Annuity Calculator By Age 2024 is a powerful tool for individuals seeking to plan for a comfortable and secure retirement. Annuities offer a guaranteed stream of income throughout your golden years, and an annuity calculator can help you understand how much you need to save and how your investments can grow over time.

Annuity contracts are issued by insurance companies. To help you understand the process, we’ve compiled information about the different types of annuity issuers and the factors to consider when choosing one. Find more details about Annuity Issuer 2024 to make an informed decision.

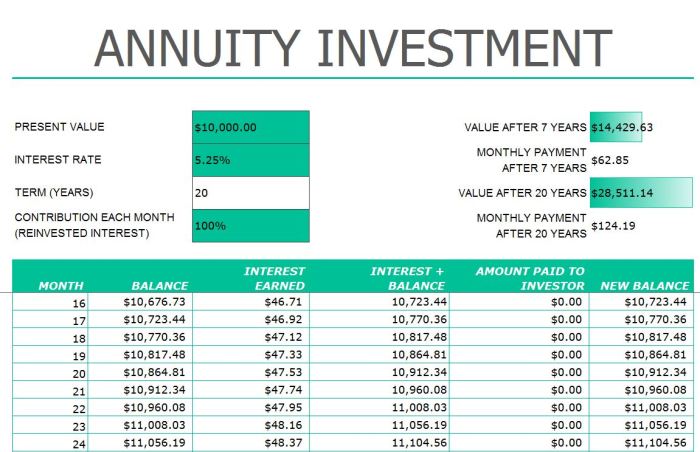

Understanding the concept of annuities and how they work is crucial for making informed financial decisions. An annuity calculator takes into account factors like your age, desired income, investment amount, and interest rates to provide personalized estimates of your future retirement income.

Annuity contracts are often considered a form of fixed income, providing a predictable stream of payments. However, it’s important to understand the nuances of how annuities work and their potential risks. To gain a better understanding of the relationship between annuities and fixed income, visit Is Annuity Fixed Income 2024.

This allows you to assess your financial needs, make adjustments to your savings strategy, and set realistic goals for your retirement years.

If you’re considering an annuity, it’s wise to explore different options and compare rates. For those in the Sarasota area, you can find information about local annuity providers at Annuity King Sarasota 2024 , which provides a comprehensive overview of the annuity market in Sarasota.

Contents List

Annuity Calculators By Age 2024

Annuities are financial instruments that provide a stream of regular payments over a specified period, often used for retirement income. Annuity calculators are essential tools that help individuals estimate potential payouts, understand the impact of different variables, and make informed decisions about their retirement planning.

Annuity contracts can offer a secure stream of income during retirement, providing peace of mind and financial stability. But it’s important to understand the potential benefits and drawbacks before making a decision. Learn more about the advantages of annuities at Annuity Is Good 2024.

Age plays a crucial role in annuity planning, as it directly influences the duration of payments and the overall payout amount. Starting early with retirement planning is vital to maximize the benefits of annuities and ensure financial security in later years.

For many people, the term “annuity” brings to mind the concept of a pension. While there are similarities, it’s important to understand the distinctions. An annuity is a financial product that provides a stream of income, but it’s not necessarily tied to a specific employer or pension plan.

Learn more about the relationship between annuities and pensions at Annuity Is Pension 2024.

Understanding Annuity Calculators

Annuity calculators are designed to simplify the process of estimating annuity payouts based on various factors. They are available in different types, each tailored to specific annuity options.

While annuities can provide financial security, it’s important to consider the potential downsides as well. For instance, annuities often come with fees and limitations that can impact your returns. Explore the potential drawbacks of annuities in more detail at Annuity Is Bad 2024.

- Fixed annuitiesprovide guaranteed payments for a set period, offering predictable income streams.

- Variable annuitiesoffer payments that fluctuate based on the performance of underlying investments, potentially leading to higher returns but also carrying greater risk.

- Immediate annuitiesbegin payments immediately upon purchase, providing instant income.

- Deferred annuitiesstart payments at a future date, allowing individuals to accumulate funds over time before receiving income.

Annuity calculations typically require key inputs, including:

- Age:Determines the length of the annuity period.

- Desired income:Specifies the amount of regular payments the individual wants to receive.

- Investment amount:Represents the initial capital invested in the annuity.

- Interest rate:Influences the growth potential of the annuity.

Annuity calculators provide outputs that offer valuable insights into the potential outcomes of annuity investments. These outputs typically include:

- Estimated monthly payments:A projection of the regular income stream the individual can expect.

- Total payout:The estimated total amount of money received over the annuity period.

- Growth potential:An indication of how the annuity investment might grow over time.

Factors Influencing Annuity Calculations

Several factors influence annuity calculations, impacting the estimated payouts and growth potential.

Annuity contracts can be quite complex, and it’s essential to understand how they work before investing. To help you navigate this, we’ve compiled information about the different types of annuities available, including variable annuities and how they differ from traditional retirement plans like 401(k)s.

- Age:As individuals get older, the duration of annuity payments decreases, leading to lower overall payouts. Conversely, younger individuals benefit from longer annuity periods and potentially higher total payouts.

- Interest rates:Higher interest rates generally result in larger annuity payouts, as the invested capital grows more rapidly. Conversely, lower interest rates can lead to smaller payouts.

