Annuity Calculator BMO 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This comprehensive guide delves into the world of BMO annuities, providing valuable insights into their diverse offerings, the powerful Annuity Calculator, and crucial factors to consider when making informed decisions about your retirement planning.

There are different methods used to calculate annuity payments. Understanding the Annuity Method 2024 used for your specific annuity can help you understand how your payments are determined and how much you can expect to receive.

Whether you’re seeking guaranteed income streams, exploring investment options, or simply seeking a better understanding of annuity intricacies, this exploration of BMO’s offerings will equip you with the knowledge you need to navigate the complex world of retirement planning.

Excel can be a helpful tool for managing your finances, including calculating annuity payments. Learn how to Calculating Annuity Payments In Excel 2024 to streamline your calculations and make informed decisions.

Contents List

BMO Annuity Products

BMO offers a variety of annuity products designed to help you secure your financial future. These products provide guaranteed income streams in retirement, offering peace of mind and financial stability. BMO annuities come in different forms, each with unique features and benefits, catering to various financial goals and risk tolerances.

Annuity payments are typically calculated based on a set formula. Understanding how Annuity Is Given By 2024 can help you understand the factors that determine your payment amount.

Types of BMO Annuities

BMO offers three primary types of annuities: fixed, variable, and indexed annuities. Each type has distinct characteristics that make them suitable for different financial situations and investment objectives.

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return on your investment, ensuring a predictable income stream. These annuities are ideal for those seeking stability and security, as the principal is protected from market fluctuations.

- Variable Annuities:Variable annuities allow you to invest in a variety of sub-accounts, such as mutual funds, ETFs, and fixed income securities. The returns on your investment are not guaranteed and fluctuate based on market performance. These annuities are suitable for those with a higher risk tolerance and a longer time horizon.

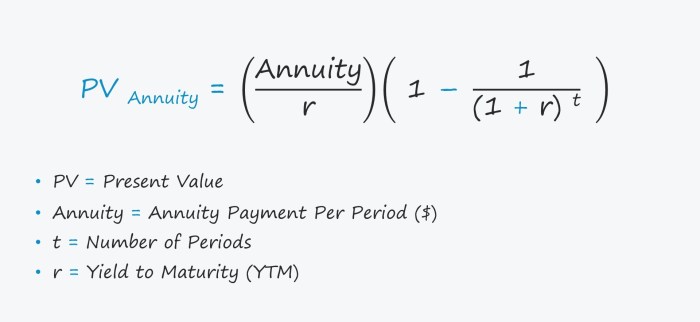

Before committing to an annuity, it’s helpful to understand its present value. You can use a calculator to Calculating Annuity Present Value 2024 to see how much your future payments are worth today.

- Indexed Annuities:Indexed annuities offer returns linked to the performance of a specific market index, such as the S&P 500. While they provide potential for growth, they also offer some protection against market losses. These annuities are suitable for those seeking a balance between growth potential and principal protection.

Investment Options within BMO Annuities

BMO annuities offer a range of investment options, allowing you to tailor your portfolio to your specific financial goals and risk appetite. The available investment options may vary depending on the type of annuity you choose. Some common investment options include:

- Mutual Funds:Diversified portfolios of stocks, bonds, or other assets managed by professional fund managers.

- ETFs (Exchange-Traded Funds):Similar to mutual funds, but traded on stock exchanges like individual stocks.

- Fixed Income Securities:Bonds, notes, and other debt instruments that provide regular interest payments.

Using the BMO Annuity Calculator: Annuity Calculator Bmo 2024

The BMO annuity calculator is a valuable tool for estimating your future retirement income, comparing different annuity options, and assessing the impact of various investment strategies. It allows you to input your personal financial information and generate personalized projections.

If you’re considering an annuity with LIC, you might need to understand the specific annuity numbers they offer. Learn more about Annuity Number Lic 2024 to find the right product for your needs.

Step-by-Step Guide to Using the BMO Annuity Calculator

- Access the Calculator:Visit the BMO website and locate the annuity calculator. It is typically found under the “Retirement Planning” or “Annuities” section.

- Input Personal Information:Enter your current age, desired retirement age, estimated annual income, and any existing retirement savings. The calculator may also ask for your risk tolerance and investment goals.

- Select Annuity Type:Choose the type of annuity you are interested in, such as fixed, variable, or indexed.

- Choose Investment Options:Select the specific investment options you want to include in your portfolio, such as mutual funds, ETFs, or fixed income securities.

- Review Results:The calculator will generate projections of your future retirement income, based on the information you provided. You can adjust the variables to see how different factors impact your results.

Variables You Can Adjust

The BMO annuity calculator allows you to adjust various variables to see how they affect your retirement income projections. These variables include:

- Age:Your current age and desired retirement age.

- Retirement Age:The age at which you plan to retire.

- Investment Amount:The amount of money you plan to invest in the annuity.

- Investment Growth Rate:The expected rate of return on your investments.

- Inflation Rate:The expected rate of inflation during your retirement years.

Factors to Consider When Choosing an Annuity

Choosing the right annuity is crucial for maximizing your retirement income and achieving your financial goals. Consider these factors when making your decision:

Financial Goals, Annuity Calculator Bmo 2024

What are your retirement income needs? How much income do you need to maintain your current lifestyle? Do you have specific financial goals, such as paying off debt or funding travel?

