education.

- Long-Term Care:Individuals can use annuity calculators to determine how much they need to save for potential long-term care expenses.

Annuity Scenarios

| Scenario | Contribution Amount | Interest Rate | Time Horizon | Future Value |

|---|---|---|---|---|

| Scenario 1 | $10,000 | 5% | 10 years | $16,470 |

| Scenario 2 | $20,000 | 6% | 20 years | $63,862 |

| Scenario 3 | $50,000 | 7% | 30 years | $339,460 |

Assessing Suitability, Annuity Calculator Compounded Monthly 2024

Annuity calculators can be used to assess the suitability of an annuity for different financial goals. For example, if you are saving for retirement, you can use a calculator to determine how much income an annuity can provide based on your expected savings and interest rates.

If you’re looking for an annuity that provides $1,000 per month, you’ll need to consider your financial goals and the types of annuities available. To explore annuities that offer monthly payments, check out this article: Annuity 1000 Per Month 2024.

Annuity Calculator Resources

There are numerous reputable online annuity calculators available to the public. These calculators provide a convenient and accessible way to estimate the future value of an annuity.

Understanding the present value of an annuity is crucial for making informed financial decisions. For a guide on calculating annuity present value, visit this link: Calculating Annuity Present Value 2024.

Reputable Online Annuity Calculators

- Bankrate:Bankrate offers a comprehensive annuity calculator that allows you to compare different annuity options and adjust for inflation.

- NerdWallet:NerdWallet provides a user-friendly annuity calculator that helps you estimate the future value of an annuity based on your specific needs.

- Investopedia:Investopedia offers a simple and straightforward annuity calculator that allows you to calculate the future value of an annuity with different compounding frequencies.

Advantages and Disadvantages

- Advantages:Online annuity calculators are typically free to use, easy to access, and provide instant results.

- Disadvantages:Some online annuity calculators may have limited features or may not be as accurate as professional financial planning tools.

Choosing the Right Calculator

When choosing an annuity calculator, consider your individual needs and financial goals. Look for a calculator that offers the features you require, such as inflation adjustment, compounding frequency options, and the ability to compare different annuity options. It is also important to choose a calculator from a reputable source, such as a financial website or a financial institution.

Annuity payments received from LIC can be taxable, depending on the type of annuity and the terms of the policy. You can find out more about the tax implications of annuity payments from LIC by checking out this article: Is Annuity Received From Lic Taxable 2024.

Final Review

Annuity calculators provide a valuable tool for understanding the potential growth of your savings through annuities. By exploring different scenarios and considering the impact of factors like interest rates and time horizons, you can gain a clearer picture of how your financial future might unfold.

Whether you are just starting to save or are nearing retirement, utilizing an annuity calculator can help you make informed decisions and achieve your financial goals with confidence.

General Inquiries

What is the difference between a fixed and a variable annuity?

When you purchase an annuity, the life expectancy of the annuitant is a crucial factor in determining the payout amount. Learn more about how life expectancy plays a role in annuity contracts here: When Annuity Is Written Whose Life Expectancy 2024.

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How does inflation affect the purchasing power of annuity payments?

Inflation erodes the purchasing power of money over time, meaning that your annuity payments may buy less in the future than they do today. Some annuities offer inflation protection to help mitigate this risk.

Are there any tax implications for annuities?

Yes, annuity payments are typically taxed as ordinary income. However, there are some tax-advantaged annuities available, such as Roth IRAs.

What are some reputable online annuity calculators?

Several reputable online annuity calculators are available, including those offered by financial institutions, investment companies, and independent financial websites.