- Inflation:The rate of inflation erodes the purchasing power of money over time. Annuities may include adjustments for inflation, but it’s crucial to consider its impact on the real value of future payments.

- Investment choices:The type of annuity and the underlying investments chosen can significantly influence the growth potential and risk associated with the annuity. Variable annuities, for example, offer the potential for higher returns but also carry greater risk.

Benefits of Using an Annuity Calculator By Age 2024

Annuity calculators offer numerous benefits for individuals planning for retirement.

When shopping for an annuity, it’s crucial to compare quotes from different providers. For those in Canada, we recommend checking out Annuity Quotes Canada 2024 , a valuable resource for finding the best annuity rates and terms available in Canada.

- Retirement planning:Annuity calculators help individuals assess their financial needs for retirement and determine if annuities are suitable for their goals.

- Financial needs assessment:By inputting their desired income, age, and other relevant factors, individuals can estimate the annuity investment required to meet their retirement income goals.

- Informed decision-making:Annuity calculators provide insights into different annuity options, allowing individuals to compare potential payouts and choose the best fit for their circumstances.

- Realistic financial goals:By understanding the potential payouts and growth potential of annuities, individuals can set realistic financial goals for retirement and make informed decisions about their investments.

Tips for Using an Annuity Calculator Effectively

To maximize the benefits of annuity calculators, individuals should follow these tips:

- Select the right calculator:Choose an annuity calculator that aligns with the specific type of annuity being considered (fixed, variable, immediate, deferred).

- Gather accurate input data:Ensure that the age, desired income, investment amount, and other input data are accurate and reflect the individual’s financial situation.

- Interpret the results:Carefully review the outputs provided by the annuity calculator, including estimated payments, total payouts, and growth potential.

- Adjust inputs based on changing circumstances:As financial goals, income, or other factors change, individuals should update the input data in the annuity calculator to ensure the calculations remain accurate.

Case Studies: Real-Life Examples

| Age Group | Annuity Needs | Example |

|---|---|---|

| 30-40 | Early retirement planning, supplemental income | A 35-year-old individual uses an annuity calculator to estimate the monthly payments they could receive from an immediate annuity if they invest $100,000. This helps them assess if an annuity can provide additional income for early retirement. |

| 40-50 | Retirement income planning, long-term financial security | A 45-year-old individual uses an annuity calculator to determine the investment amount required to generate a specific monthly income in retirement. This helps them plan for their retirement income needs and adjust their investment strategies accordingly. |

| 50-60 | Guaranteed income, estate planning | A 55-year-old individual uses an annuity calculator to compare different annuity options, including fixed and variable annuities. This helps them choose an annuity that aligns with their risk tolerance and income needs. |

Last Point

By utilizing an annuity calculator, you can gain valuable insights into your retirement planning. It empowers you to make informed decisions about your financial future and ensures that you are on the right track to achieving your desired lifestyle during retirement.

When planning for retirement, it’s crucial to weigh the pros and cons of different investment options. Deciding between an annuity and a 401(k) depends on your individual financial goals and risk tolerance. To help you make an informed decision, we’ve put together a comprehensive guide comparing these two options, available at Annuity Vs 401k 2024.

Remember to consider your individual circumstances and consult with a financial advisor for personalized guidance. With proper planning and the right tools, you can confidently embrace your retirement years.

General Inquiries: Annuity Calculator By Age 2024

What are the different types of annuities?

Annuities come in various forms, including fixed annuities, variable annuities, immediate annuities, and deferred annuities. Each type offers different features and benefits, so it’s essential to understand the distinctions before making a choice.

How often should I use an annuity calculator?

It’s recommended to use an annuity calculator regularly, especially when your financial circumstances change. This includes major life events like marriage, birth of a child, job changes, or changes in investment strategies.

Is it possible to adjust my annuity plan later?

Yes, most annuity contracts allow for adjustments to your plan. However, there may be limitations or fees associated with changes, so it’s crucial to review the terms and conditions carefully.

Deciding whether an annuity is a good idea for your retirement planning requires careful consideration. It’s crucial to weigh the potential benefits against the potential drawbacks, taking into account your individual financial situation and goals. Explore the pros and cons of annuities in more detail at Annuity Is It A Good Idea 2024.

Annuity contracts are designed to provide a stream of income, making them a potential source of retirement income. However, it’s important to understand the nuances of how annuities work and their potential risks. For more information about how annuities can provide income, visit Is Annuity Income 2024.

Annuity rates can vary significantly depending on factors like your age, health, and the type of annuity you choose. For those in the UK, we recommend checking out Annuity Rates Uk 2024 , which provides an overview of current annuity rates and how they compare across different providers.

While annuity rates can fluctuate, it’s not uncommon to find contracts offering guaranteed returns, such as those with an 8% annual payout. For more information about annuities with high returns, visit Annuity 8 Percent 2024.

Annuity contracts are often confused with life insurance, but they are distinct financial products. While both can provide financial protection, they operate differently. Learn more about the differences between annuities and life insurance at Is Annuity Life Insurance 2024.

When comparing annuities to traditional retirement plans like 401(k)s, it’s essential to understand the advantages and disadvantages of each. While both can help you save for retirement, they have different features and risks. To help you decide which option is best for you, explore the comparison between annuities and 401(k)s at Is Annuity Better Than 401k 2024.