Risk Tolerance

How comfortable are you with investment risk? Are you seeking a guaranteed income stream or are you willing to accept some market volatility in exchange for potential higher returns?

Excel can be a valuable tool for managing your financial planning, including calculating annuity payments. You can learn how to Calculating Annuity In Excel 2024 to streamline your calculations and make informed decisions.

Time Horizon

How long do you plan to live in retirement? Your time horizon will influence your investment choices and the type of annuity you select.

Advantages and Disadvantages of Annuities

Annuities offer advantages such as guaranteed income streams and tax benefits. However, they also have disadvantages, such as surrender charges and limited investment flexibility. Compare annuities to other retirement savings options, such as traditional IRAs and 401(k)s, to determine the best fit for your needs.

If you’re a 60-year-old man considering an annuity, it’s a good idea to explore the options available to you. Learn more about Annuity 60 Year Old Man 2024 and how they can help you secure your financial future.

Potential Risks

Annuities can involve certain risks, such as:

- Surrender Charges:Fees incurred when withdrawing funds from the annuity before a specified period.

- Investment Losses:Variable annuities are subject to market fluctuations, which could result in investment losses.

- Inflation Risk:The purchasing power of your annuity payments could be eroded by inflation.

BMO Annuity Fees and Charges

BMO annuities, like other financial products, involve fees and charges. Understanding these fees is essential for evaluating the overall cost and return of your annuity.

When you receive payments from an annuity, you might receive a Annuity 1099 2024 form, which details the amount of income you received for tax purposes. It’s important to understand how these forms affect your tax obligations.

Types of Fees

- Administrative Fees:Fees charged for managing and administering the annuity contract.

- Investment Management Fees:Fees charged for managing the investments within the annuity.

- Surrender Charges:Fees incurred when withdrawing funds from the annuity before a specified period.

Comparison with Other Providers

Compare the fees of BMO annuities to those of other annuity providers to ensure you are getting a competitive rate. Consider the total cost of ownership, including all fees and charges.

The tax implications of annuities can be complex. It’s important to understand whether Is Annuity Interest Taxable 2024 to properly plan for your tax obligations.

Impact of Fees on Returns

Fees can significantly impact the overall return of your annuity. Higher fees can reduce your potential earnings over time. Carefully evaluate the fee structure of any annuity you are considering.

There are various types of annuities available, and understanding the differences is crucial. Learn about Annuity 712 2024 and how it might fit into your overall financial strategy.

Tax Implications of BMO Annuities

The tax implications of BMO annuities can vary depending on the type of annuity and how you withdraw funds. Understanding the tax treatment of annuities is essential for maximizing your after-tax income.

To figure out how many payments you’ll receive from your annuity, you can use an Annuity Number Of Periods Calculator 2024. This tool helps you estimate the duration of your annuity based on factors like your initial investment and the interest rate.

Taxation of Annuity Payments

Annuity payments are generally taxed as ordinary income. The amount of taxes you pay will depend on your tax bracket.

If you’re considering using your 401(k) to purchase an annuity, it’s important to understand the implications. Learn more about Annuity 401k 2024 and how it might affect your retirement planning.

Tax Benefits

Annuities can offer tax benefits, such as:

- Tax-Deferred Growth:Earnings within an annuity are generally not taxed until you withdraw them.

- Tax-Free Death Benefit:If you die before annuitizing your contract, the death benefit may be paid tax-free to your beneficiary.

Tax Implications of Early Withdrawals

Withdrawing funds from an annuity before retirement may result in taxes and penalties. The specific tax implications will depend on the type of annuity and your age.

Impact of Taxes on Returns

Taxes can significantly impact the overall return of your annuity. Consider the tax implications when comparing different annuity options and investment strategies.

Closing Summary

As we conclude our journey through the realm of BMO annuities, we’ve gained a comprehensive understanding of their products, tools, and considerations. The BMO Annuity Calculator empowers you to envision your retirement goals, while the diverse annuity options cater to various risk tolerances and financial aspirations.

Remember, retirement planning is a multifaceted endeavor, and seeking professional advice is often essential to crafting a strategy that aligns with your unique circumstances.

Clarifying Questions

What is the minimum investment amount for a BMO annuity?

If you’re considering an annuity, it’s a good idea to explore your options and compare quotes from different providers. You can find a variety of Annuity Quotes Online 2024 to help you make an informed decision.

The minimum investment amount varies depending on the specific annuity product. It’s best to consult with a BMO representative or refer to their website for detailed information.

Are there any penalties for withdrawing funds from a BMO annuity before retirement?

Yes, BMO annuities typically have surrender charges that apply if you withdraw funds before a certain period. These charges are designed to offset the costs associated with managing the annuity. The specific terms and conditions vary depending on the annuity product.

Determining the right annuity amount can be tricky, but there are tools to help. If you’re wondering How Much Annuity For 40 000 2024 , you can use a calculator to estimate the potential payout based on your desired income stream.

It’s crucial to review the annuity contract carefully before making any withdrawals.

Can I adjust my investment strategy within a BMO annuity after I’ve purchased it?

Yes, depending on the specific annuity product, you may have the option to adjust your investment strategy within certain limitations. You can typically change your investment allocation, but there may be restrictions on the frequency and type of changes. It’s recommended to consult with a BMO representative to understand the specific terms and conditions of your annuity.